Post Party Congress Pivot to Economy Lifts Stocks

3 Min. Read Time

| Live Q&A Webinar |

| Join us Tomorrow, October 27th at 10:00 am EDT for our webinar: China Market Volatility Update and Q&A With KraneShares Click here to register. |

Key News

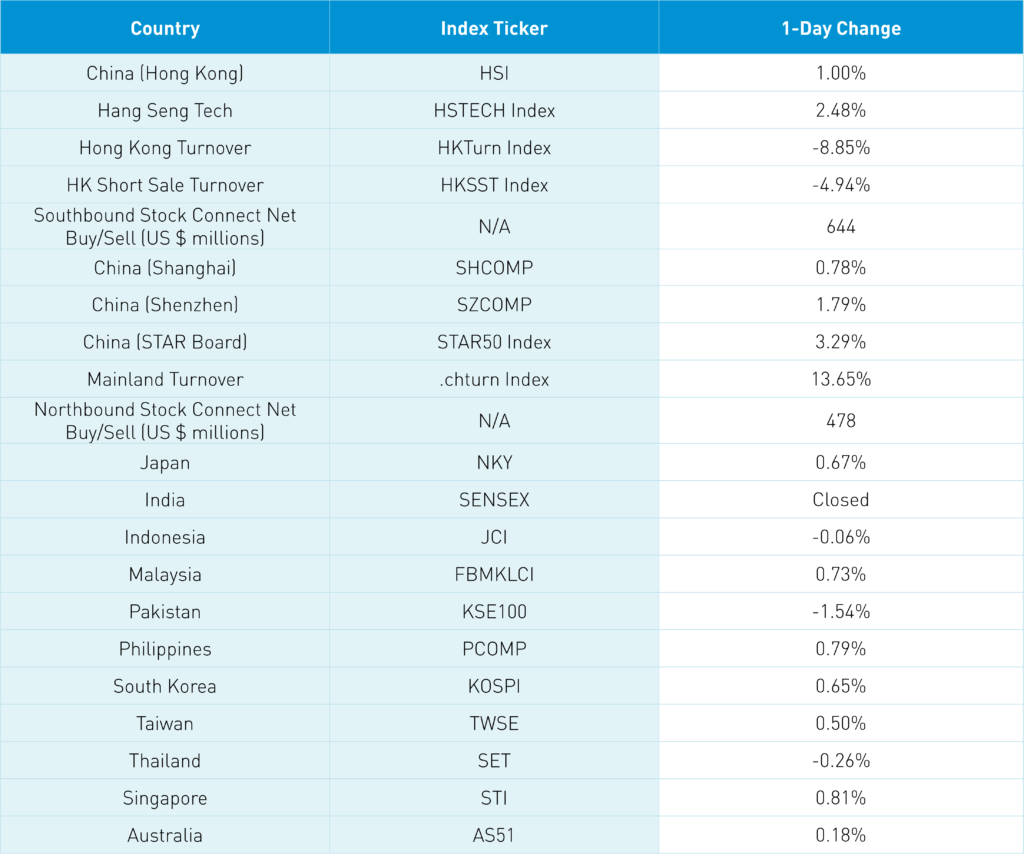

Asian equities had a positive day with Hong Kong and China outperforming while India had the day off for Diwali.

Today’s catalyst was yesterday’s news that the PBOC (People’s Bank of China) and SAFE (State Administration of Foreign Exchange) met to “Strengthen departmental cooperation to maintain the healthy development of the stock market, bond market and property market.” Sounds like they understand the challenges/risks facing China’s economy and are willing to tackle it. “…maintain a reasonable growth in the total amount of monetary and credit, increase support for key areas such as scientific and technological innovation…”. Sounds like a mix of fiscal and monetary support. Additionally, they stated “We will promote high-level two-way opening of the financial market and support the continued prosperity and development of the Hong Kong international financial center.” This totally flies in the face of the media narrative that China is closing for business following President Xi’s promotion of allies.

We’ve proposed our “Back to Business” thesis that post Party Congress, the government will pivot from ensuring they have a job for the next five years to securing the economy and hopefully improving diplomatic relations. The new State Council also met in order to review the Party Congress, which again, President Xi speech last Sunday was very focused on the economy. Markets got the message and ripped higher though came off their intra-day highs on reports of a district in Wuhan having a COVID outbreak. That district is going into quarantine/lockdown while the Universal amusement park in Beijing closed as Beijing reported seventeen new COVID cases today. Remember COVID is all over China though we aren’t seeing lockdowns extending to economic consequences.

