Nio and Meituan Under Pressure as Investors Ask “Where’s The Beef?”, Week in Review

3 Min. Read Time

Week in Review

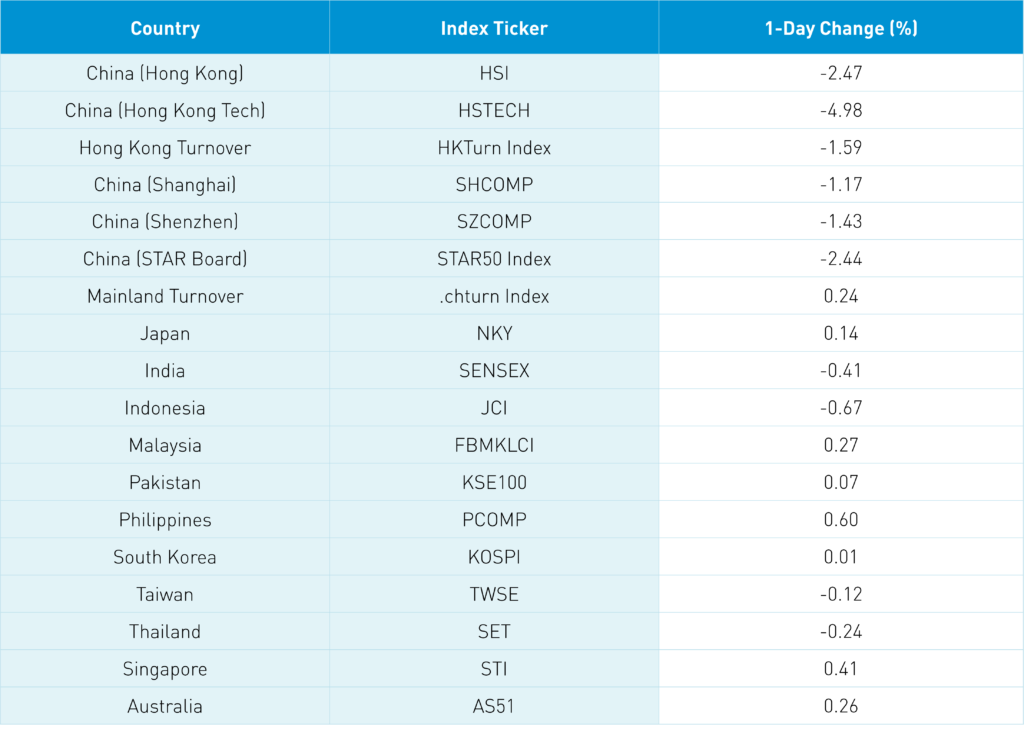

- Asian equities saw choppy trading this week as geopolitics and higher commodity prices continued to present risks and growth/internet stocks saw some pressure following last week’s monster gains.

- E-commerce company Pinduoduo (PDD US) reported Monday that Q4 revenues grew by +3% year-over-year (YoY), missing analysts estimates slightly, though net income and EPS beat significantly as the company controlled costs and reported strong growth in its agricultural product lines.

- Alibaba (BABA US, 9988 HK) announced Tuesday it would increase its buyback program from $15B to $25B after having already bought back 56.2 million shares, for a total of $9.2B.

- Tencent reported lackluster Q4 earnings on Wednesday. Management described 2021 as a “challenging year,” but expressed optimism for the future sustainable growth of its business and the internet sector following the implementation of new, forward-looking regulations.

Friday's Key News

Asian equities ended the week mixed as China and Hong Kong’s decline on light volumes negated gains earlier in the week.

Yesterday’s statement from the PCAOB that a solution to the HFCAA was still “premature” was a factor in the weakness in Hong Kong-listed China internet stocks overnight. We also had the SEC add Weibo to the HFCAA non-compliant list though one should expect all US-listed Chinese ADRs to end up on the list once they file their 2021 annual reports with the SEC. This is the first time the PCAOB has directly acknowledged its engagement with the CSRC, China’s securities regulator. It also shows their commitment that no special rules are made, which isn’t surprising. As we noted yesterday, differentiating between private companies, which likely have nothing to hide, and State-Owned Enterprises (SOEs), whose audits may contain sensitive information, is an easy first step solution.

Investors are also getting ancy about seeing tangible follow-ups to Vice Premier Liu He’s speech last week, which included a commitment to resolve the HFCAA, curtail internet regulation, and provide support for the economy. To date myself, the old Wendy’s commercial “Where’s the beef?” comes mind. Skeptics would say it is all words and no action. The supertanker doesn’t turn on a dime as I suspect that today’s market action has not gone unnoticed.

Profit-taking was likely also a factor in today’s market action considering the significant move in growth/internet stocks over the last week and a half. This pullback should bring more buyers in from the sidelines, especially if we see some tangible results from the Vice Premier’s comment, which I expect that we will. There are other factors at play, including the Fed’s hawkish tone and the ongoing crisis in Ukraine.

