Alibaba Leads Hong Kong Internet Charge, Week in Review

4 Min. Read Time

Week in Review

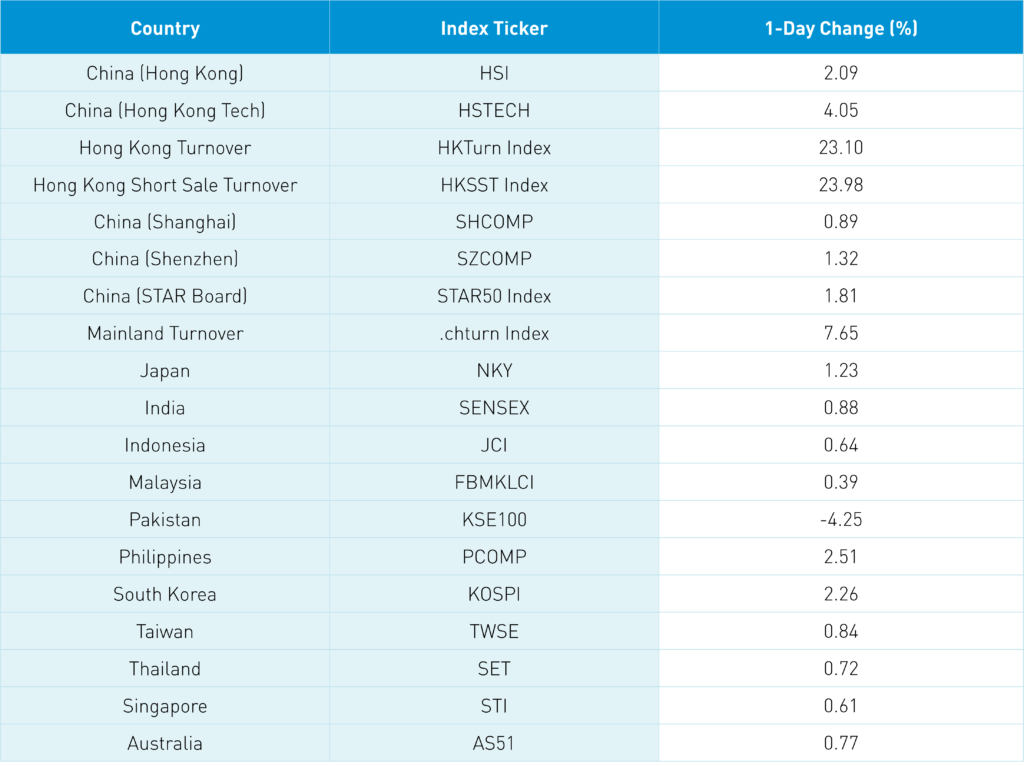

- Asian equities were mixed this week as South Korea faltered and China markets gained, especially the internet sector, which saw a major improvement in sentiment.

- Real estate also had a positive week on data showing that new home sales increased +49% month-over-month in the first two weeks of June as policy shifts to being more accommodative of the sector.

- President Biden said Tuesday that he will be speaking with Xi Jinping soon as the US president mulled tariff action to curb inflation, which resulted in the announcement later in the week that the US will waive tariffs on imports of solar panels from Southeast Asia. However, we are still waiting for action on China tariffs.

- The electric vehicle ecosystem had a decent week as major firms’ shares soared on Thursday as China extended tax breaks for new energy vehicles.

Key News

Asia ended the week on a positive note except for Pakistan, which was off by nearly -4%. For the week, Hong Kong and China outperformed while South Korea had a rough week.

Volumes in both Hong Kong and Mainland China were strong overnight, coupled with healthy inflows into Mainland stocks via Northbound Stock Connect and into Hong Kong-listed stocks from Mainland investors via Southbound Stock Connect. Today, foreign investors bought $1.4 billion worth of Mainland stocks, bringing the weekly total to over $600 million.

