Hong Kong Internet High In Advance of Alibaba’s Results as Caixin Services PMI Exceeds Expectations

2 Min. Read Time

Key News

Asian equities had a positive day on light summer volumes except for Mainland China. Pelosi’s Taiwan visit did not spark World War III as some had feared. Plane tracking website FlightAware noted that Pelosi’s flight was the most watched plane landing ever on their website and app.

The offshore Yuan (CNH) is the version of China’s currency that trades during US hours. We use it as a barometer of how serious “news” items are because stocks are easy to move, whereas the currency market is much deeper. It was interesting to see CNH rally versus the US dollar yesterday, which provided a clue that the trip was perhaps not as important as the media made it out to be. Defense stocks and semiconductors were two of the best performing sub-sectors in both Hong Kong and China as investors exhaled after putting on some hedges.

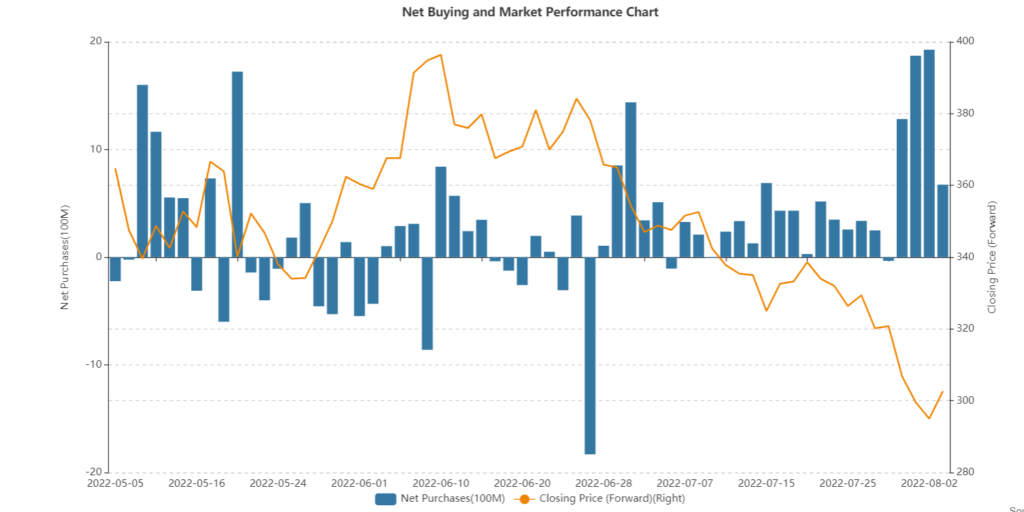

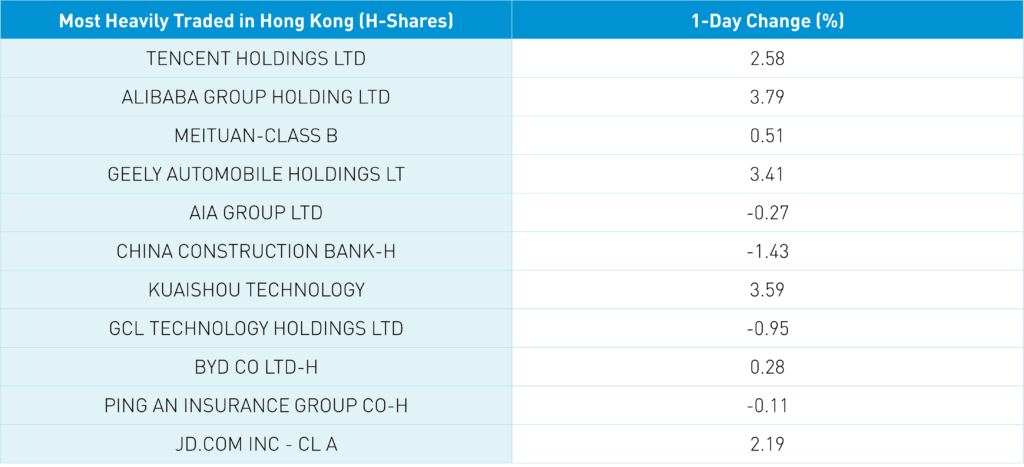

Hong Kong was led higher by internet stocks as the most heavily traded stocks by value included Tencent, which gained +2.58% on the 4th straight day of net buying by Mainland investors though not quite as robust as the previous three days (chart below), Alibaba HK, which gained +3.79% ahead of tomorrow’s financial results, and Meituan, which gained +0.51%.

Mainland China was off on higher volumes as local investors were very concerned about the potential response to Pelosi’s visit by going risk-off as Treasury bonds rallied.

Overnight, Caixin reported their July Services PMI. This was a strong release that I can guarantee you won’t see any headlines.

