Bank Contagion Keeps Buyers Sidelined, Pinduoduo’s “Investment” Leaves Investors Wanting

3 Min. Read Time

Pinduoduo Q4 Earnings Release

E-commerce company Pinduoduo released Q4 2022 results this morning. Revenue missed lofty analyst expectations, despite growing +46% year-over-year, while adjusted net income and adjusted earnings per share (EPS) beat analyst expectations. Pinduoduo’s stock has had a decent 2023 so far.

The company did not give a forecast, though noted “steady growth” of consumers during Q1 2023 while higher priced goods such as cell phones saw “decent growth”. Management noted that competition is “intense” as technology investment and expenses rose from RMB 13.8 billion to RMB 21.8 billion. “Temu,” the platform’s international brand, will expand to new markets including in Canada and Europe.

At the end of day, Pinduoduo’s revenue grew nearly ~50%, but net income grew only about ~30%, though cash saw a healthy increase. Management’s emphasis on investment is unlikely to instill confidence, as indicated by the -13% fall pre-US market open.

- Revenue increased +46% to RMB 39.8 B ($5.773B) versus analyst expectations of RMB 41.9 B and Q4 2022’s RMB 27.2 B

- Adjusted Net Income increased +43% to RMB 12.1 B ($1.8 B) versus analyst expectations of RMB 11.17 B and Q4 2022’s RMB 8.4 B

- Adjusted EPS was RMB 8.34 ($1.21) versus analyst expectations of RMB 7.54 and Q4 2022’s RMB 5.9.

