Pinduoduo Crushes Analyst Expectations, Week in Review

2 Min. Read Time

Week in Review

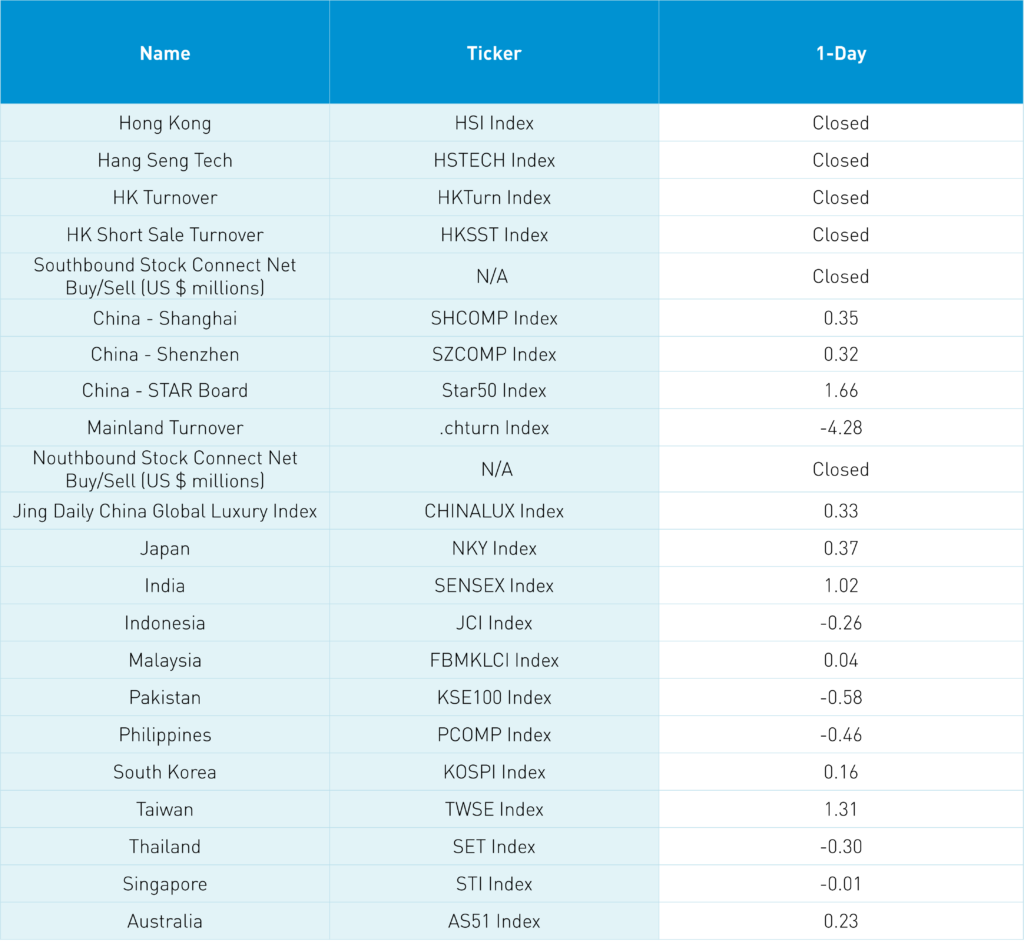

- Asian equities were mixed this week as US debt ceiling woes weighed on risk assets globally.

- Taiwan was a strong outperformer in the region on Nvidia earnings and tit-for-tat restrictions on Micron’s chips in China, which also benefitted Korean chipmakers.

- Internet earnings season continued this week with strong Q1 results from Pinduoduo, Kuaishou, Full Truck Alliance, NetEase, Weibo, and Meituan.

- Officials from China arrived in Washington, DC to meet with their US counterparts, in a significant step towards improving relations.

Pinduoduo Earnings Overview

This morning, E-Commerce company Pinduoduo beat analyst estimates on its Q1 financial results.

