Baidu Beats, Retail Sales Up +18% Year-over-Year

3 Min. Read Time

Baidu Earnings Overview

Prior to the US open, Baidu (BIDU US, 9888 HK) reported first-quarter financial results that beat analyst expectations. Baidu is a good canary in the coal mine as its search business is driven by advertising, which is coming back following the repeal of the zero COVID policy.

- Revenue +10% to RMB 31.144 billion ($4.535 billion) from RMB 28.411 billion versus analyst expectations of RMB 30 billion

- Adjusted Net Income +48% to RMB 5.727 billion ($834 million) from RMB 3.879 billion versus analyst expectations of RMB 4.34 billion

- Adjusted EPS +43% to RMB 16.10 ($2.34) from RMB 11.22 versus analyst expectations of RMB 12.92

Key News

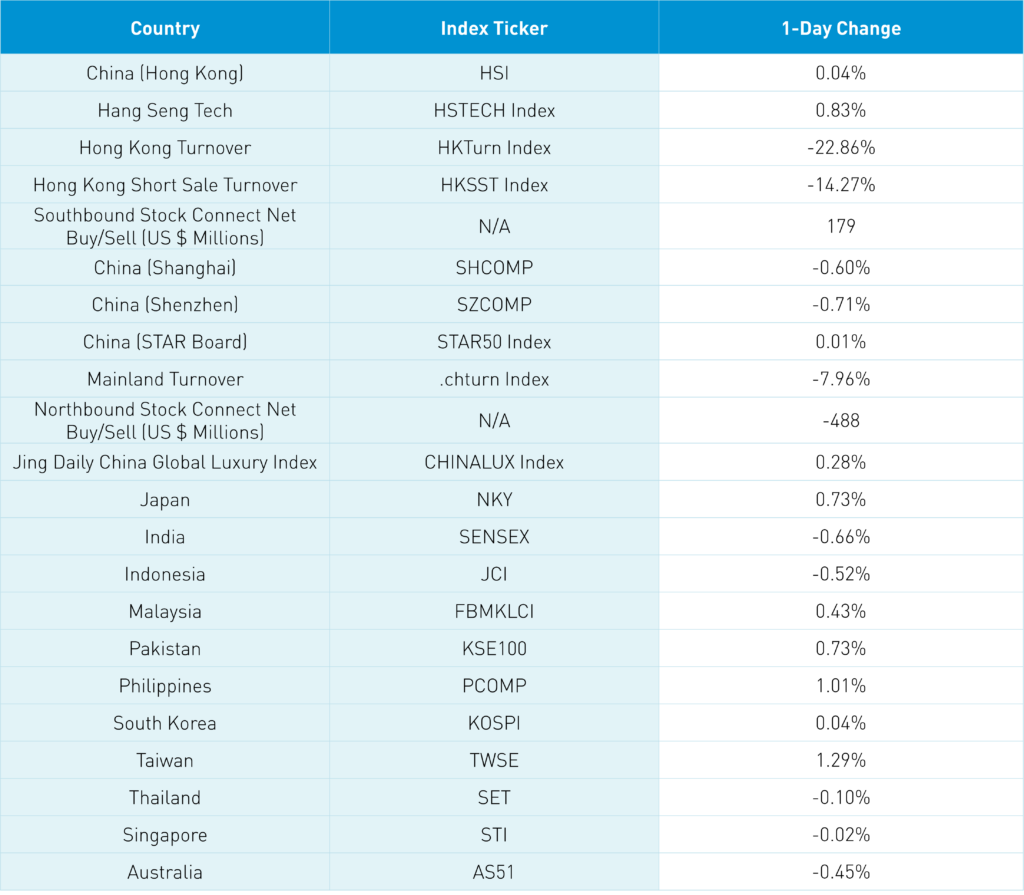

Asian equities were mixed overnight as Taiwan and the Philippines outperformed.

Yesterday, we saw a strong move in US-listed China ADRs likely driven by short covering turning into a panic to cover shorts in advance of internet companies’ financial results this week. A major investment bank noted last week that positioning in Chinese equities from foreign investors is back to October lows. A China rally creates pain for active managers that are underweight China as it creates “tracking error," i.e. deviation from the benchmark, which eventually is called negative alpha, which gets you fired. A rally would not surprise me for this reason. Hong Kong opened higher though the 10 am release of April economic data led Johnny to sweep the leg out from the rally to close flat. Yes, the April economic data all missed economist expectations though I’ll be the only person to point out that all data improved month- over-month from March.

Industrial Production was 5.6% versus expectations of 10.9% and March’s 3.9%,

Retail Sales +18.4% versus expectations of 21.9% and March’s 10.6%.

