Pinduoduo Beats Estimates, Hong Kong Cheers Internet Earnings, Week in Review

3 Min. Read Time

Week in Review

- Asian equities had a relatively upbeat week overall as President Biden visited the region and China internet earnings season kicked off with a few surprises to the upside in names including Alibaba, Baidu, Kuaishou, NetEase, and Pinduoduo.

- However, Snapchat’s deeply disappointing earnings release in the US led to a sentiment downturn in Asia on Tuesday.

- John Tuttle (Vice-Chairman and Chief Commercial Officer, at the New York Stock Exchange) joined KraneShares CEO Jonathan Krane on a panel in Davos this week, where he said he believes NYSE will see more China ADR listings in the future rather than fewer as regulators in the US and China work towards an audit deal. Watch the full panel discussion here.

- The State Council held a conference call with a rumored one hundred thousand participants, urging them to “…seize the time window and strive to bring the economy back to the normal track,” after the PBOC made a deeper-than-expected cut to a key lending rate last Friday.

Friday’s Key News

Asian equities were mostly higher overnight as Hong Kong outperformed, led by internet stocks following the strong performance in US-listed China internet stocks yesterday.

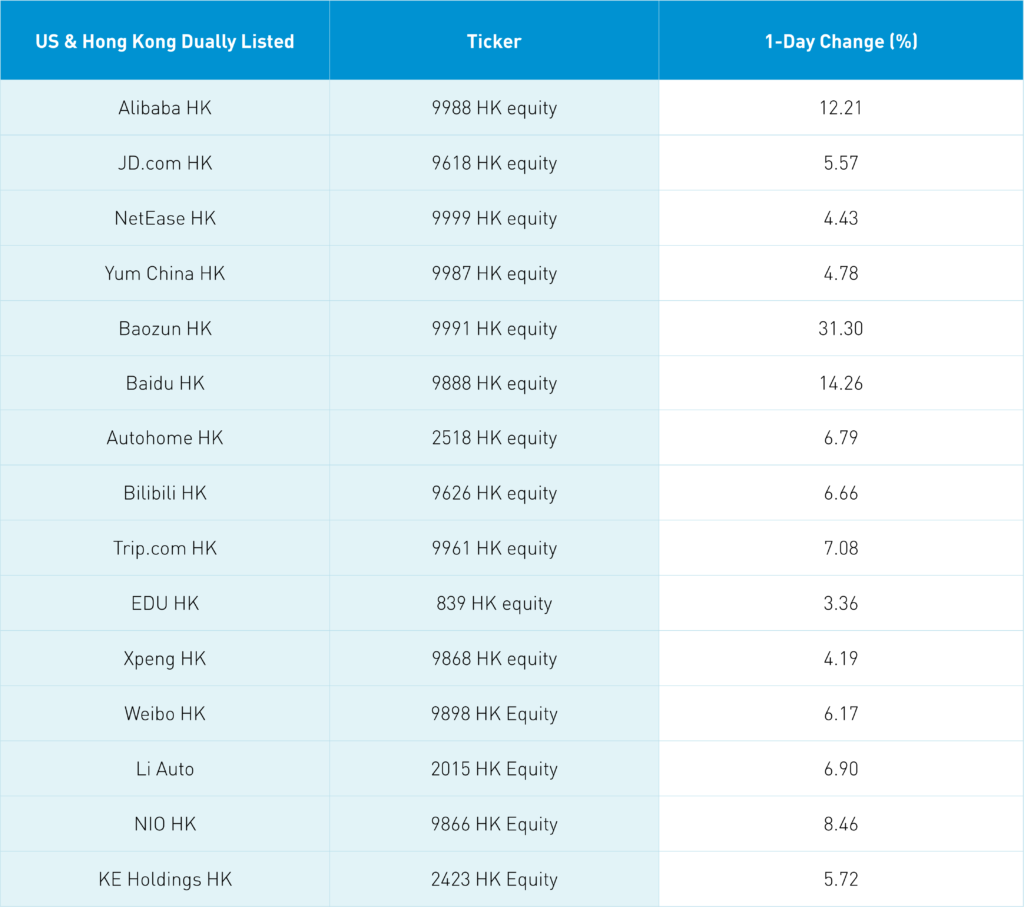

Alibaba HK and Baidu HK gained +12.21% and +14.26%, respectively, following their expectation-beating financial results, which we covered in yesterday’s note.

