Meituan Earnings Excel, Week in Review

3 Min. Read Time

Week in Review

- Asian equities ended a choppy trading week mostly lower on global growth concerns, while China real estate developers outperformed as policy support begins to take shape.

- Zero COVID continued to be cited as a risk for China equities as Shijiazhuang, a region near Beijing, saw some lockdown measures, and workers at Foxconn’s Zhejiang plant protested the mishandling of an outbreak at the plant.

- Baidu and Kuaishou both reported earnings this week. The former beat analyst estimates handily as it grew its share of China’s E-Commerce market while the latter’s advertising business continues to face headwinds.

- Ant Group could be fined up to $1 billion by the PBOC, which would mark the end of its regulatory review period and lead to the approval of its application to become a financial holding company by the central bank.

Meituan Q3 Earnings Overview

Meituan has been more resilient than most platforms in recent quarters, as COVID restrictions in some areas have led customers to order food delivery more than they would have otherwise. Evidently, the company has learned to adapt to new restrictions and deliver. The company has also seen its costs come down significantly and has reported positive net income for the first time since 2019. However, shares in the company have been under pressure as major shareholders Tencent and Prosus have been unloading shares both to trim their capital at risk and hand their own shareholders healthy dividends and fund stock buybacks.

- Revenue +28% year-over-year to RMB 62.6 billion

- Net Income RMB 1.1 billion

- Net Margin 1.8%

- Earnings per Share RMB 0.18

Key News

Asian equities were mostly lower overnight though Shanghai and the Philippines outperformed the region. China’s dynamic zero COVID policy has been on display this week as authorities attempted to stem the outbreak in Shijiazhuang without causing harm to the economy.

The real estate sector was one of the top-performing sectors on the Mainland and in Hong Kong as the PBOC announced the provision of $14 billion in M&A financing to state-owned developers through their banks and asset managers that hold their shares. This is a push to have state-owned developers acquire failing private developers and another important move by the central government to shore up the ailing sector, one of many that have contributed to a significant rebound over the past few weeks. Country Garden Holdings, a developer, was the most heavily traded stock by value in Hong Kong overnight and gained nearly +10%. Real estate policy has always been a balancing act between curbing excess and preventing the decline of what makes up the majority of Chinese household assets. We should see homebuyers come back into the market as developers finish projects and zero COVID is gradually relaxed.

According to the South China Morning Post, President Xi is planning a visit to Saudi Arabia. Relations with the kingdom are important to China, given its need for imported oil and gas. This is the latest among a slew of diplomatic overtures by the Chinese leader, representing a significant shift in tone and praxis after the conclusion of the Party Congress in October. We expected this as the lead-up to the Party Congress required leaders to turn inward.

