PBOC Cuts RRR After Stronger Than Expected Economic Data Release

2 Min. Read Time

Key News

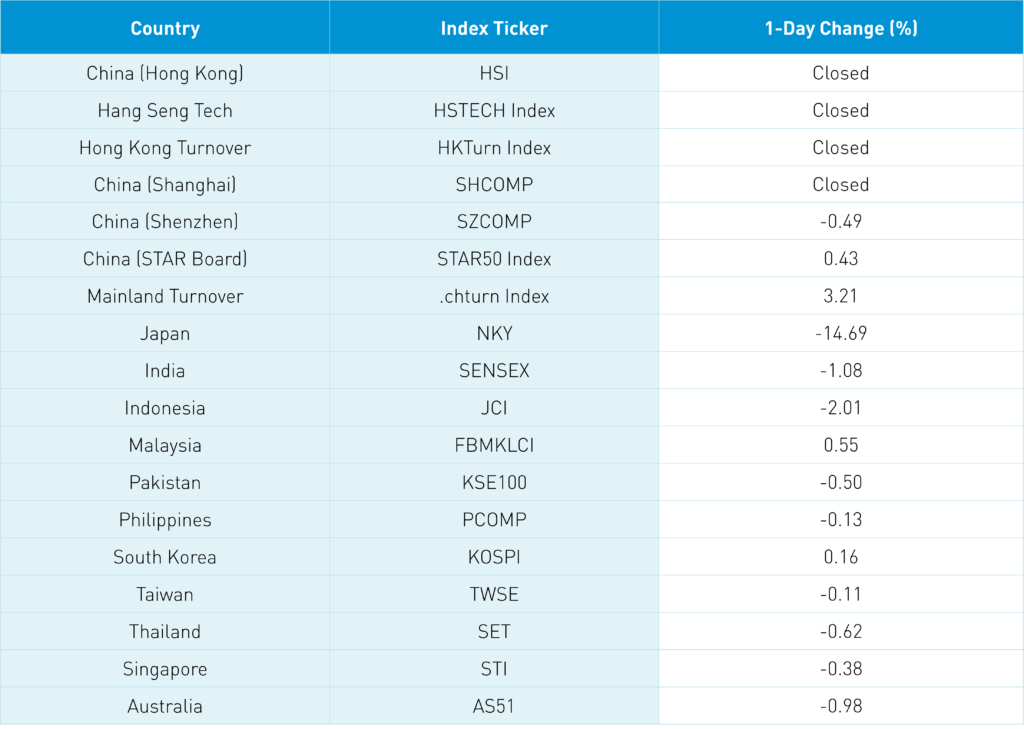

Asian equity markets were largely lower led by Japan, India, Taiwan, and South Korea while Hong Kong and Australia remained on holiday. The PBOC cut the bank reserve requirement ratio (RRR) by 25bps Friday while not cutting the medium-term lending facility (MLF) or the repurchase rate. The market expected a 50bps RRR cut though the PBOC’s statement made it clear they will cut incrementally versus pulling the band-aid.

Q1 GDP grew +4.8% versus expectations of 4.2% while March industrial production +5% versus expectations of 4% and retail sales -3.5% versus expectations of -3%. Within retail sales, online retail sales grew in March by +2.9% year over year and +8.8% in Q1. We’ll see the effect of Shanghai’s lockdown though Wednesday restrictions will be loosened for many industries including automakers. Vice Premier Liu He led another meeting on allowing port and logistics activity to take place despite the Shanghai restrictions.

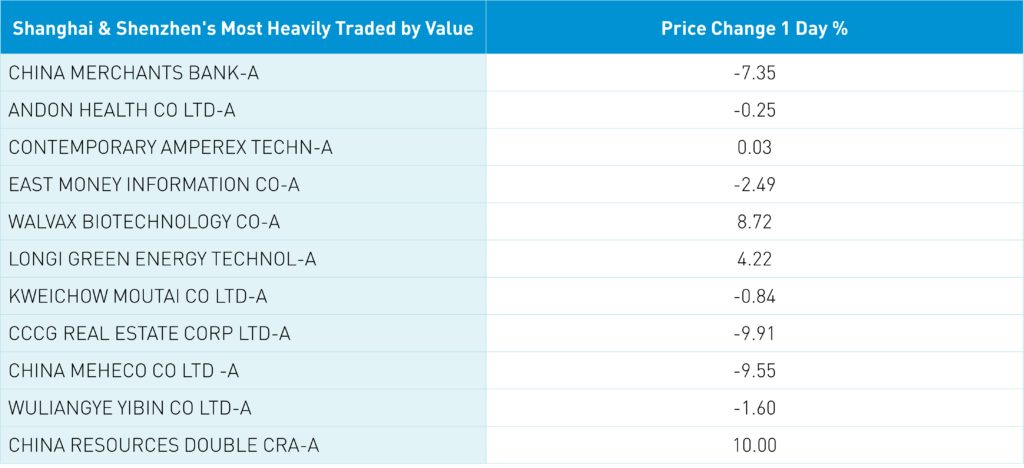

China Merchant Bank’s Shenzhen Stock Exchange listing fell -7.35% after President Tian Huiyu unexpectedly stepped down. The private/non-SOE bank has historically been an investor favorite.