This morning, following the market close in Hong Kong, e-commerce company Pinduoduo (PDD US) released earnings that beat analyst expectations on revenue, adjusted EPS, monthly users, and active buyers. Pinduoduo’s release is covered below.

After the close in Hong Kong, HKEX announced that Hong Kong-listed ETFs will be added to Southbound Stock Connect. While the date of inclusion has not been announced yet, Mainland investors are apt to be interested in growth-oriented ETFs such as internet proxies. There was also an announcement on easing the rules for foreign investors in China’s onshore bond market.

Pinduoduo (PDD US) reported Q1 results pre-market open. The results beat expectations, leading to a pre-market rally in shares. However, management was conservative in its outlook. Unfortunately, neither management nor analysts on the earnings call spoke to the prospects of Pinduoduo relisting in Hong Kong. I am shocked that the company has yet to publicly file, though, in theory, they may have filed privately. Management did a good job keeping costs down. They also did a good job maintaining profitability, which is key in this market environment.

- Revenue increased +7% to RMB 23.793B ($3.753B) versus expectations of RMB 20.649B

- Average monthly users increased +4% and 7% to 751.3mm and 881.9mm

- Total operating expense declined to RMB 14.479B ($2.284B) from RMB 15.568B

- Adjusted net income was RMB 4.200B ($662.6mm) up from a loss of RMB -1.890B versus expectations of RMB 2.65B

