Tencent Acquisition Approval Ignites Hong Kong Internet Rally

2 Min. Read Time

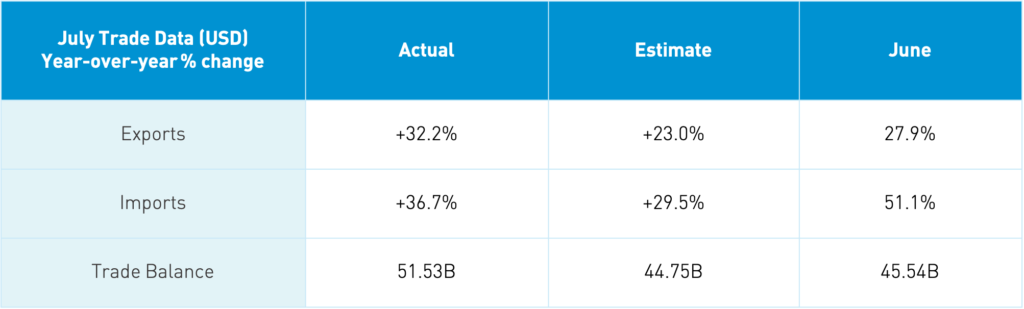

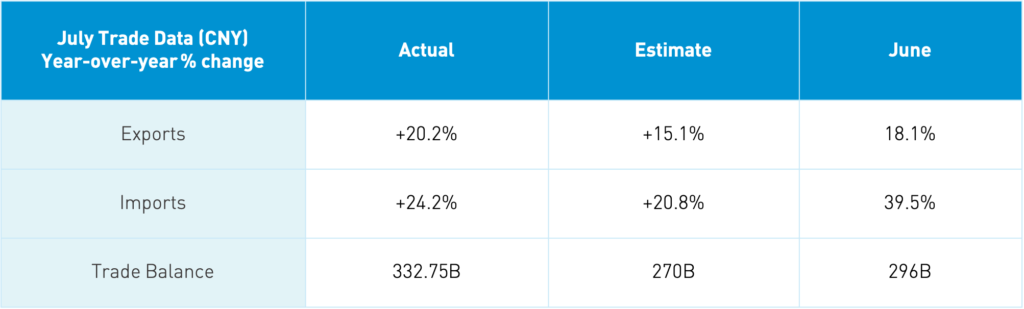

Trade Data Release

Takeaway: Today’s release was a strong beat indicating that the global economy is rebounding post-pandemic. It also highlights how intertwined China is in the global economy. Imports from the US increased month-over-month (MoM), though China’s imports from the EU are almost double, while imports from Australia increased MoM. Exports to the US and EU also increased month-over-month. The year-over-year percentage changes are very high though we know the percentage change will slow later this year. The release was a catalyst for the Hong Kong market today.

