Asia Rebounds on Value Bounce

3 Min. Read Time

Key News

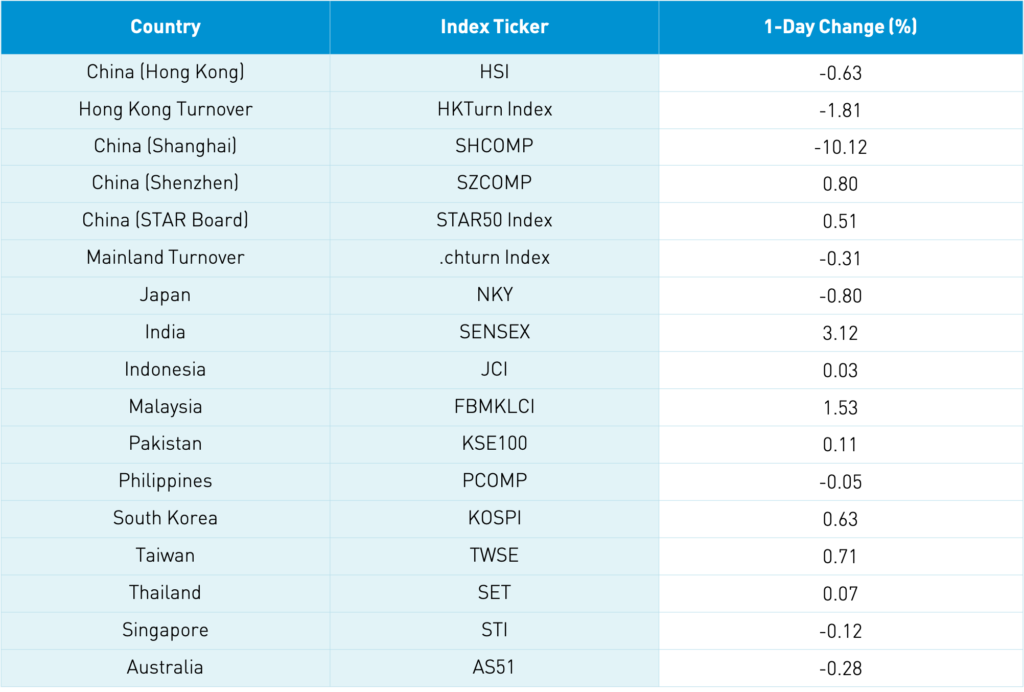

Today was nearly the exact opposite of yesterday as Asia rebounded. Japan outperformed while value outperformed growth. Hong Kong was off on light volumes as internet names underperformed, though tutoring company New Orient (EDU US, 9901 HK) jumped +7.38%. China’s value sectors had a strong day while growth managed small gains. It was fairly quiet on the news front as 51job (JOBS US), an online employment firm, will go private at a 28.9% premium to the closing price when the deal was announced.

I did not think yesterday’s news on Chinese mobile wallets being asked not to allow cryptocurrencies was worth mentioning, though Bitcoin’s subsequent fall clearly meant that it was a bigger deal.

The US officially removed TikTok and Tencent’s WeChat from the prohibited transaction list.

It was funny to see the Wall Street Journal report on First Solar’s efforts to manufacture solar panels in the US as news percolates that the Biden administration might address suspicions Chinese solar panels or their parts might be manufactured in Xinjang. I have no idea whether this claim is true or not, but I am fairly confident that China has removed virtually all subsidy support for the industry. Glossed over in the article are First Solar’s lobbying efforts, which you can see for yourself on OpenSecrets.org. Ultimately, factories are in Asia because there are 4 billion customers there. Where would you put a factory?

Full Truck Alliance (YMM US) will go public today raising $1.9 billion after selling 82.5mm shares at $19 a share, which is the top of the range. China’s Uber for truck drivers is an interesting company that deserves more attention than I can give it today.

It is always good to have a friend with expertise in a particular field. I spoke with my go-to fixed income guru Nancy Davis of Quadratic Capital on her thoughts after last week’s market action which saw inflation assets sold on the Fed’s potential interest rate hikes down the road. Do you believe the Fed will be raising rates as we creep to the 2024 election? I doubt it as President Bush blamed the Fed for his reelection loss to Bill Clinton when they raised rates (the read my lips might have been a factor as well).

