China Returns From Golden Week Holiday, US Semiconductor Ban Weighs On Technology

3 Min. Read Time

Key News

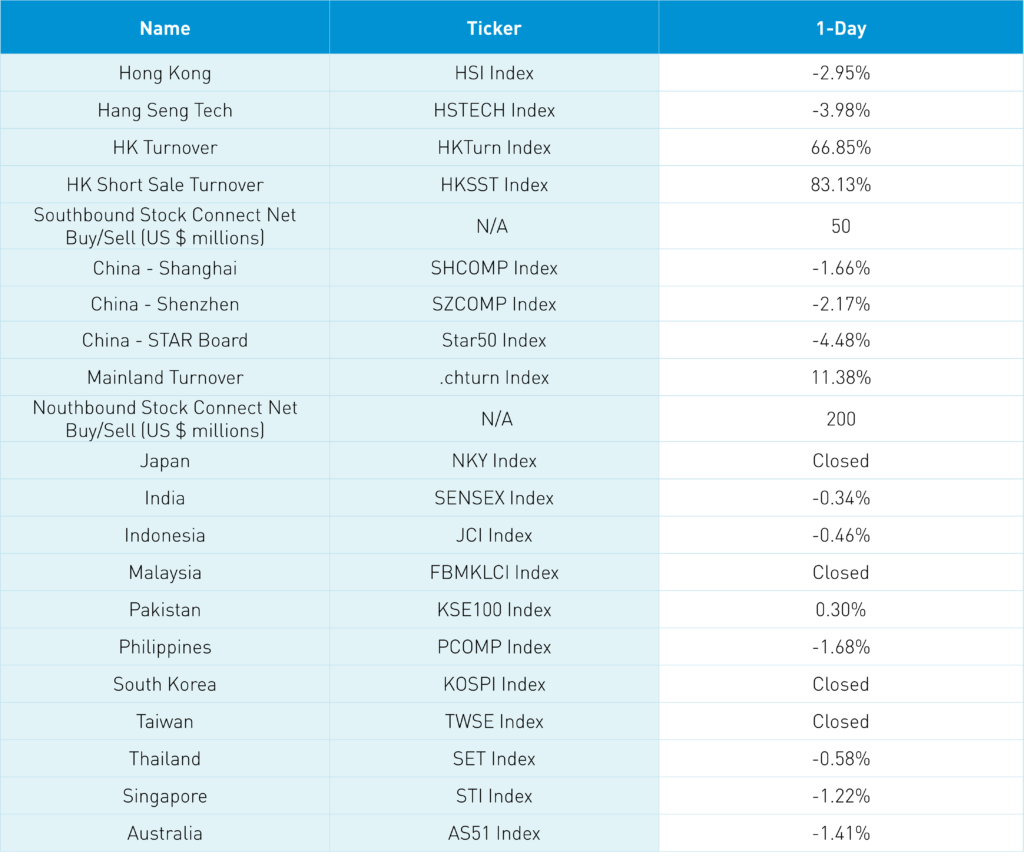

Asian equities were all down following US stocks’ poor performance on Friday following the strong employment release as investors face the reality of further US Fed rate hikes. Several markets missed the downdraft due to market holidays, including Japan, which was off for National Sports Day, Malaysia, which was off for Mawlid-al-Nabi, South Korea, which was of for the Substitution Holiday, and Taiwan, which was off for Double Tenth Day.

Much of today’s Asia downdraft was anticipated by Friday’s US sell off and reflected in Asian ADRs. Specific to China, last week’s announced expansion of the US export restrictions on semiconductors and chip-making equipment to China weighed heavily on the semiconductor industry and the broader tech sector. I find it ironic and worth pointing out that most US chip makers that will be adversely affected by the export ban are based in California. It is also worth noting that Apple’s supplier ecosystem was down overnight. The US Commerce department also added thirty-one Chinese companies to its “unverified” list, including the company that makes China’s high-speed trains. Head scratcher on that one!

Golden Week travel numbers were down from last year and compared to pre-COVID numbers due to travel restrictions, placing consumer staples and consumer discretionary stocks among the worst performers in both markets. COVID spikes following Golden Week, including stricter measures in Shanghai, did not help sentiment.

September’s Caixin Services PMI came in at 49.3 versus expectations of 54.4 and August’s 55, though the lower-than-expected release was not a factor in market action overnight.