Key News

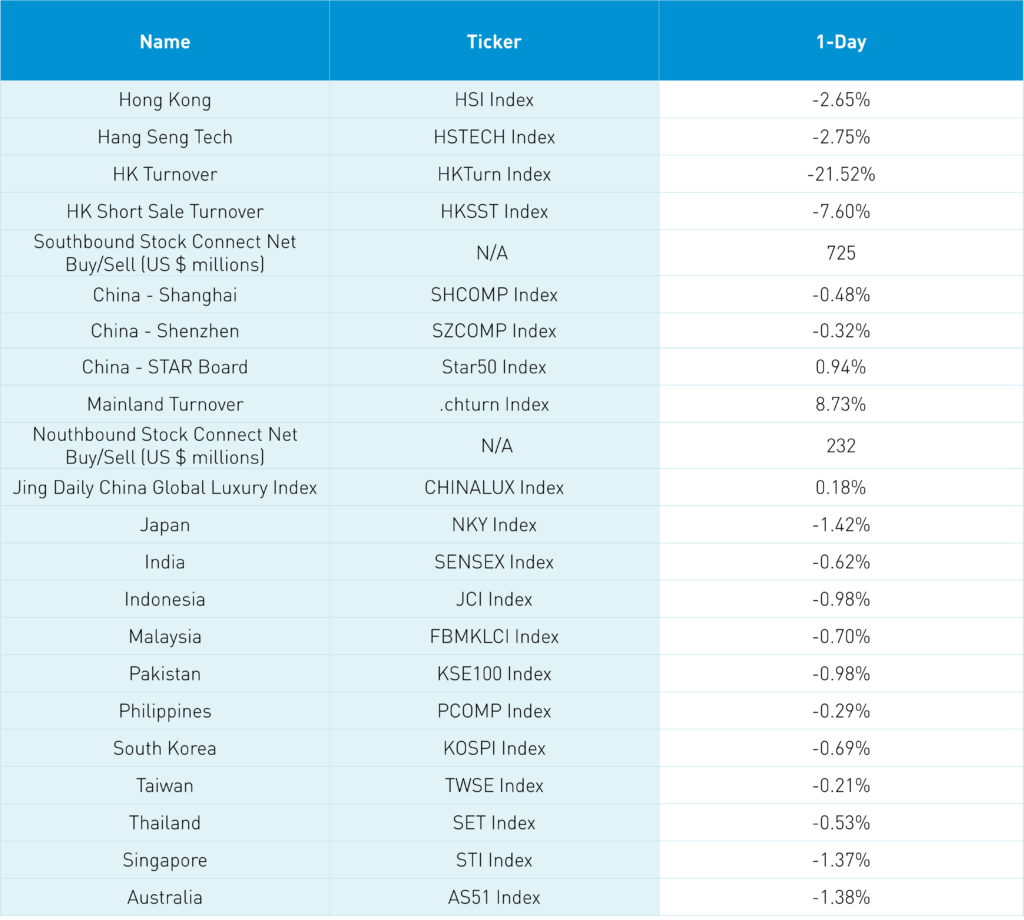

Asian equities were all lower as financial contagion fears kept buyers on the sidelines despite the weekend announcement around Credit Suisse and UBS. Credit Suisse has a strong presence in Asia, great Asia and China research, and solid people who hopefully successfully navigate events outside of their control. The crisis of confidence, which seems to be benefiting Bitcoin in a bad look for central banks, includes wiping out $17 billion worth of Credit Suisse bonds held by regional Asian banks. It is worth noting that CNY posted a small gain versus the US dollar as maybe the Fed will pause their rate hikes.

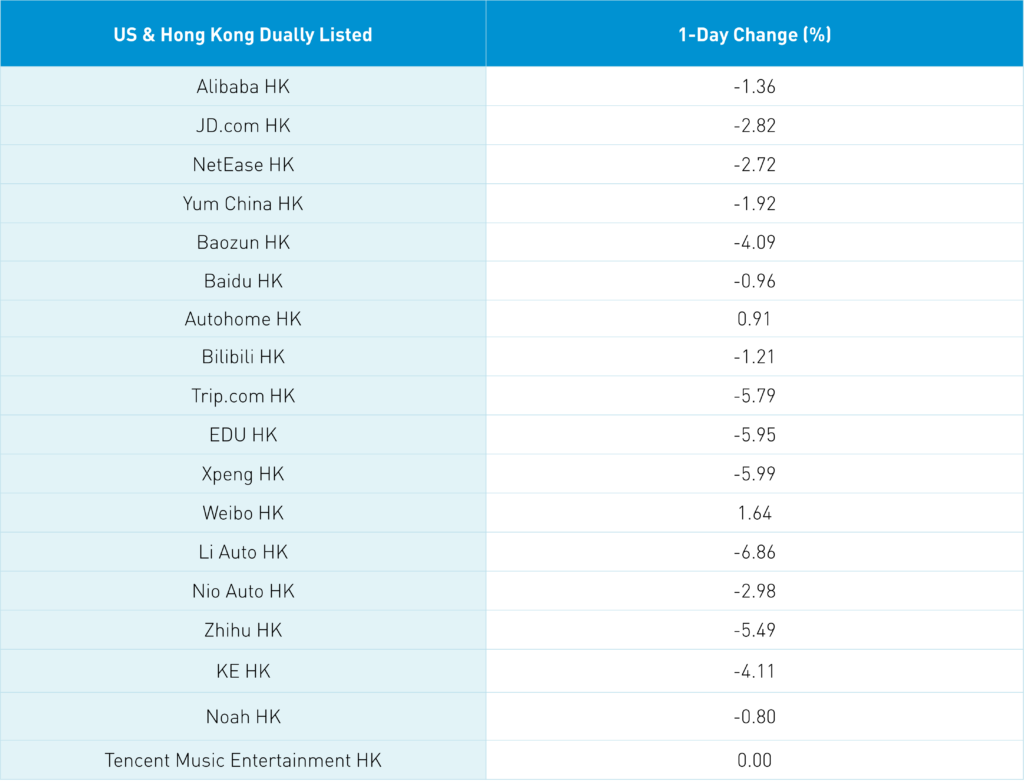

Foreign investors were far more pessimistic as Hong Kong was off more than -2% while mainland markets were off, but not nearly as much. Mainland markets remembered Friday’s bank reserve requirement ratio cut was after the market’s close and followed by the 1 and 5-year loan prime rates being left unchanged over the weekend. Mainland investors bought a healthy $725 million worth of Hong Kong stocks via Southbound Connect overnight as Tencent was a large net buy. Hong Kong advancers/decliners was negative as short volume was 19% of total turnover, led by high short volumes in Hong Kong ETFs, though not individual stocks. Hong Kong’s most heavily traded stocks by value were Tencent, which fell -1.36%, Alibaba, which fell -2.82%, China Mobile, which fell -3.56%, HSBC, which fell -6.23%, and Meituan, which fell -1.15%.

