December PMIs & Markets Rise, Internet Outperforms, Week In Review

3 Min. Read Time

Week in Review

- The CSRC, China's SEC, issued a statement confirming its support for variable interest entities (VIEs) and foreign listings on Monday.

- In a Tuesday address, PBOC Governor Yi Gang signaled support for the economy, financials helping achieve carbon goals, and commenting on the real estate market.

- Hong Kong internet names were off on Wednesday despite positive news such as JD.com increasing their buyback to $3B from $2B, Reuters reporting that Alibaba is looking to sell its stake in Weibo, and Meituan and Kuiashou announcing a partnership.

- Asian equities were mixed Thursday on a slow news day before New Years’.

Key news

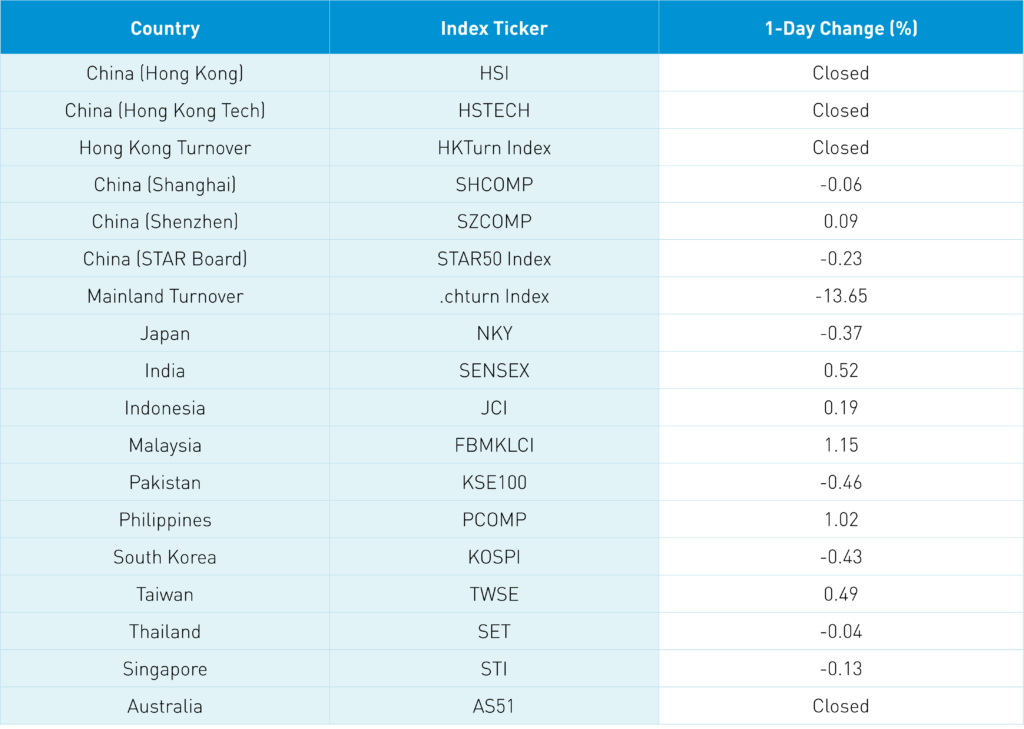

Asian equities ended 2021 broadly higher on light volumes with Hong Kong internet stocks outperforming in a half-day session while the Philippines underperformed in its half-day session. South Korea, Taiwan, Indonesia, and Thailand were closed today as traders got a head start on their New Year’s celebrations.