- Adjusted EPS RMB 2.95 ($0.47) versus expectations of RMB 1.52

- Cash on the books increased to RMB 95.2B ($15B) from RMB 92.9B

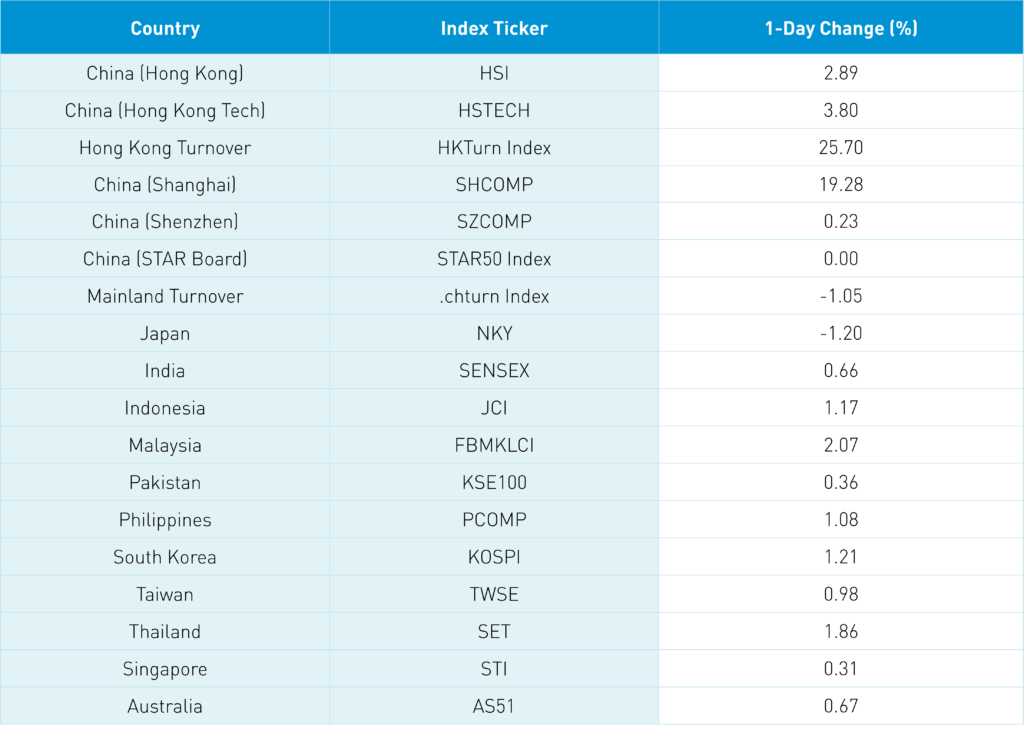

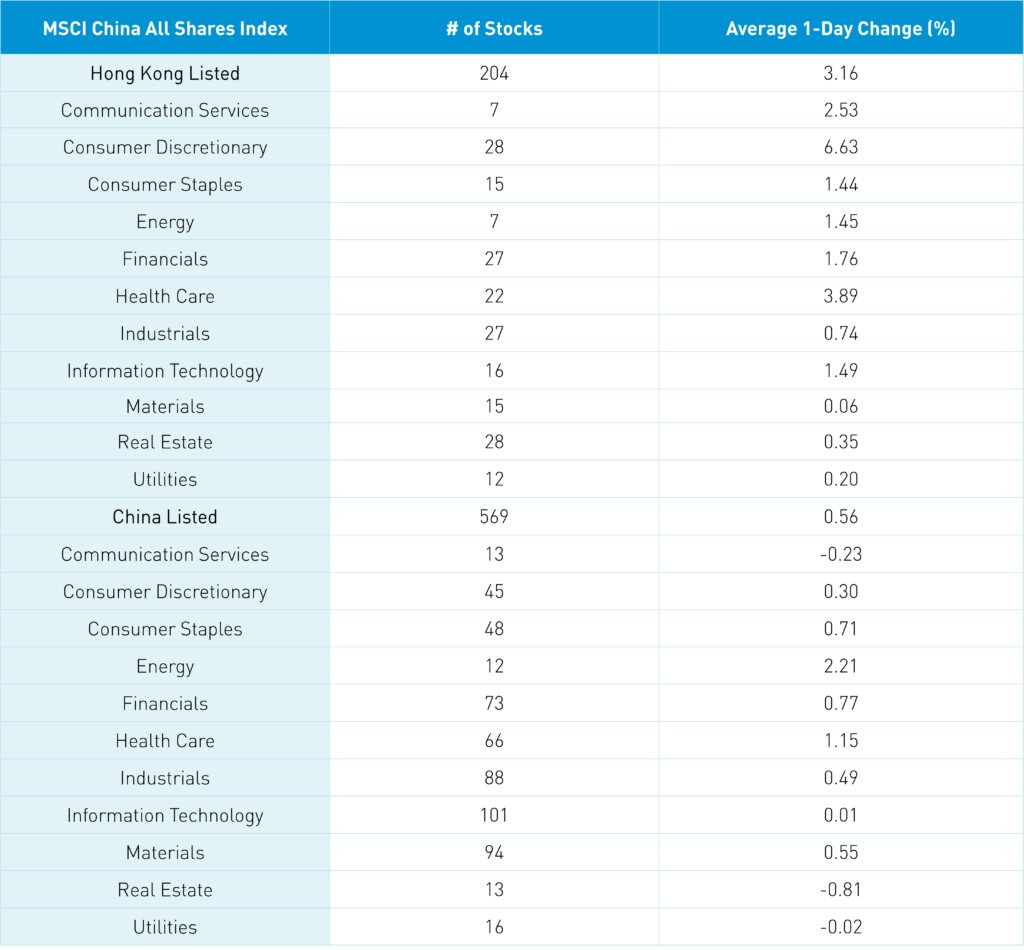

The Hang Seng and Hang Seng Tech Index gained +2.89% and +3.8%, respectively, on volume that was +25.7% higher than yesterday, which is 85% of the 1-year average. 307 stocks advanced while 161 declined. Hong Kong short sale volume increased +19.28% from yesterday, which is 88% of the 1-year average. Growth factors outperformed value factors as large caps outperformed small caps. All sectors were in the green, led by discretionary, which gained +6.63%, healthcare, which gained +3.89%, and communication, which gained +2.53%. Outperforming subsectors included contract research organizations (CROs, or outsourced pharma research and manufacturing work), e-commerce, and cloud stocks. Southbound Stock volumes were average in mixed trading though Tencent saw a small net sell and Meituan saw a small net buy.

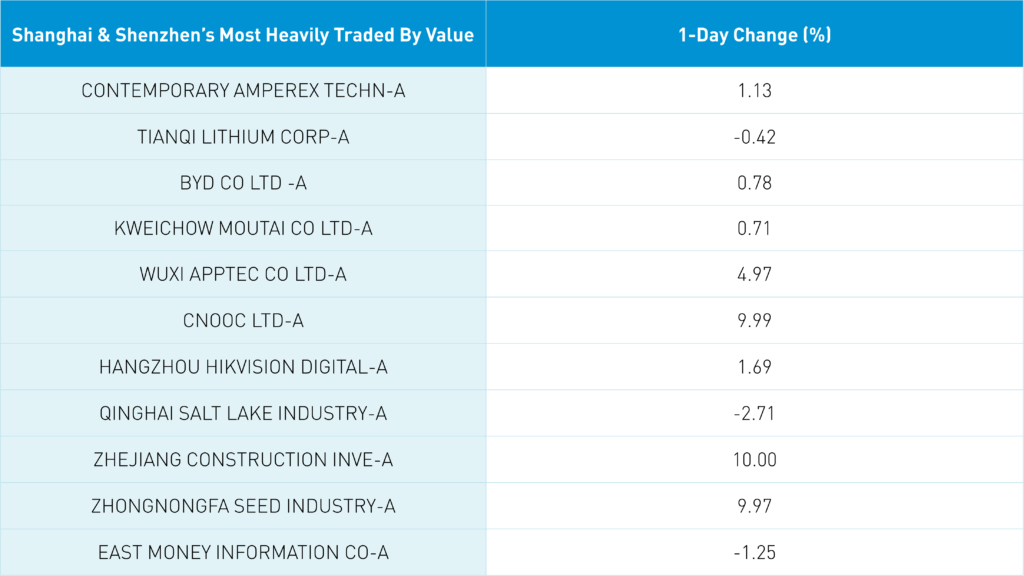

Shanghai, Shenzhen, and the STAR Board diverged to close +0.23%, 0.00%, and -1.05%, respectively, on volume that fell -1.2% from yesterday, which is 75% of the 1-year average. 1,574 stocks advanced while 2,743 stocks declined. Large and mega caps outperformed small caps while growth and value factors were even. The top sectors were energy, which gained +2.33%, healthcare, which gained +1.6%, and financials, which gained +0.88%. Meanwhile, communication fell -0.12% and real estate fell -0.7%. CROs and energy exploration were among the top sub-sectors while cement, semiconductors, and software stocks were off. Foreign investors bought $581 million worth of Mainland stocks via Northbound Stock Connect. Treasury bonds rallied, CNY rallied +0.43% versus the US dollar to 6.71 and copper rallied +0.84%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.70 versus 6.74 yesterday

- CNY/EUR 7.18 versus 7.23 yesterday

- Yield on 1-Day Government Bond 1.20% versus 1.25% yesterday

- Yield on 10-Year Government Bond 2.70% versus 2.71% yesterday

- Yield on 10-Year China Development Bank Bond 2.94% versus 2.93% yesterday

- Copper Price +0.84% overnight