China’s Clean Energy Push Grows, Week in Review

2 Min. Read Time

Week in Review

- Asian equities started the week on a strong note except for Japan, which was off for Marine Day, a national holiday meant to give thanks for the ocean’s bounty.

- On Tuesday it was reported that Didi will be fined $1B, ending its investigation and allowing the company to resume full operations.

- SEC Chair Gary Gensler recommended that Congress refrain from shortening the HFCAA compliance window on Wednesday.

- Baidu World kicked off this week with the announcement of the Apollo RT6 autonomous electric vehicle.

Key News

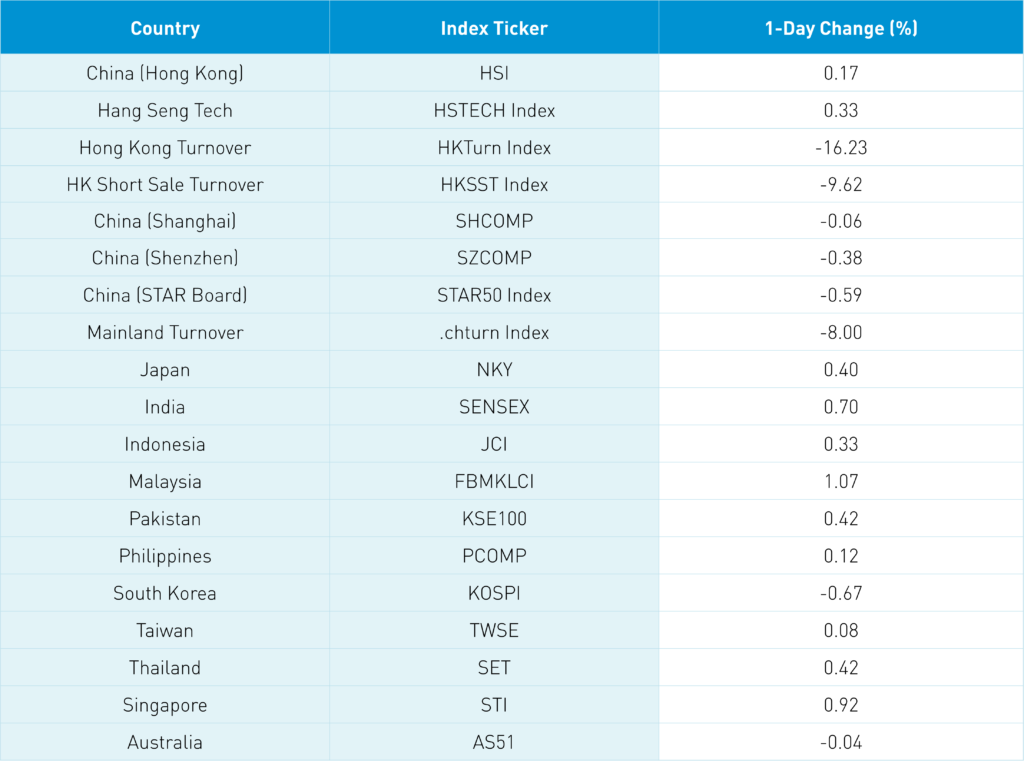

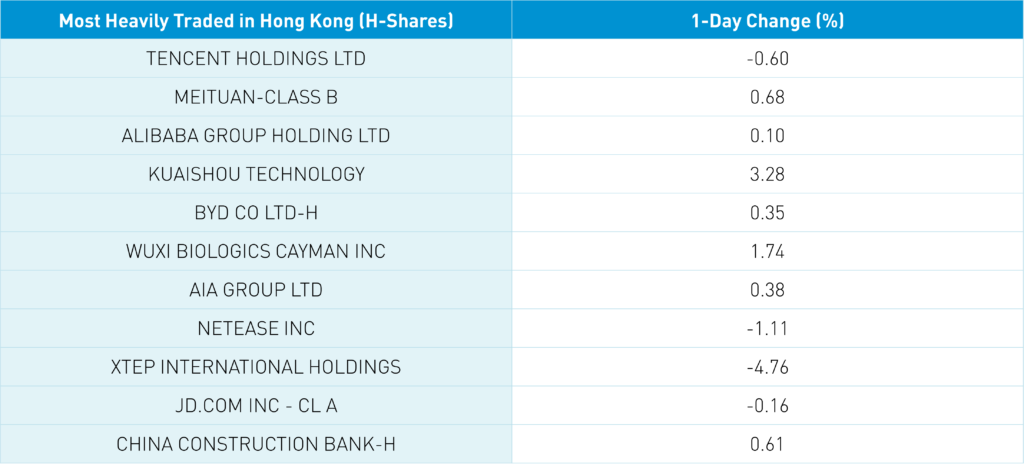

Asian equities ended a positive week with a positive Friday except for South Korea. Although Snap's disappointing results didn't weigh on Asia tech investors, volumes and news flow were light. Hong Kong internet stocks were mixed with Meituan +0.68%, Alibaba HK +0.1%, Kuiashou +3.28%, and Baidu +0.72%, while Tencent –0.6% with the Prosus selling overhang, JD.com HK -0.16% and NetEase -1.11% despite yesterday's news on hit game Diablo Immortal being approved in China.

