Hong Kong Internet Rally Gets Legs as Jack Ma Enjoys Spain

3 Min. Read Time

Key News

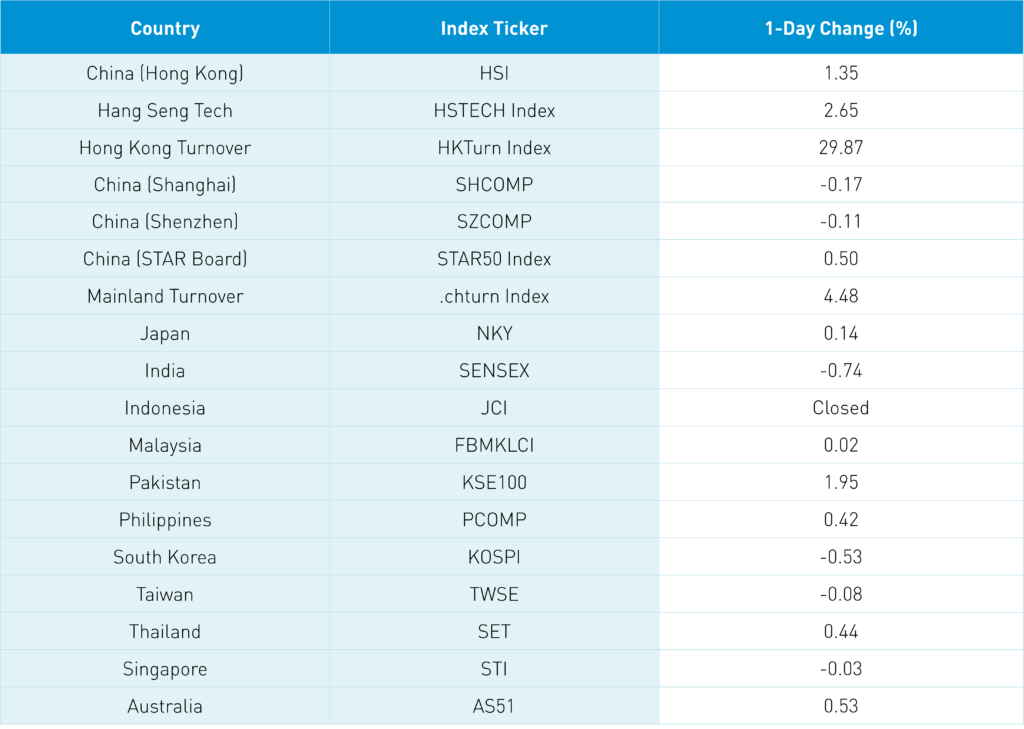

Asian equities had a mixed day, as Hong Kong and Pakistan outperformed while India and China were off small. Hong Kong was once again led by internet stocks as the Hang Seng Tech jumped +2.65% versus the Hang Seng Index’s +1.35%. Today’s rally was accompanied by strong volume, up +29% from yesterday, which is a good sign though off from the 1-year average.

Jack Ma’s vacation in Spain is being cited as a sign regulation is loosening, though the company’s new chip for its cloud computing business is a more realistic sign. We also have Alibaba’s Singles Day sales event, the largest e-commerce event globally, in a few weeks. The biggest factor is investors’ significant underweight to the space based on our air pocket thesis: investors have moved to the sidelines and not tried to catch a falling knife until there is more regulatory certainty. Overnight a global investment bank made China an overweight in the Asia Pac country model for the first time since last summer. If this rally gets some legs we are apt to see more strategists do the same.

Investors are overweight India which is now the most expensive market by valuation in Asia Pacific. While China’s coal issues garner apocalyptic attention, there is no attention to the reality that 71% of India’s electricity is generated by coal according to Bloomberg New Energy Finance (BNEF puts China at 61%). As I’ve stated in the past, I’m just jealous of the money investors throw at India.

