Prosus Selling Weighs on Tencent Despite Buybacks

3 Min. Read Time

Key News

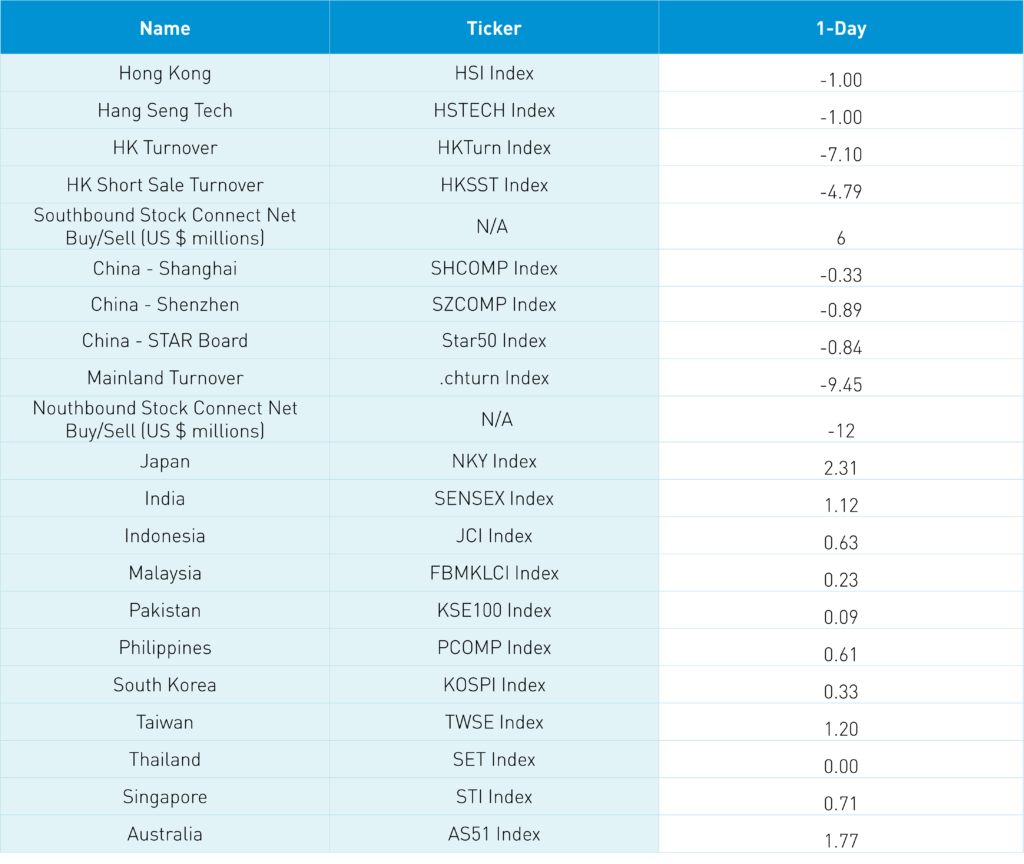

Asian equities cheered the US dollar’s fall as it approached big psychological numbers such as China’s CNY at 7 and the Japanese Yen nearing 150.

Pure speculation on my part but as the US Fed comes under increasing pressure as more countries feel the pain of higher US interest rates, maybe 50 basis points in September makes more sense than 75 basis points? China and Hong Kong didn’t get the message as both markets opened off alright but quickly slid over the course of the day despite a strong day yesterday from US-listed China ADRs.