Hong Kong volumes were light at 60% of the 1-year average though Hong Kong short sellers pressed their bets against internet names, but moreso on real estate stocks. With Alibaba's earnings two weeks away, I'm a bit surprised shorts are pressing their bets, but hopefully, we see an epic short-covering rally. Baidu's +0.72% autonomous EV announcement was heavily featured in Mainland press as it presents another sign of internet regulation being in the rearview mirror. Macao casinos will open this weekend despite rising Hong Kong covid cases, another sign of China's lives first/zero covid policy being tweaked.

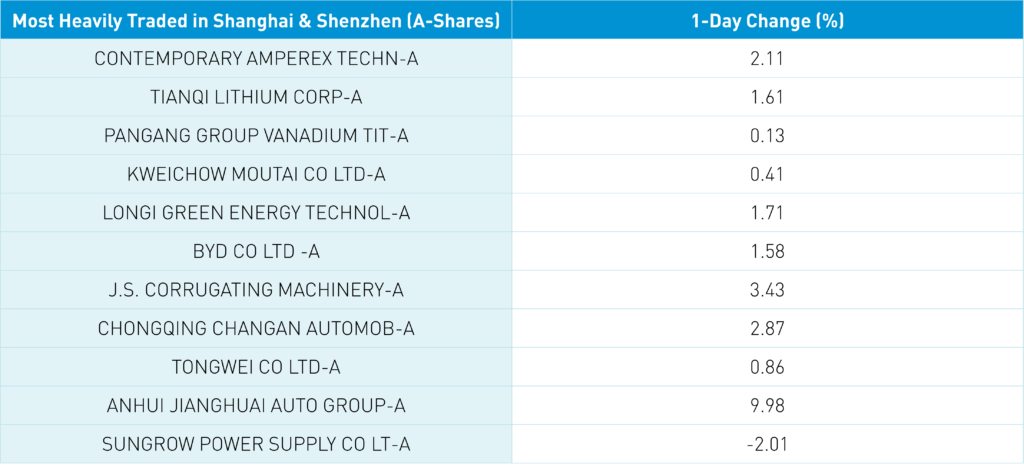

Mainland China was off on no real news though we are starting to see preliminary financial results. CATL (300750 CH) was the most heavily traded by value, +2.11%, after announcing an EV deal with Ford. Tianqi Lithium (002466 CH) was the #2 most heavily traded by value +1.61% after a strong forecasted 1st half net income between RMB 9.6B to 11.6B, an increased +134% year over year! Premier Li gave a speech on policy support for the economy though the insurance regulator spoke about ensuring consumers are supported by the financial system. The consumer will be a big focus in 2H of 2022.

China's installed renewable power generation increased +8.1% year over year in the 1st half of 2022 to 2.4B kilowatts. Wind increased +7.2% to 340mm KW while solar +25.8% to 340mm KW. Four CSI 1,000 ETFs were launched in China overnight, with the asset managers raising a total of RMB 22B ($3.2B)!