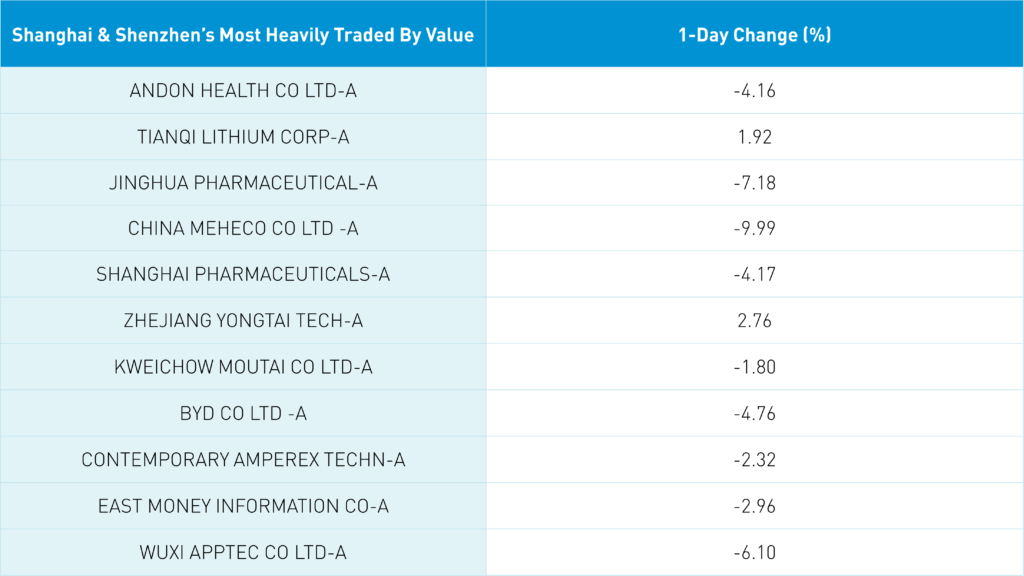

One China-specific headwind was a covid outbreak and subsequent lockdown in Shanghai. Some stock-specific headwinds were Nio’s weak guidance and skepticism going into Meituan’s Q4, which turned out to be better than expected after it was reported post-close in Hong Kong.

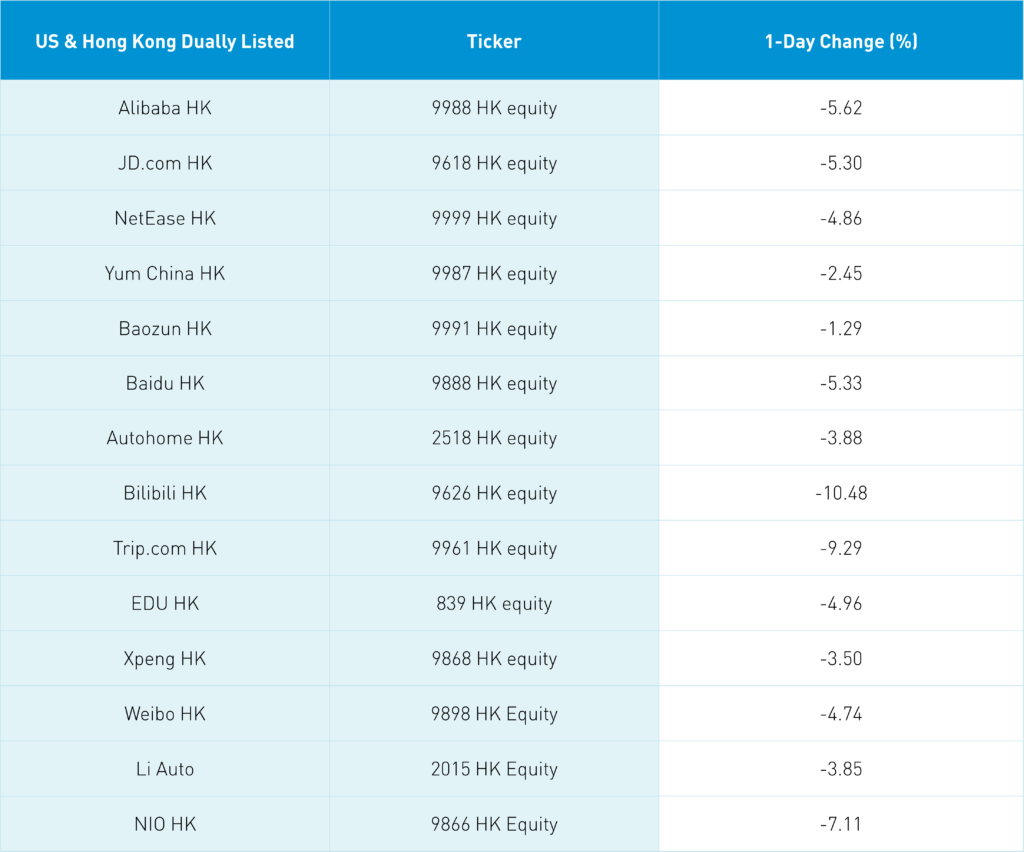

Trip.com HK was off -9.29% despite far better-than-expected results yesterday.

Today, Tencent is spinning off its stake in JD.com as investors will receive shares of JD’s Hong Kong share class. This has put pressure on JD.com as many investors, including Tencent, will receive cash, leading to sales in JD.com stock.

