Tencent, Meituan, JD.com, and Kuaishou Lead Hong Kong Internet Rebound

3 Min. Read Time

| Upcoming Webinar: |

| Join us tomorrow for our webinar with ETF Trends at 2:00 pm EST. China: The Next Global Equity Boon with Rate Cuts is Near? Click here to register. |

Key News

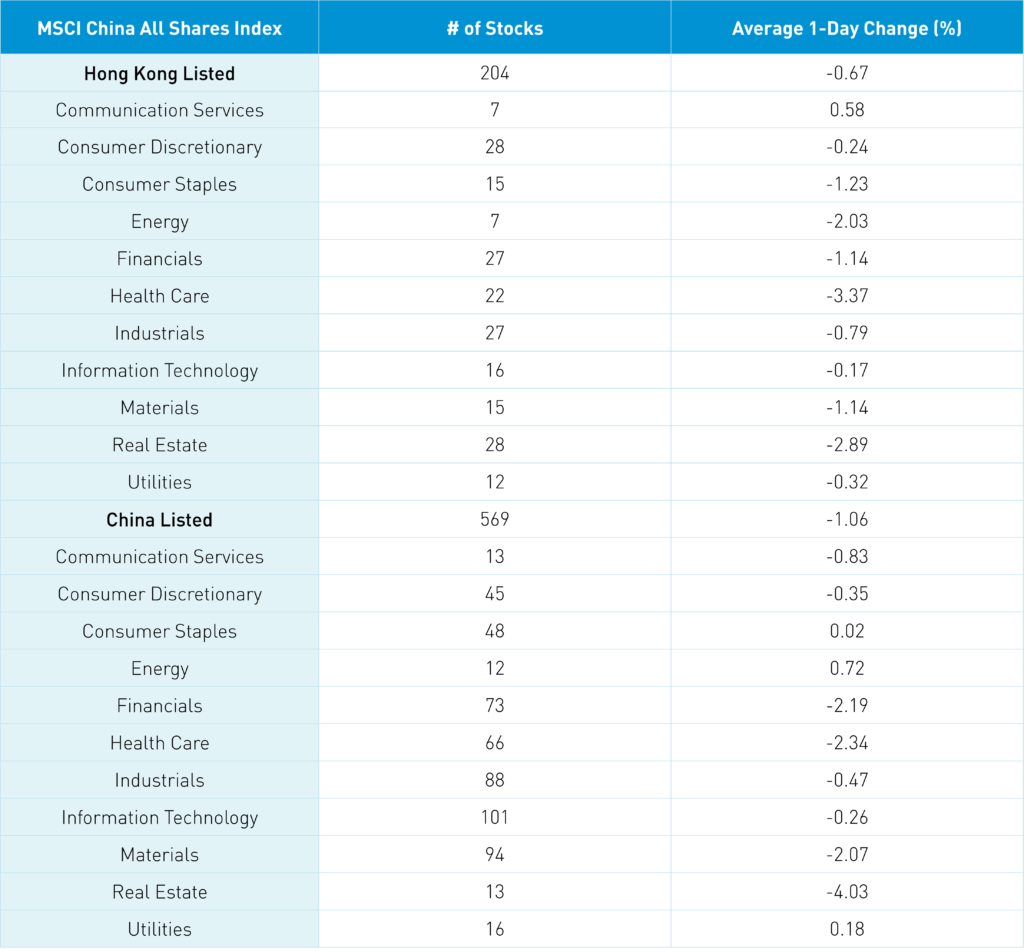

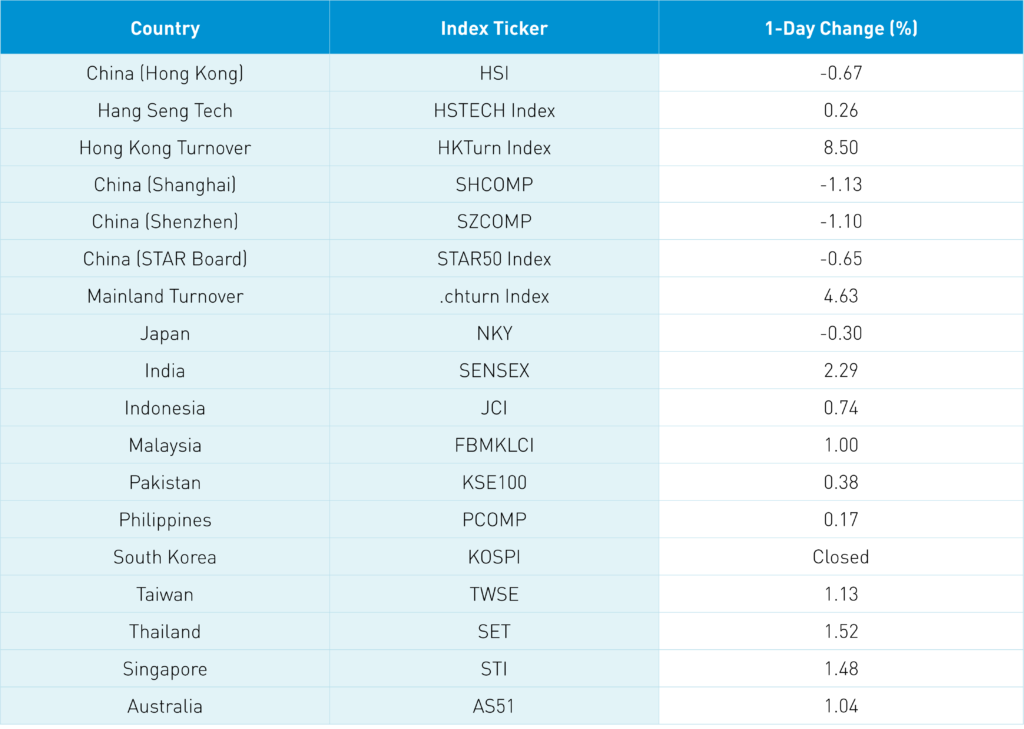

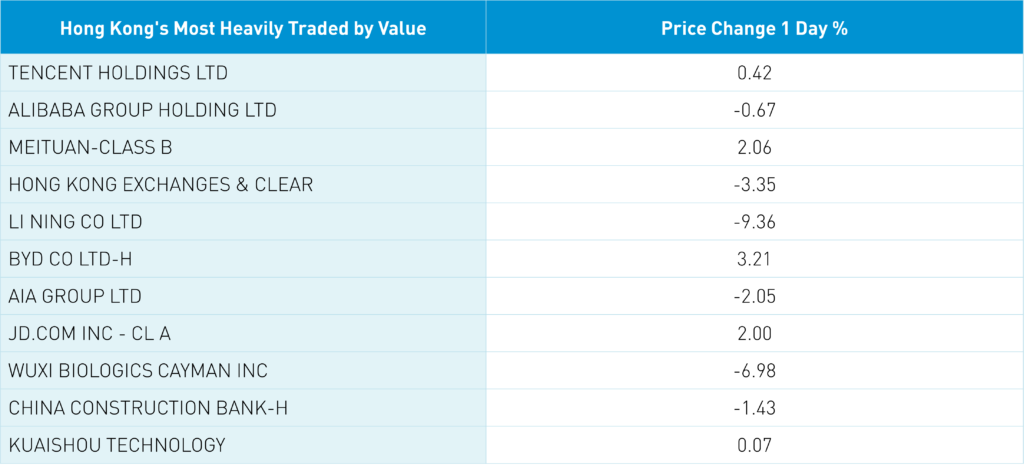

Asian equities had a mixed day as India, Singapore, Malaysia, and Thailand posted positive returns. Japan, China, and Hong Kong declined and South Korea was closed for their Presidential election today. South Asia likely benefited from optimism on Ukraine peace talks, which are lifting European markets. The Hang Seng Index was off -0.67%, hitting a 52 week low on volume that rose +8.48% from yesterday, which is 124% of the 1-year average. The Hang Seng Index was off -3.19% intra-day, but managed a late-session rally to curtail the loss. Internet stocks were an outlier to the upside as the Hang Seng Tech Index gained +0.26% led by Tencent, which gained +0.42%, Meituan, which gained +2.06%, JD.com HK, which gained +2%, and Kuaishou, which pulled a James Bond and gained +0.07%. However, Alibaba HK was off -0.67%.

Ant’s IPO won’t occur in 2022 despite the “news” coming from a fairly dubious source. Tencent, Meituan, and Kuaishou were net buys from Mainland investors via Southbound Stock Connect. The CSRC approved a Chinese tech company for a US IPO in a small sign of a potential regulatory thaw.

