Mainland Investors Buy Hong Kong Stocks as Short Selling Continues

2 Min. Read Time

Key News

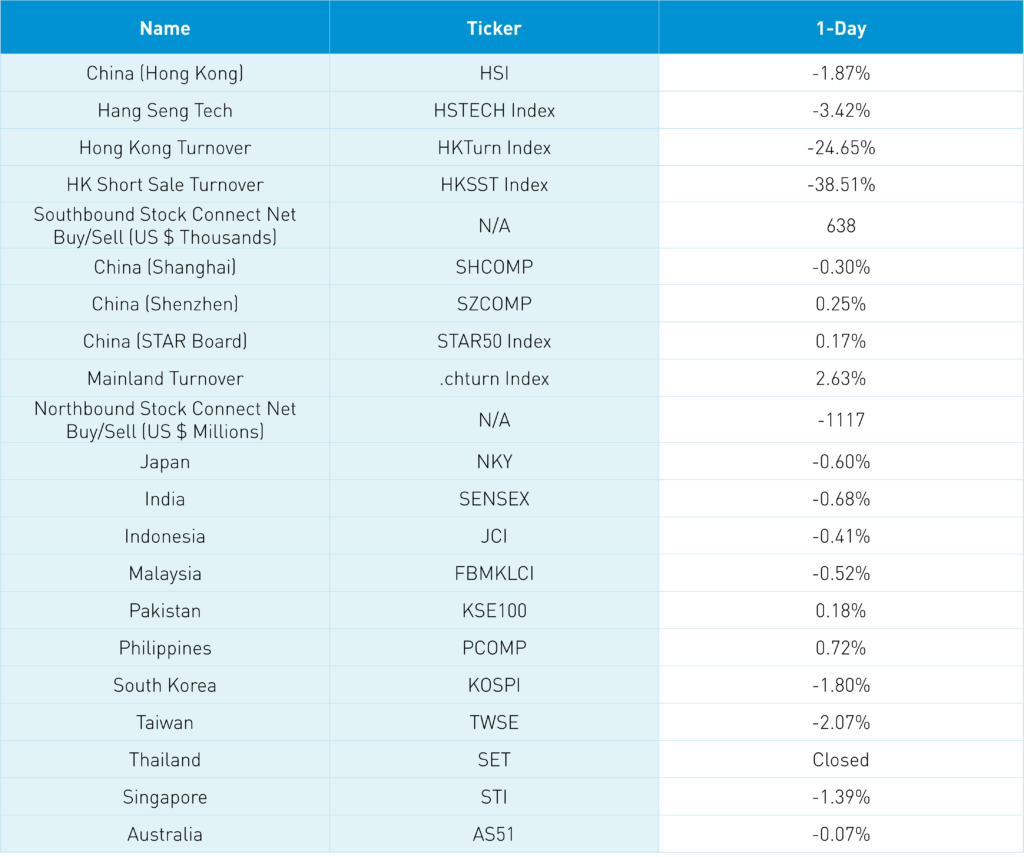

Asian equities were down on light volumes in advance of today’s US CPI print, with Thailand on holiday. The Asia dollar currency index gained as the US dollar slid slightly overnight. At the same time, China’s renminbi (CNY) fell somewhat versus the US dollar as it nears what I would call the unacceptable level for the PBOC. The onshore (Shanghai and Shenzhen) versus offshore (Hong Kong) dynamic is at play in price action and volume. Mainland investors weren’t very interested in the US CPI print as volumes were moderate on a mixed performance day, with Shanghai -0.30% and Shenzhen +0.25%. Hong Kong volumes were very light on a down day as markets drifted lower on no significant news. The press conference by the National Health Commission received considerable attention in the offshore market, reiterating the zero covid/lives first policy. I’ve not received today’s covid numbers though it is clear cases have increased across many cities post-Golden Week travel. A broker noted that highway traffic hasn’t declined despite strong restrictions indicating little tolerance for lockdowns to weigh on the economy. Frustration is rising on zero covid in China. The government will recognize this, as I suspect/hope the policy is tweaked following the Party Congress, which kicks off this weekend.

