Mainland Investors Buy The Dip In Hong Kong

2 Min. Read Time

Key news

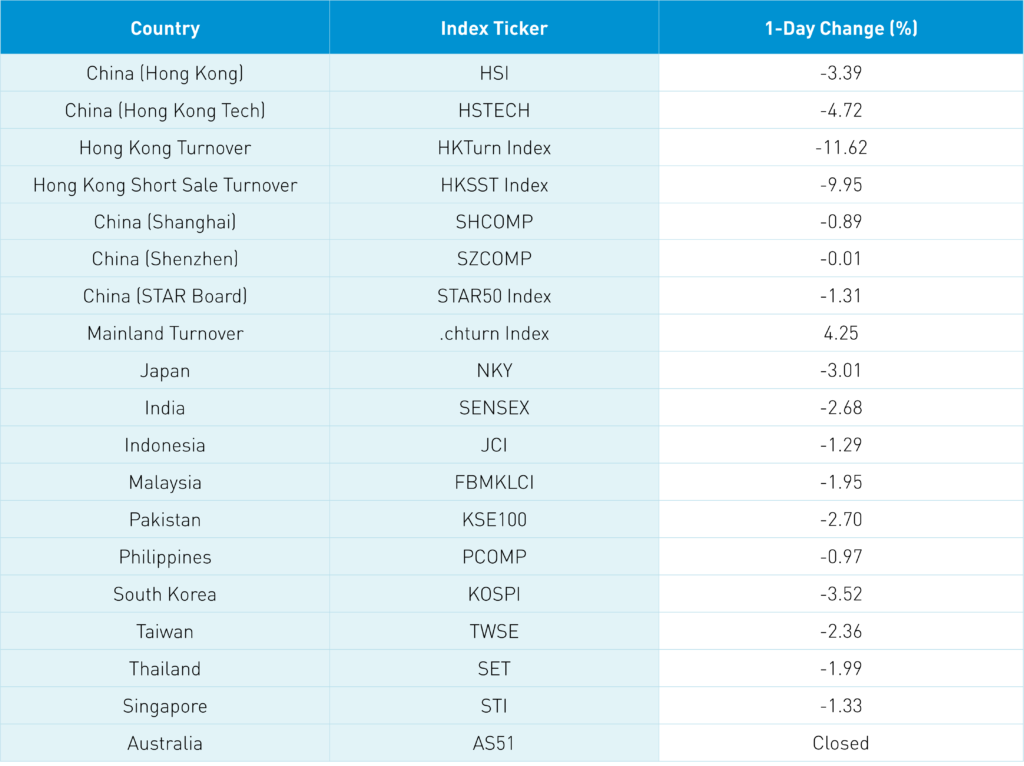

Asian equities didn’t forget about Friday’s US CPI print nor the ECB’s rate hike language leading to a similar fall as we had in Europe and the US Friday. Bitcoin was also smoked over the weekend as a sign of risk-off contagion. South Korea was hit especially hard while Australia dodged the bullet due to the Queen’s birthday and market holiday.

Growth stocks were hit harder in the region and Hong Kong than they were in China. Volumes were high, though lower than Friday’s high volumes, driven by Hong Kong and Mainland China index rebalances.

