JD Beats, Hong Kong Tech Concludes Strong Week, Week in Review

3 Min. Read Time

Week in Review

- Asian equities were mixed this week while Hong Kong-listed internet and real estate stocks outperformed.

- President Biden met with President Xi on the sidelines of the G20 on Monday, notching a key improvement in relations between the two superpowers and the first time the leaders have met face to face. Their meeting was followed by a meeting between US Treasury Secretary Janet Yellen and China’s central banker.

- Key authorities laid out a 16-point plan to support developers on Monday, which included more leniency than markets had anticipated and led to a strong rebound in the sector.

- Tencent, Tencent Music, JD.com, and Alibaba all reported solid, but not amazing Q3 results this week.

JD.com Earnings Overview

JD.com beat on top-line revenue, which increased +11.4% year-over-year to RMB 243.54 billion versus an estimated RMB 243.07 billion. The company’s net margin also increased to 2.4% versus 1.1% in Q3 2021, a record-high margin. This was a beat on both the top and bottom lines, which is impressive considering the macroeconomic conditions the company has faced over the past 12 months. The company’s results from Singles Day will be included in its Q4 earnings.

Key News

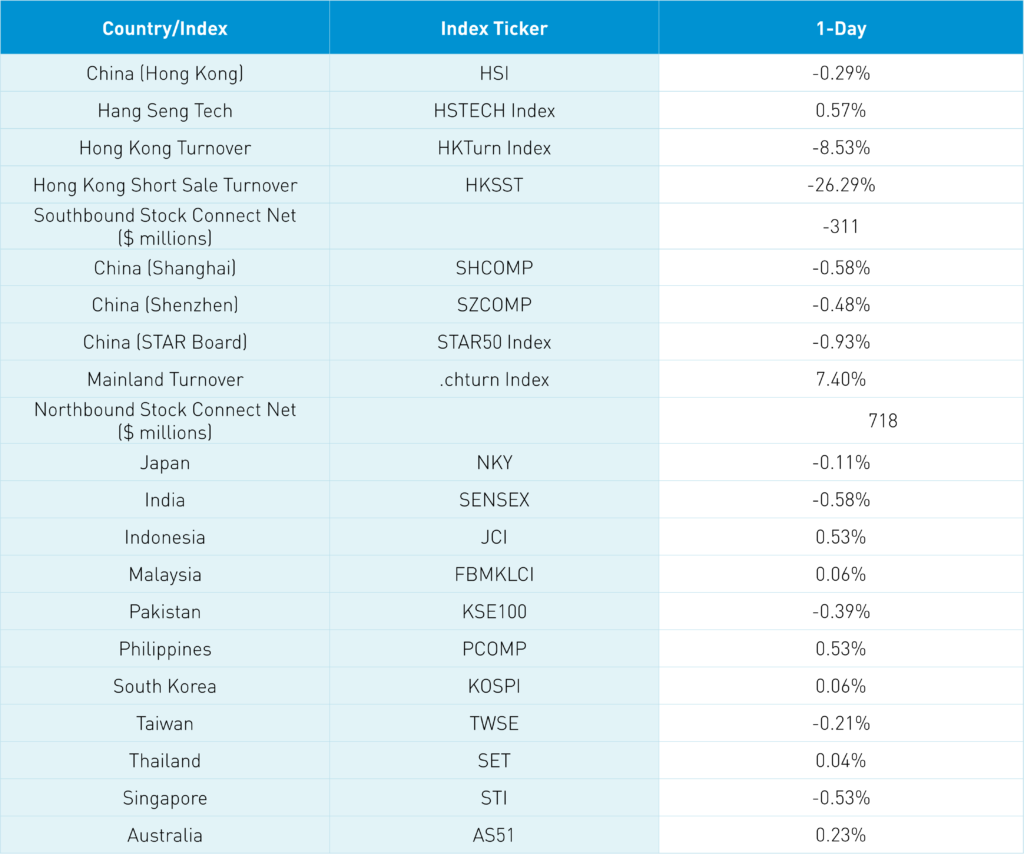

Asian equities ended the week mixed, which is fitting for an off week though Hong Kong and especially Hong Kong tech stocks had a good week. Foreign investors cheered renewed diplomatic dialogue between China and the US at the G-20 in Bali and at Bangkok’s Asia-Pacific Economic Cooperation meetings. Asian markets trimmed gains in afternoon trading as North Korea fired off a missile.