President Xi is calling for a peaceful resolution to the Ukraine/Russia conflict. An element of today’s weakness could have been curtailing risk asset exposure going into the weekend, considering how quickly the situation in Ukraine is changing.

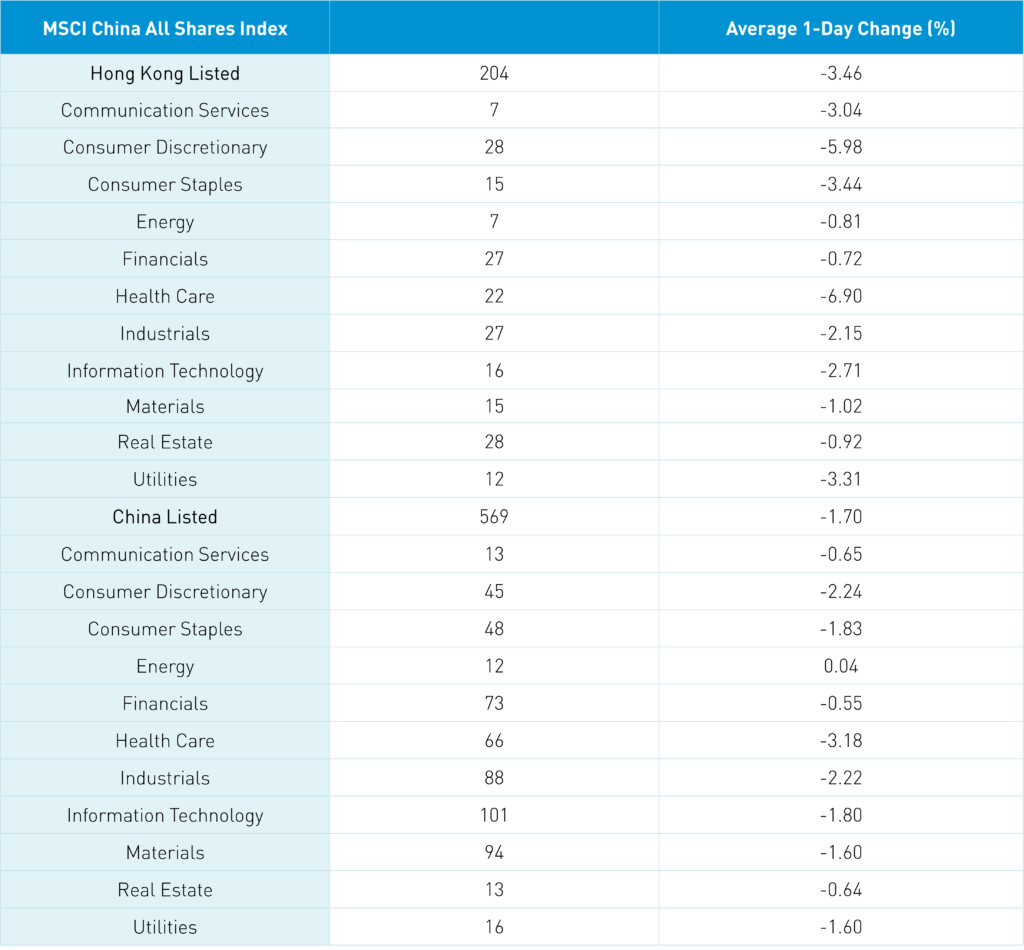

The Hang Seng declined -2.47% with all sectors down while the Hang Seng TECH Index was off -4.98% on internet weakness as Tencent fell -2.62%, Alibaba HK fell -5.62%, Meituan fell -8.16%, and JD.com HK fell -5.3%. Volumes were off -1.59% from yesterday, which is 98% of the 1-year average, short selling volume increased +15.54% from yesterday though off the recent high while only 77 stocks advanced and 427 declined. In addition to internet, the electric vehicle ecosystem was quite weak as Nio HK fell -7.11%, Li Auto fell -3.85%, and Xpeng fell -3.5%. Mainland investors sold Hong Kong stocks today via Southbound Stock Connect as Tencent and Meituan were both net sales, but not by significant amounts. Value and dividend factors outperformed, meaning they simply fell less.

Shanghai fell -1.17%, Shenzhen fell -1.43%, and the STAR Board fell -2.44% on volume that was +0.24% higher than yesterday, which is 87% of the 1-year average. 1,986 stocks advanced while 2,283 stocks declined with every sector in the red except for energy’s gain of +0.05%. Healthcare was hit with profit-taking after its recent outperformance. Foreign investors sold -$489 million worth of Mainland stocks today, which brings the weekly sale to $2.01 billion. Treasury bonds rallied, CNY was flat versus the US dollar, and Copper was off -0.1%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.36 versus 6.37 yesterday

- CNY/EUR 7.01 versus 7.01 yesterday

- Yield on 1-Day Government Bond 1.56% versus 1.56% yesterday

- Yield on 10-Year Government Bond 2.80% versus 2.81% yesterday

- Yield on 10-Year China Development Bank Bond 3.06% versus 3.06% yesterday

- Copper Price -0.10% overnight