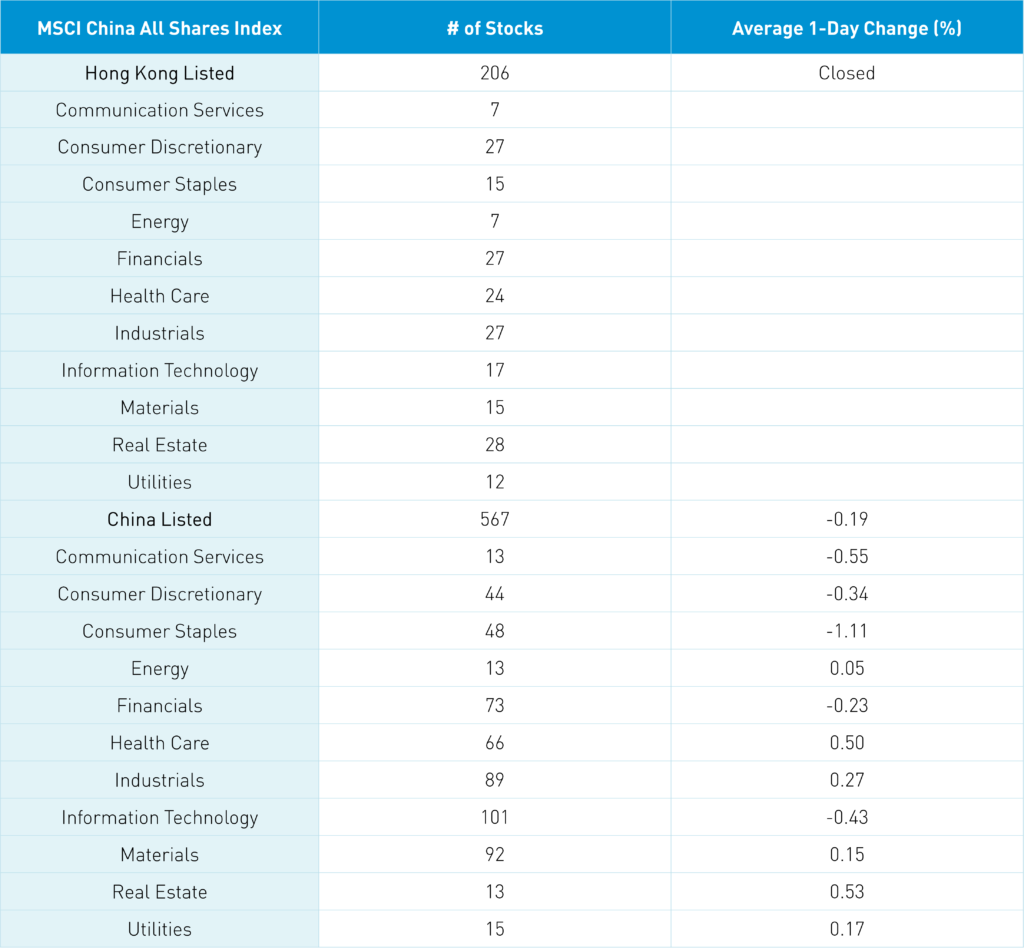

I would like to pause and reflect on 2021, which was a year that I had not anticipated. 2021 saw a spectacular divergence between what foreign investors think of China, represented by Hong Kong and US-listed ADRs, and what Chinese investors think about China, represented by the Mainland market’s Shanghai and Shenzhen-listed stocks. The MSCI China All Shares Index is comprised of Hong Kong-listed Chinese stocks (41.92% weight), Shanghai/Shenzhen-listed stocks (51.51% weight) and US-listed Chinese stocks (6.58% weight). In 2021, Hong Kong-listed stocks were down -19.7%, US-listed stocks were down -37.94%, and Shanghai and Shenzhen-listed stocks were up +3.77%.

Foreign investors overweighted Mainland stocks, as evidenced by the $67.14 billion in net inflow into Mainland stocks via Northbound Stock Connect, which was 2X the amount of inflow in 2020. This divergence also shows up in China’s currency, which appreciated +2.6% versus the US dollar this year. CNY closed 2020 at 6.52 and 2021 at 6.36. Chinese Treasury bonds also had a strong year as the Bloomberg Treasury 7-10 Years Index gained +5.7%. China’s economy may continue to roar in 2022, but it may look a little different than in previous years.

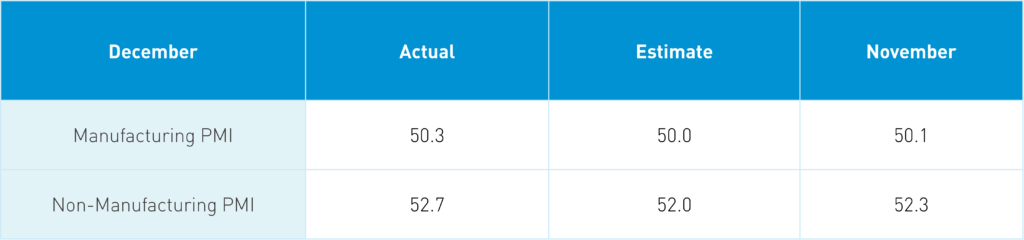

As a diffusion index, readings above 50 represent growth month-over-month, and readings below 50 indicate a contraction. Popping the hood and looking at the details are mixed as new orders and export orders fell below 50. Business expectations for both PMIs were strong with readings of 54.3 and 57.3. The PMIs were not considered market-moving events by local brokers.