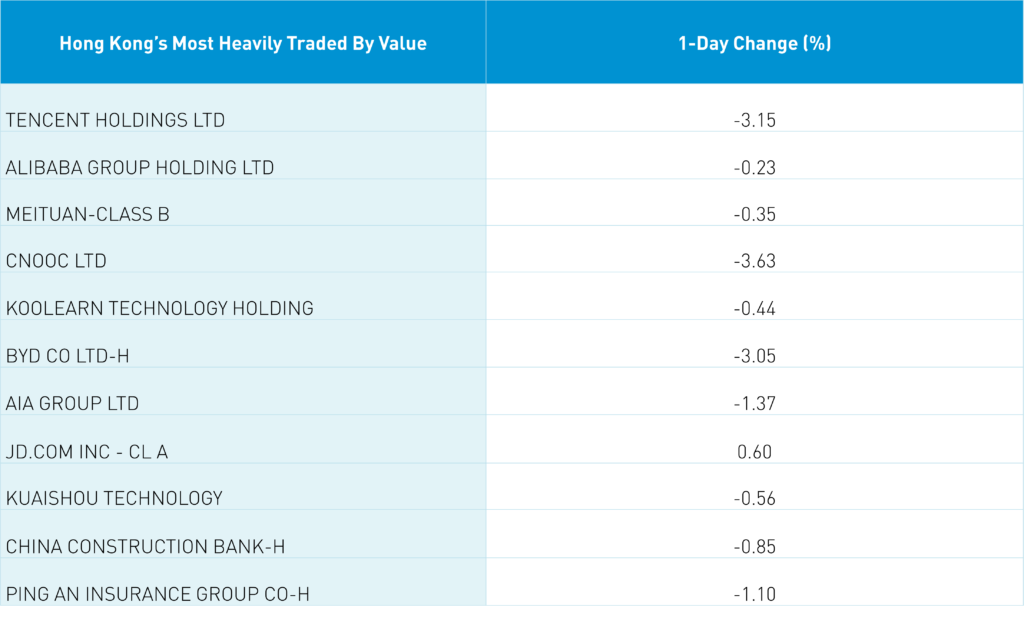

Hong Kong was dragged lower by Tencent -3.15% after an investor registered to sell $7.6 billion/192 million shares. The culprit is very likely Prosus, the spinoff from Naspers, the South African newspaper company turned venture capital investor in the late 1990s. Because Prosus stated the end game other than to use the proceeds to buy back its own stock, the 2.769 billion shares it owns weighs on Tencent. In Tencent’s defense, it has been buying back 1 million shares a day which I read is the maximum Prosus can sell daily (I need to check on this as I am not 100% sure it is true). Bloomberg had an article noting the Naspers sale, along with Softbank’s Alibaba sale and Berkshire Hathaway’s BYD sale, marks the end of several legendary China investments that produced spectacular returns. Journalistic victory lap articles tend to mark a bottom. The article misses the key that with the sellers gone, it removes the overhang.

Hong Kong internet names were all off less JD.com HK +0.6%. Short sellers pressed their bets (again) as Tencent, Alibaba HK, Meituan, and JD.com HK all had short trading account for more than 25% of trading! As the Hang Seng closed below 19k and the Hang Seng Tech closed below the 4k level, the dominance of short sellers is apt to become a big PR problem. Where are the buyers? HFCAA is an issue as big asset managers don’t want to look stupid if a solution doesn’t arise. We’ll know soon enough as the PCAOB auditors are packing their bags for Hong Kong. The WSJ noted an interesting work around for the companies by hiring US based accounting firms which I don’t think would work.

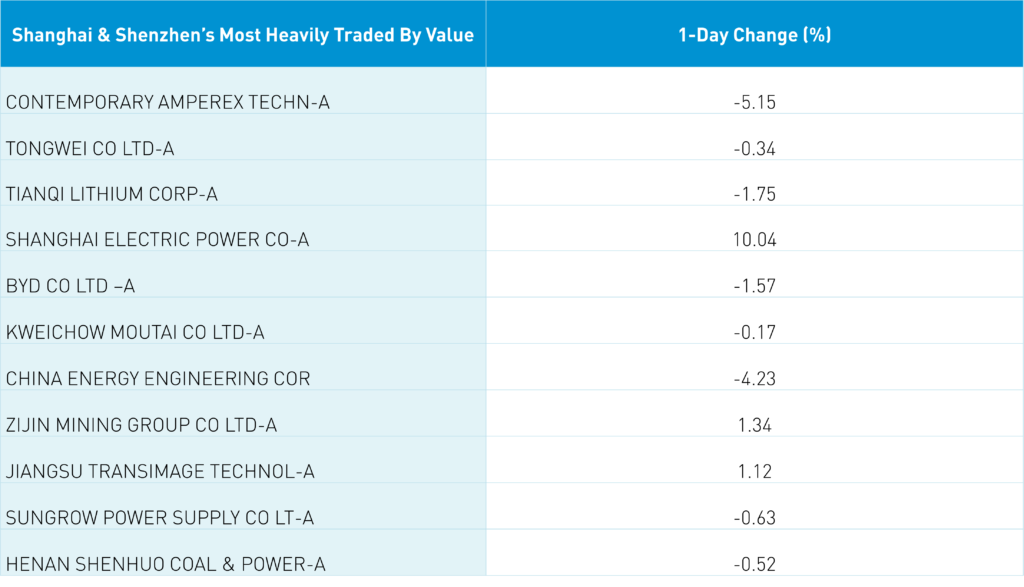

China was off as more members of Congress visited Taiwan which received remarkably little press here in the US. I guess our collective ADD is kicking in as domestic issues take center stage. The blame China for everything narrative is getting a bit tired in my opinion. With that said, the Biden Administration didn’t lift the China tariffs and National Security Advisor Jake Sullivan said a Chinese invasion of Taiwan is a “distinct threat”. The growth stocks that had a great day yesterday were all hit with profit taking as value names outperformed. I wouldn’t be surprised if China’s National Team, the nickname for big pension/insurance/sovereign wealth funds, was active as they like to buy big/mega names on weakness. After the close, it was announced that from September 10th to October 31st, for intra-province travel one needs a covid test within the past 48 hours. The time frame covers the weeklong holiday in China which may indicate vacation travel could happen. Interesting to note that domestic Chinese travel stocks were higher today though Trip.com HK was off today. After the Hong Kong close, Bilibili (BILI US, 9626 HK) reported mixed financial results. The stock is off pre-market, but the company announced Hong Kong will be its primary listing which would allow the Hong Kong stock to be added to the Southbound Stock Connect.