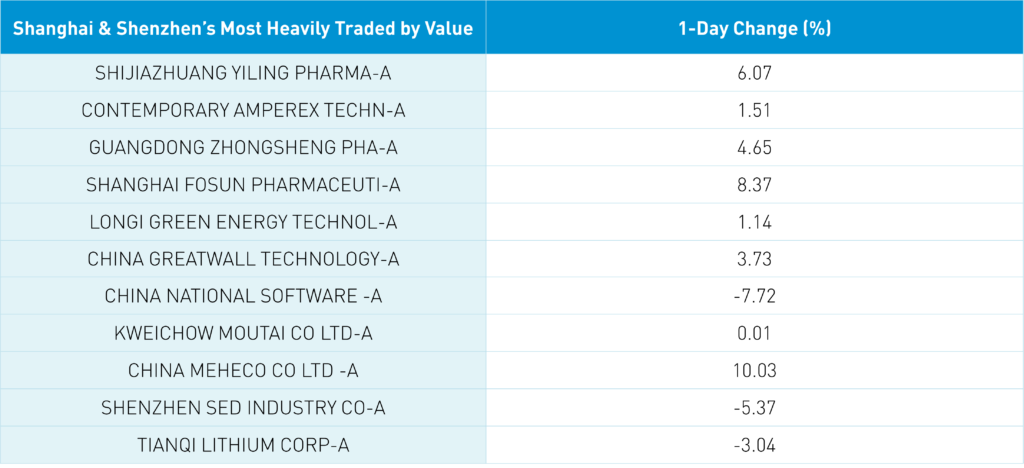

There were 2,276 new covid cases and 22,853 asymptomatic cases in China today as healthcare was the top performing sector on the Mainland, though the sector was off slightly in Hong Kong. Investors recognize that dynamic zero COVID will result in more cases, including those who will need treatment. A Mainland media source noted the rollout of CanSino Biologics’ inhalable covid vaccine across 14 cities, including Beijing and Shanghai. Meanwhile, Yiling Pharmaceutical (002603 CH) gained +6.07% overnight and was the Mainland’s most heavily traded stock by value, hitting a 52-week high after rising 48% this week. The company announced that it had applied for a clinical trial to treat the common cold using traditional Chinese medicine.