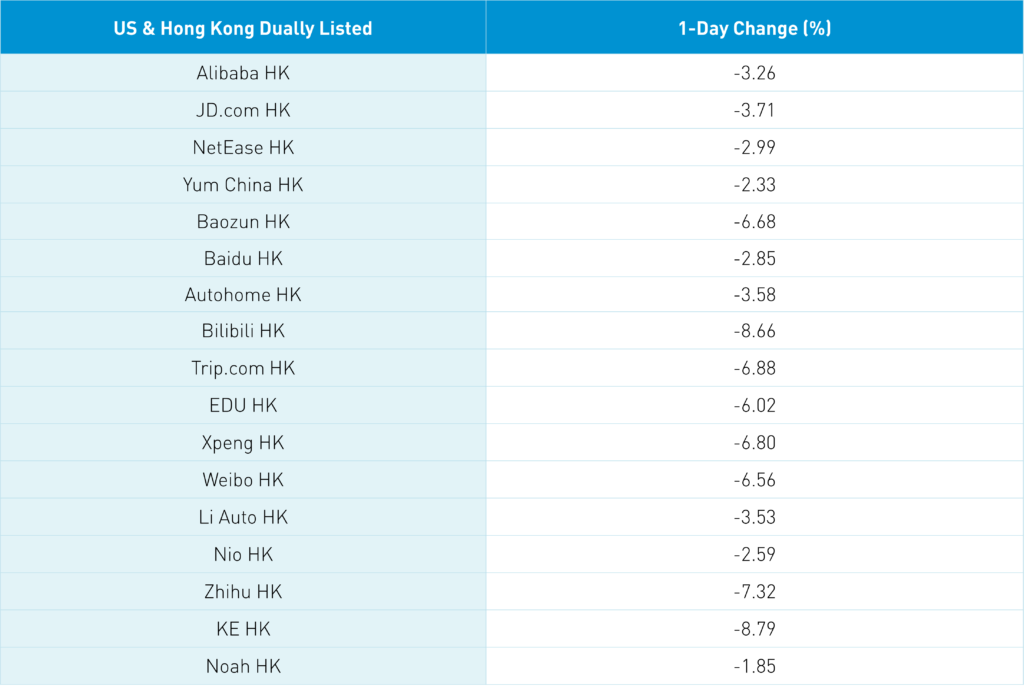

Against this backdrop, Hong Kong short sellers pressed their bets as 25% of the Main Board’s turnover was short. Meituan saw 31% of its volume traded short, Alibaba HK saw 31% short, Tencent saw 11% short, and JD.com HK saw 39% short.

Over the weekend, it was announced that Southbound Stock Connect will now include the Hong Kong primary listings of dual share class companies, in which management’s shares exceed the holdings of other shareholders. Using Bilibili as an example, since it converted Hong Kong to a primary share class last Monday, it would become eligible for Southbound Stock Connect in March of 2023. Bilibili HK’s share class fell -8%, despite it being highlighted. Alibaba anticipates a December approval for Hong Kong to become its primary share class.

Wuxi Biologics was removed from the US’ “unverified” list, though the stock was dragged lower by the market.

The onshore Renminbi (CNY) played catch up to the dollar’s strength, moving from 7.12 CNY per USD to 7.15 CNY per USD. Chinese Treasury bonds had a strong day of trading.

