Hong Kong’s Typhoon Tears Internet Shorts to Shreds as Alibaba and JD.com Rise

3 Min. Read Time

Key News

Asian equities had a good day with Hong Kong having a fantastic day despite the morning session, 9:30 to noon followed by a one-hour lunch break before afternoon trading starts at 1pm, being called off due to a typhoon.

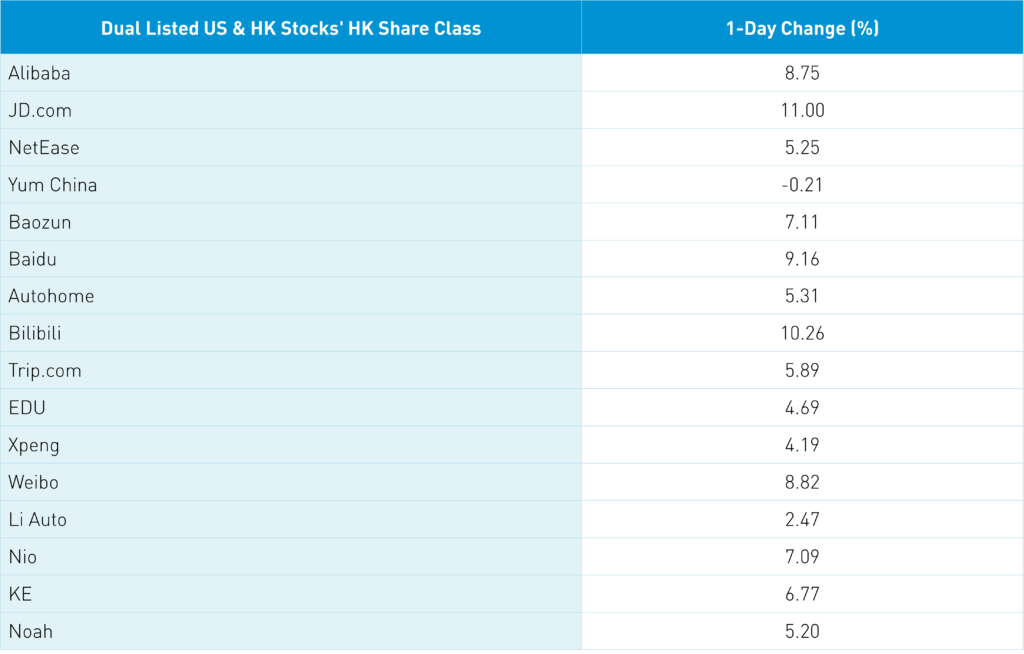

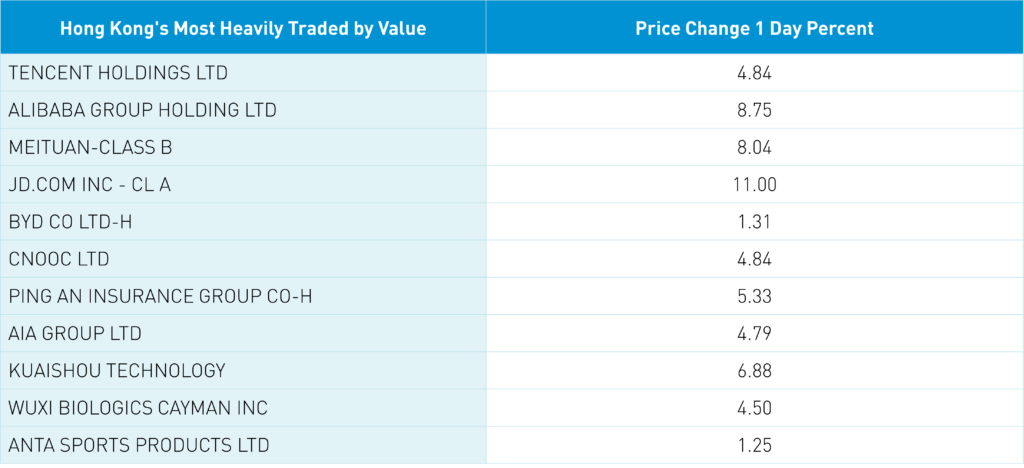

Hong Kong-listed internet stocks flew as evidenced by the fact that Hong Kong’s most heavily traded stocks by value were Tencent, which gained +4.84%, Alibaba HK, which gained +8.75%, Meituan, which gained +8.04%, and JD.com HK, which gained +11%. Rumors are flying that Chinese regulators are meeting with the "Big Four" US accounting firms on allowing the Public Company Accounting Oversight Board (PCAOB) to conduct audit reviews in Mainland China. There is nothing tangible thus far on this. Could it be true? Sure, the recent five State Owned Enterprises (SOEs) delisting from the US is a positive due to the sensitive information potentially contained in their audit reviews. The rumors could be false. The key is the rumor was the spark for a fire that has been waiting to be lit.

