Executive Order To Have Minimal Impact, Vipshop Delivers VIP Results

4 Min. Read Time

Week In Review

- China equities ended Monday’s trading session higher on hopes that a President Biden would bring stability and predictability to the relationship between the world’s two largest economies.

- According to the official release over the weekend, China’s exports rose +11.4% YoY in October compared to an estimated +9.2%, highlighting not only China’s strength, but also hope for a global recovery.

- China released data Tuesday indicating that CPI inflation had been lighter than expected in October, coming in at 0.5%.

- Alibaba reported Wednesday that the company’s Singles Day shopping event brought in a record $75 billion in sales, nearly doubling from last year. Meanwhile, Asian equities ended the trading session mostly higher as investors rotated to value and cyclicals on positive vaccine news.

- Tencent and Pinduoduo reported earnings that beat estimates on Thursday, growing revenues by +29% and +89%, respectively.

Key News

Yesterday, President Trump signed an executive order barring US citizens from investing in 31 Chinese companies due to their affiliation with China’s military. My initial thought was that since the majority of these companies are private this must be another classic distraction tactic to say “look over there and not here” as US coronavirus cases climb. The only company that is worth mentioning is China Mobile (941 HK/CHL US). It is 1.36% of the MSCI China Index and 0.56% of the MSCI Emerging Markets Index. The other public companies are rounding error holdings.

The probability this will be implemented is infinitely small in my opinion. Let’s call it for what it is: capital controls. Implementation would threaten the US’ role as the world’s financial center. One broker noted that enforcement would be carried out by the US Treasury Department. I highly doubt Biden’s Treasury head will follow through on this. The Journal noted “Investors have until November of next year to divest their holdings.” Don’t fall for the distraction.

Perhaps investors should thank Trump for not allowing them to invest in China Mobile since the stock has done nothing but go down. The stock is trading at the same price as it was in June 2006! The stock is down -63% from its all-time high in 2007 and down -44% in the last five years! The company is a great example of the value trap in old economy sectors in Asia. But I get a 6% yield? Yeah, but you lost half of your principal. Anyway, the company’s lawyers will be excited as this will be challenged in court just like the “ban” on TikTok. The probability that this will be implemented is extremely low in my opinion.

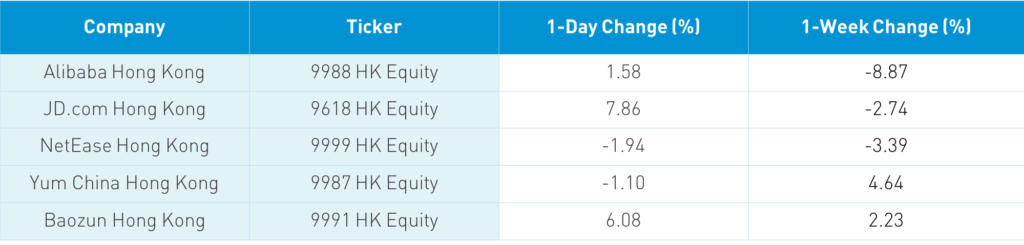

Asian equities finished a strong week with a quiet session. Remember Tencent (700 HK) reported after Hong Kong’s close yesterday, leading to a strong day for the stock as growth stocks outperformed. Hong Kong volume leaders were Tencent, which gained +4.33%, Alibaba HK, which gained +1.58%, Meituan Dianping, which gained +6.62%, Xiaomi, which gained +4.3%, BYD, which gained +2.77%, JD.com HK, which gained +7.86%, China Mobile, which fell -5.03%, Ping An, which fell -0.64%, and China Construction Bank, which fell -2.61%. The growth names dumped earlier in the week came roaring back while the cyclical/value plays underperformed today. The earnings from these growth names are hard to ignore!

Mainland China was off as the Trump ban weighed on technology stocks. Corporate bonds in China sold off as a Chinese coal company defaulted. However, it is unlikely to have a significant impact as the principal was only a few hundred million. Foreign investors sold Mainland stocks today after buying $1.385 billion worth of Mainland stocks this week. CNY was flat for the week versus the US dollar.

Hang Seng Indices announced Meituan Dianping, Budweiser and Anta Sports will be added the Hang Seng Index while Swire Pacific will be removed. The announcement was after the market’s close.

American Airlines flew its first flight in nine months from Dallas to Shanghai with two flights a week expected. Big US oil loves China!