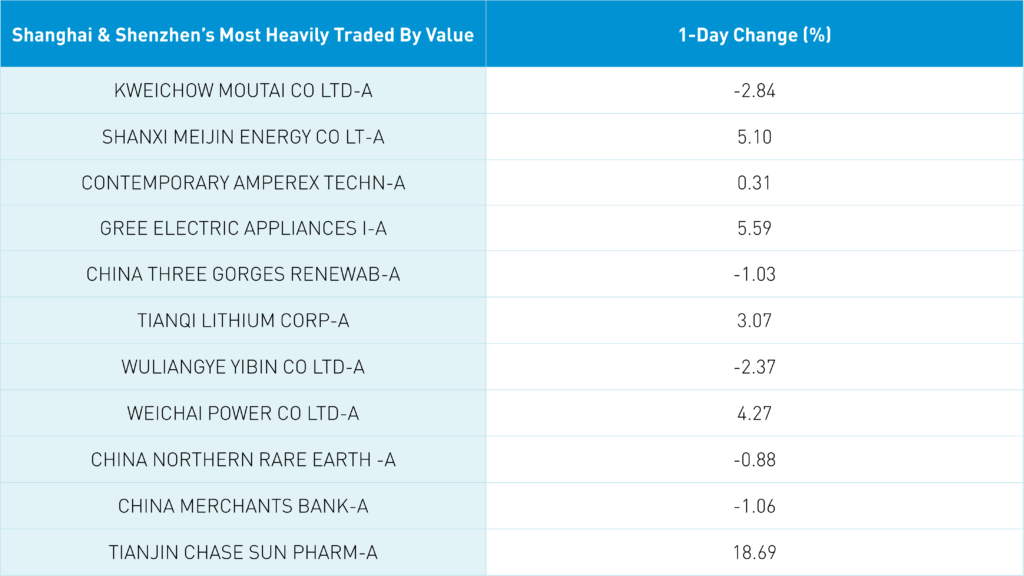

The Hang Seng closed a dismal year up +1.24% led by internet stocks as the Hang Seng Tech Index gained +3.57% while many individual names posted very strong returns after a very strong day in the US yesterday. Volumes were -16.72% lower than yesterday’s full-day session. Hong Kong’s most heavily traded stocks by value were Tencent, which gained +3.02%, Alibaba HK, which gained +8.19%, Meituan, which gained +3.21%, JD.com HK, which gained +5.47%, and Wednesday IPO SenseTime, which surged +33.17%. Short sellers were likely forced to cover their shorts though year-end window dressing was also likely a factor. In thin markets, the moves tend to be exaggerated. I am hoping that with tax-loss selling over we can keep the momentum going into the new year. Fingers crossed! Southbound Stock Connect was closed today. In addition to internet stocks, healthcare had a strong day on supportive policy measures for Chinese Traditional Medicine as the sector gained +3.32% in Hong Kong.

The Mainland had a full day session and Shanghai gained +0.57%, Shenzhen gained +0.52%, and the STAR Board gained +1.65% on volume that was +3.85% higher than yesterday, which is just above the 1-year average. Real estate was the best performing sector as the city of Ningbo implemented apartment loans for families having more than two children according to Mainland media source Yicai. The article notes that this policy is expected to be rolled out nationally as policies to raise the birth rate are apt to be one of the big stories in 2022. The clean technology sector had a strong day led by solar, lithium, and wind plays on a Ministry of Commerce release supporting the sector in the 14th Five Year Plan. The Ministry of Finance announced that electric vehicle (EV) subsidies will be cut by 30% in 2022 though EV plays were unaffected. Foreign investors bought $719 million worth of Mainland-listed shares today via Northbound Stock Connect. Bonds were off, CNY had a strong day, and copper gained +0.14%.

The Regional Comprehensive Economic Partnership (RCEP) will become effective tomorrow. 15 Asian countries will enjoy preferential trading arrangements with one another.

Private company Huawei reported poor results due to the US technology export ban. It is interesting that the media does not highlight the reality that the US government is trying to kill the company.

RIP to Yale professor and China historian Jonathan Spence.

A shoutout and hat tip to my colleagues Henry, Megan, and Joe, who help bring China Last Night to life on a daily basis. We appreciate you reading China Last Night and welcome any comments and recommendations on content and data. We hope you and your loved ones enjoy New Year Eve, which is also my birthday, and wish you success both personally and professionally in 2022

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.36 versus 6.37 yesterday

- CNY/EUR 7.22 versus 7.22 yesterday

- Yield on 1-Day Government Bond 1.78% versus 1.78% yesterday

- Yield on 10-Year Government Bond 2.78% versus 2.77% yesterday

- Yield on 10-Year China Development Bank Bond 3.08% versus 3.07% yesterday

- Copper Price +0.14%