Hong Kong short sellers have pressed their bets on Hong Kong internet stocks, which we’ve been writing about for weeks. Despite the Hang Seng Index nearly reaching the 19,000 level, a big level of psychological support, shorts pressed their bets. With all the negative media coverage of China, combined with light summer volumes, who can blame them? The problem for the shorts is that doing so has made them vulnerable to moves like today's. It is worth noting that shorts increased their bets today. Meituan had 28% of its total volume short, with Tencent having 20%, Alibaba HK 14%, and JD.com HK 25%. Today’s move could have some legs for this reason as momentum gets in on the fun of running the shorts over.

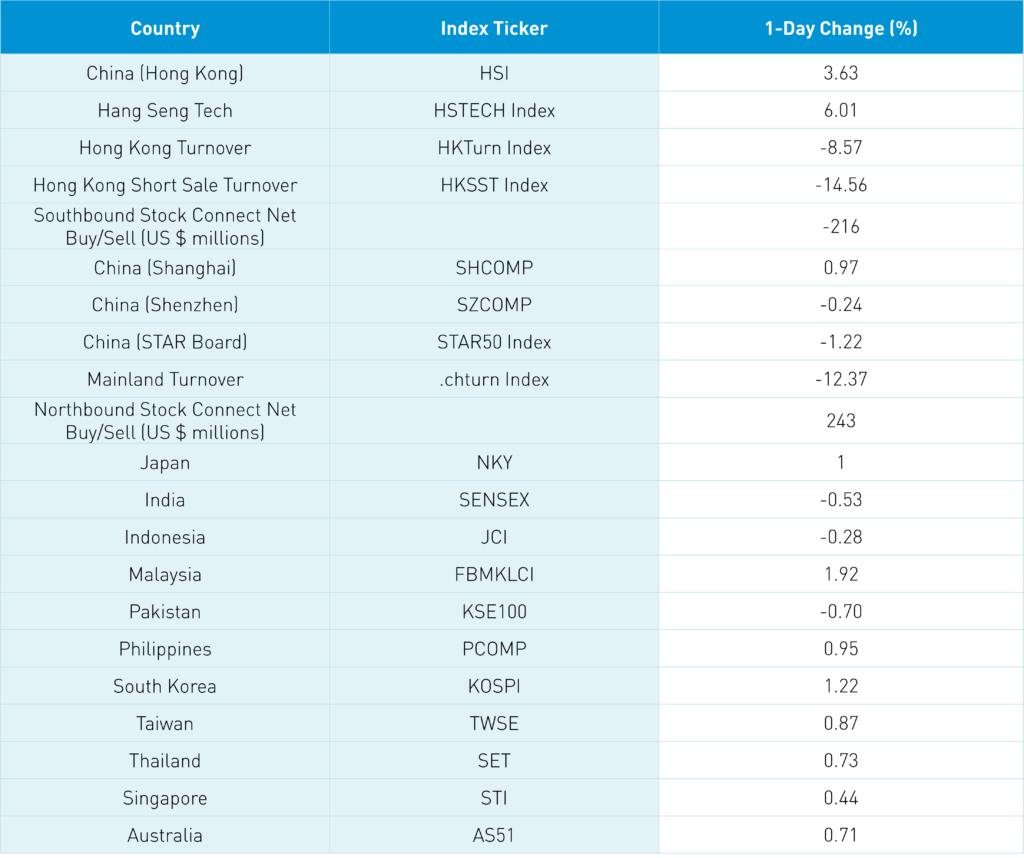

Today’s move inflicts pain on emerging market managers who have been underweight China/Hong Kong and overweight India, which closed down today. India is a favorite despite sky-high valuations and a currency falling out of bed, while Hong Kong, especially Hong Kong-listed internet stocks, are at low valuations and denominated in a currency pegged to the US dollar! A rational person would say that today’s rally was driven by Premier Li and the State Council’s statement, which we touched on yesterday, outlining economic policy support and stimulus. This news came out after the Asia close yesterday. It turns out the support was more than anticipated at $146 billion for infrastructure. Was this the factor in Hong Kong? Yes, but the auditor rumor was bigger, in my opinion. Shanghai was up +1% today though Shenzhen and the STAR Board were off. That is not too surprising as the housing-focused stimulus helps old economy stocks that are more likely to be listed in Shanghai than in Shenzhen. It also explains growth underperforming value in China today.