- Revenue +58% to RMB 37.64B ($5.48B) from RMB 23.793B versus analyst expectations of RMB 32.32

- Adjusted Net Income +141% to RMB 10.126B ($1.474B) versus analyst expectations of RMB 5.999B.

- Adjusted EPS was RMB 6.92 ($1.01) from RMB2.95 versus analyst expectations of RMB 4.36.

Key News

Asian equities were mixed overnight except for Taiwan and India. Hong Kong was closed for Buddha’s birthday, a Buddhist festival celebrating the birth of the Prince Siddhartha Gautama, the founder of Buddhism.

Yesterday, US Commerce Secretary Gina Raimondo and China’s Minister of Commerce Wang Wentao met at the Asia-Pacific Economic Cooperation Council’s (APEC) Trade Minister conference. The US Commerce Department called the meeting “candid and substantive,” while Chinese media called the meeting “candid, professional and constructive”. The key is that this simply represents the resumption of communication between the two, which could lead to a Biden/Xi meeting later this year at the APEC.

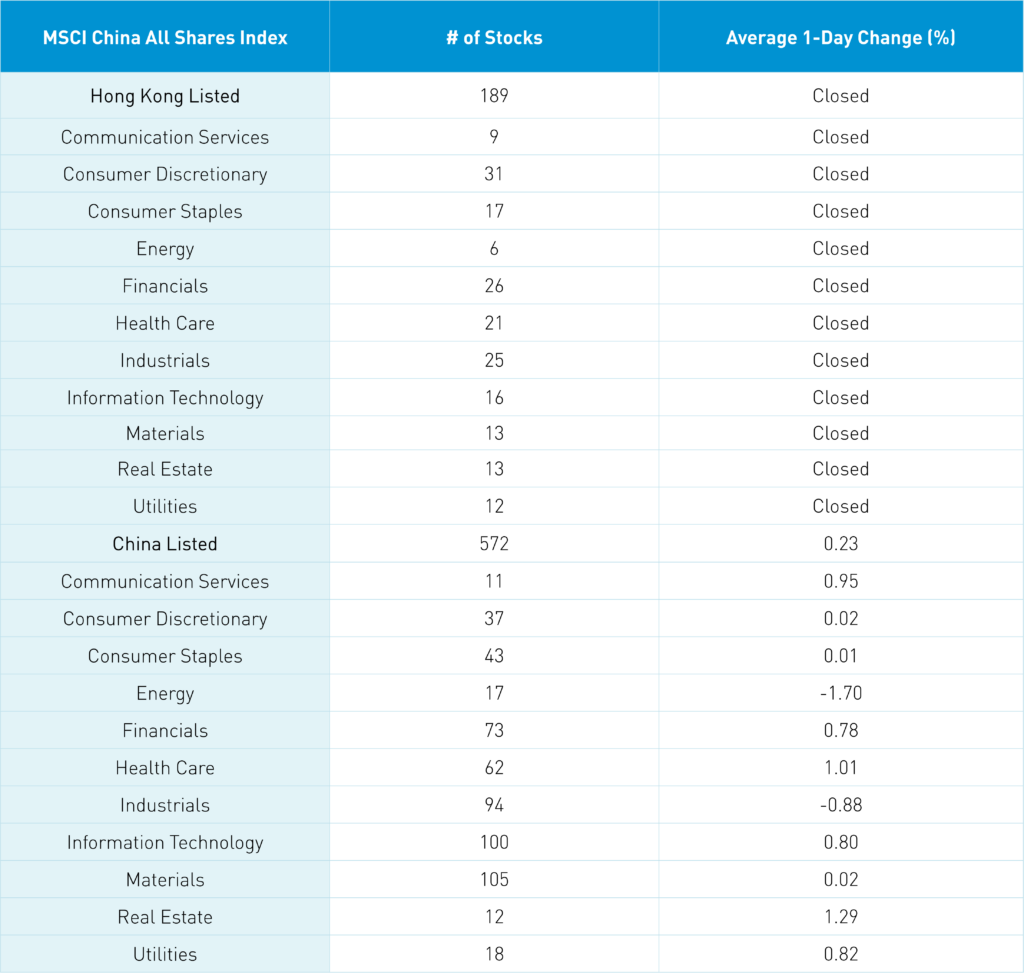

Mainland China’s markets overcame morning losses to close higher as depressed sectors saw buyers emerge. This includes Real Estate, which was the top-performing sector, though clean technology was off.

