Economy Takes Center Stage, Prompting The PBOC To Take Action

3 Min. Read Time

Key News

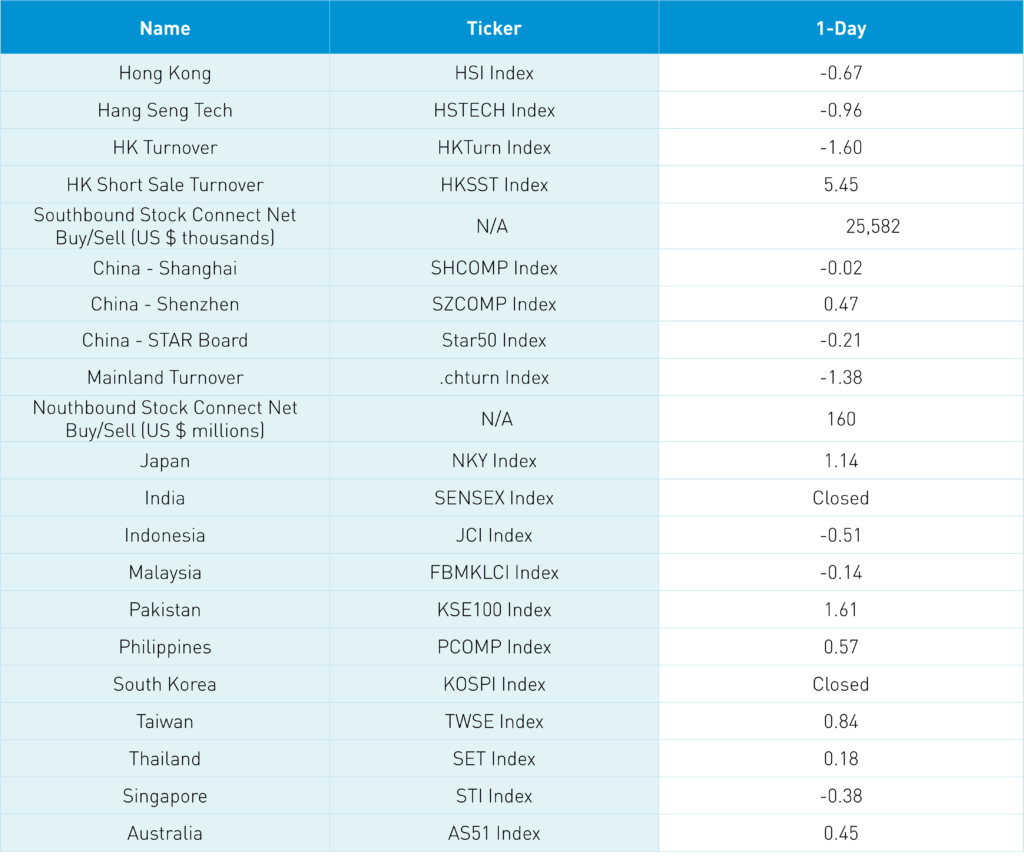

Asian equities were mixed overnight as India was closed for Independence Day and South Korea was closed for Liberation Day. Mainland China and Hong Kong both bounced around the room to close lower.

Once again, given the same information, onshore China (Shanghai and Shenzhen, which are 95% owned by investors in China) held up better than Hong Kong stocks, which are predominately held by foreign investors. Friday’s announcement that five US-listed state-owned enterprises (SOEs) would delist from the New York Stock Exchange weighed on sentiment. Removing the SOE ADRs paves the way for a solution to the Holding Foreign Companies Accountable Act (HFCAA). There are 273 US-listed Chinese ADRs and seven of them are SOEs. What is the chance that 5 for 5 of the companies announcing a delisting happen to be SOEs?! For over a year, we have advocated for SOEs to delist to allow private companies to adhere to the HFCAA. While not universal and especially not in Asia, several of our institutional brokers highlighted this along with several media stories.

Hong Kong-listed internet stocks were largely lower as Hong Kong’s most heavily traded stocks by value were Tencent, which fell -1.25%, Meituan, which gained +1.01%, and Alibaba, which fell -1.24%. While Hong Kong volumes were light, down -1.6% from Friday, short sellers pressed their bets as Hong Kong short sale volume increased +5% from Friday. While the SOE delisting from Friday along with Congress not shortening the HFCAA window should be viewed as significant positive catalysts, the media narrative remains negative on the former or silent on the latter.

