Tech Wreck Goes Global as CSRC Sends Another HFCAA Olive Branch, Week in Review

3 Min. Read Time

Week in Review

- Over the weekend, Han Wenxiu, a member of the Central Committee for Financial and Economic Affairs, spoke about the Central Economic Work Conference (CEWC) release, stating that “the government should be cautious about unveiling policies that could trigger contraction," which might suggest a dialing back on internet regulation.

- Weibo HK was off -9.62% on Tuesday, which is a loss of 792mm in market cap, after being fined a minuscule RMB 3mm ($471k) by the State Cyberspace Office. The market’s reaction considering the tiny size of the fine highlighted the fragile state of the space.

- According an article from the Financial Times published Wednesday, which cited unnamed sources, the US Commerce Department is expected to update its export technology ban list on Thursday to include several private companies and potentially some biotech names.

- Trip.com (TCOM US) reported fiscal Q4 financial results on Thursday prior to the US open today. While costs increased, analysts seemed to be impressed by the company’s results.

Key News

Asian equities had a rough end to a rough week. Volumes surged, driven by FTSE Russell and S&P index rebalances along with Quad Witching. Quad Witching is the quarterly event of index and stock options and futures expiring.

Yesterday’s US tech wreck set the tone while news headlines were far from helpful as Asian investors digested the US export ban, which did not end up including biotech firm Beigene, which fell -2.41% overnight, as had been originally expected. What’s the consequence for the Financial Times, which reported the company would be on the ban, which, in turn, led to the stock falling -7.66% on Wednesday?

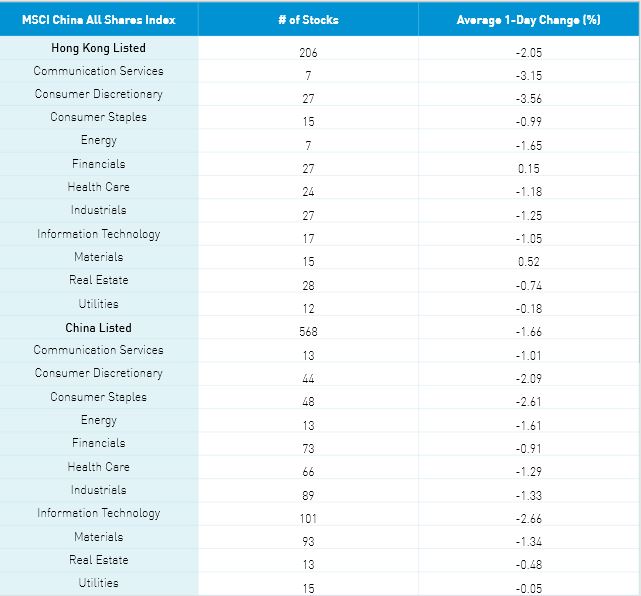

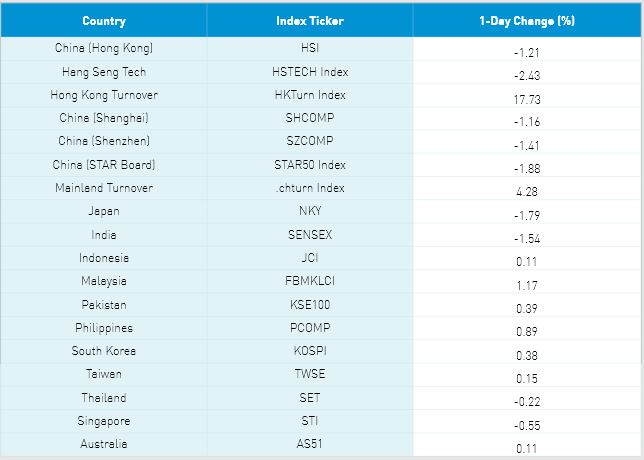

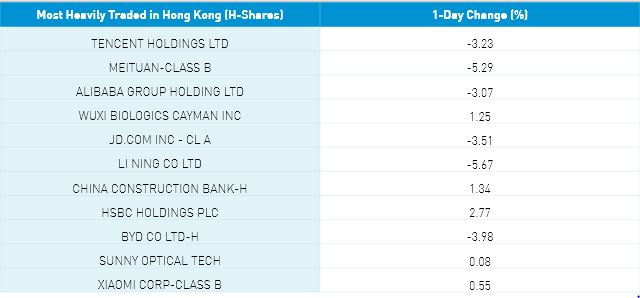

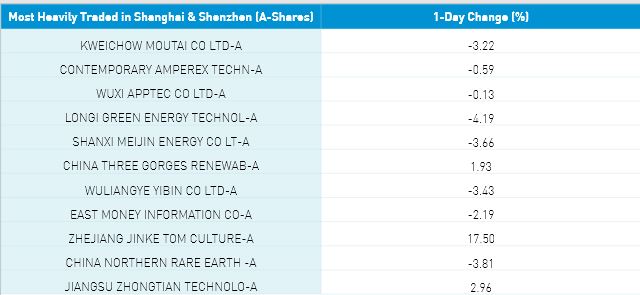

Both Hong Kong and the Mainland were off today as growth stocks/sectors were lower versus value stocks/sectors as the Hang Seng fell -1.21% while Shanghai fell -1.16%, Shenzhen fell -1.41%, and the STAR Board fell -1.88%. Elements of the clean energy ecosystem held up along with gold stocks though it was an ugly day. The only positive I can find is that Tencent, which fell -3.23%, had the largest inflow day via Southbound Stock Connect since September 28th while Meituan, which fell -5.29%, saw a small net buy from Mainland investors.

Hong Kong internet had an off day as several brokers were left scratching their heads on today’s price action. On big index rebalance days we shouldn’t overly read too much into the price action, in my opinion. Foreign investors sold $1 billion worth of Mainland stocks. However, for the week, foreign investors bought $1.801B of Mainland stocks this week. Mainland bonds rallied, CNY was off versus the US dollar, and copper gained.

After the close, the CSRC put out another release stating they will continue to work with the SEC and PCAOB to solve the issue of US-listed Chinese companies' non-compliance to the Holding Foreign Companies Accountable Act (HFCAA). The CSRC stated, “At present, the relevant regulatory agencies of China and the United States are negotiating on the cooperation of audit supervision, and some positive progress has been made.” Fingers crossed!

Alibaba held its investor day yesterday and today. As it is still occurring as I write, we’ll do a proper write-up on Monday. Chairman and CEO Daniel Zhang acknowledged the company faces increased competition. How is the company going to drive growth? Increasing user growth in China’s smaller cities, the share of wallet expansion, and value creation. Growing outside of China was a big emphasis in addition to the growth of cloud computing. More to come from an exceedingly well-produced event.

The CSRC, China’s regulator, noted that Mainland investors won’t be allowed to trade through Northbound Stock Connect. The CSRC noted that the number of Mainland investors using Northbound Stock Connect is small though I don’t understand why a Mainland investor would use Connect.

Evergrande’s April 2022 bond gained +$0.07 to $21.80 while the Evergrande June 2025 declined -$0.11 to $19.20. I also noticed that Ping An Healthcare and Technology (1833 HK) filed after the close to buy back 56 million shares.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.38 versus 6.37 yesterday

- CNY/EUR 7.22 versus 7.21 yesterday

- Yield on 10-Year Government Bond 2.85% versus 2.86% yesterday

- Yield on 10-Year China Development Bank Bond 3.09% versus 3.09% yesterday

- Copper Price +1.97% overnight