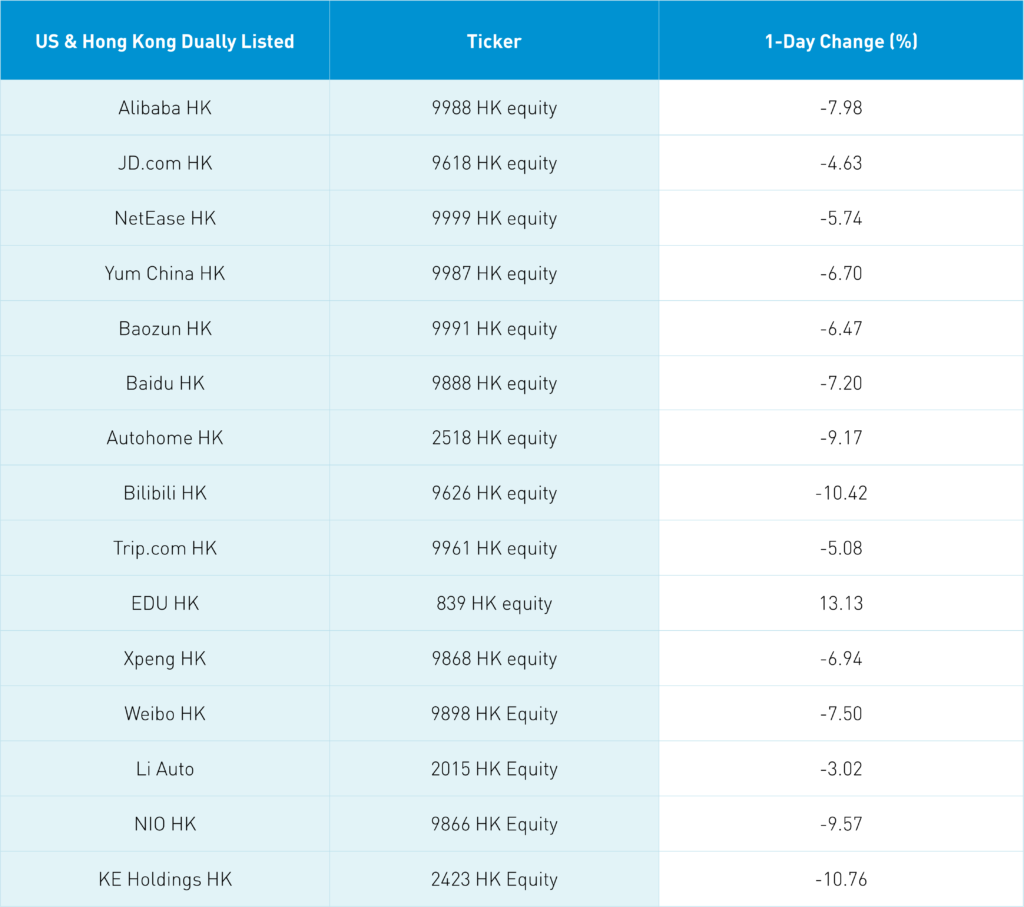

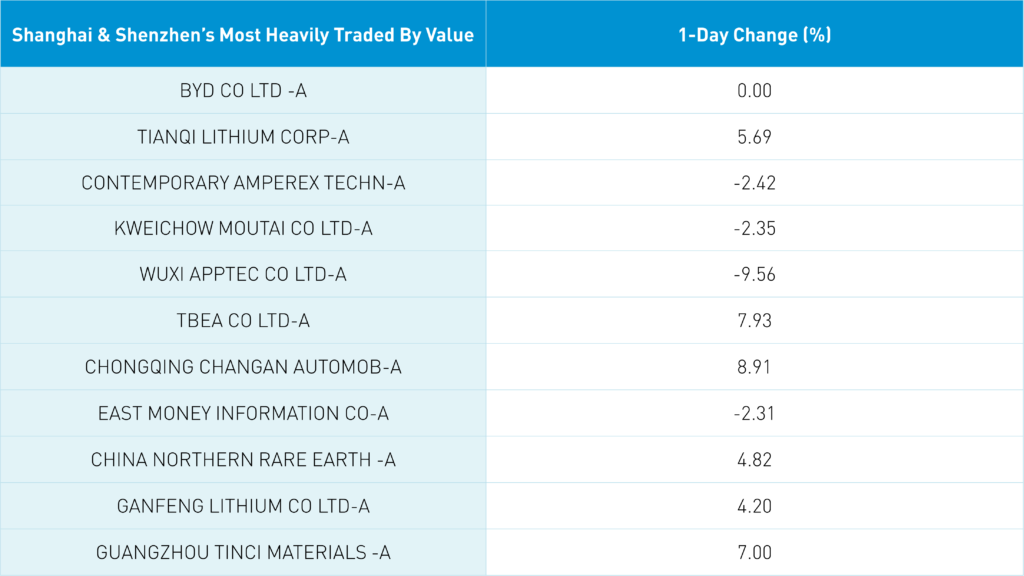

Yes, there were rumors of more covid testing in Beijing and Shanghai though macro factors were overwhelmingly at play overnight. May industrial production and retail sales will be released on Wednesday. Foreign investors sold a healthy $2 billion worth of mainland stocks today though mainland investors bought the dip in Hong Kong, especially in Tencent, Kuaishou, Meituan, and Li Auto. Electric vehicles (EV) and lithium stocks were rare strong spots on May EV sales.

Wuxi Biologics (2269 HK) and WuXi AppTec (603259 CH) were off -5.8% and -9.56%, respectively, as a consortium of owners trimmed their stake in the companies.