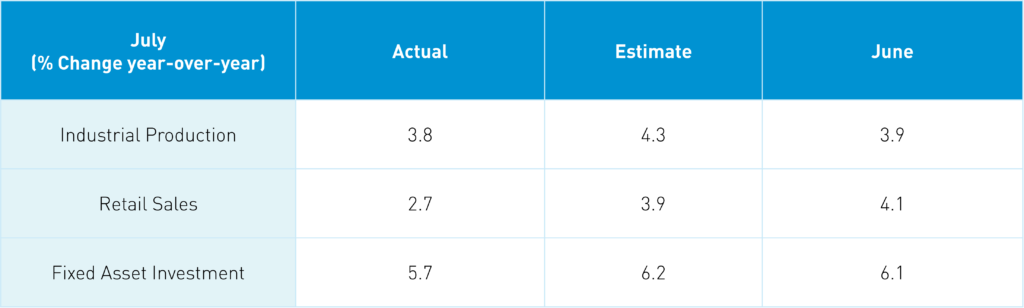

According to data released after Friday’s close, lending fell in July, indicating weak demand for credit/loans driven by slumping real estate prices and slow growth. During morning trading, the People’s Bank of China (PBOC), China’s central bank, unexpectedly announced a cut to the medium-term lending facility, lowering the key lending rate to 2.75% from 2.85% and the seven-day repo rate to 2% from 2.1%.

It is worth noting that the PBOC is keeping the financial system flush with liquidity. Also, online retail sales (e-commerce) increased in July to 6.3% YoY, which is up from June’s 5.5%.

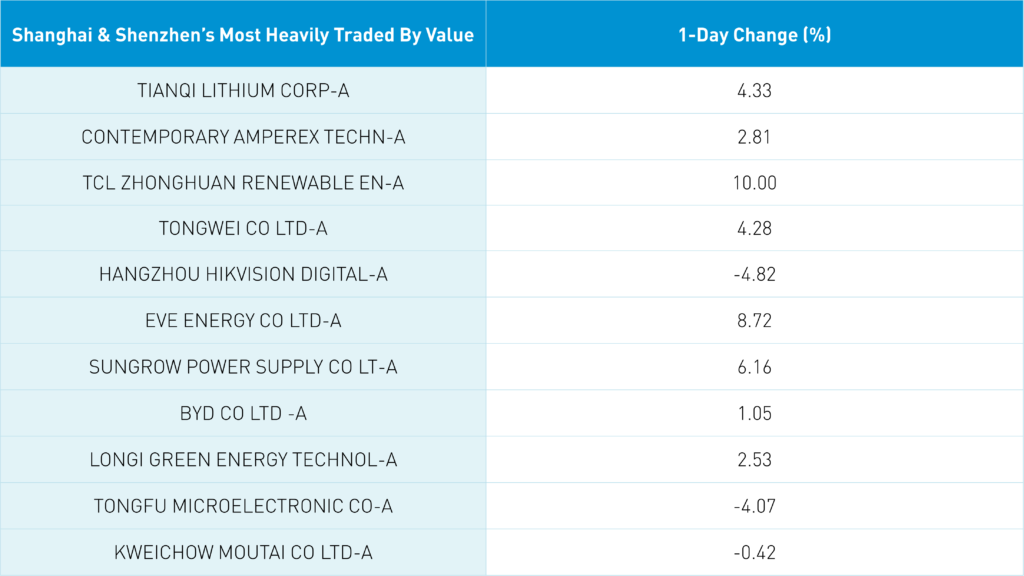

The PBOC’s easing posture propelled growth stocks and clean technology ecosystem stocks, including solar, wind, and electric vehicle charging. Mainland China’s most heavily traded stocks by value were Tianqi Lithium, which gained +4.33%, CATL, which gained +2.81%, and TCL Zonghuan Renewable Energy, which gained +10%. Foreign investors were small net buyers of Mainland stocks via Northbound Stock Connect.

The Hong Kong Stock Exchange (HKEX) announced today that, going forward, Stock Connect will remain open on the day prior to a Hong Kong holiday. There were three reasons MSCI did not continue with the inclusion of mainland stocks within their indices: 1) no mainland MSCI China futures existed 2) misalignment of HK and China holidays curtailed the number of days foreign investors could transact via Northbound Stock Connect, and 3) Mainland China settles on trade date versus T+2 (trade date plus two days) for most markets, which is problematic for passive asset managers. Issue 1 is gone as MSCI China A 50 futures now trade in Hong Kong. Today’s announcement would increase the number of Northbound trade dates by six. One to go, right?