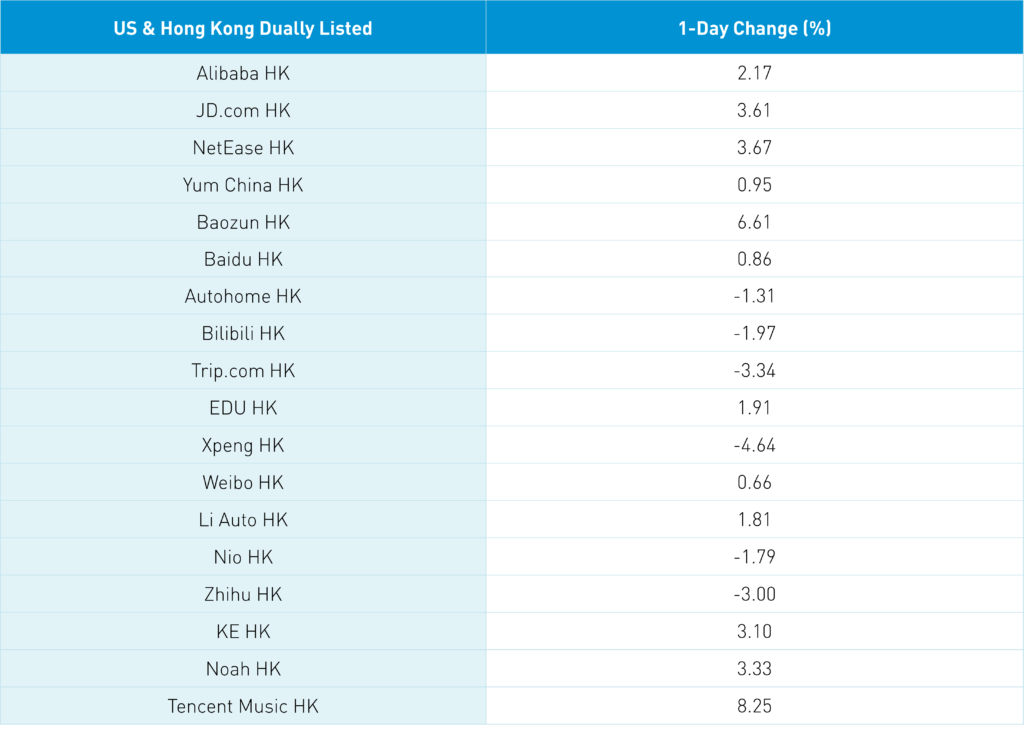

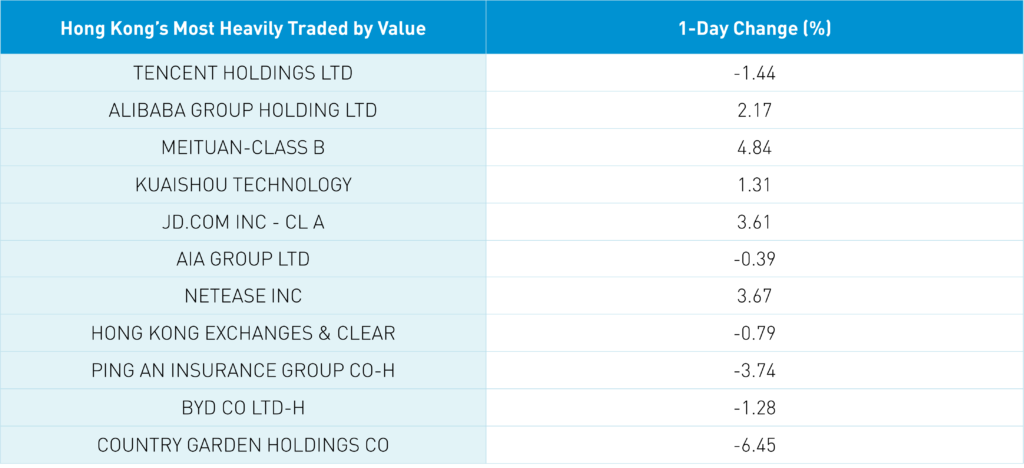

Hong Kong-listed internet stocks bucked the weak market today with strong gains, following Alibaba’s +2.17% gain and NetEase’s +3.67% after both companies beat analyst expectations along with strong buyback programs. JD.com HK gained +3.67%, following Alibaba higher in advance of today’s market open in the US. Tencent was off -1.44% despite the company receiving a new game approval along with NetEase. Tencent did see another day of robust net buying via Southbound Stock Connect, which saw a rare net sale of Hong Kong stocks by Mainland investors.

It is worth pointing out that distressed developer Country Garden saw five straight days of net Southbound Connect buying this week. Mainland stocks were off on no news except for several reports about fixed income fund redemptions as the PBOC comments on keeping an eye on inflation surprised investors. Two exchange-traded money market ETFs have seen big outflows this month on an absolute basis, though outflows represented only ~5% of AUM.