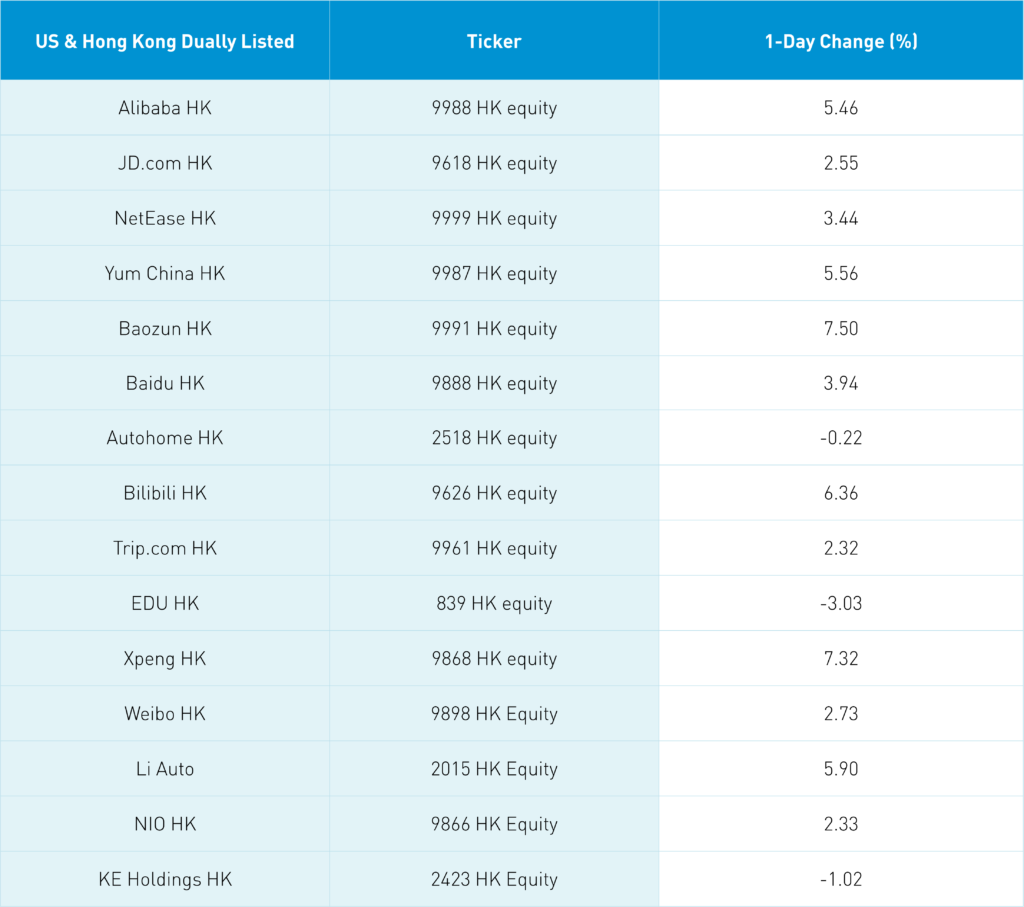

Growth stocks outperformed in China as Hong Kong-listed internet stocks were strong, led by Alibaba HK, which gained +5.46%, Tencent, which gained +2.45%, and Meituan, which gained +2.86%. Ant Group becoming a financial holding company, which would pave the way for an IPO, was a factor in Alibaba’s strong performance overnight. Meanwhile, the State Council’s anti-monopoly law, which is going into effect on August 1st, is not as heavy-handed as some had expected.