Baidu managed a small gain, up +0.91% following the positive ERNIE Bot reviews. Huarong Securities fell -7.22% after announcing a wider than expected loss for 2022 and news its auditor was fined.

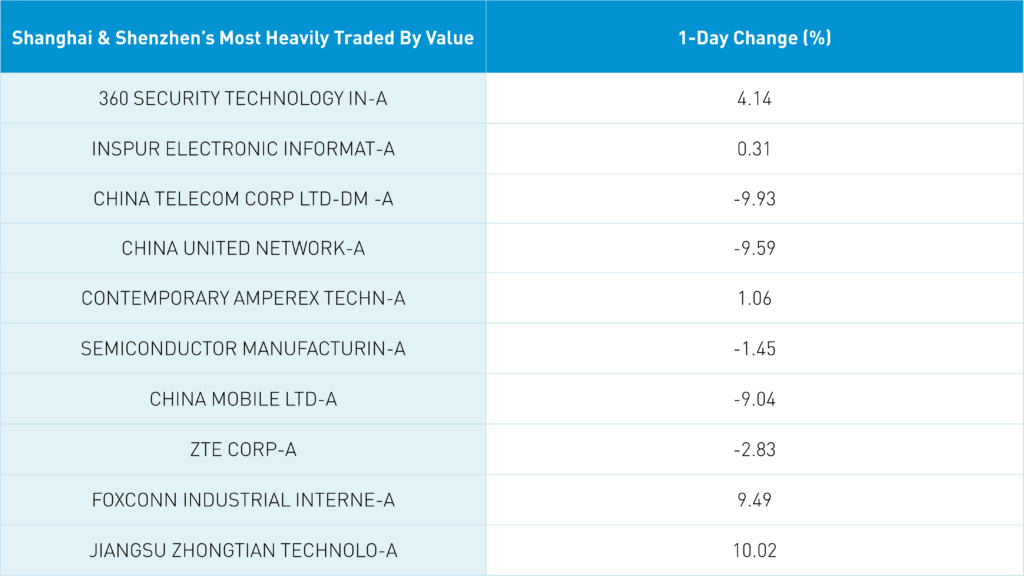

Mainland markets were mixed after opening higher but slid lower over the trading day as Shanghai and Shenzhen posted small losses and the STAR Board posted a small gain. Foreign investors bought a net $232 million worth of Mainland stocks via Northbound Stock Connect.

President Xi is visiting Russia to push his Ukraine peace plan. Markets could use some good news as a resolution and/or progress toward a resolution would be the ultimate black swan.