Key News

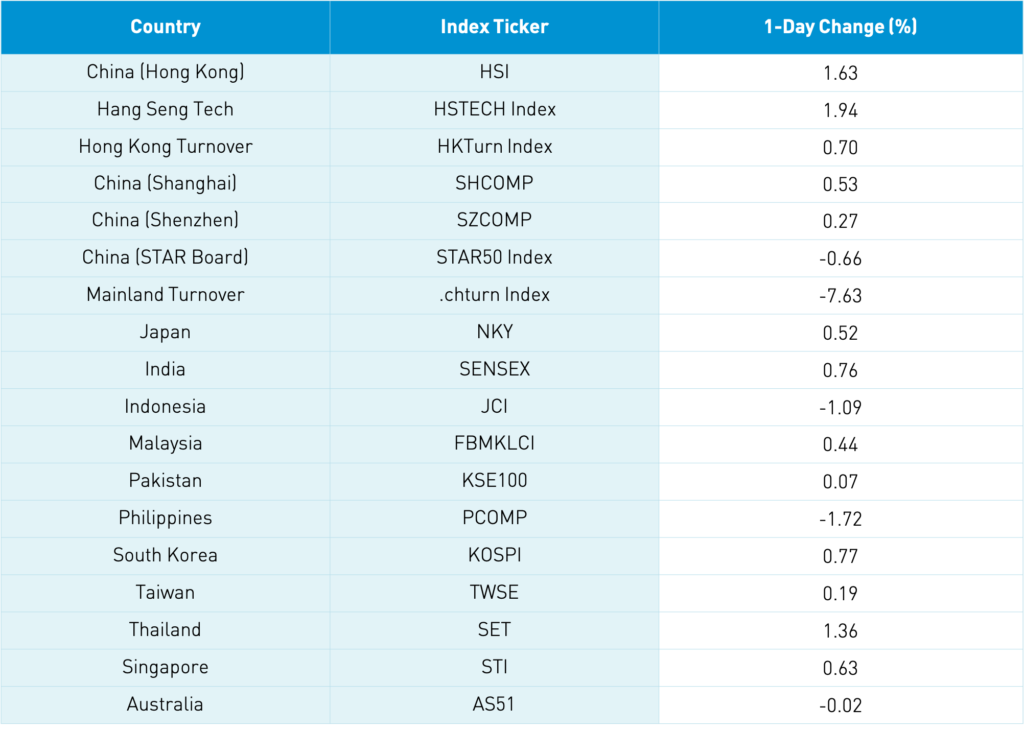

Asian equities had a strong day with Hang Seng Index, Hang Seng TECH Index, and Thailand outperforming. In addition to the strong trade data, it was announced that Tencent’s acquisition of search engine Sogou (SOGO US) was approved. The approval sparked a large rally in Hong Kong-listed internet stocks as Tencent’s volume was twice Meituan’s volume, which was the second-highest volume stock by value.

Mainland investors were net buyers of Tencent’s stock for the first time out of the last eleven trading days. Tencent has seen the percentage of market cap held by Mainland investors drop from 6.95% in early June to 6.31% today. Mainland investors hold twice as much Tencent as China Construction Bank, which is #2 in market cap held by Mainland investors via Southbound Stock Connect.

Alibaba Hong Kong jumped +3.95%, JD Hong Kong rose +3.41%, Baidu Hong Kong rose +3.31%, and Bilibili Hong Kong gained +3.58%, though Baozun HK was off -3.54%. The Mainland saw a reverse from yesterday’s rally in growth/smaller caps as large caps outperformed while profit-taking hit yesterday’s winners such as EV and semis. Carbon neutral stocks had a very strong day as investors focus on the clean technology companies that will assist China in reaching its peak carbon goal by 2030. There is chatter that China’s carbon emissions trading market will launch this Friday. Energy did well in both markets on higher crude prices while healthcare was off.