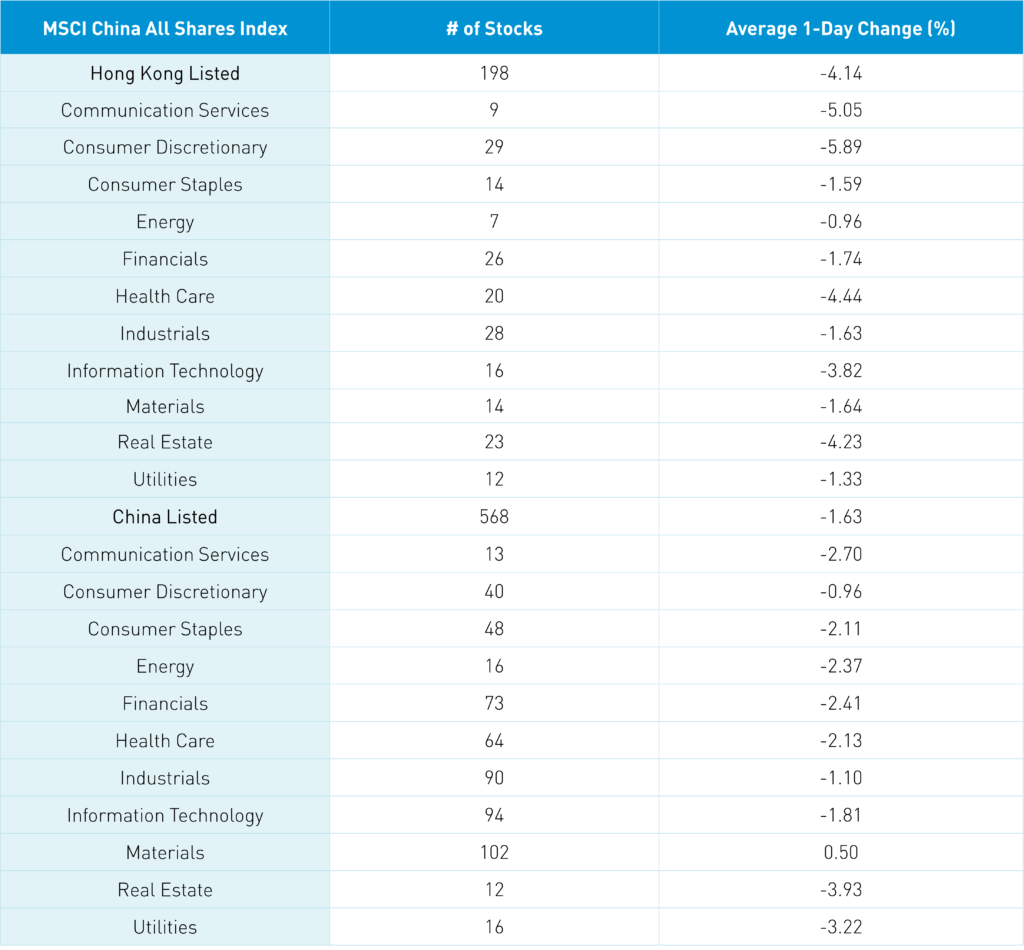

The Hang Seng and Hang Seng Tech indexes dropped -3.39% and -4.72%, respectively, on volume that was -11.62% lower than Friday, which is 112% of the 1-year average. 157 stocks advanced while 316 fell. Hong Kong short sale turnover fell -9.95% from Friday, which is 123% of the 1-year average. Value and dividend factors outperformed growth factors while large caps “outperformed” small caps. Energy was the “best” performer, down -0.96%, while discretionary fell -5.89%, communication fell -5.05%, and healthcare fell -4.44%. Online education was the top sub-sector along with the EV ecosystem, while internet and biotech were down. Southbound Stock Connect volumes were elevated as Mainland investors bought Hong Kong-listed stocks, including net buys in Tencent, Meituan, Kuaishou, and Li Auto.

Shanghai, Shenzhen, and the STAR Board were off -0.89%, -0.01%, and -1.31%, respectively, on volume that was +4.25% higher than Friday, which is 101% of the 1-year average. 1,858 stocks advanced while 2,539 stocks declined. Growth factors outperformed value factors while small caps outperformed large caps. Materials was the only positive sector, gaining +0.5%, while real estate fell -3.94%, utilities fell -3.22%, and communication fell -2.7%. Lithium-related stocks and online education stocks outperformed while power and electrical plants underperformed. Northbound Stock Connect volumes were high as foreign investors sold a healthy $2 billion worth of Mainland stocks today. Treasury bonds sold off along with CNY versus the US dollar, which fell to 6.72 CNY/USD, and copper fell -0.8%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.75 versus 6.71 on Friday

- CNY/EUR 7.05 versus 7.06 on Friday

- Yield on 1-Day Government Bond 1.15% versus 1.15% on Friday

- Yield on 10-Year Government Bond 2.77% versus 2.75% on Friday

- Yield on 10-Year China Development Bank Bond 2.98% versus 2.97% on Friday

- Copper Price -0.8%