Chinese Equities Outperform Asia for the Day, Week, Month & Quarter

2 Min. Read Time

Key News

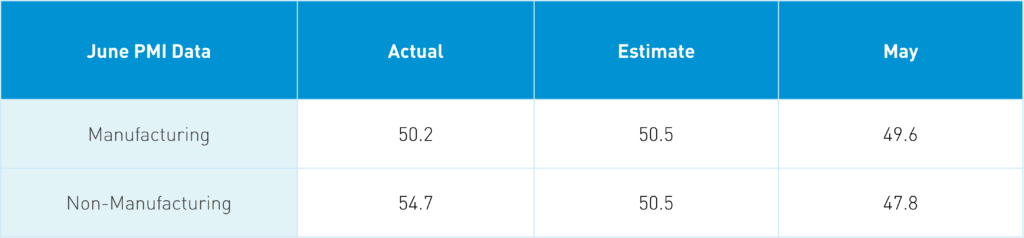

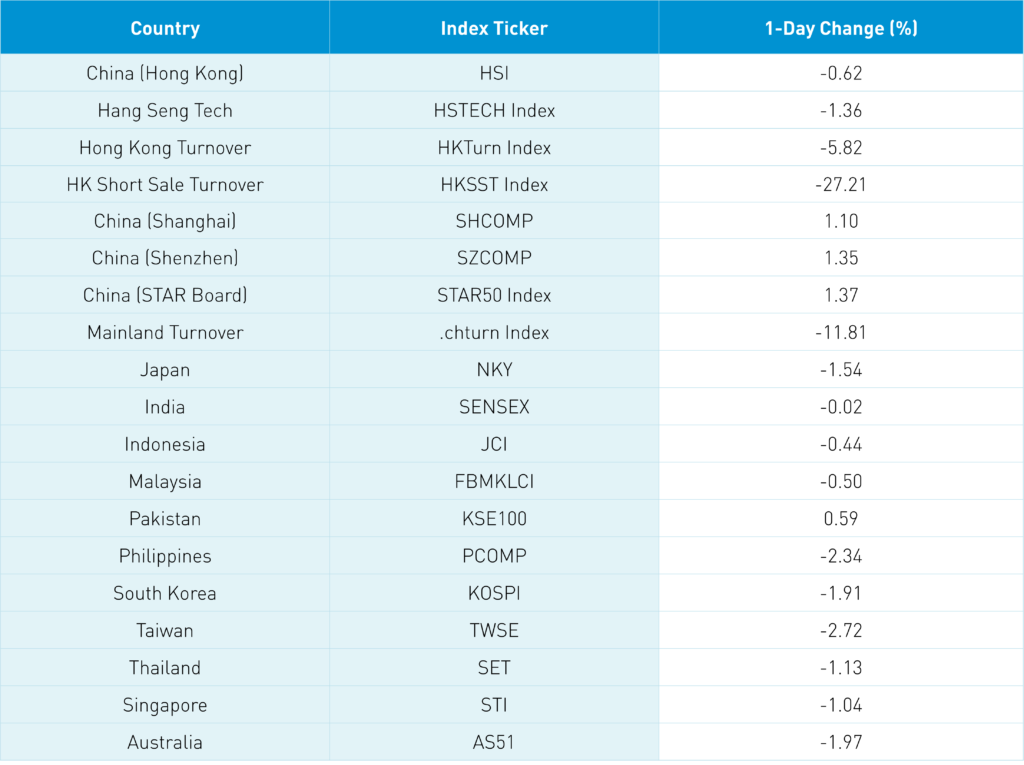

Asia ended the month with a thud except for China which is fitting as China and Hong Kong equities were the only positive markets for the month. For Q2, China and Hong Kong were off slightly, while most Asia developed and emerging markets were off double digits. Please keep it a secret, as hopefully, we can grind higher! Taiwan underperformed as US semis' weakness goes global. Mainland investors cheered June’s Manufacturing PMI of 50.2 versus expectations of 50.5 and May’s 49.6 and Non-Manufacturing PMI of 54.7 versus expectations of 50.5 and May’s 47.8. Remember, month by month, things should get better/less bad! Output prices for both PMIs were subdued, indicating inflation is tepid in China. This gives the green light for more economic support without raising inflation. A hidden gem in the PMIs is business activity expectations which were both strong/increasing.