Healthcare and real estate were the weakest sectors in both Hong Kong and Mainland China. Healthcare’s weakness was driven by the CIA’s head mentioning a ban on US investments in Chinese technology companies, which local investors interpreted as focused on healthcare after Wuxi was added to the US’ unverified list. Adding the company is a joke as the company can’t be verified until travel to China resumes. Investors continue to worry about China’s property sector as bond spreads widen on the risk-off macro environment.

Hong Kong-listed clothing manufacturer, Li Ning (2331 HK), was down -12.16% closing -9.36% after Norway’s sovereign wealth fund Norges Bank said it will sell its stake on humanitarian concerns.

The market ignored a stealth monetary stimulus announcement as the PBOC moves RMB 1 trillion to the Ministry of Finance to support small, private companies. We also had China’s February CPI meet expectations at 0.9% while PPI declined from January’s 9.1% to 8.8%, though was a touch above expectations of 8.6%.

In addition to the invasion’s horrific human toll, inflation should be a significant economic catalyst for a peaceful resolution, driven by Western politicians and Western media’s Putin appeasement. It also provides a small taste of what “decoupling” would look like.

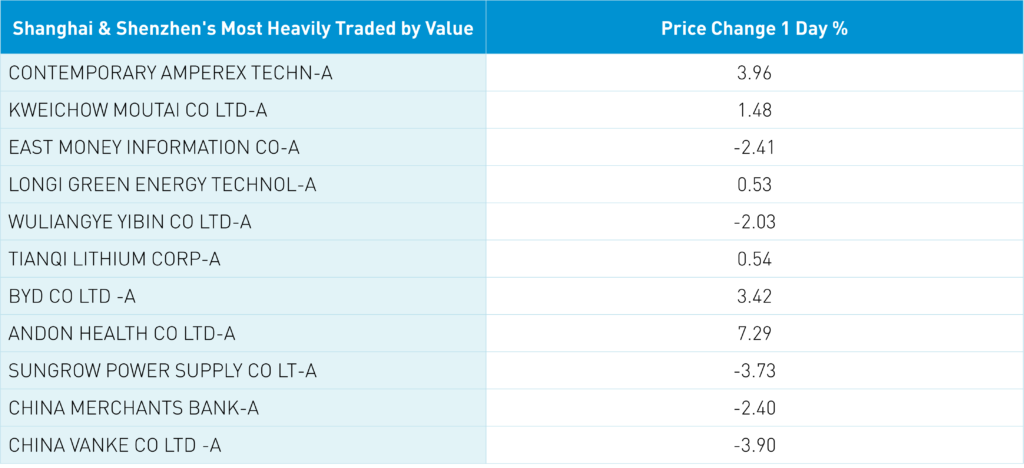

Shanghai, Shenzhen, and the STAR Board closed down for the fifth day, falling -1.13%, -1.1%, and -0.65%, respectively, though the indexes closed above their intra-day lows of -4.43%, -5.2%, and -3.52%, respectively. Local investors appear to be shaken by the risk-off environment. There was a flurry of corporate buybacks announced from Mainland companies overnight. Liquor giant Kweichow Moutai (600519) gained +1.48% after announcing strong January/February results for the first time following recent stock weakness. Electric vehicle battery maker CATL (300750 CH) rebounded +3.6% after recent weakness due to concerns about higher battery input prices. Foreign investors trimmed their Mainland stocks to the tune of -$1.731 billion via Northbound Stock Connect. So much for buying the dip! Chinese Treasury bonds eased a touch while the currency gained very slightly versus the US dollar and copper was off -1.05%.

The Financial Times had an interesting article on prestigious hedge funds' rough performance in 2021 and YTD 2022 due to technology weakness. The article didn’t mention Chinese tech weakness specifically, though it likely was a factor in the performance of several hedge funds.

A local Hong Kong newspaper had an article on institutional broker Citic’s CEO mentioning that Southbound Stock Connect criteria should be loosened in order to allow Mainland investors access to more Hong Kong stocks. I agree! The CEO sits on the HKeX’s board, so the article was, admittedly, slightly self-serving and a bit biased.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.32 versus 6.32 yesterday

- CNY/EUR 6.93 versus 6.89 yesterday

- Yield on 10-Year China Government Bond 2.84% versus 2.83% yesterday

- Yield on 10-Year China Development Bank Bond 3.12% versus 3.10% yesterday

- Copper Price -1.05% overnight