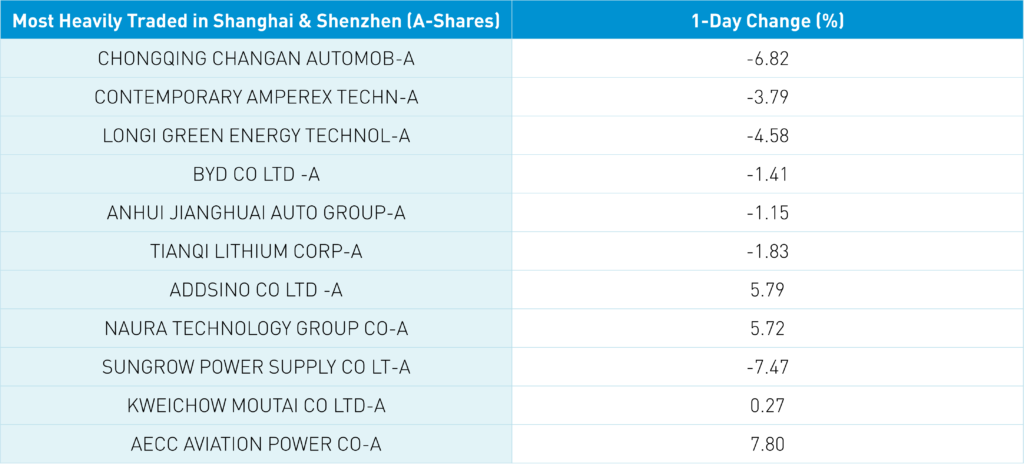

Mainland clean tech plays such as EV, solar, and wind were off after light earnings from Longi Green Energy -4.58%. Not helping was global battery maker CATL -3.79% announcing they might delay their North America factory to support Ford and Tesla’s EV efforts. Not sure the point as their rivals would happily fill the void. Net-net Pelosi’s visit should highlight how integrated the US and China’s economies are with one another. It is worth noting several US companies that have large China revenue exposure were down worse than the US equity market yesterday.

Online car seller Autohome (ATHM US) beat revenue and adjusted EPS this morning.

