Internet Stocks Rally, China’s Weight To Increase in MSCI EM, Week in Review

3 Min. Read Time

Week in Review

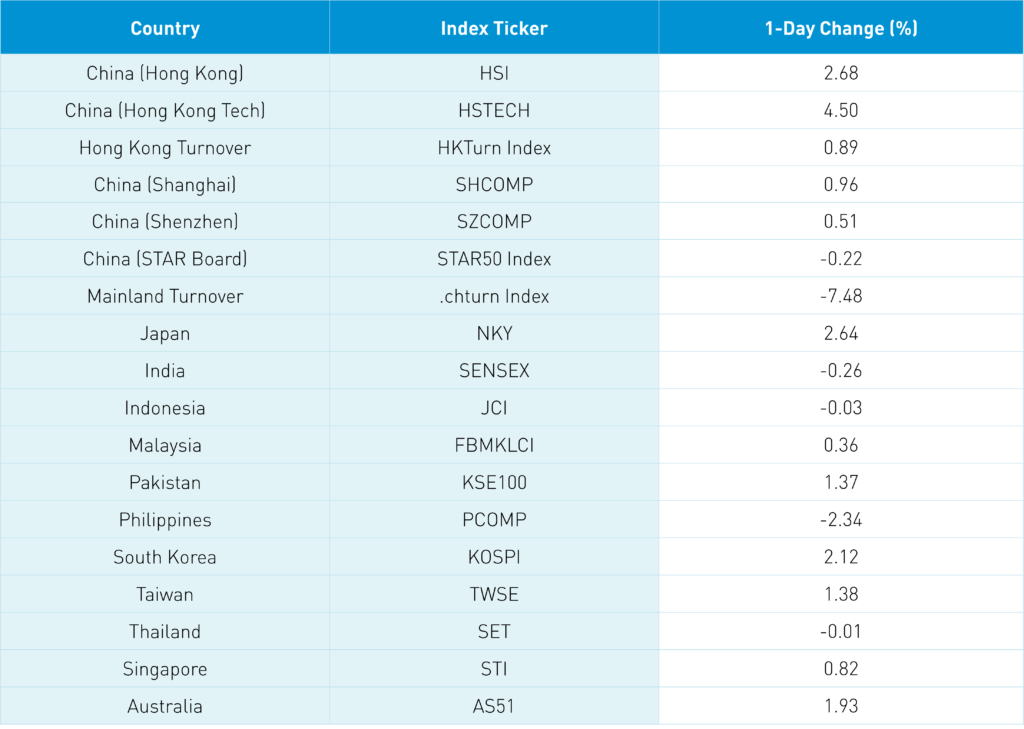

- Asian equities saw another week of turbulent trading as the market continues to price in risks though Mainland China held up better than most markets in Asia this week and some markets were closed earlier in the week.

- Mainland media source Yicai Global reported Monday that Tiktok’s parent ByteDance might list the Chinese version of TikTok in Hong Kong, rebranding itself Douyin.

- China’s April PPI and CPI came in at 8.0% and 2.1%, respectively, slightly higher than expectations of 7.8% and 1.8%. However, the market expects inflation is not high enough to stop further stimulus.

- Tencent and Meituan saw strong net buying throughout the week by Mainland investors via Southbound Stock Connect.

- In this week's video update, Xiabing Su takes us to breakfast at KFC in China to demonstrate the continuing popularity of American fast food in the world's second-largest economy.