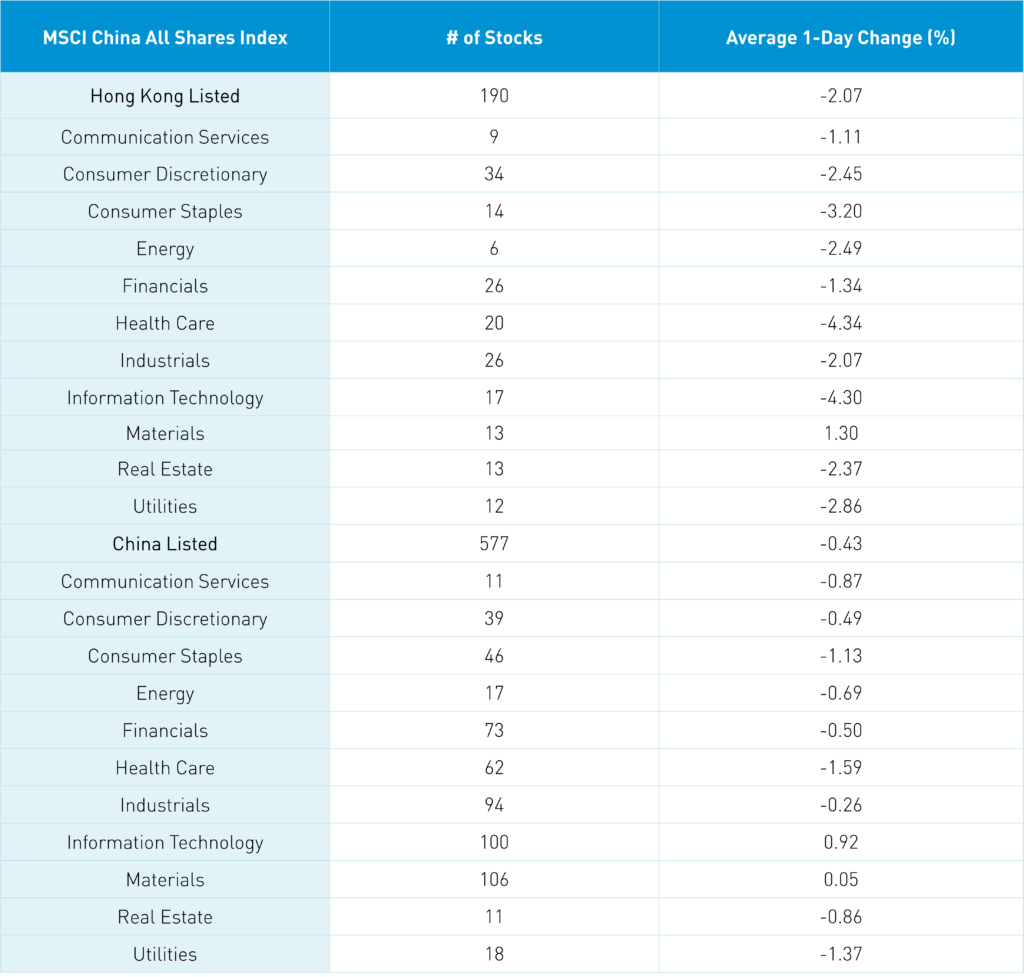

The Hang Seng and Hang Seng Tech indexes fell -2.65% and -2.75%, respectively, on volume that declined -21.52% from Friday, which is 107% of the 1-year average. 49 stocks advanced, while 464 stocks declined. Main Board short turnover declined -7.53% from Friday, which is 1,221% of the 1-year average, as 19% of turnover was short. Value “outperformed” growth as large caps “outperformed” small caps. Materials was the only positive sector, up +1.31%, while healthcare fell -4.33%, technology fell -4.3%, and consumer staples fell -3.2%. Materials was the only industry group positive while healthcare equipment, pharmaceuticals/biotech, and consumer services were the worst. Southbound Stock Connect volumes were moderate/light as Mainland investors bought $725 million of Hong Kong stocks as Tencent was a moderate/strong net buy and Meituan was a small net buy.

Shanghai, Shenzhen, and the STAR Board were mixed to close -0.48%, -0.32%, and +0.94%, respectively, on volume that increased +8.73% from Friday, which is 118% of the 1-year average. 1,863 stocks advanced while 2,824 stocks declined. Growth factors outperformed value factors as small caps outpaced large caps. Technology and materials were the only positive sectors, up +0.92% and +0.06%, respectively, while healthcare fell -1.58%, utilities fell -1.37%, and consumer staples fell -1.12%. The top-performing industries were precious metals, semiconductors, and power generation equipment, while telecoms, office supplies, and diversified financials were the worst-performing industries. Northbound Stock Connect volumes were high as foreign investors bought $232 million worth of Mainland stocks. CNY gained +0.12% versus the US dollar, while the Asia dollar index was flat, Treasury bonds rallied, Shanghai copper gained, and steel was down slightly.