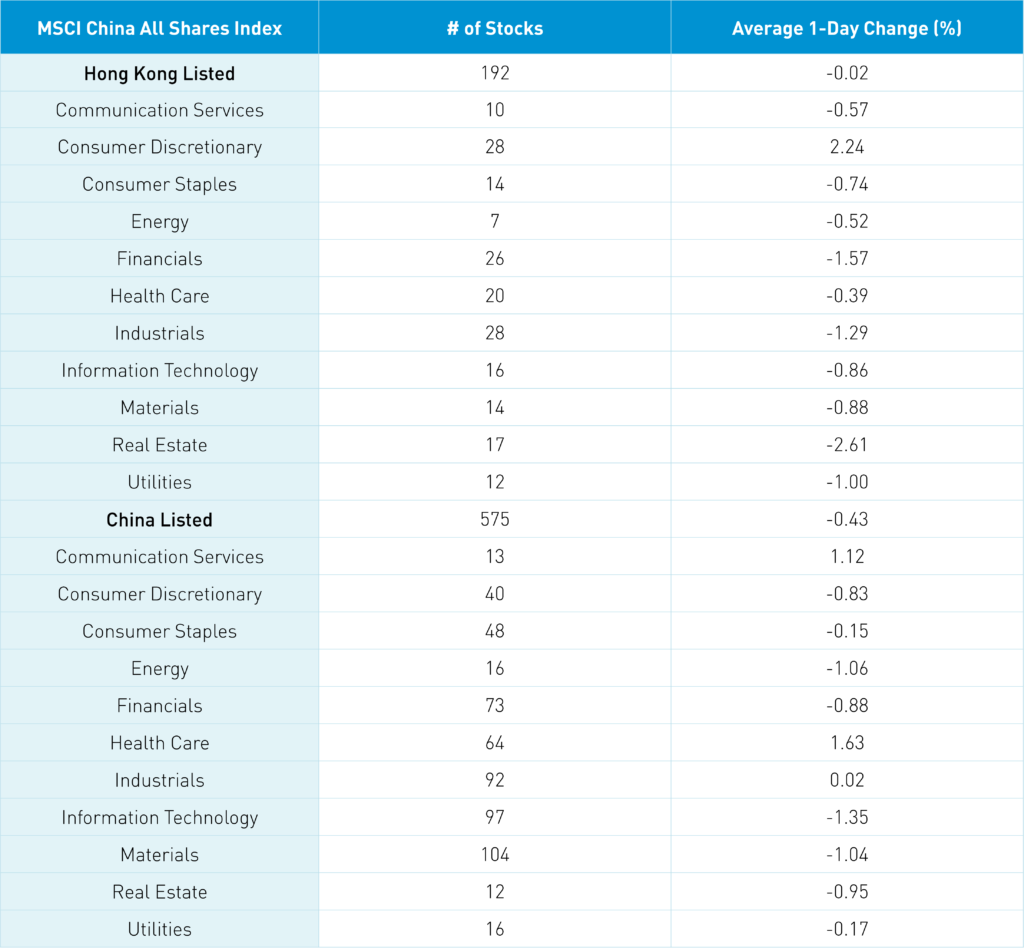

The Hang Seng and Hang Seng Tech indexes diverged to close -0.29% and +0.57%, respectively, on volume that decreased -8.53% from yesterday, which is 112% of the 1-year average. 143 stocks advanced, while 347 declined. Main Board short turnover declined -26.26% from yesterday, which is 93% of the 1-year average, as 14% of today’s turnover was short. Growth factors outperformed value factors as large caps outpaced small caps. Consumer discretionary was the only positive sector, gaining +2.25%, while real estate fell -2.6%, financials fell -1.57%, and industrials fell -1.29%. The top-performing subsectors were food, media, and retailers, while semiconductors, real estate, and transportation were among the worst. Southbound Stock Connect volumes were elevated at 1.5X the 1-year average as Mainland investors sold -$311 million worth of Hong Kong stocks as Tencent was a strong net buy, Meituan was a moderate net sell, and Kuaishou was a small net buy.

Shanghai, Shenzhen, and the STAR Board eased -0.58%, -0.48%, and -0.93%, respectively, on volume that increased +7.4% from yesterday, which is 101% of the 1-year average. 1,255 stocks advanced while 3,359 stocks declined. Growth and value factors were mixed as large caps outperformed small caps. The top performing sectors were healthcare, which gained +1.62%, communication services, which gained +1.12%, and industrials, which gained +0.01%. Meanwhile, tech fell -1.36%, energy fell -1.07%, and materials fell -1.05%. The top-performing subsectors were education, biotech, and telecom, while marine/shipping, software, and aerospace were among the worst. Treasury bonds rallied, CNY appreciated +0.41% versus the US dollar to 7.12 while copper fell -0.69%.