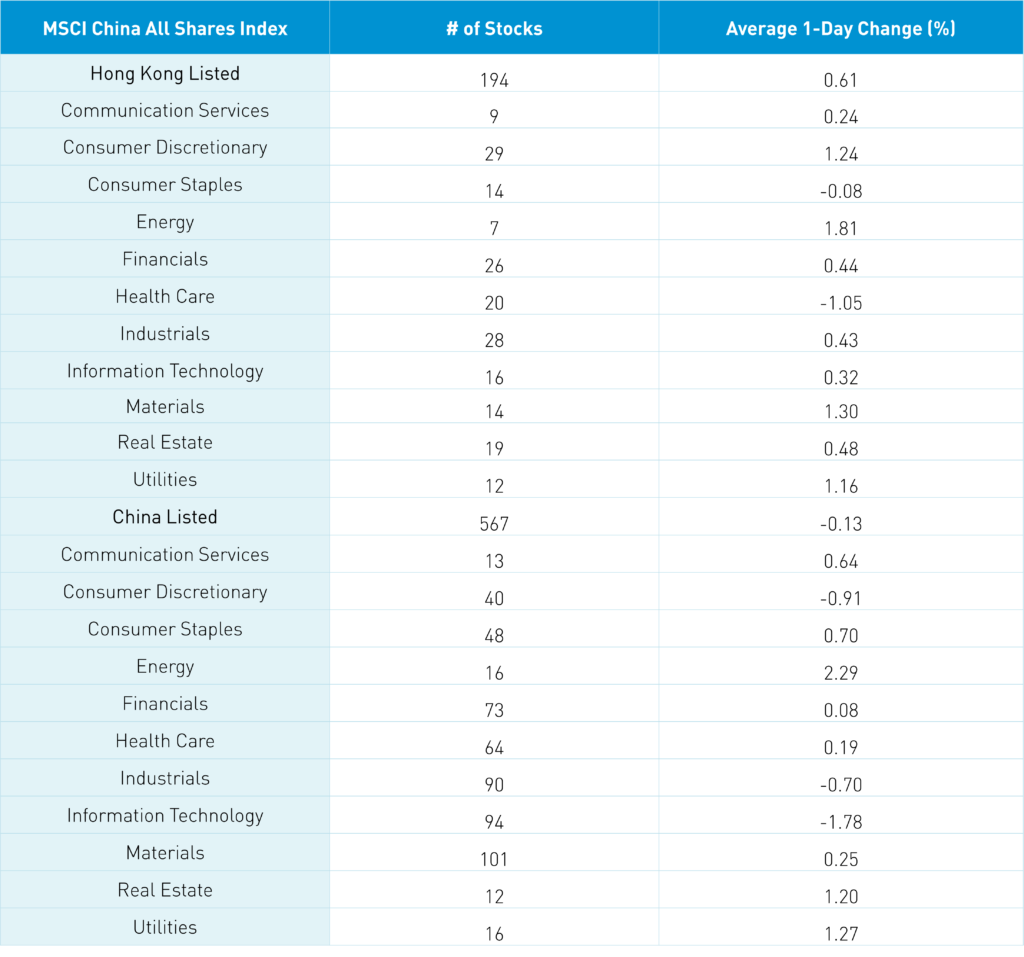

The Hang Seng and Hang Seng Tech indexes fell -0.67% and -0.96%, respectively, on volume that fell -1.6% from Friday, which is 55% of the 1-year average. 135 stocks advanced while 336 stocks declined. Hong Kong short sale turnover increased +5.48%, which is 59% of the 1-year average, as short sale turnover accounted for 18% of turnover. Growth and value factors were equally poor as small caps “outperformed,” falling less than large caps. Consumer Staples was the only positive sector, gaining +0.37% while industrials fell -2.4%, real estate fell -2.09%, and energy fell -1.81%. The top performing sub-sectors were fast food restaurants and several healthcare-related sub-sectors such as online medicine, while ports/logistics and semiconductors were among the weakest sub-sectors. Southbound Stock Connect volumes were light as Mainland investors bought $25 million worth of Hong Kong stocks, while Tencent saw its first net sell day since July 28th as Li Auto and Meituan were small net sells as well.

Shanghai, Shenzhen, and the STAR Board closed -0.02%, +0.47%, and -0.21%, respectively, on volume that decreased -1.38% from Friday, which is 92% of the 1-year average. 2,081 stocks advanced, while 2,357 stocks declined. Growth stocks outperformed value stocks, while large caps outperformed small caps. The top performing sub-sectors were solar, wind, and battery-related, while airport and healthcare contract research organizations (CROs) were among the worst. Northbound Stock Connect volumes were light as foreign investors bought $160 million worth of Mainland stocks. Treasury bond prices were flat, CNY was off -0.39% to 6.77 versus the US dollar, and copper was off -1.24%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.77 versus 6.74 Friday

- CNY/EUR 6.91 versus 6.91 Friday

- Yield on 1-Day Government Bond 1.00% versus 1.00% Friday

- Yield on 10-Year Government Bond 2.66% versus 2.73% Friday

- Yield on 10-Year China Development Bank Bond 2.85% versus 2.91% Friday

- Copper Price -1.24% overnight