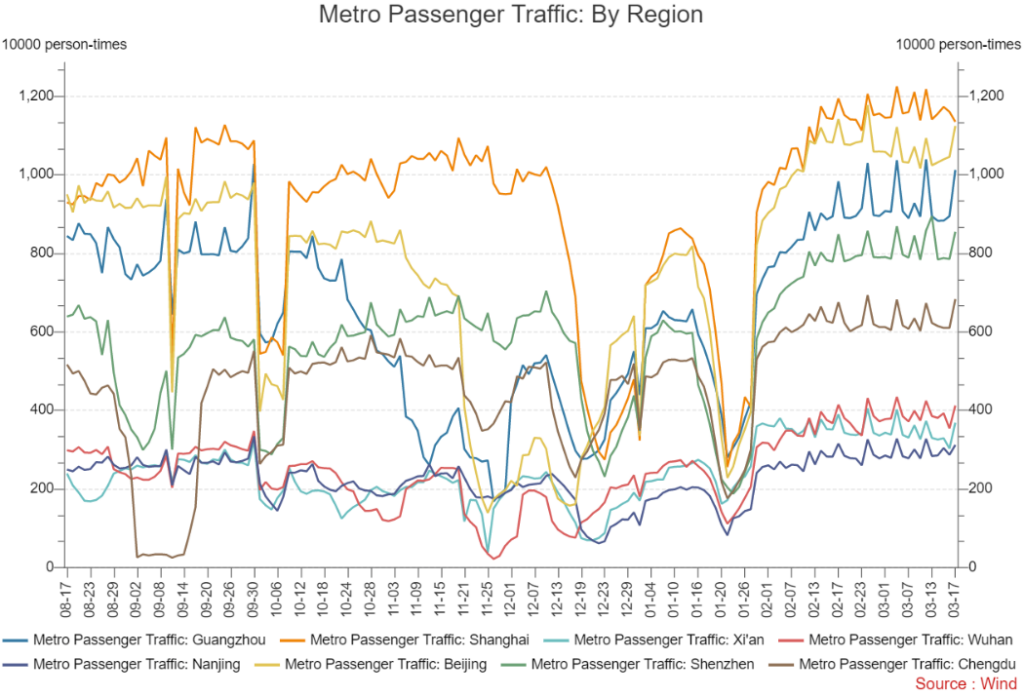

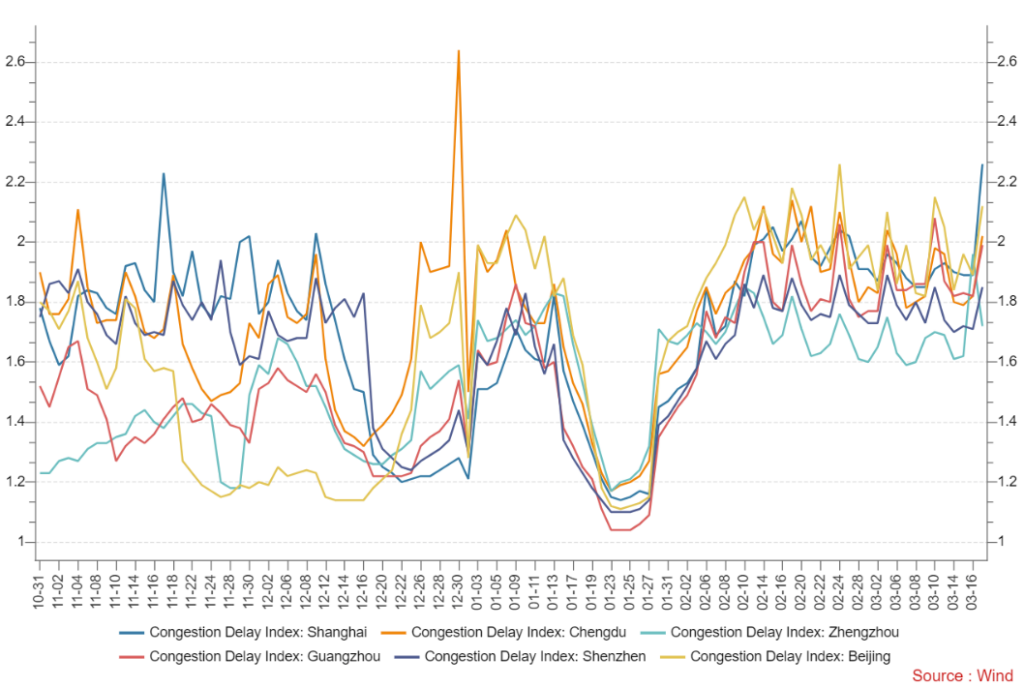

Major Chinese City Mobility Tracker

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.88 versus 6.88 Friday

- CNY per EUR 7.37 versus 7.36 Friday

- Yield on 1-Day Government Bond 1.81% versus 1.82% Friday

- Yield on 10-Year Government Bond 2.85% versus 2.86% Friday

- Yield on 10-Year China Development Bank Bond 3.01% versus 3.02% Friday

- Copper Price +0.48% overnight

- Steel Price -0.02% overnight