Fixed Asset Investment +4.7% versus expectations of 5.7% and March’s 5.1%

Property Investment YTD -6.2% versus expectations of -5.7% and March’s -5.8%

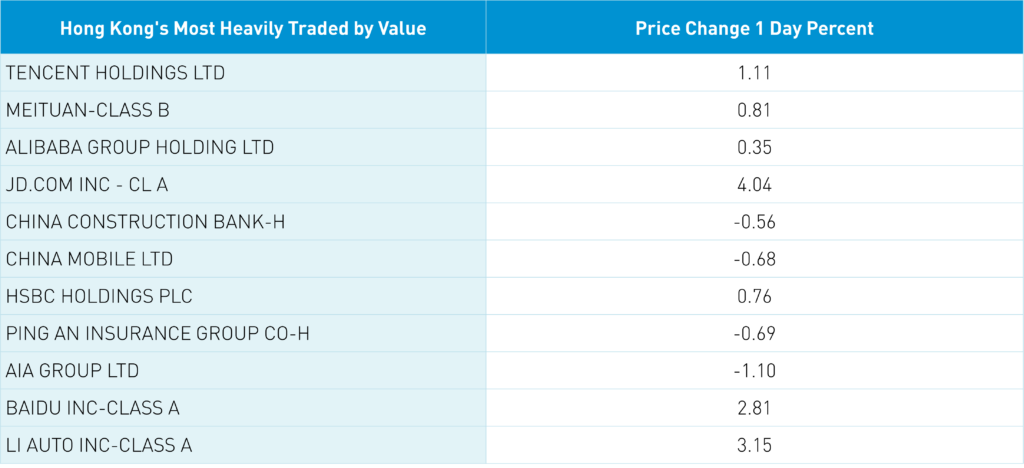

Youth unemployment is garnering attention though it should improve as many young people work in the service sector such as restaurants, hotels, and airlines. For instance, restaurant revenue increased by +43.8%. Year to date, online retail sales increased 12.3%. Online retail sales of physical goods increased 10.4% accounting for 24.8% of total retail sales of consumer goods. While Hong Kong and China were both lower on VERY light volumes, today’s release should motivate policymakers to support the economy. I wouldn’t be surprised to see comments coming on how the government is going to support the economy. Worth noting that Moody’s raised their outlook on China’s real estate sector from negative to stable. Interesting! Hong Kong’s most heavily traded stocks by value were Tencent, which gained +1.11%, Meituan, which gained +0.81%, Alibaba, which gained +0.35%, and JD.com, which gained +4.04%, which is less than the gain in the US listing yesterday, which should lead to a pullback in the latter today. Foreign investors were net sellers of Mainland stocks, to the tune of -$488 million via Northbound Stock Connect. Bonds rallied on the economic data and stocks' move lower.

Yesterday was an important day for ETF providers as institutional investors file their quarterly 13F with the SEC, allowing them to know who owns their ETFs. It is worth noting that Michael Burry of The Big Short fame took positions in both Alibaba and JD.com. In China, well-respected hedge fund Hillhouse is widely followed. Specific to China, as the company’s investment mandate is global and not China-specific, took a new position Li Auto, while adding to their stakes in Pinduoduo, KE Holdings, Alibaba, and Full Truck Alliance. They sold out of their stake in Trip.com while cutting their stakes in JD.com, Vipshop, iQiyi, and Sohu.com.