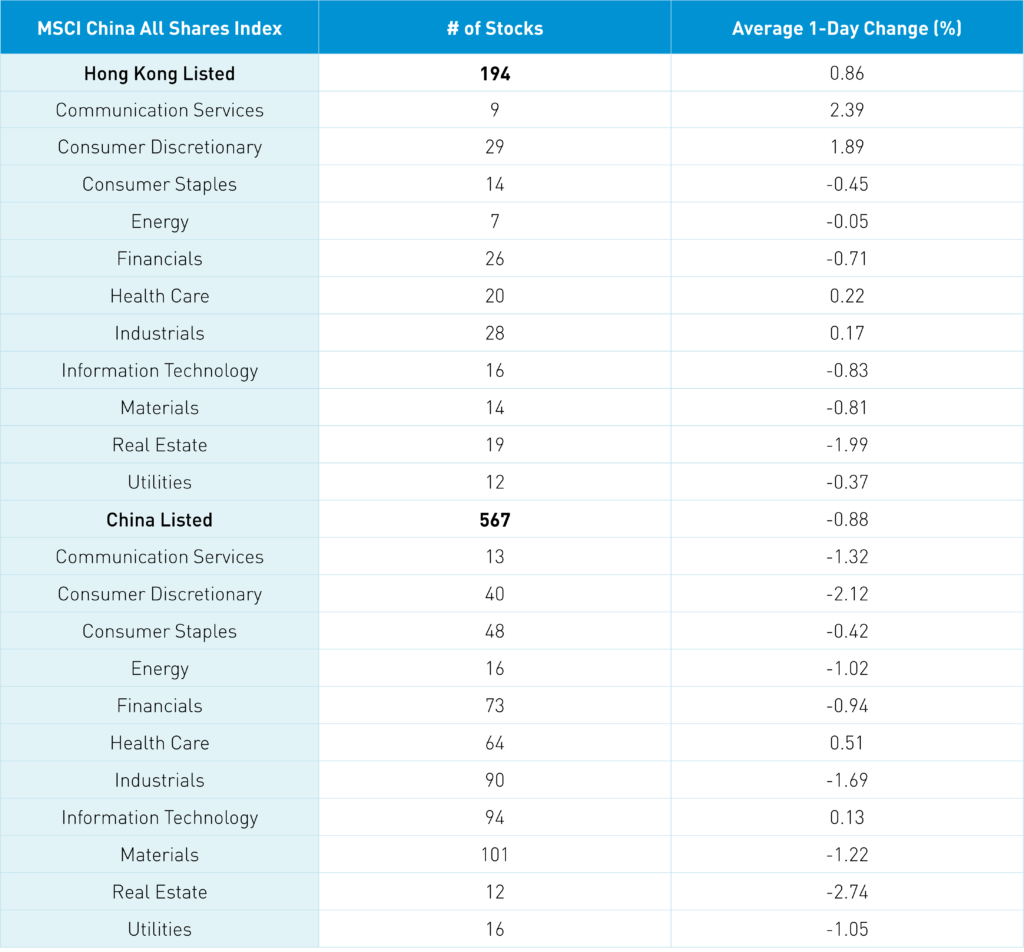

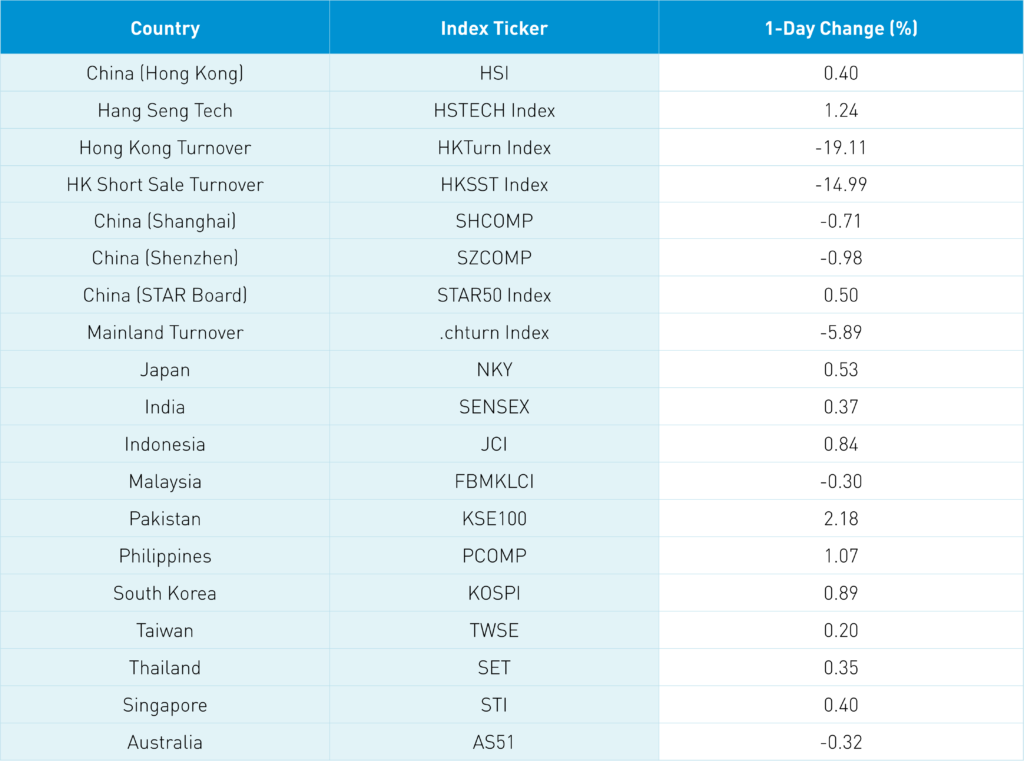

The Hang Seng and Hang Seng Tech gained +0.4% and +1.24% on volume, down -19.11% from yesterday, which is 70% of the 1-year average. 200 stocks advanced while 265 declined. Hong Kong short sale turnover declined by -14.99% from yesterday, 82% of the 1-year average, as short sale turnover accounted for 19% of total turnover. Growth and value factors were mixed as large caps outperformed small caps. Top sectors were communication +2.39%, discretionary +1.89% and healthcare +0.22% while real estate -1.99%, tech -0.83% and materials -0.81%. Top sub-sectors were defense stocks and technology related such as cloud, software, and semis, while bottom performers were steel, electric utilities, property managers, iron ore, and liquor. Southbound Stock Connect volumes were light as Mainland investors were net buyers of Hong Kong stocks, with Tencent seeing another buy day not as large as the previous three days, Meituan a small net buy, and Kuaishou a small net sell.

Shanghai, Shenzhen, and STAR Board diverged -0.71%, -0.98%, and +0.5% on volume -5.89% from yesterday, which is 104% of the 1-year average. 2,505 stocks advanced while 1,961 stocks declined. Growth and value factors were mixed, while small caps outperformed large caps. Healthcare and tech were the only positive sectors +0.52% and +0.14% while real estate -2.72%, discretionary -2.1% and industrials -1.68%. The top sub-sectors were semis and defense stocks, while solar, lithium, and wind were among the worst. Northbound Stock Connect volumes were light/moderate as foreign investors sold -$155mm of Mainland stocks today. Treasury bonds had a strong day; CNY gained +0.11% versus the US $ to 6.75, and copper was flat.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.76 versus 6.76 Yesterday

- CNY/EUR 6.88 versus 6.92 Yesterday

- Yield on 10-Year Government Bond 2.72% versus 2.73% Yesterday

- Yield on 10-Year China Development Bank Bond 2.90% versus 2.91% Yesterday