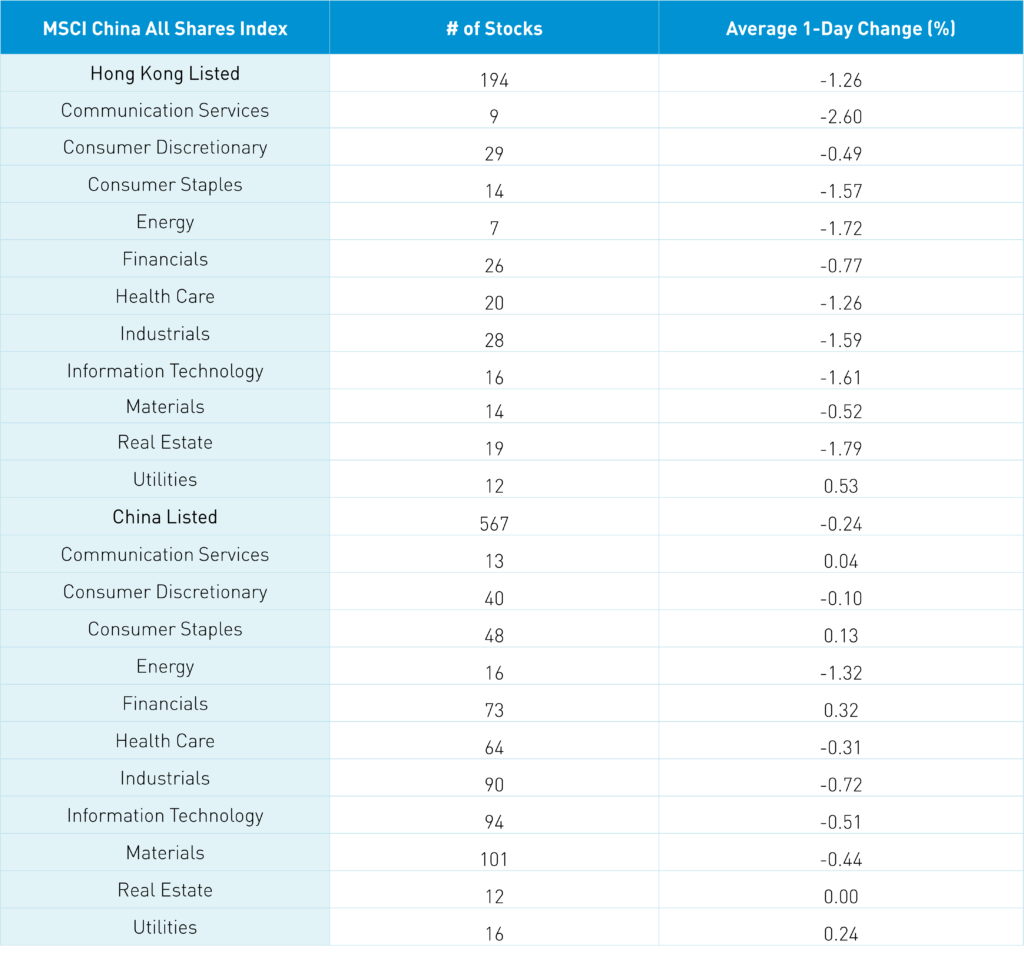

The Hang Seng and Hang Seng Tech were both down -1% on volume -7.1% from yesterday which is 62% of the 1-year average. 123 stocks advanced while 357 declined. Hong Kong short turnover declined -4.57% from yesterday which is 70% of the 1-year average as short turnover accounted for 19% of total trading. Growth factors were mixed as value factors declined and large caps edged out small caps. The positive sector was utilities +0.53% while communication -2.6%, real estate -1.79%, and energy -1.72% were down. Top sub sectors were electricity companies, solar, and wind while EV, online games, and software were among the worst. Southbound Stock Connect volumes were light as Mainland investors bought $6 million of Hong Kong stocks with Tencent being a moderate buy, Meituan a small buy, and Kuaishou a small net sell.

Shanghai, Shenzhen, and STAR Board were off -0.33%, -0.89%, and -0.84% respectively on volume -9.45% from yesterday which is 77% of the 1-year average. 1,122 stocks advanced while 3,386 stocks declined. Value factors outperformed growth while large caps outperformed small caps. Top sectors were financials +0.34%, utilities +0.26%, and staples +0.15% while energy -1.31%, industrials -0.71%, and tech -0.5%. Top sub-sectors included travel related stocks such as airlines and duty free along with nuclear power while biotech, gas, lithium, pork, and chicken were among the worst. Northbound Stock Connect volumes were light as foreign investors sold -$12 million of Mainland stocks. Treasury bonds declined, CNY appreciated +0.12% versus the US $ to 6.95, and copper fell -0.02%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.96 versus 6.98 yesterday

- CNY/EUR 6.97 versus 6.91 yesterday

- Yield on 10-Year Government Bond 2.63% versus 2.62% yesterday

- Yield on 10-Year China Development Bank Bond 2.79% versus 2.78% yesterday

- Copper Price -0.02% overnight