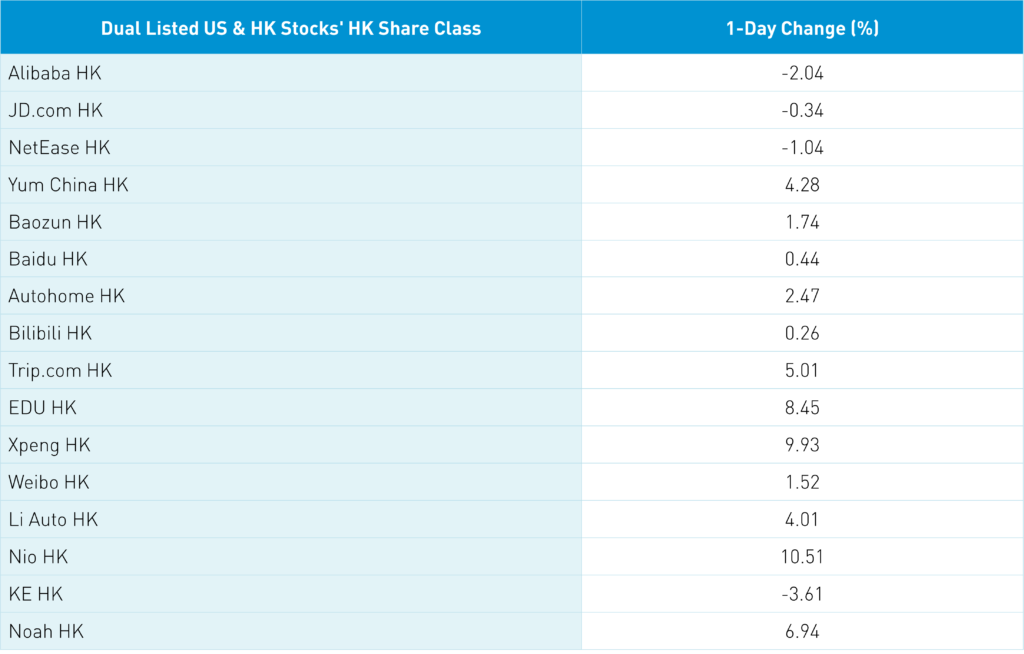

Healthcare was the top performer in both China +6.97% and Hong Kong +4.78% after yesterday’s news that an inhalable vaccine has been approved for use in Shanghai. CanSino Biologics (6185 HK) surged +20.6% in Hong Kong as investors realized it is the company involved. Hong Kong internet stocks performed well with Hong Kong’s most heavily traded company being Tencent +2.52% after seeing another strong day of net buying from Mainland investors via Southbound Stock Connect. Meituan gained +5.02% though Alibaba HK was down -2.04% despite initial reports of Singles Day pre-sales being strong. Short activity has slowed the last few days though several individual stocks saw short selling turnover increase.

One interesting discovery was around the rumor Monday that ADR funds were being liquidated. It turns out that an ETF provider removed Tencent, Baidu, and Weibo from their ETFs due to a change in their ESG rating. The aggregate sale wasn’t that big though, the rumor clearly contributed to Monday’s meltdown. To me, the move is another strong contrarian signal. The other big news today was CNY appreciated +1.3% versus the US dollar closing at 7.17 from yesterday’s 7.31 (remember CNY quote is different than most currencies as it is quoted $1=7.17 renminbi therefore a decline is confusingly appreciation). The chatter is Chinese banks were sellers of US dollars. Interest rates determine currency prices so one can’t materially change the price over the long run, but the move does slow the decline.

