Weibo’s Wicked Results as Real Estate Policy Adjusts

3 Min. Read Time

Weibo (WB US), the Twitter of China, released Q3 financial results before the US market open this morning. The results beat analyst estimates handily. After Tencent’s weak advertising results yesterday, Weibo’s results are a bit of a shock. Hat tip to management on navigating the macro headwinds. It’s interesting to note that the company mentioned the Beijing Winter Olympics as a strong opportunity for the company. Analysts had many regulation-related questions, as the company repeatedly stated “we have had a very good communication and relationship with the government even before the implementation of any regulation”. The company noted that the Personal Information Protection Law went into effect on November 1st.

- Revenue increased +30% to $607.4mm versus analyst estimates of $593mm and Q3 2020’s $465.7mm

- Revenue segmentation: advertising/marketing +29% to $537.6mm

- Average daily users reached 248mm in September, monthly active users reached 573mm in September

- Costs/Expenses increased +29% to $394.4mm from $304.8mm driven by “higher personnel-related cost and marketing expense.”

- Adjusted Net Income $209.6mm versus analyst estimate of $189mm

- Adjusted EPS $0.90 versus estimate of $0.83

- Corporate cash is $2.71B

- Q4 Revenue forecast increase between 15% to 20%

Key News

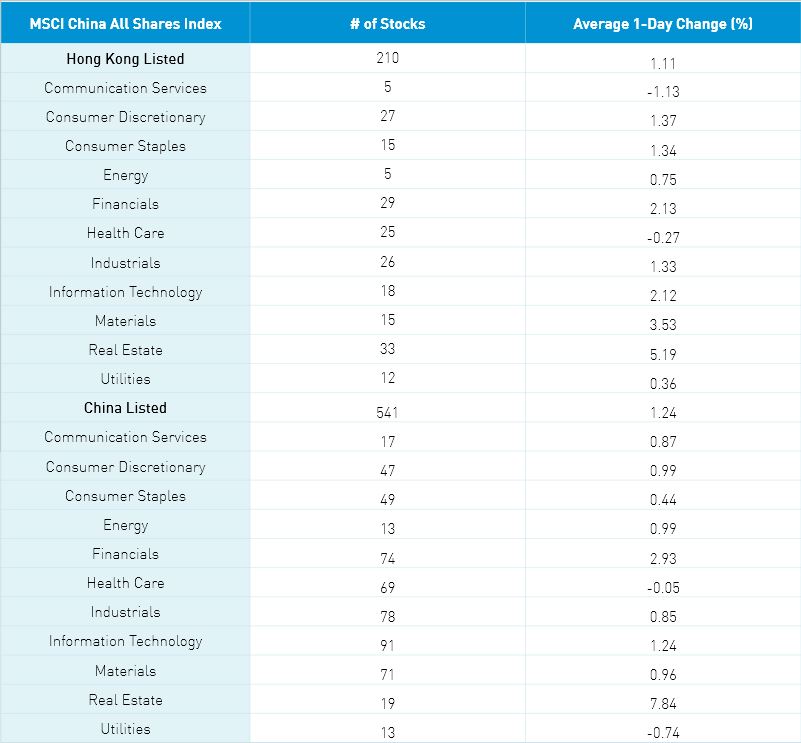

Asian equities had a mixed day as Japan, Hong Kong, and China outperformed while Taiwan and India underperformed. Today’s price action is brutal for active emerging market managers who are 10% underweight China, weighted by the size of active EM funds, while overweight India and Taiwan. This underweight is the dry powder that can come back into the stocks. What these managers want to see are indications that China’s regulatory crackdown is coming to an end.

In Tencent’s Q3 earnings call yesterday, President Marin Lau stated “….if there has been already a lot of regulations and the regulations in the future on an incremental basis will be smaller in terms of percentage-wise, and as the industry adapted further, then the impact on the industry will be less and less over time.” Good sign right!

There were several catalysts to today’s China and Hong Kong moves as the US and China unexpectedly agreed to work on methane and environmental issues at COP26 in advance of the Biden-Xi virtual summit next week.

There was chatter that Didi could be coming out of its regulatory review and reports that real estate policies will be eased to support the industry.

October mortgage loans increased 4% while Evergrande made three bond coupon payments at the 11th hour. Evergrande’s April 2022 US $ bond fell -3.7% to $28.10 while the June 2025 bond was off -2.67% to $23.92. The WSJ is reporting today that the company will be dismantled while allowing the company to finish the projects it started. The article states foreign-held bonds aren’t a concern which runs contrary to official statements that foreign bondholders should be treated no different than domestic bondholders. I’m generally in agreement with the article as we’ve been saying this line of thinking for weeks.