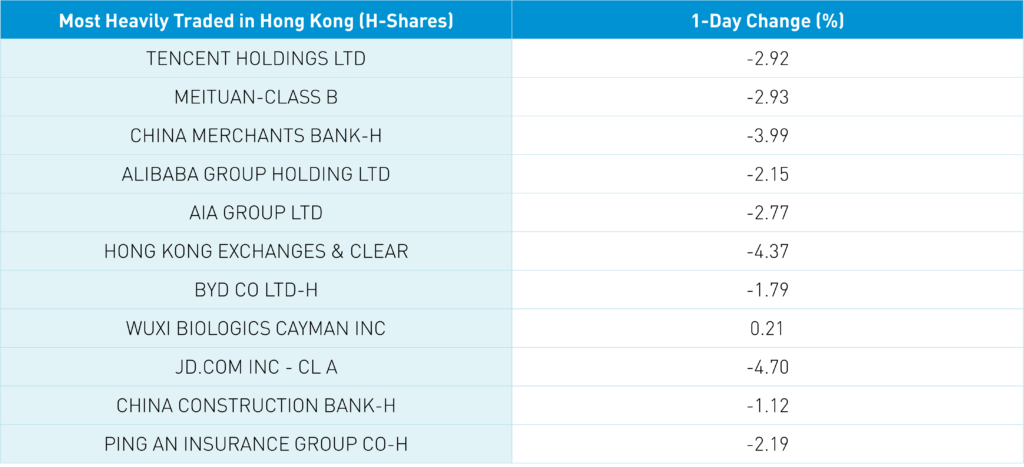

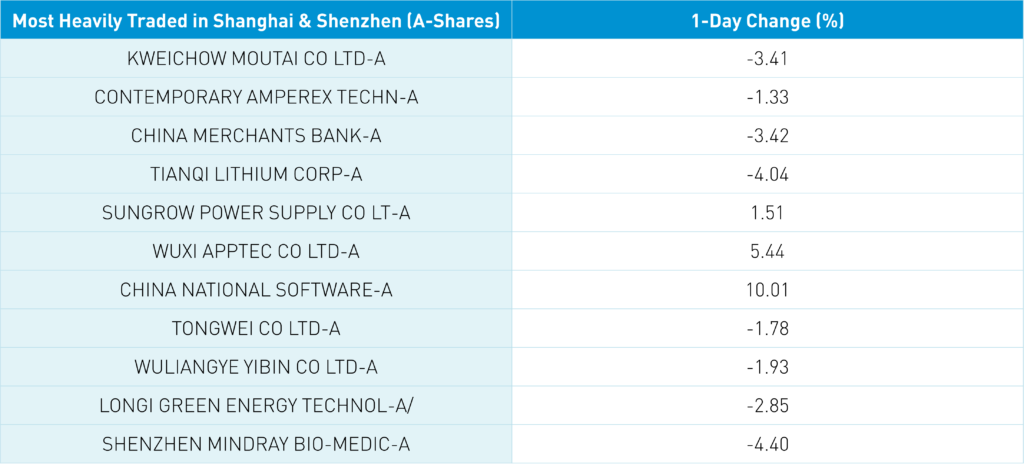

Fingers crossed! Against this backdrop, shorts pressed their bets (again) with 17% of Main Board trading short today, with Meituan seeing 23% of volume short, Tencent 10%, Alibaba HK 22%, and HSBC a shocking 53%. Worth noting that JD.com HK fell off the shortlist. Tencent had another strong day of Mainland investors buying via Southbound Stock Connect. Despite Mainland markets holding up, foreign investors sold a healthy -$1.117B with growth/favored stocks such as Shanghai-listed Kweichow Moutai, China Merchants Bank, Wuxi Apttect, Long Green Energy, Tongwei, and Ping An.

Meanwhile, in Shenzhen, CATL, Wuliangye Yibin, BYD, Luxshare, and Yunnan Energy New Material were all sold off. After the close, Applied Materials announced a poor financial forecast due to US government restrictions on chip exports to China as Washington DC learns ECON 101. The Santa Clara, California-based company employs 60,000 employees globally, highlighting the importance of chips to California’s economy. A China media source noted that Intel received an exemption from the US government to continue making chips in China.