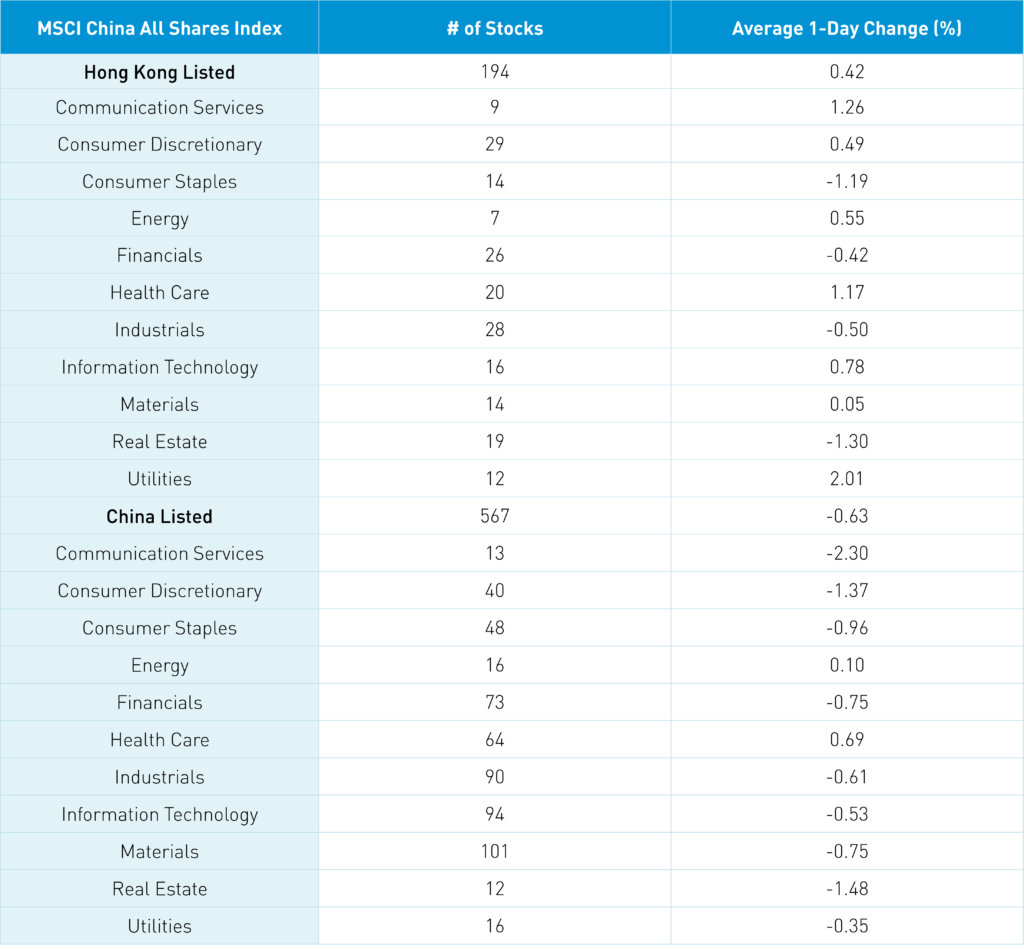

The Hang Seng and Hang Seng Tech gained +0.04% and +0.83%, respectively, on volume off -22.86% from yesterday which is 66% of the 1-year average. 196 stocks advanced while 284 stocks declined. Main Board short turnover declined -14.27% from yesterday which is 60% of the 1-year average as 15% of turnover was short turnover. Growth factors outperformed value factors as large caps outpaced small caps. The top sectors were utilities +2%, communication +1.26%, and healthcare +1.16% while real estate -1.31%, staples -1.2%, and industrials -0.51%. The top sub-sectors were media, semis, and pharma while insurance, transportation, and business/professional services. Southbound Stock Connect volumes were light as Mainland investors bought $179 million of Hong Kong stocks with Tencent a moderate/large net buy, Meituan a small net buy, and China Construction Bank a moderate sell.

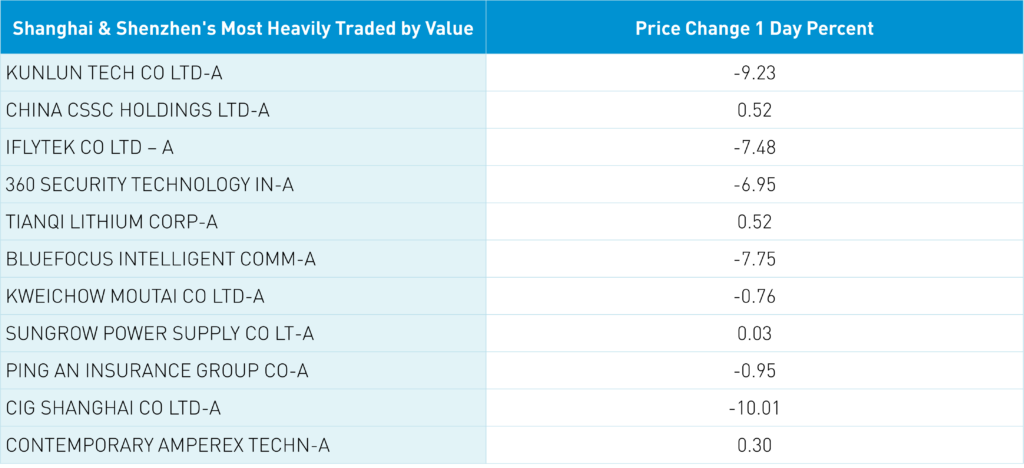

Shanghai, Shenzhen, and STAR Board were largely lower -0.6%, -0.71%, and +0.01% on volume -7.96% from yesterday which is 94% of the 1-year average. 1,281 stocks advanced while 3,441 declined. Growth and value factors were mixed as large caps edged out small caps. Healthcare and energy were the only positive sectors +0.7% and +0.1% while communication -2.3%, real estate -1.47%, and discretionary -1.36%. The top sub-sectors were soft drinks, pharma, and semis while education, cultural media, and the internet were the worst. Northbound Stock Connect volumes were moderate as foreign investors sold -$488 million of Mainland stocks with CSSC a small net buy, and Kweichow Moutai and Ping An small net sells. CNY and Asia's dollar were down versus the US dollar while Treasury bonds rallied. Copper was off while steel was up.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.96 versus 6.96 yesterday

- CNY per EUR 7.59 versus 7.55 yesterday

- Asia Dollar Index -0.07% overnight

- Yield on 10-Year Government Bond 2.71% versus 2.71% yesterday

- Yield on 10-Year China Development Bank Bond 2.88% versus 2.87% yesterday

- Copper Price -0.05% overnight

- Steel Price +0.27% overnight