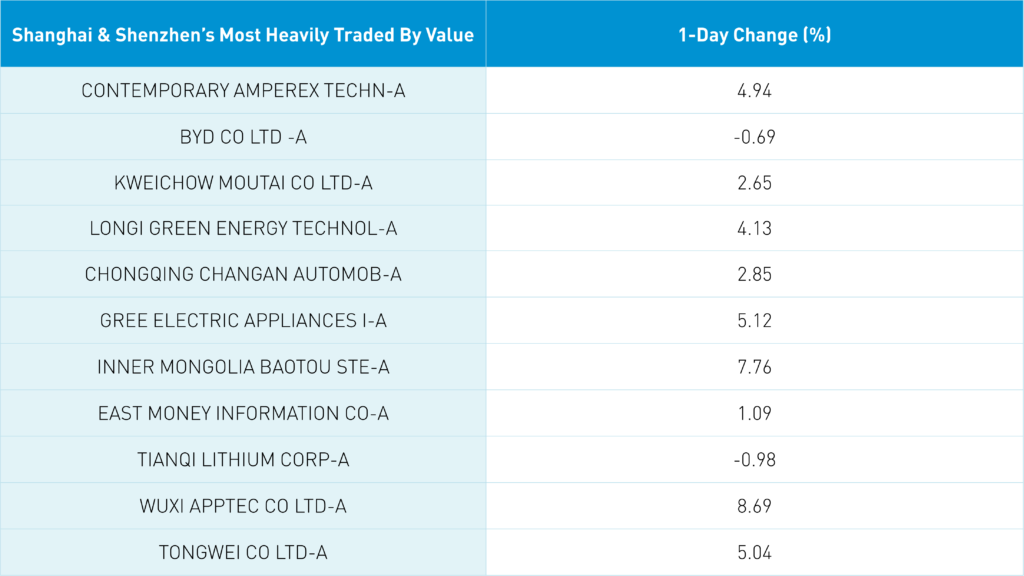

Health care was a very strong performer overnight though I have been struggling to identify today’s catalyst. A Mainland media source noted that Capital Group has been buying Mainland-listed Wuxi AppTec, which popped +8.69% today.

CATL was the most heavily traded stock by value in Mainland China, gaining +4.94% on the release of its new 1,000-kilometer range battery. There was also chatter that Li Auto will be using the battery, which led Li Auto to gain +5.9% in Hong Kong.

Buyers beat out short-sellers in Hong Kong as short sale volume was up today but fell to 15% of Hong Kong turnover from the low 20% range of late. I think China’s strong performance could become very uncomfortable for managers underweight the space as we head into quarter-end. That thesis seems to be playing out nicely!

MSCI released its annual country classification results with no word on further China A inclusion nor any upgrade of South Korea to developed market status. Meanwhile, Hong Kong Exchange & Clearing (HKEX) listed its first MSCI China A50 futures contract last year, which checks the box on one MSCI issue. The other big issue is China’s practice of delivering cash on trade day (T+0) versus most markets, which deliver the cash within two days (T+2) or one day (T+1) of the trade date. T-Zero is an issue for passive managers that need to rebalance. The other issue is the misalignment of holidays between Hong Kong and the Mainland.

The China Securities Regulatory Commission (CSRC) reported on the institutionalization of the mainland/onshore markets as professional investors accounted for 22.8% of the market value of tradable stocks, which is an increase of +6.9% from 2016. Individual investors accounted for less than 70% of the value of trading volume for the first time.

I have always been skeptical of the narrative that the Renminbi could replace the US dollar as the world’s currency, which is often espoused by China hawks. The Renminbi accounted for 2.15% of global payments, according to SWIFT. Will the percentage go up? For sure! But this does not mean that it will come close to beating out the dollar.