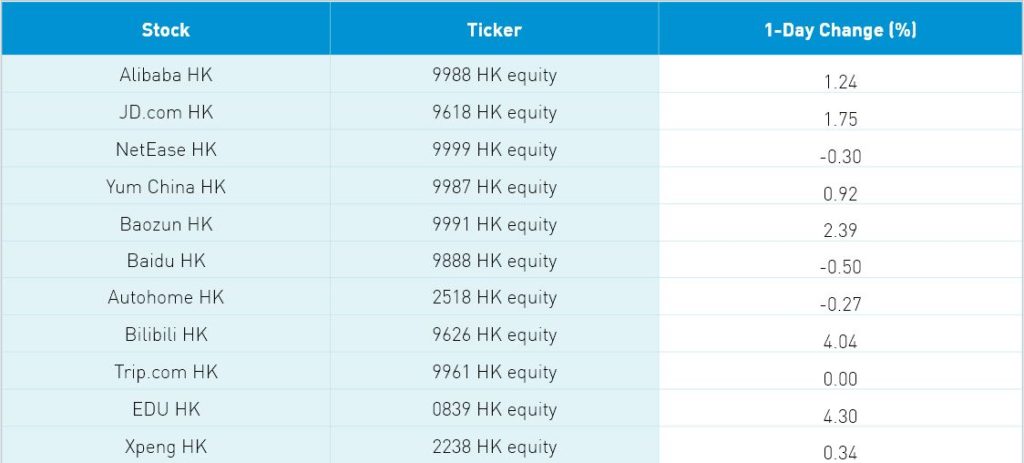

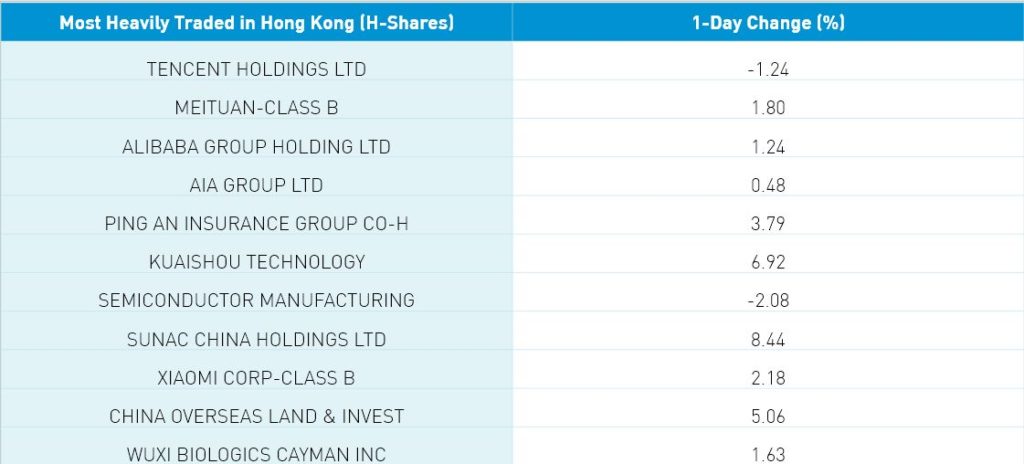

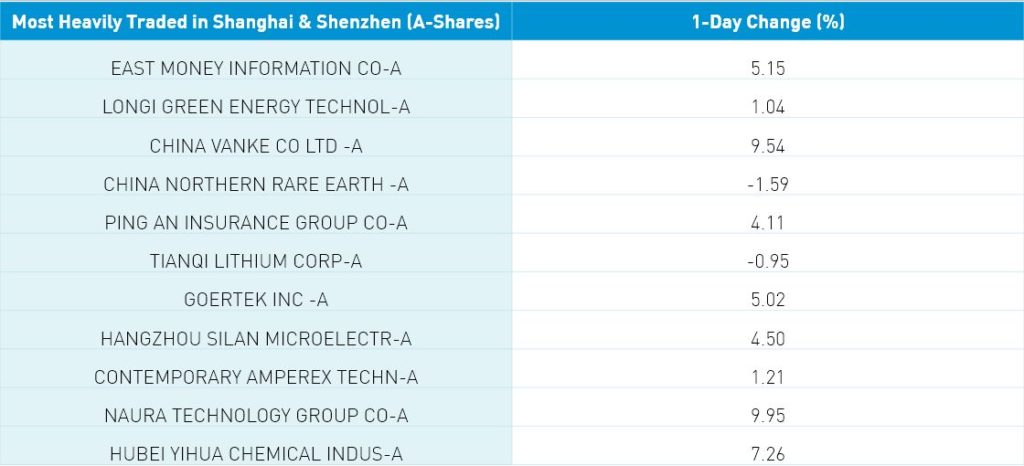

Real estate was the best performing sector in both China +7.87% and Hong Kong +5.19% on the news. Hong Kong-listed internet stocks ripped on the Didi news with Meituan +1.8%, Alibaba HK +1.24%, Kuaishou +6.92%, and JD.com HK +1.75% though Tencent was off -1.24% as Mainland investors were net sellers in moderate size via Southbound Stock Connect. Hong Kong volumes were flat which is only 80% of the 1-year average. The Mainland volumes were up +3.94% which is 112% of the 1-year average. Foreign investors bought $1.347B of Mainland stocks today as Northbound Stock trading accounted for 4.9% of Mainland turnover.

Today is Alibaba’s Singles Day. Amazing how quiet things have been surrounding the largest e-commerce event globally. The company is clearly keeping a low profile this year though the sales numbers will be interesting to find out. The company did state 290,000 brands will have goods sold ranging from high fashion brands to electronics.

After the close, we get MSCI’s Pro-forma for the end-of-month Semi-Annual Index Review.

BNP Paribas upgraded China equity in their Asia allocation model moving the country to overweight from neutral. The December Central Economic Work Conference was noted as a potential policy catalyst.

Xiaohongshu, which is like Instagram, reportedly raised cash from investors in anticipation of a Hong Kong listing.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.40 versus 6.40 yesterday

- CNY/EUR 7.33 versus 7.39 yesterday

- Yield on 10-Year Government Bond 2.94% versus 2.89% yesterday

- Yield on 10-Year China Development Bank Bond 3.20% versus 3.17% yesterday

- Copper Price +0.09% overnight