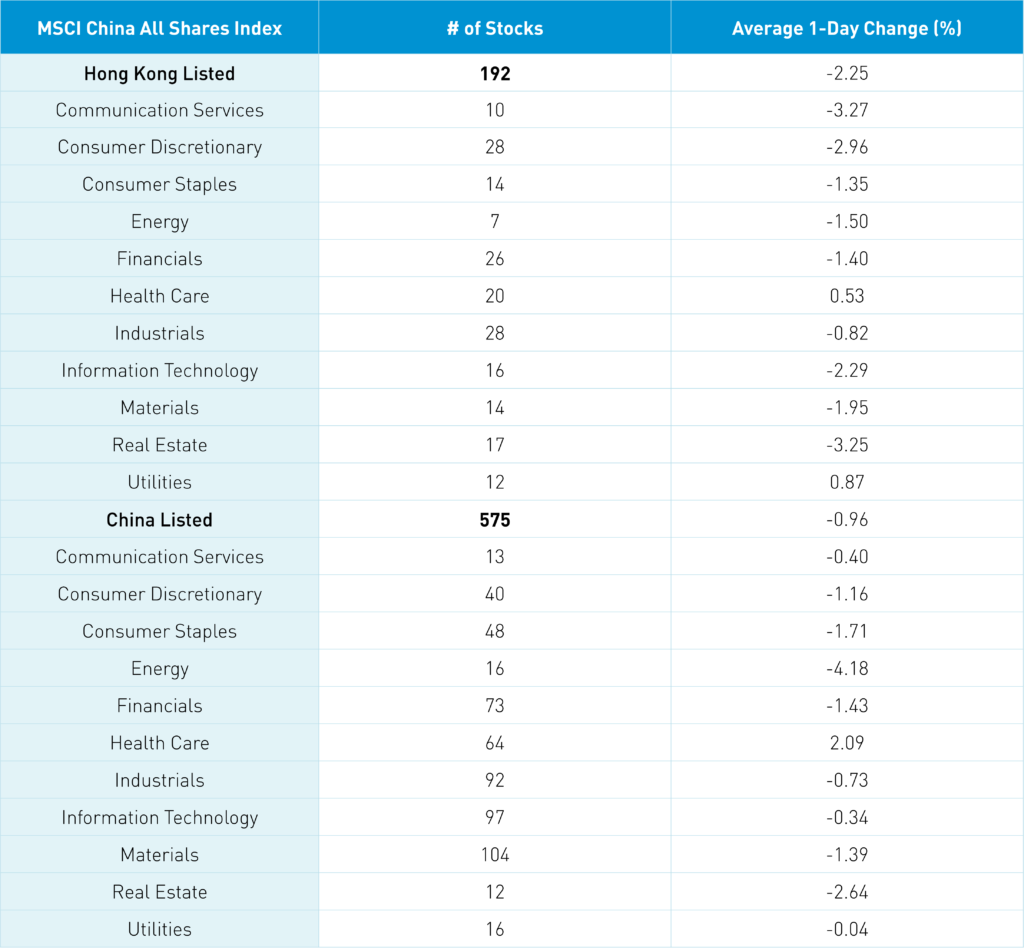

The Hang Seng Index and Hang Seng Tech declined -1.87% and -3.42%, respectively, on volume that fell -24.65% from yesterday, which is 68% of the 1-year average. 122 stocks advanced, while 375 declined. Main Board short selling volume declined -38.51% from yesterday, which is 68% of the 1-year average, as short selling accounted for 17% of Main Board trading. Value factors outperformed growth factors, while large caps “outperformed” small caps. Utilities and healthcare were the only positive sectors, gaining +0.87% and +0.52%, respectively, while communication services fell -3.27%, real estate fell -3.25%, and consumer discretionary fell -2.96%. The top-performing subsectors were biotech/life sciences, while software, retail, and consumer durables were among the worst. Southbound Stock Connect volumes were moderate though strongly skewed toward buying as Mainland investors bought $638 million worth of Mainland stocks, with Tencent seeing another strong net buy day, Li Auto was a small/moderate net buy, while Wuxi Biologics and Meituan were both a small net buy.

Shanghai, Shenzhen, and the STAR Board were mixed -0.3%, +0.25%, and +0.17%, respectively, on volume that increased +2.63% from yesterday, which is 74% of the 1-year average. 3,215 stocks advanced, while 1,301 stocks declined. The only positive sector was healthcare +2.09%, while energy -4.18%, real estate -2.64%, and staples -1.71%. The top sub-sectors were software, pharma, biotech, education, and hardware, while coal, liquor, and petrochemical were among the worst. Northbound Stock Connect volumes were moderate/light though foreign investors sold -$1.117B of Mainland stocks today. Treasury bonds rallied, CNY was off -0.19% versus the US $ to 7.18, and copper +0.14%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.17 yesterday

- CNY per EUR 6.99 versus 6.96 yesterday

- Yield on 10-Year Government Bond 2.73% versus 2.74% yesterday

- Yield on 10-Year China Development Bank Bond 2.89% versus 2.90% yesterday

- Copper Price +0.14% overnight