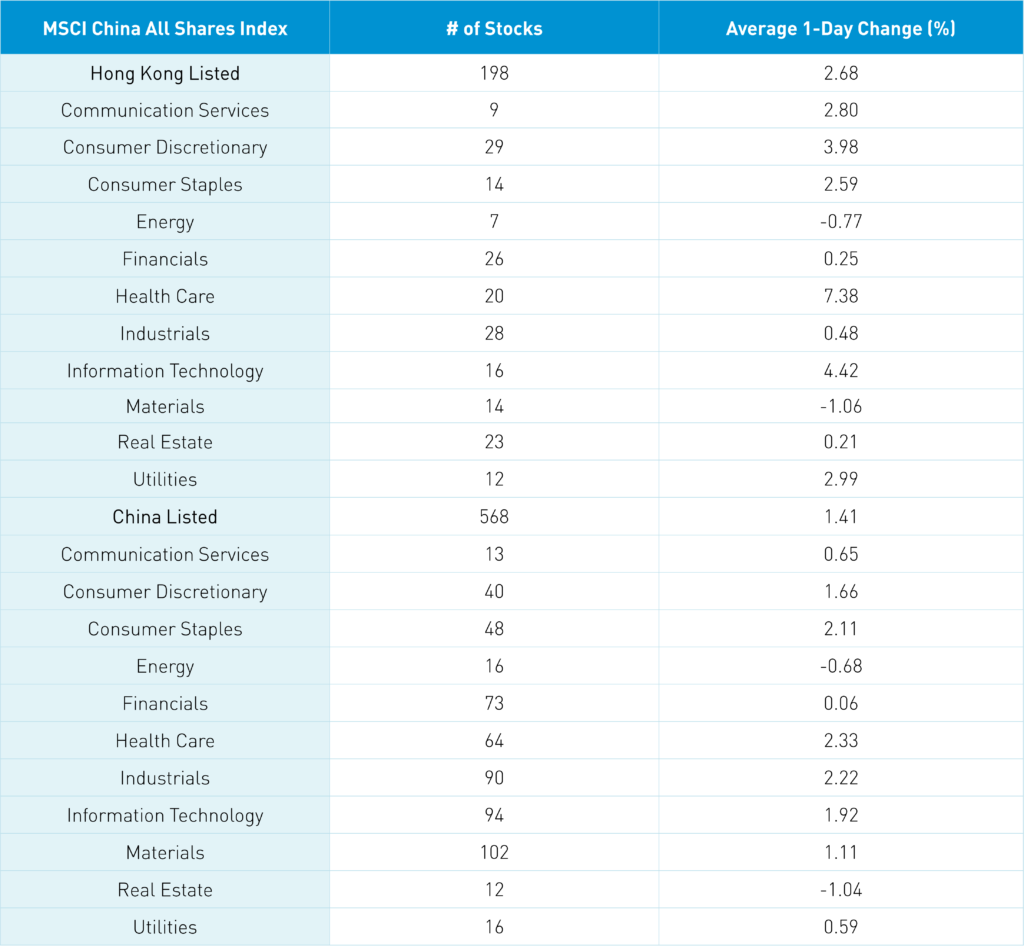

The Hang Seng and Hang Seng Tech indexes gained +2.09% and +4.05%, respectively, on volume that was +23.1% higher than yesterday, which is 104% of the 1-year average. 340 stocks advanced while 138 declined. Hong Kong's short-selling turnover increased by +23.9%, which is just below the 1-year average and 15% of the total Hong Kong turnover. Growth outperformed value factors while small caps outperformed large caps slightly. The top sectors were healthcare, which gained +7.38%, information technology, which gained +4.42%, and consumer discretionary, which gained +0.98%. Meanwhile, materials and energy were off -1.06% and -0.77%, respectively. Contract research organizations (CROs) and lithium were the top-performing subsectors while precious metals were off. Southbound Stock Connect volumes were high today as Mainland investors bought small amounts of Tencent and Kuaishou stock and sold stock in Meituan.

Shanghai, Shenzhen, and the STAR Board gained +0.89%, +1.32%, and +1.81%, respectively, on turnover that increased +7.65% from yesterday, which is 107% of the 1-year average. 2,871 stocks advanced while 1,473 stocks declined. Growth factors outperformed value factors as small caps outperformed large caps slightly. Top sectors included healthcare, which gained +2.33%, industrials, which gained +2.22%, and staples, which gained +2.11%. Meanwhile, real estate and energy were off -1.04% and -0.68%, respectively. CROs, lithium, and solar were top sub-sectors while online education was one of the worst. Northbound Stock Connect volumes were moderate/average as foreign investors bought a healthy $1.4 billion worth of Mainland stocks. CNY was basically flat while copper was rocked, falling -2.66%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.69 versus 6.70 yesterday

- CNY/EUR 7.06 versus 7.04 yesterday

- Yield on 1-Day Government Bond 1.17% versus 1.18% yesterday

- Yield on 10-Year Government Bond 2.80% versus 2.78% yesterday

- Yield on 10-Year China Development Bank Bond 3.01% versus 2.99% yesterday

- Copper Price -2.66% overnight