Friday’s Key News

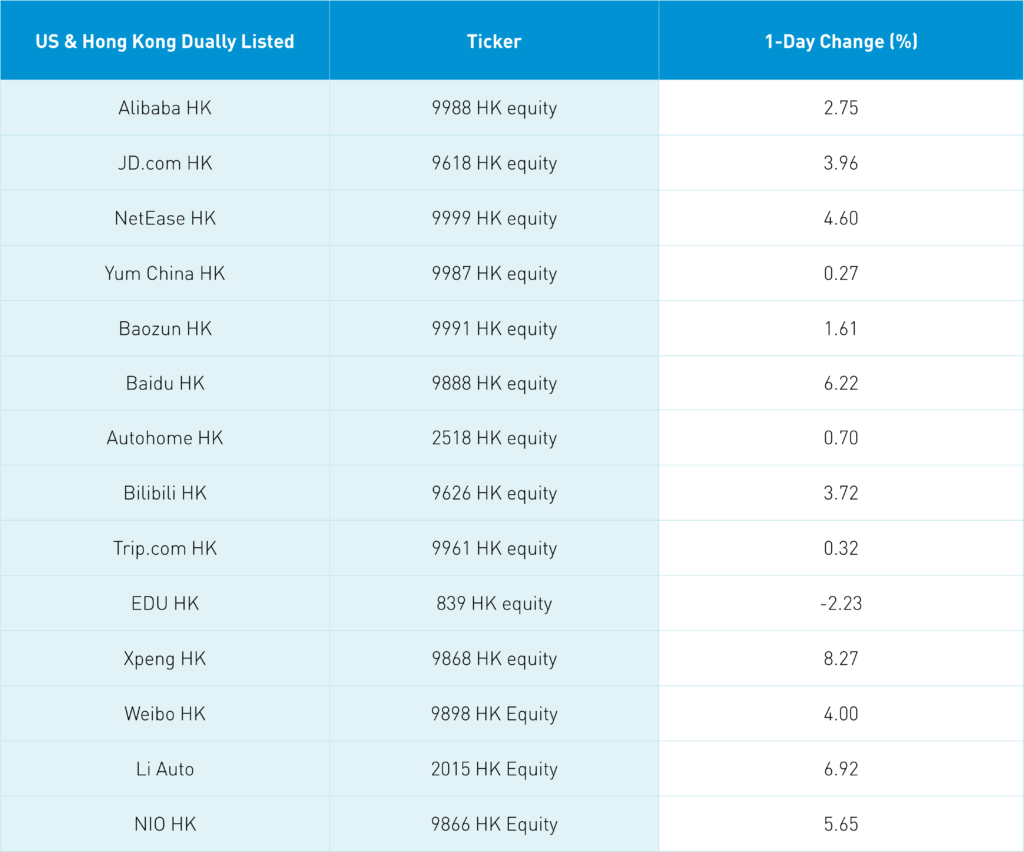

Asian equities were mixed but mostly higher overnight as Hong Kong outperformed, led by internet stocks on little in the way of news. Mainland investors had been significant buyers of Tencent, Meituan, and other internet stocks throughout the week and we saw the result of their purchases come to the fore on Friday.

The rally in internet stocks was interesting as the US market was lower overnight and there was no significant news for China internet. The CPPCC is set to host a forum next week, where it is expected to again affirm that the internet regulatory cycle is over. In attendance will be private firms including Baidu. It is possible that this is the underlying reason for the rally and for Mainland investors’ enthusiasm for internet names this week.

Dollar strength continues to weigh on the Renminbi, China’s currency, after the latter’s fantastic rise over the past two years. Overnight, CNY traded at the psychologically important level of 6.8 per US dollar for the first time in nearly three years. Some analysts expected it to go higher (depreciate further).

The Securities Times, a Mainland financial newspaper, reported that China may introduce new lending and re-lending tools with the goal of providing targeted support to the real economy. In other words, stimulus!

China property developer Sunac defaulted on a dollar bond payment worth $29.5 million. Distressed developers’ bonds continued to trade lower overnight as fears of contagion among foreign investors abound. However, not all developers are created equal as Country Garden’s stock gained over +6% overnight in Hong Kong. Evidently, there is a flight to quality in the real estate development space. While these defaults could have been inevitable, we are seeing some cautiously optimistic signs in the real estate space including a slight uptick in home prices in the first quarter and the relaxing of purchase restrictions in multiple provinces.

After the US close, MSCI released its pro-forma for the June 1st Semi-Annual Index Review. Within the MSCI Emerging Markets Index, the number of Chinese equities fell by 11 stocks based on 33 additions and 44 deletions. However, the percentage weight of China in the index is increasing from 29.9% to 30.2%. China will account for 733 stocks of MSCI Emerging Markets’ 1,162 stocks. Didi is being removed from the index though its current weight is only 0.01%. Remarkably, the US equity market accounts for $44.86 trillion of the world’s free float market cap of $73.829 trillion, which is 60.8% of the ACWI IMI Index.

MSCI is also migrating its exposure to Baidu and Bilibili to their Hong Kong share classes from the US-listed ADRs. This has nothing to do with the Holding Foreign Companies Accountable Act, but rather their index methodology, which compares the value traded in the local listings versus the ADRs one year after the local listing takes place.

China released guidelines for the development of “county towns,” which are a middle ground between rural and urban development. This could characterize China’s infrastructure development model over the next few years as policymakers wish to bring rural areas more into the economic fold and connect them better to large metropolises. While this type of development will demand less than the previous style of massive urban development, infrastructure spending and investment will still be needed.

The Hang Seng and Hang Seng Tech Indexes closed +2.68% and +4.50%, respectively, on volume that was nearly in line with yesterday, which is just 80% of the 1-year average. Mainland investors bought a net HKD 3.5 billion worth of Hong Kong stocks via Southbound Stock Connect overnight.

Shanghai, Shenzhen, and the STAR Board closed +0.96%, +0.51%, and -0.22%, respectively, on volume that was -7% lower than yesterday, which is 70% of the 1-year average. Foreign investors bought a net RMB 2.1 billion worth of domestic stocks today vie Northbound Stock Connect. China Treasury bonds were unchanged overnight, CNY depreciated very slightly, and copper was flat.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.80 versus 6.79 yesterday

- CNY/EUR 7.05 versus 7.06 yesterday

- Yield on 1-Day Government Bond 1.26% versus 1.29% yesterday

- Yield on 10-Year Government Bond 2.81% versus 2.81% yesterday

- Yield on 10-Year China Development Bank Bond 3.00% versus 2.99% yesterday

- Copper Price -0.00% overnight