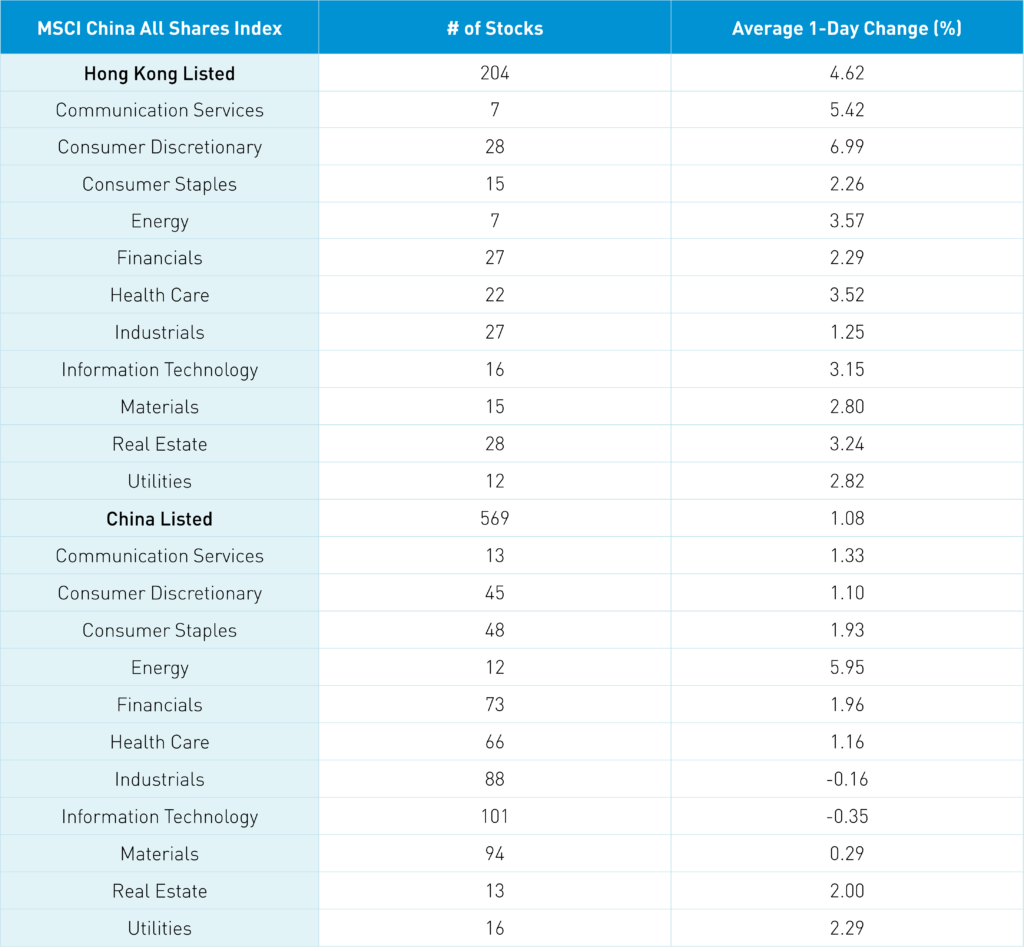

The Hang Seng and Hang Seng Tech indexes gained +3.63% and +6.01%, respectively, as volume decreased -8.57% from yesterday, despite it being only a half day. 412 stocks advanced while 73 stocks declined. Hong Kong short sale turnover declined -14.56% from yesterday, also due to the half day as short sale turnover accounted for 19% of total turnover. Growth factors outperformed value as large caps outpaced small caps. All sectors were positive as consumer discretionary gained +6.99%, communication services gained +5.42%, and energy gained+3.57%. Meanwhile, industrials lagged, only gaining +1.07%. The top performing subsectors were internet-related, including Ant Group-related stocks, online video, and e-commerce, while property management and food were among the worst. Southbound Stock Connect volumes were moderate despite the half day as Mainland investors sold -$216 million worth of Mainland stocks as Meituan saw net buying for the 1st time in 15 trading days. Tencent was a small net buy, and Kuaishou was a small net sell.

Shanghai, Shenzhen, and the STAR Board diverged to close +0.97%, -0.24%, and -1.22% on volume that was down -12% from yesterday, which is 94% of the 1-year average. 1,583 stocks advanced while 2,939 stocks declined. Value factors outperformed growth factors as large caps outpaced small caps. The top performing sectors were energy, which gained +5.94%, utilities, which gained +2.27%, and real estate, which gained +1.99%. Meanwhile, industrials and technology were off -0.17% and -0.37%, respectively. The top-performing subsectors were coal, insurance, and liquor. Meanwhile, solar and electricity companies were among the worst. Northbound Stock Connect volumes were light as foreign investors bought $243 million worth of Mainland stocks. Treasury bonds sold off, CNY appreciated versus the US dollar, up +0.11% to 6.85, and copper fell -0.51%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.85 versus 6.87 yesterday

- CNY/EUR 6.84 versus 6.82 yesterday

- Yield on 10-Year Government Bond 2.64% versus 2.61% yesterday

- Yield on 10-Year China Development Bank Bond 2.83% versus 2.80% yesterday

- Copper Price -0.51% overnight