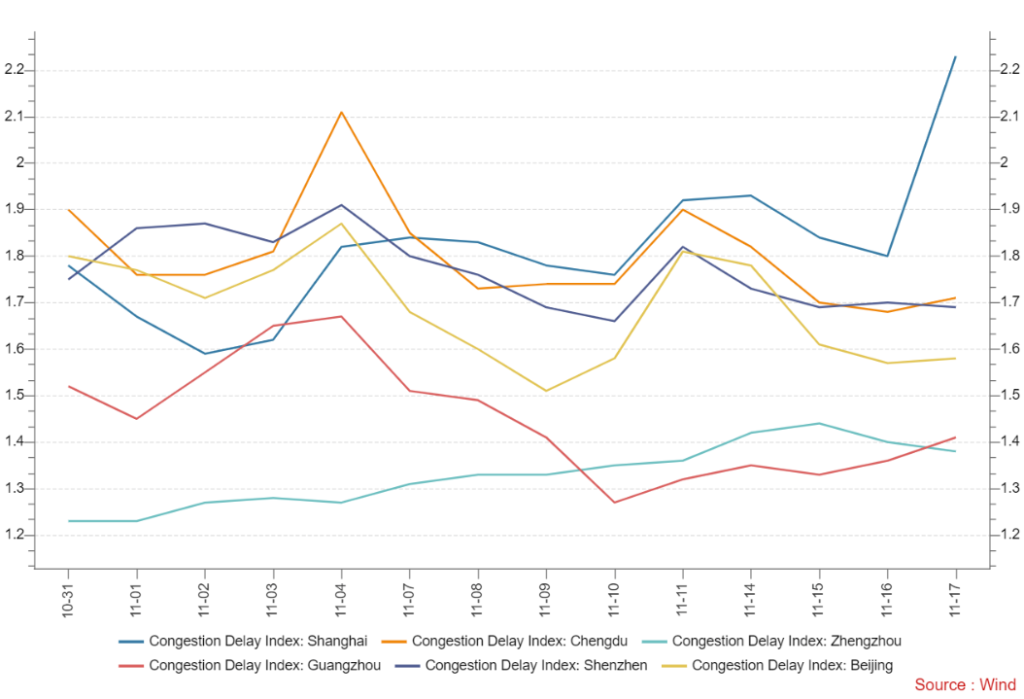

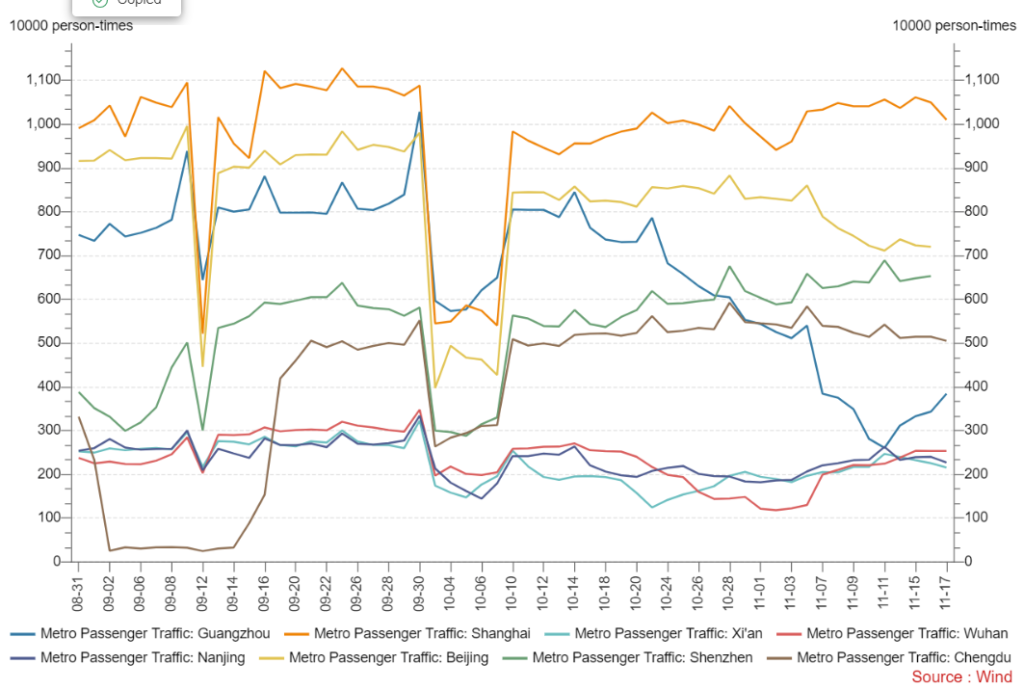

China City Mobility Tracker

We continue to see subway traffic flatline/diminish except for in Guangzhou, which has seen a rapid turnaround that seems to confirm dynamic zero COVID in the city. City traffic continues to get worse, especially in Shanghai, which also appears to confirm dynamic zero COVID.

Last Night's Performance

Last Night's Exchange Rates, Prices, & Yields

- CNY per USD 7.12 versus 7.16 yesterday

- CNY per EUR 7.37 versus 7.41 yesterday

- Yield on 1-Day Government Bond 1.20% versus 1.22% yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.80% yesterday

- Yield on 10-Year China Development Bank Bond 2.96% versus 2.94% yesterday

- Copper Price -0.69% overnight