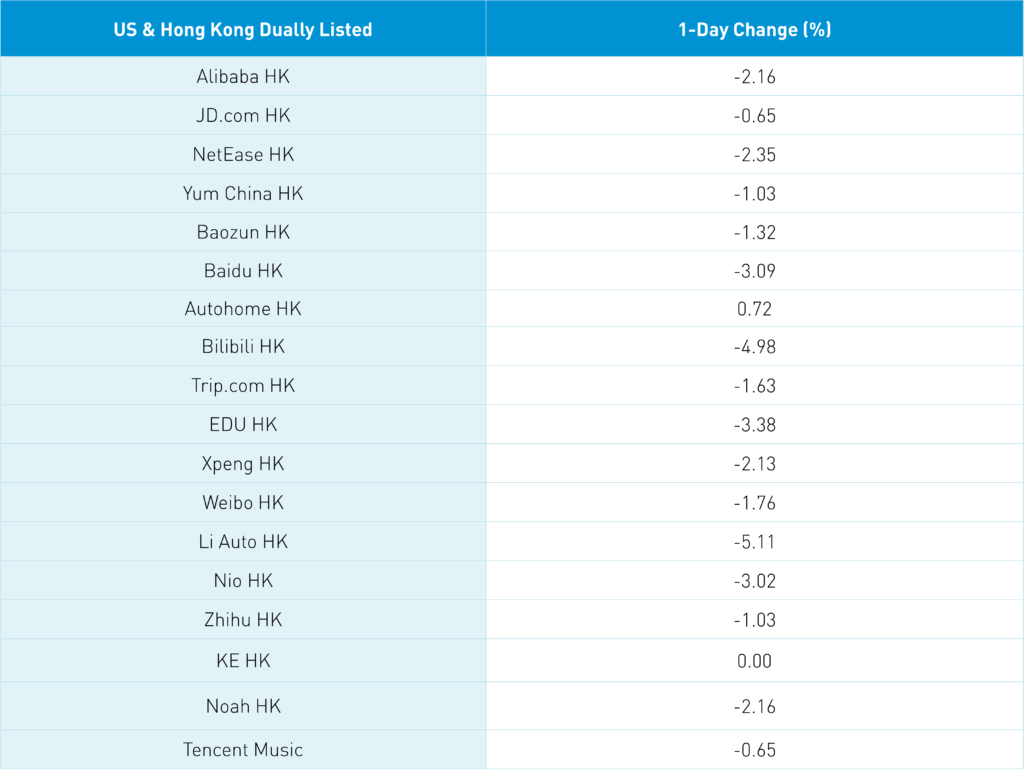

Internet stocks have been trading lower over the past two sessions on little company or sector-specific news other than Meituan earnings and concerns over the impact of zero COVID as China is currently in the winter flu season. The downdraft could also be a technical correction after the massive rally earlier this month.

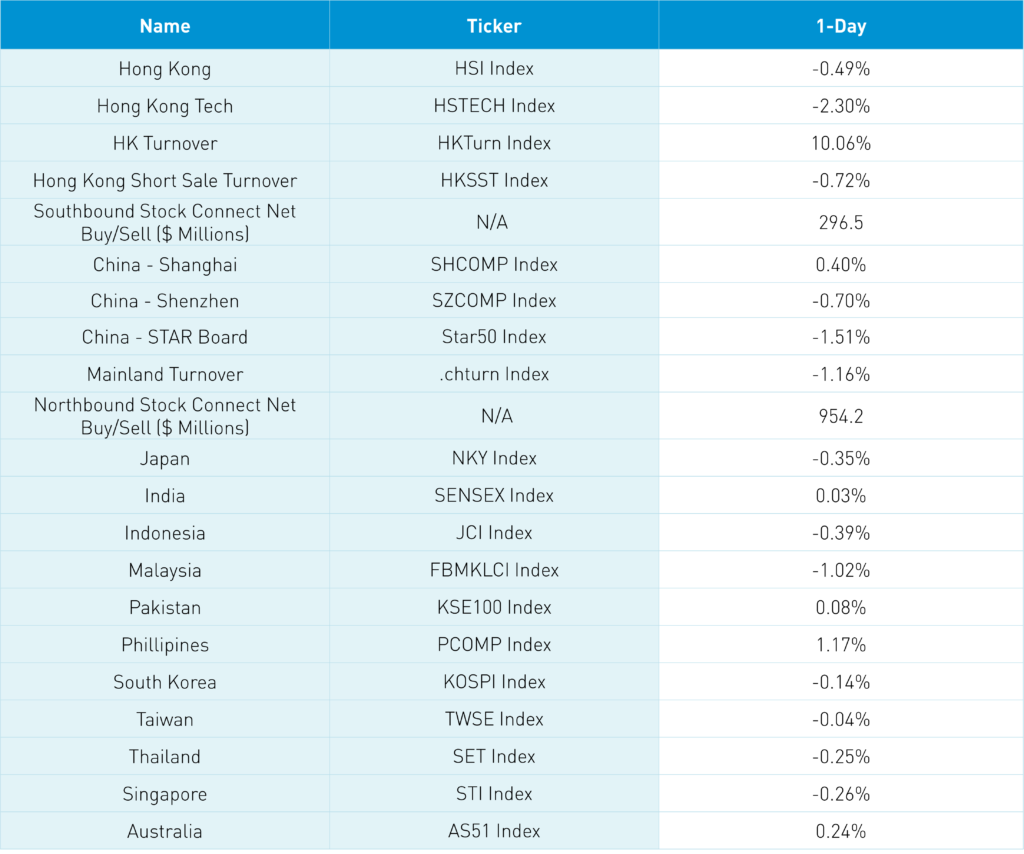

The Hang Seng and Hang Seng Tech indexes closed -0.49% and -2.30%, respectively, on volume that increased +10% from yesterday. Value factors outpaced growth factors, while real estate was one of the top-performing sectors overnight. Mainland investors bought a net $297 million worth of Hong Kong stocks overnight.

Shanghai, Shenzhen, and the STAR Board diverged to close 0.40%, -0.70%, and -1.51%, respectively, on volume that decreased -1% from yesterday. Value factors outpaced growth factors overnight on the Mainland. Foreign investors bought a net $954 million worth of Mainland stocks overnight.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.18 versus 7.15 yesterday

- CNY per EUR 7.45 versus 7.45 yesterday

- Yield on 1-Day Government Bond 0.99% versus 1.00% yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.80% yesterday

- Yield on 10-Year China Development Bank Bond 2.93% versus 2.90% yesterday

- Copper Price -0.06% overnight