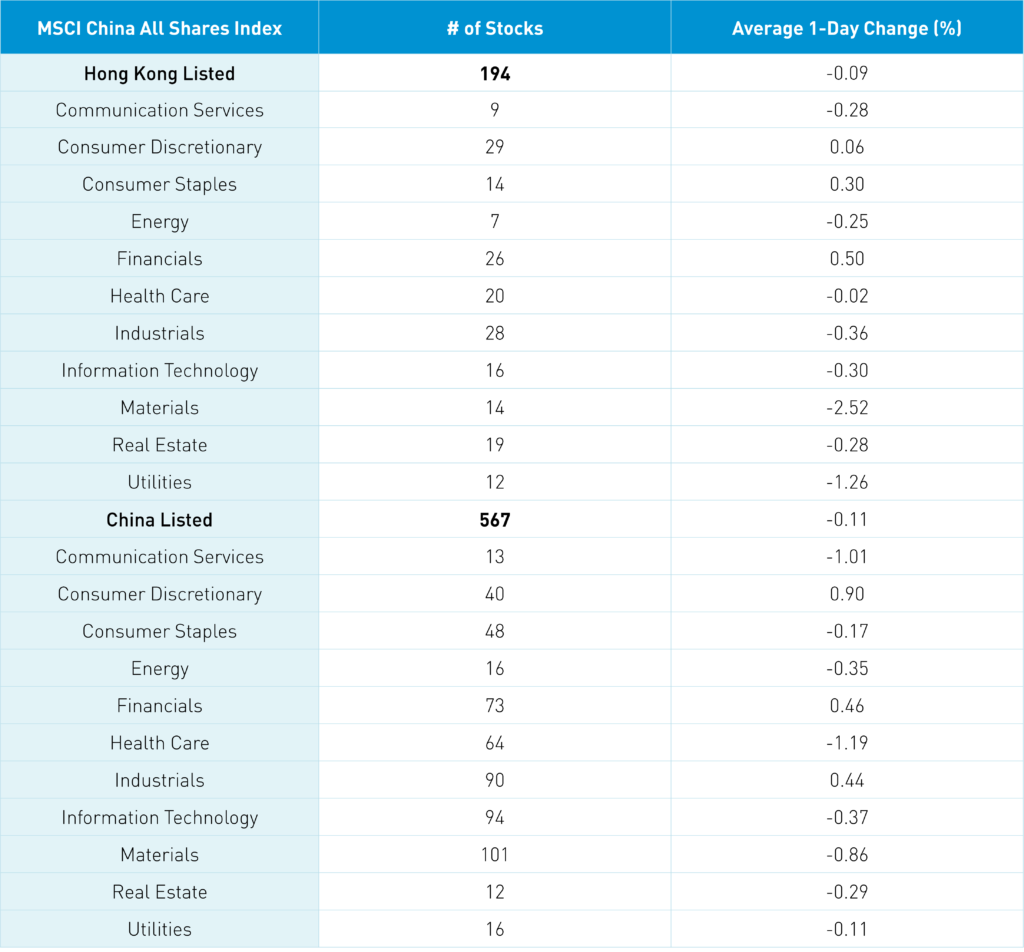

The Hang Seng and Hang Seng Tech gained +0.17% and +0.33% on volume, down -16.23% from yesterday, which is just 60% of the 1-year average. 210 stocks advanced while 257 declined. Hong Kong short sale turnover declined -9.62% from yesterday which is 65% of the 1-year average as short sale turnover accounted for 17% of Hong Kong turnover. Growth factors outperformed value factors today as large caps outperformed small caps. The top sectors were financials +0.5%, staples +0.3% and discretionary +0.06% while materials -2.51%, utilities -1.36% and industrials -0.35%. The top sub-sectors were Macao casino stocks, autos and consumer related while cobalt, cement, e-cigarette and tobacco sub-sectors were among the worst. Southbound Stock Connect volumes were light as Mainland investors were small net buyers with Tencent, Kuaishou and Meituan seeing small net buys.

Shanghai, Shenzhen and STAR Board declined -006%, -0.38% and -0.59% on volume -8% from yesterday which is 87% of the 1-year average. 1,415 stocks advanced while 3,004 stocks declined. Value factors outperformed growth while large caps outperformed small caps. The top sectors were discretionary +0.96%, financials +0.52% and industrials +0.5% while healthcare -1.13%, communication -0.95% and materials -0.8%. The top sub-sectors were autos, hydropower and solar while lithium and semis were among the worst. Northbound Stock Connect volumes were light as foreign investors bought $243mm of Mainland stocks today. Treasury bonds sold off slightly, CNY gained +0.11% versus the US $ to 6.75 and copper pulled an inverse James Bond -0.07%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.76 versus 6.77 yesterday

- CNY/EUR 6.87 versus 6.90 yesterday

- Yield on 10-Year Government Bond 2.79% versus 2.76% yesterday

- Yield on 10-Year China Development Bank Bond 3.05% versus 3.03% yesterday

- Copper Price -0.07% overnight