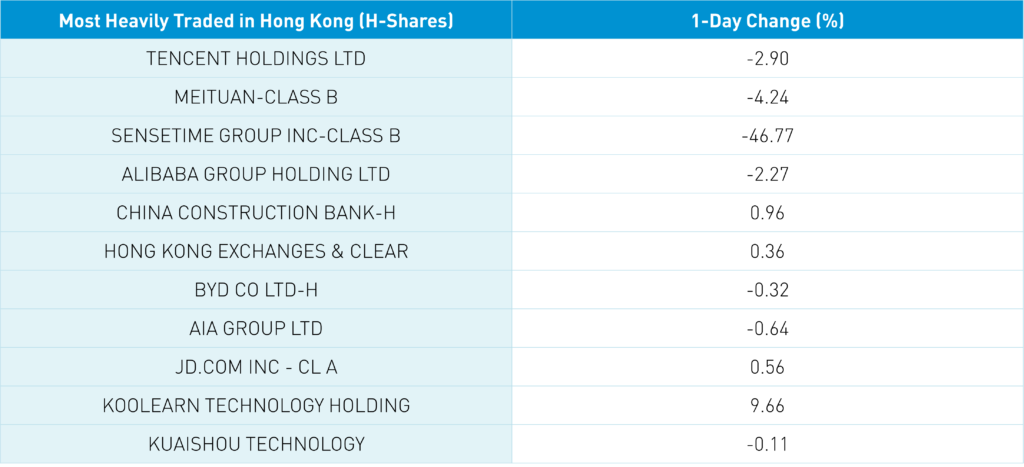

Domestic and foreign investors' favorite growth-oriented mega/large-cap stocks had a strong day despite Northbound Stock Connect being closed today. Another big story is the $10.912 billion net buying of onshore China (Shanghai & Shenzhen stocks) from foreign investors via Northbound Stock Connect. Since 12/31/2019, a total of $106 billion has gone in. Real estate was a strong performer in China and Hong Kong following yesterday's Vanke executives' bold real estate market bottom call. Travel names such as Trip.com HK (9961 HK) +0.73% also performed well in both markets as the world should be waking up at some point to the easing of covid policies and quarantines. Hong Kong gave up morning gains for afternoon losses as President Xi visited the city in advance of tomorrow's 25th anniversary of the British handover of Hong Kong to China. Tencent (700 HK) was off -2.9% though it saw robust buying from Mainland investors in Southbound Stock Connect.

The recent slide after shareholder Prosus announced it would sell down its Tencent stake has led Tencent to start buying back stock. Today was the third day it bought back shares. JD.com HK (9618 HK) +0.56% as Prosus' announcement had sold their position should be a suitable catalyst though many internet names were off by a small margin. NIO HK (9866 HK) +3.93% shrugging off short-seller fraud claims. AI company SenseTime (20 HK) cratered by -46.77% as its IPO share lockup expires. Tianqi Lithium's HK shares IPO will take place on July 13th. Bilibili HK -3.55% (9626 HK) despite announcing it will make Hong Kong it's primary listing, making it Southbound Stock Connect eligible.