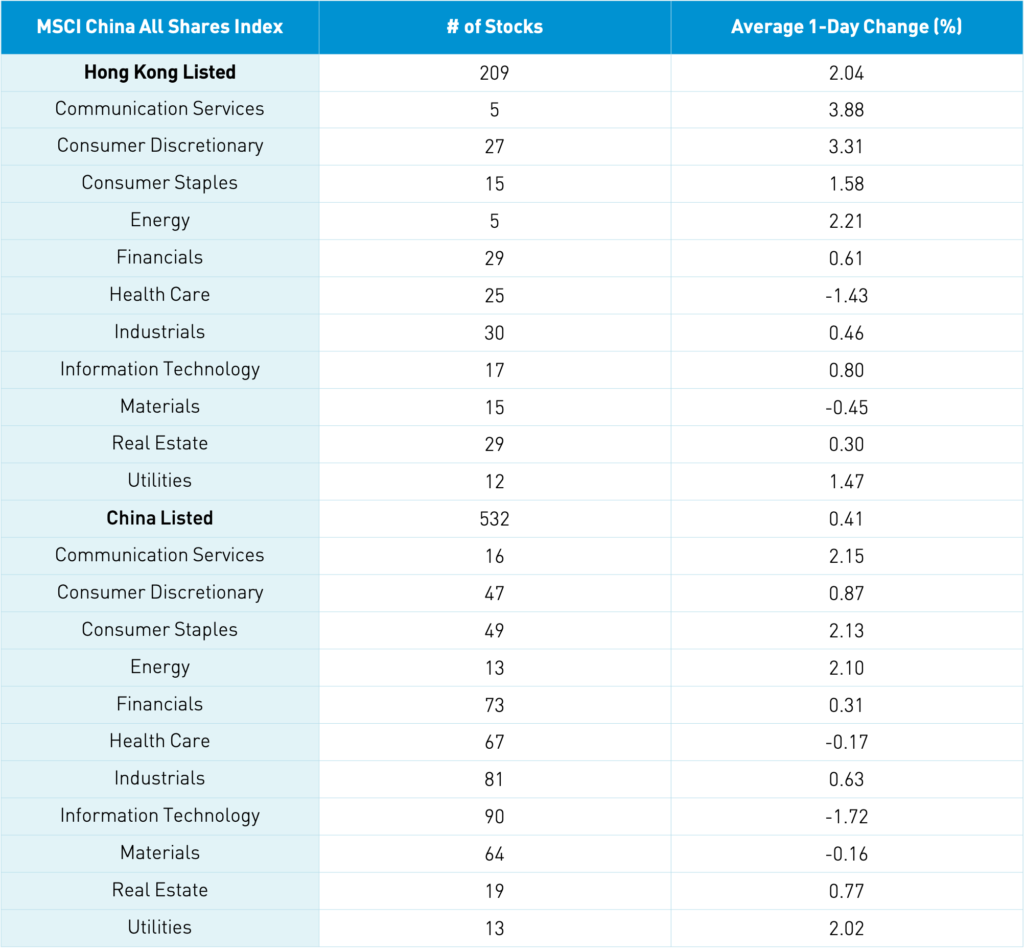

H-Share Update

The Hang Seng Index and Hang Seng TECH Index jumped in the morning session before leveling off at +1.63% and +1.94% respectively as volume rose +0.73% from yesterday, which is 95% of the 1-year average. The 209 Chinese companies listed in Hong Kong within the MSCI China All Shares Index gained +2.04%, led by communication +3.88%, discretionary +3.31%, energy +2.21%, staples +1.57%, utilities +1.47%, and tech +0.8%, while healthcare fell -1.43% and materials -0.45%. Hong Kong’s most heavily traded by volume were Tencent, which gained +3.93%, Meituan, which gained +3.44%, Alibaba HK, which gained +3.95%, HK Exchanges, which gained +0.6%, Xiaomi, which gained +1.31%, Geely Auto, which gained +5.18%, Kuaishou Tech, which gained +5.69%, China Mobile, which gained +1.61%, AIA, which gained +3.08%, and BYD, which gained +0.52%. Southbound Stock Connect volumes were moderate/elevated as Mainland investors bought $191mm of Hong Kong stocks as Northbound trading accounted for 14.1% of Hong Kong turnover.

A-Share Update

Shanghai, Shenzhen, and STAR Board were mixed at +0.53%, +0.27%, and -0.66% respectively as volume declined -7.63% from yesterday, which is 133% of the 1-year average. The 532 Mainland stocks within the MSCI China All Shares gained +0.41%, led by communication +2.15%, staples +2.13%, energy +2.1%, utilities +2.02%, and discretionary +0.87%, while tech fell -1.72% and healthcare -0.7%. The Mainland’s most heavily traded stocks by value were China Northern Rare Earth, which rose +1.22%, China Three Gorges Renewables, which rose +3.1%, ZTE, which rose +3.46%, Longi Green Energy, which fell -2.2%, COSCO Shipping, which rose +3.94%, Jiangsu Hoperun Software, which fell -2.46%, CATL, which fell -0.49%, GEM, which rose +3.6%, BYD, which fell -0.52%, and broker East Money, which fell -2.03%. Northbound Stock was moderate/high as foreign investors bought $398mm of Mainland stocks as Northbound Stock Connect trading accounted for 5.2% of mainland turnover. CNY appreciated slightly against the US $, bonds rallied, and copper was off a touch.