Worth noting that technology/growth stocks outperformed as dividend/value sectors underperformed. The clean technology ecosystem outperformed overnight led by solar, wind, and EV-related stocks.

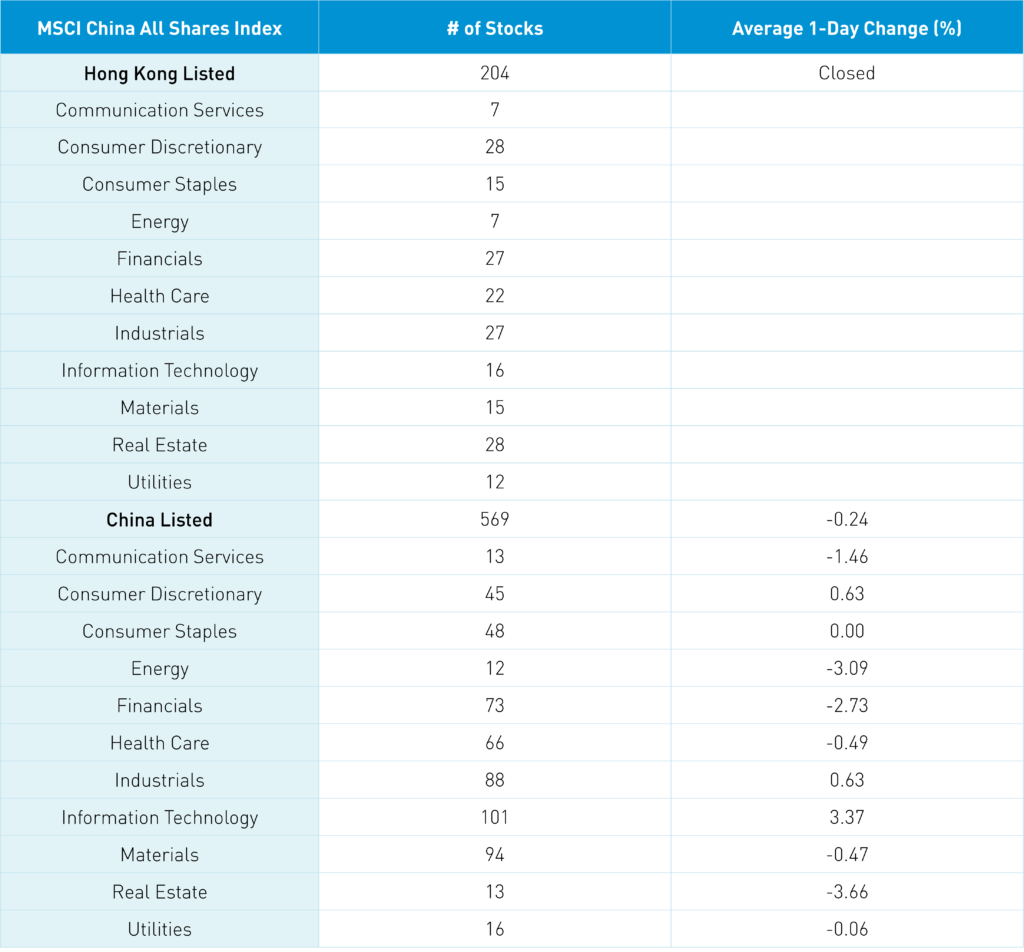

Shanghai, Shenzhen, and STAR Board diverged overnight -0.49%, +0.49%, and +3.21% though volumes were off -14.69%, which is just 72% of the 1-year average. There were 2,709 advancing stocks versus 1,634 declining stocks. Technology was the best performing sector +3.39% while real estate -3.64%, energy -3.07%, financials -2.71% and communication -1.43%. Northbound Stock Connect was closed. Treasury bonds sold off, CNY appreciated slightly versus the US $, and copper +.51%.

The Financial Times produced a fine piece of journalism in its interview with Scottish asset manager Baillie Gifford’s James Anderson who will retire later this month. While not a household name here in the US, Anderson is a legend due to his strong investment returns driven by early investments in US and Chinese tech companies. His focus is on founder-run companies and “…trying to find the extreme winners is the best way to invest.” A worthwhile read if your schedule allows!

Didi announced it will hold a shareholder meeting on May 23rd to discuss delisting its NYSE listing. The company said it would not seek another listing venue. Because we do not hold Didi shares, I’ve not followed its saga closely. I’ll do some work overnight and report back.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.37 versus 6.37 yesterday

- CNY/EUR 6.88 versus 6.95 yesterday

- Yield on 10-Year Government Bond 2.81% versus 2.76% yesterday

- Yield on 10-Year China Development Bank Bond 3.04% versus 3.00% yesterday

- Copper Price +0.51% overnight