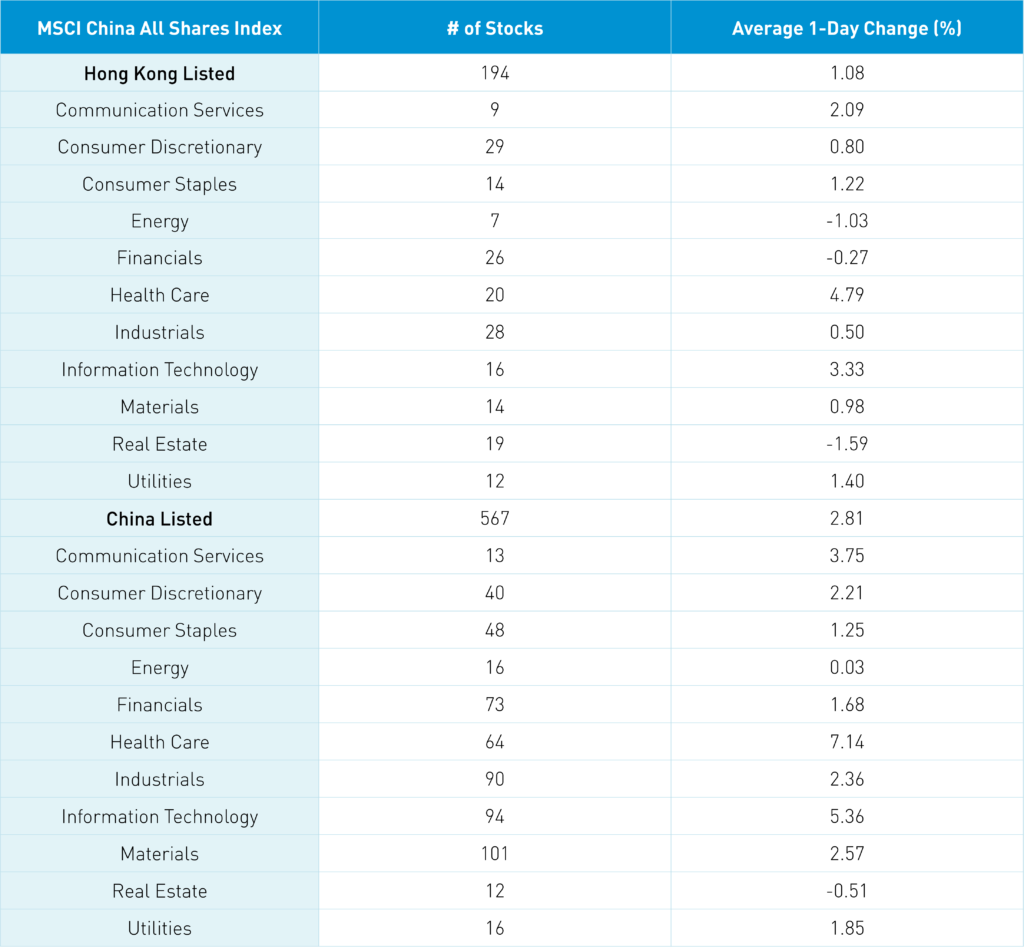

The Hang Seng and Hang Seng Tech gained +1% and +2.48% on volume -8.85% from yesterday which is 106% of the 1-year average. 390 stocks rose while 99 stocks declined. Main Board short selling turnover fell -4.94% which is 96% of the 1-year average as 16% of trading was short. Value and growth factors were mixed as small caps outpaced large caps. Top sectors were healthcare closing up +4.79%, tech gained+3.33%, and communication +2.09%, while real estate fell -1.59%, energy -1.03%, and financials -0.27%. Top sub-sectors were tech hardware, healthcare equipment, auto parts, and semis while energy, banks, and property were among the worst. Southbound Stock Connect volumes were high as Mainland investors bought $644 million of Hong Kong stocks with Tencent seeing strong buying though half of Mondays at HK $1.456 billion. Meituan saw strong buying at HK $1.246 billion, Wuxi Biologics a moderate net buy, and Kuaishou a small net buy.

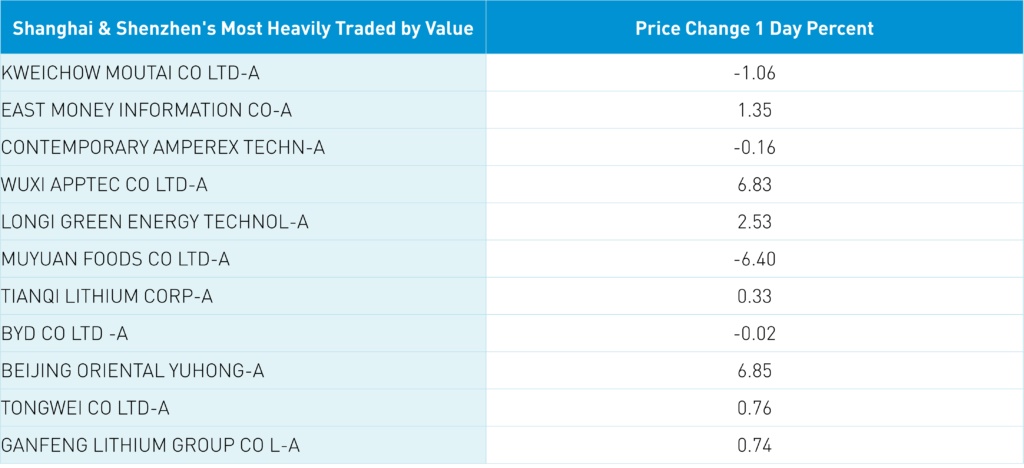

Shanghai, Shenzhen, and STAR Board rose +0.78%, +1.79%, and +3.29% respectively on volume +13.65% from yesterday which is 93% of the 1-year average. 3,670 stocks advanced while 883 stocks declined. Growth factors outpaced value factors while small caps outperformed large caps. Top sectors were healthcare +7.14%, tech +5.35%, and communication +3.75%, while real estate was off -0.52%. Top sub-sectors chemicals, software, and pharmaceuticals while agriculture, coal, and real estate were among the worst. Northbound Stock Connect volumes were moderate as foreign investors bought $478 million of Mainland stocks. CNY gained +1.3% versus the US $ closing at 7.17, while Treasury bonds gained and copper +0.35%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.31 yesterday

- CNY per EUR 7.19 versus 7.21 yesterday

- Yield on 10-Year Government Bond 2.70% versus 2.72% yesterday

- Yield on 10-Year China Development Bank Bond 2.86% versus 2.87% yesterday

- Copper Price +0.35% overnight