Southbound Stock, the trading venue that allows Chinese institutional investors to buy Hong Kong stocks, had a very strong inflow day with Tencent seeing small net buying while Meituan had a very strong inflow day. Coal stocks took a beating in both Hong Kong and China while the clean technology sector had a strong day led by EV, wind, and solar.

Both Vice Premier Liu He and PBOC head Yi Gang spoke about controlling the Evergrande situation and not allowing it to become a financial crisis. Yi Gang spoke about not letting Evergrande take out other real estate developers in addition to preventing it from becoming a financial crisis.

Yesterday’s rise was attributed to a loan prime rate cut which didn’t happen overnight. As we mentioned yesterday, the loan prime rate (LPR) hasn’t been cut since April 2020. The PBOC has been active in pumping liquidity into the financial system over the last several days. Coal prices were a big topic as the government tries to ramp up production while jawboning down prices.

Foreign investors were active buyers of mainland stocks overnight while the renminbi took a breather versus the dollar while staying below the 6.40 level.

H-Share Update

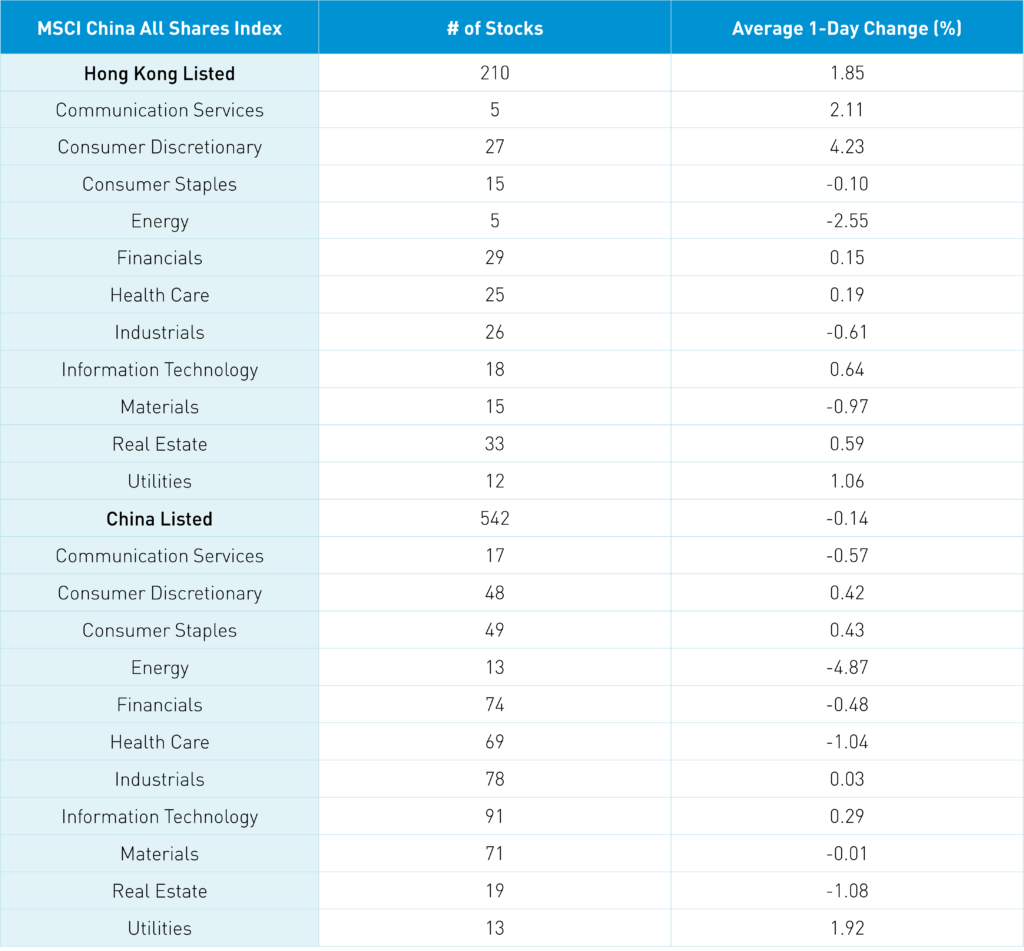

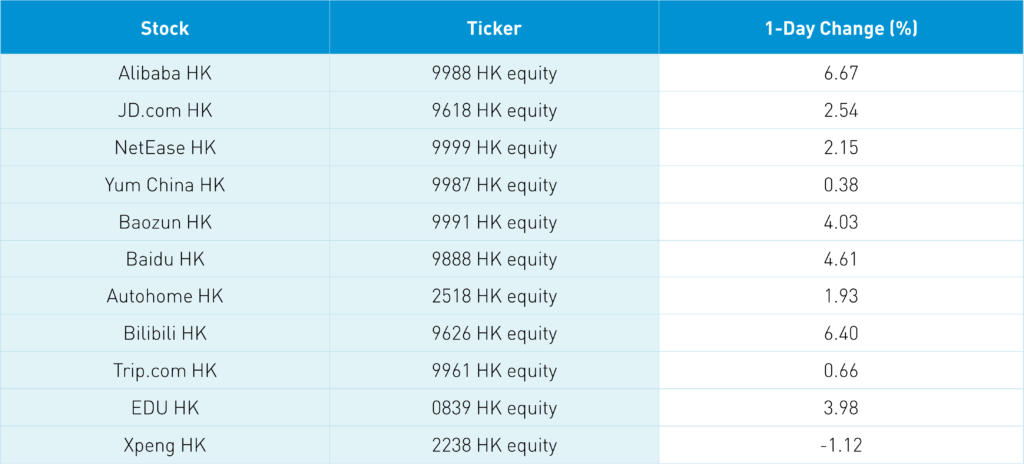

The Hang Seng opened higher, took a mid-morning swoon before rallying back to close +1.35% as volume jumped +29.87% which is 91% of the 1-year average. The 210 Chinese companies listed in HK within the MSCI China All Shares gained +1.85% led by discretionary +4.23%, communication +2.1%, utilities +1.06% and tech +0.64% while energy -2.55% and materials -0.97%. HK’s most heavily traded by value were Tencent +2.1%, Alibaba HK +6.67%, Meituan +2.87%, Kuaishou +4.28%, Xiaomi +1.33%, HK Exchanges +1.66%, Geely Auto +4.93%, Anta Sports-1.07%, JD.com HK +2.54% and AIA +1.4%. Southbound Stock Connect volumes were moderate/light as mainland investors bought $503mm of HK stocks as Southbound trading accounted for 11% of HK turnover.

A-Share Update

Shanghai, Shenzhen and STAR Board bounced around the room closing -0.17%, -0.11% and +0.5% as volume increased +4.48% which is 103% of the 1-year average. The 542 mainland stocks within the MSCI China All Shares were off -0.12% with utilities +1.94%, staples +0.45% and discretionary +0.44% while energy -4.85%, real estate -1.06% and healthcare -1.02%. The mainland’s most heavily traded stocks were Longi Green Energy +3.38%, China Northern Rare Earth +4.48%, CATL _0..19%, Tianqi Lithium flat, Jiangxi Special Electric Motor +8.98%, BYD +2.04%, Kweichow Moutai +1.59%, Tianjin Zhonghuan Semiconductor +3.84%, Zijin Mining -4.07% and Jiangsu Hengrui Medicine +3.97%. Northbound Stock Connect flows were light as foreign investors bought $638mm of mainland stocks today as Northbound trading accounted for 5.4% of mainland turnover.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.39 versus 6.39 yesterday

- CNY/EUR 7.43 versus 7.45 Yesterday

- Yield on 10-Year Government Bond 3.00% versus 3.01% Yesterday

- Yield on 10-Year China Development Bank Bond 3.33% versus 3.33% Yesterday

- Copper Price -02.19% overnight