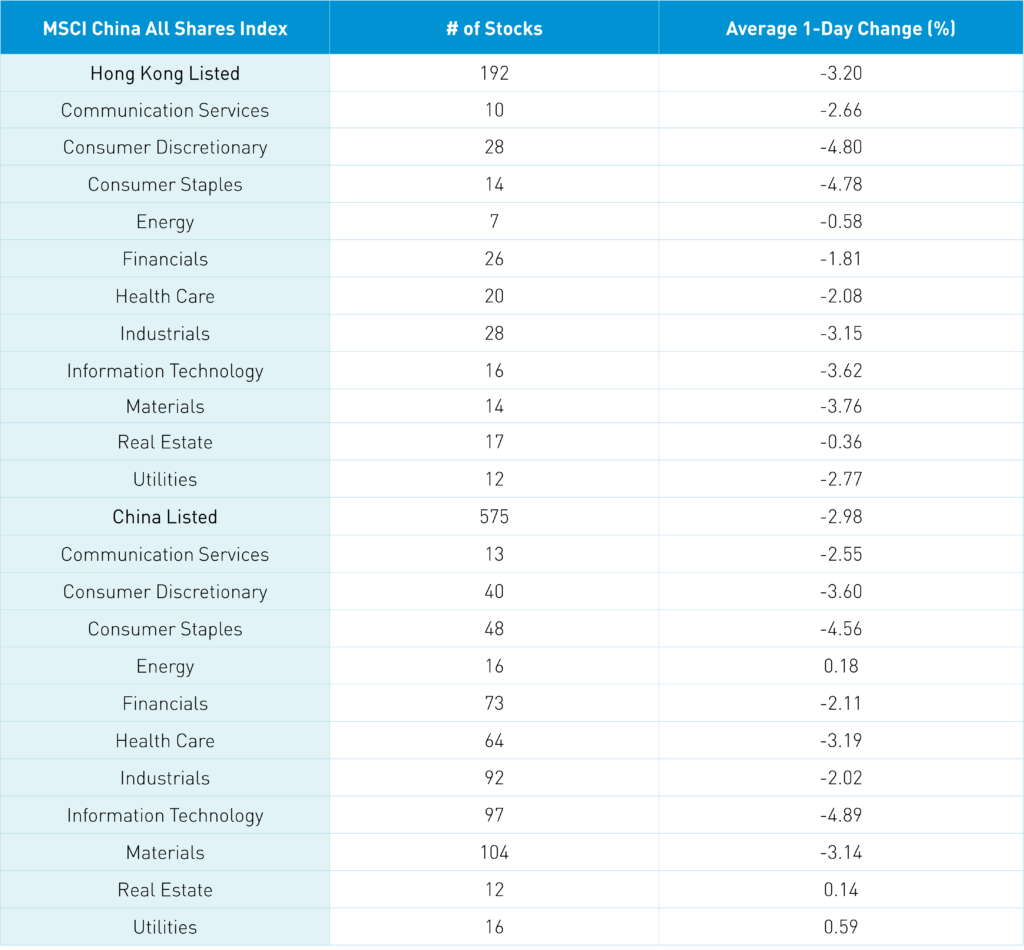

The Hang Seng and Hang Seng Tech indexes fell -2.95% and -3.98%, respectively, as volume surged +66.85%, which is 76% of the 1-year average. 60 stocks rose while 439 declined. Main Board short selling volume increased +83%, which is 109% of the 1-year average, as 25% of turnover was short trading. Value factors outperformed growth factors as small caps “outperformed” large caps. All sectors were negative as real estate off -0.36% while consumer discretionary fell -4.8%, consumer staples fell -4.78%, and materials fell -3.76%. Semiconductors were the worst performing subsector while consumption-related subsectors were also off, including autos, retailers, and liquor. Southbound Stock Connect reopened to light/moderate volumes as mainland investors bought $50 million worth of Hong Kong stocks as Tencent was a small net buy, Li Auto was a moderate buy, and Meituan was a small net sell.

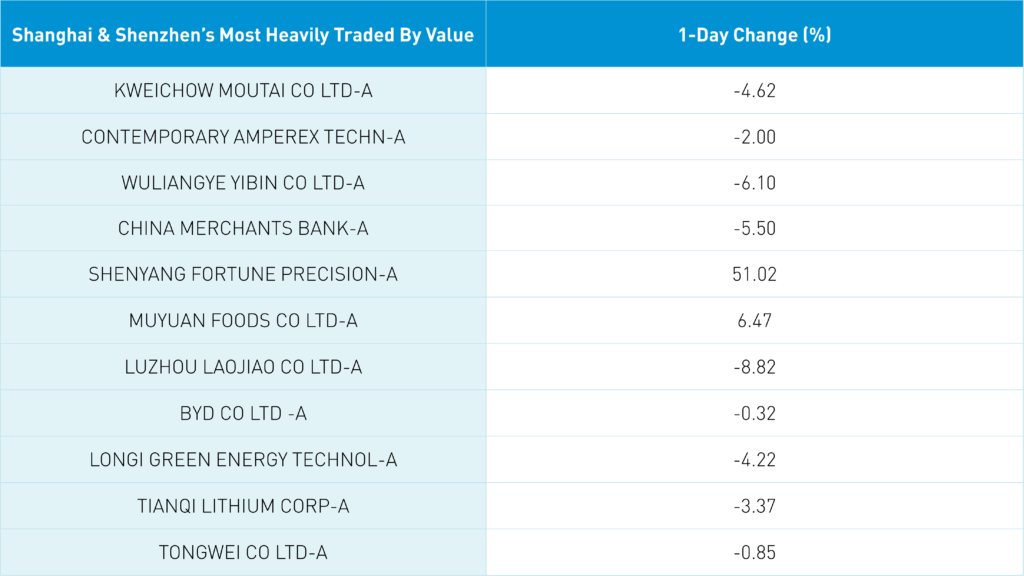

Shanghai, Shenzhen, and the STAR Board fell -1.66%, -2.17%, and -4.48%, respectively, on volume that increased +11.38%, which is 63% of the 1-year average. 895 stocks advanced while 3,670 fell. Value factors outperformed growth factors, while large caps outpaced small caps. Advancing sectors included utilities, which gained +0.57%, energy, which gained +0.16%, and real estate, which gained +0.12% while tech fell -4.91%, staples fell -4.58%, and consumer discretionary fell -3.62%. The top performing subsectors included agriculture, including chicken and pork plays, along with oil, gas, and coal while semiconductors, hardware, and liquor were among the worst. Northbound Stock Connect volumes were moderate/light as foreign investors bought $200 million worth of Mainland stocks. Chinese Treasury bonds had a very strong day, CNY fell -0.47% to 7.15 versus the US dollar, and copper gained +0.38%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.15 versus 7.12 on September 30th

- CNY per EUR 6.94 versus 6.98 on September 30th

- Yield on 1-Day Government Bond 1.40% versus 1.49% on September 30th

- Yield on 10-Year Government Bond 2.74% versus 2.76% on September 30th

- Yield on 10-Year China Development Bank Bond 2.91% versus 2.94% on September 30th

- Copper Price +0.38% on September 30th