H-Share Update

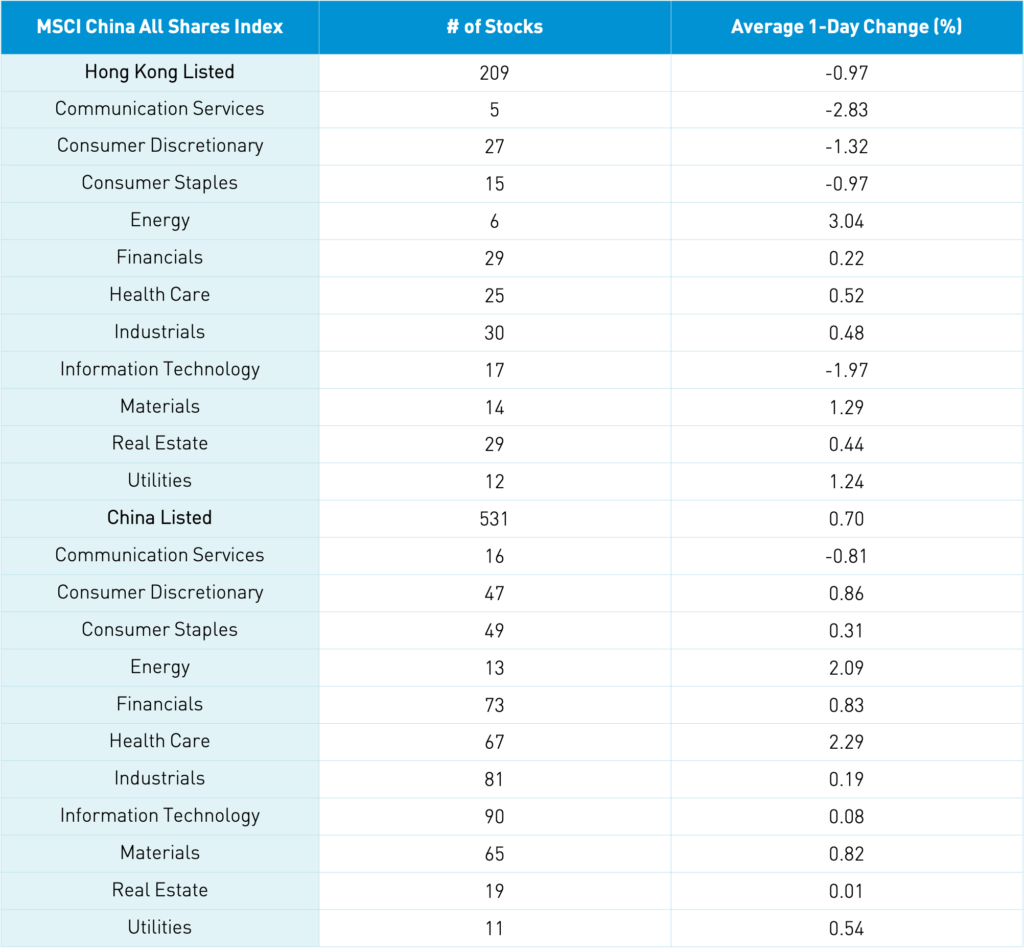

The Hang Seng Index and Hang Seng TECH Index sold off into the close down -0.63% and -1.81% respectively as volume declined -10% from yesterday, which is 86% of the 1-year average. The 209 Chinese companies listed in Hong Kong within the MSCI China All Shares Index were off -0.97% with energy +3.04%, materials +1.29%, utilities +1.24%, and healthcare +0.52% while tech -1.97%, discretionary -1.32%, and staples -0.97%. Hong Kong’s most heavily traded by value were Tencent, which fell -2.88%, Xiaomi, which fell -3.22%, Meituan, which fell -2.98%, Alibaba HK, which fell -1.17%, Wuxi Biologics, which fell -1.67%, HK Exchanges, which fell -1.78%, BYD, which fell -4.04%, Geely Auto, which fell -0.4%, AIA, which rose +0.05%, and Ping An, which was flat. Southbound Stock Connect volumes were moderate as Mainland investors accounted for $119mm of Hong Kong stocks as Southbound trading accounted for 15% of Hong Kong turnover.

A-Share Update

Shanghai, Shenzhen, and STAR Board opened higher and kept on trucking gaining +0.8%, +0.51%, and -0.31% respectively as volume declined -0.8% but still was 108% of the 1-year average. The 531 Mainland stocks within the MSCI China All Shares Index gained +0.7%, led by healthcare +2.29%, energy +2.09%, discretionary +0.86%, financials +0.83%, materials +0.82%, and utilities +0.54%, as only communication fell -0.81%. The Mainland’s most heavily traded by value were BYD, which fell -1.94%, COSCO Shipping, which rose +3.09%, Kweichow Moutai, which fell -0.32%, Sany HeavyIndustry, which rose +4.44%, Luzhou Laojiao Co, which fell -1.89%, Tianqi Lithium, which gained +2.83%, Chongqing Zhifei Biologics, which fell -5.6%, China Railway Construction IPO, which gained +186%, Gree Electric Appliance, which fell -2.52%, and BOE Tech, which gained +1.3. Northbound Stock Connect volumes were moderate as foreign investors sold -$372mm of Mainland stocks as Northbound Stock Connect trading accounted for 5.8% of Mainland turnover. CNY was off a touch versus the US $, bonds rallied a touch and copper managed a small gain.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.48 versus 6.47 yesterday

- CNY/EUR 7.70 versus 7.70 yesterday

- Yield on 1-Day Government Bond 1.65% versus 1.55% yesterday

- Yield on 10-Year Government Bond 3.09% versus 3.09% yesterday

- Yield on 10-Year China Development Bank Bond 3.51% versus 3.50% yesterday

- Copper Price +0.51%