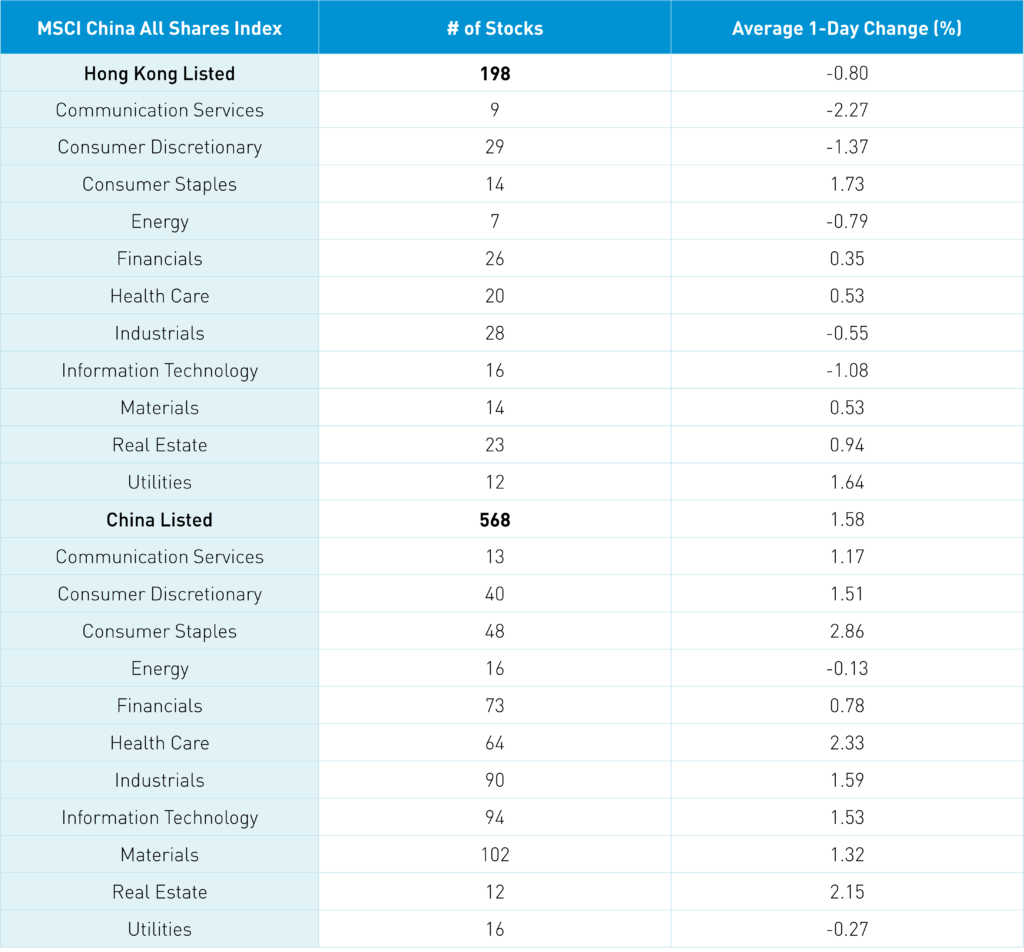

The Hang Seng and Hang Seng Tech closed -0.62% and -3.27% on volume -8.58% from yesterday, 106% of the 1-year average. 200 stocks advanced while 277 declined. Hong Kong short sale turnover declined by -27.2% from yesterday, 96% of the 1-year average. Value and growth factors were mixed as large caps outperformed small caps. Top sectors were staples +1.73%, utilities +1.65% and real estate +0.95% while communication -2.26%, discretionary -1.36% and tech -1.07%. Top subsectors were online education, power companies, beer stocks, and private hospitals, while liquor stocks, virtual reality, video games, and AI stocks were among the worst. Southbound Stock Connect volumes were high/moderate as Mainland investors were net buyers of Hong Kong stocks, with Tencent seeing strong buying.

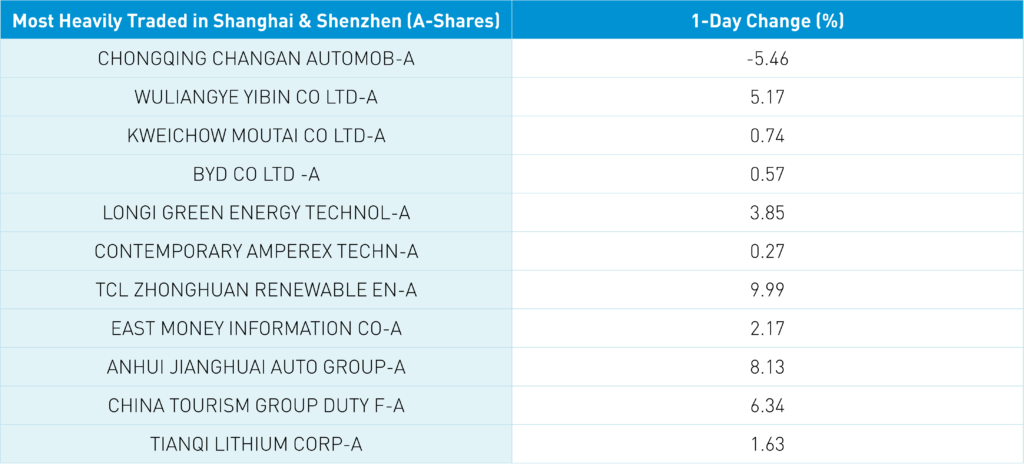

Shanghai, Shenzhen, and STAR Board gained +1.1%, +1.35%, and +1.37% on volume -11.81% from yesterday, which is 107% of the 1-year average. 2,879 stocks advanced, while 1,413 declined. Growth factors outperformed value factors as large caps outperformed small caps. The top sectors were staples +2.81%, healthcare +228%, and real estate +2.1%, while utilities and energy were off -0.32% and -0.18%. Top subsectors were travel-related, liquor stocks, and food-related, while infrastructure and auto parts were among the worst. Northbound Stock Connect was closed today. Treasury bonds rallied, CNY eased versus the US $, and copper managed a small gain.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.70 versus 6.69 yesterday

- CNY/EUR 6.97 versus 7.05 yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.83% yesterday

- Yield on 10-Year China Development Bank Bond 3.05% versus 3.05% yesterday

- Copper Price +0.39% overnight