It is worth noting that Alibaba denied it was laying people off, but rather hiring 15,000 new employees this year. In the myth busting vein, Amazon announced it will pull out of China due to a lack of success. I thought US tech firms were banned in China? No, rather, when they fail against local competitors or fail to adhere to local laws, as was the case with Ebay, Google, and Facebook, they claim they are banned.

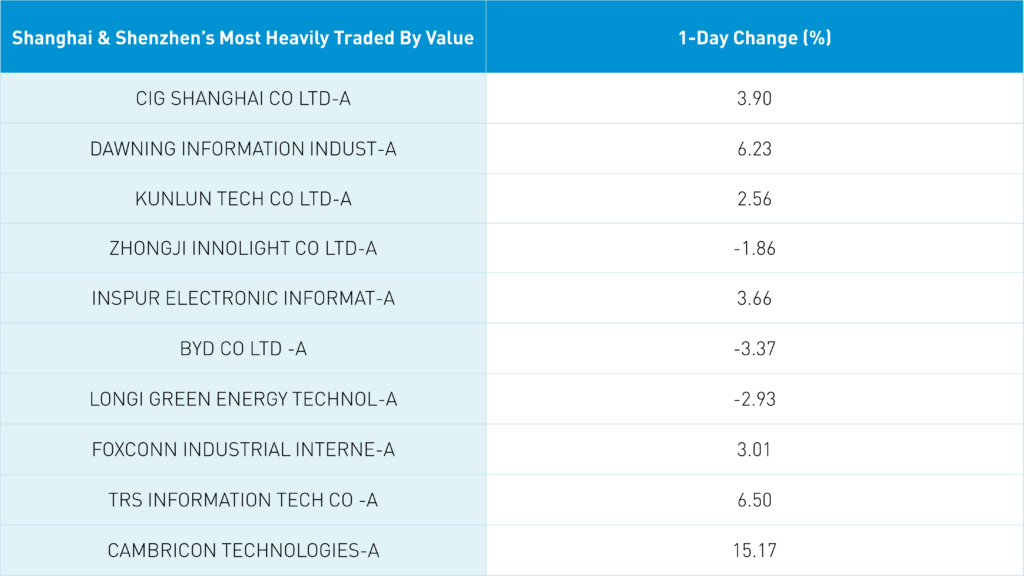

Shanghai, Shenzhen, and the STAR Board gained +0.35%, +0.32%, and +1.66%, respectively, on volume that decreased -4.28% from yesterday, which is 92% of the 1-year average. 2,599 stocks advanced, while 2,017 stocks declined. Meanwhile, value and growth factors were both negative. The top-performing sectors were Real Estate, which gained +1.3%, Healthcare, which gained +1.03%, and Communication Services, which gained +0.96%. Meanwhile, Energy fell -1.69% and Industrials fell -0.87%. The top-performing subsectors were education, computer hardware, and software, while power generation equipment, coal, and the electric power grid were among the worst. Northbound Stock Connect was closed overnight because of Hong Kong’s market holiday. CNY and the Asia Dollar Index gained versus the US dollar, while Treasury bonds sold off. Copper and steel had a strong day.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.06 versus 7.07 yesterday

- CNY per EUR 7.58 versus 7.59 yesterday

- Yield on 1-Day Government Bond 1.44% versus 1.44% yesterday

- Yield on 10-Year China Development Bank Bond 2.72% versus 2.71% yesterday

- Yield on 10-Year China Development Bank Bond 2.89% versus 2.87% yesterday

- Copper Price +1.01% overnight

- Steel Price +0.20% overnight