On Monday, we have earnings releases from Meituan Dianping, KE Holdings (BEKE US), Baidu (BIDU US) and iQiyi (IQ US). October data for Industrial Production (estimate 6.75%) and Retail Sales (estimate 5%) is also expected Monday.

Vipshop (VIPS US) is a Chinese e-commerce company focused on discounts with an emphasis on clothing. They are a successful version of Groupon. The company reported strong results both year over year and above analyst expectations before the US market open today.

- Revenue +18.2% $3.4B (RMB 23.2B) versus estimate RMB 21.575B

- Gross Merchandise Value (stuff sold) +21% to RMB 38.3B from 31.7B

- Active customers +36% to 172.8mm

- Operating Profit +15.2% to $204mm (RMB 1.386B) versus estimate RMB 1.173B

- Adjusted EPS RMB 1.80 versus RMB 1.69

H-Share Update

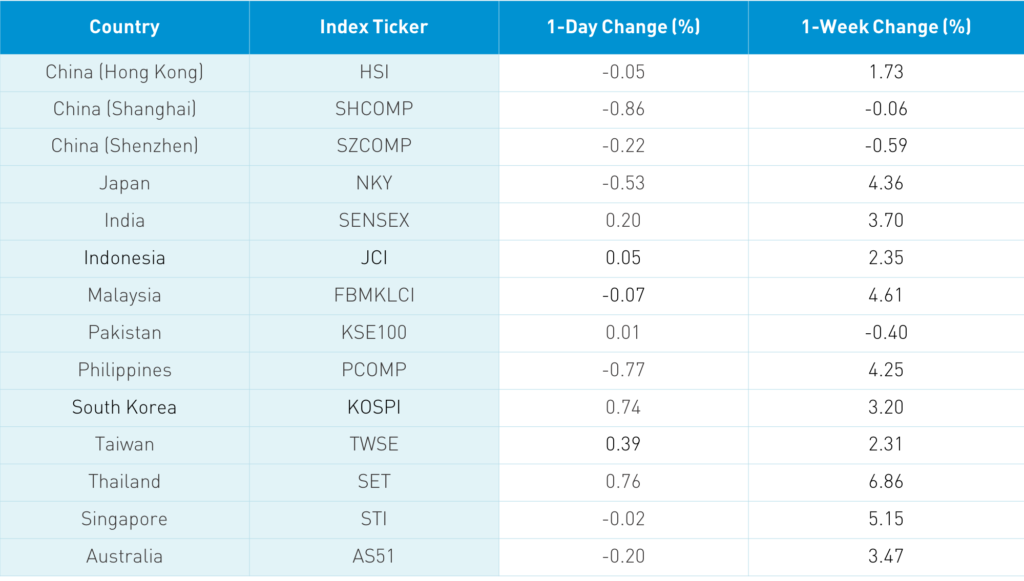

The Hang Seng Index had a choppy session closing at the day’s high -0.05%/-51 index points at 26,156. Volume was off -9% from yesterday which is 127% of the 1 year average. Breadth was off with 17 decliners and 32 advancers. The204 Chinese stocks listed in HK +1.18% led by discretionary 3.81%, communication +3.17%, health care +2.59% and tech +2.46% while energy -3.21%, financials -2.19%, materials -1.55% and utilities -0.77%. Southbound Connect trading was moderate as mainland investors bought $411mm of HK stocks as Southbound trading accounted for 10.9% of HK turnover.

A-Share Update

Shanghai & Shenzhen bounced around the room -0.86% and -0.22% to close at 3,310 and 2,268. Volumes were +3% from yesterday which is 90% of the 1 year average. The 518 mainland Chinese stocks within the MSCI China All Share -0.58% with consumer discretionary +0.43% and industrials +0.39% while real estate -1.74%, financials -1.43%, staples -1.28% and utilities -0.83%. Northbound Stock Connect volumes were moderate as foreign investors sold -$747mm of mainland stocks today as Northbound trading accounted for 7% of mainland turnover.

Last Night’s Exchange Rates & Yields

- CNY/USD 6.61 versus 6.61 yesterday

- CNY/EUR 7.81 versus 7.81 yesterday

- Yield on 1-Day Government Bond 2.00% versus 1.92% yesterday

- Yield on 10-Year Government Bond 3.27% versus 3.26% yesterday

- Yield on 10-Year China Development Bank Bond 3.72% versus 3.72% yesterday