Services PMI Beats Expectations, Goes Unreported

3 Min. Read Time

Key News

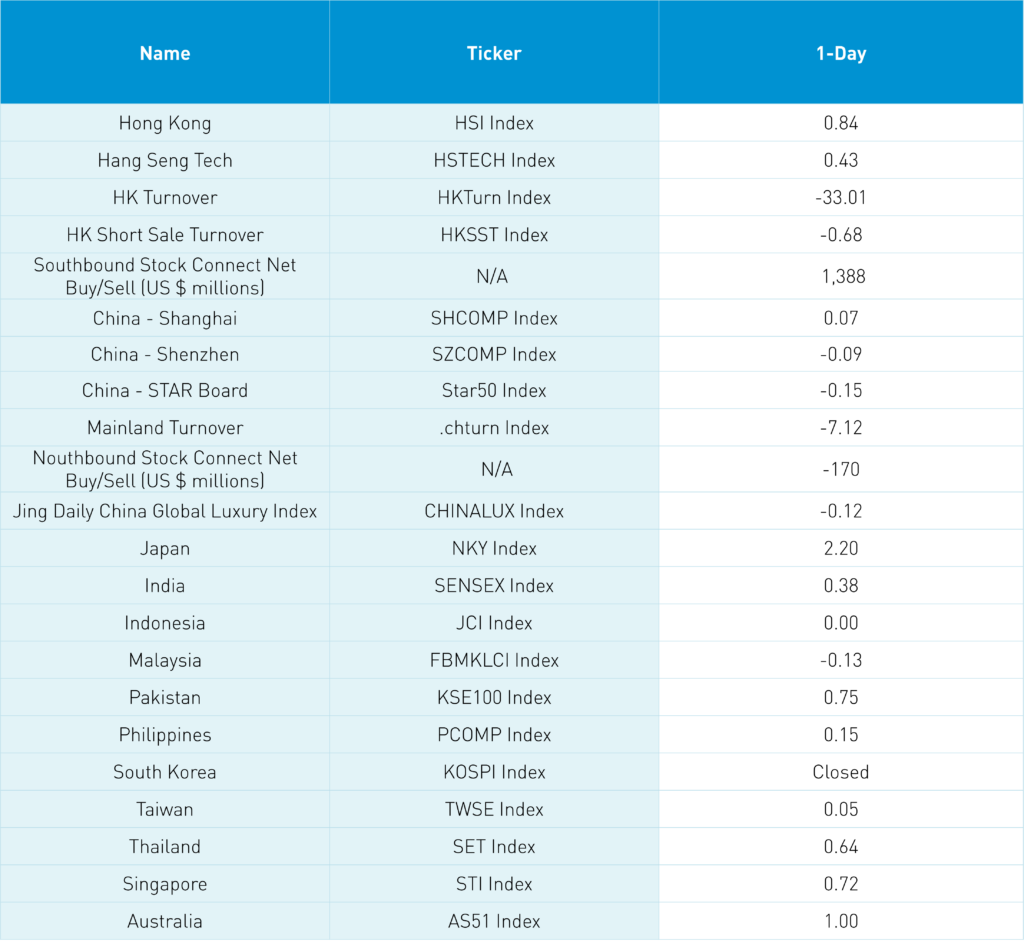

Asian equities were largely higher overnight as Japan outperformed while South Korea was closed for their Memorial Day holiday.

It was a quiet night overnight as Hong Kong and Mainland China had a choppy session, though Shanghai and Shenzhen pushed slightly higher and above the 3,200 and 2,000 support levels, respectively. Hong Kong closed back above the 19,000 level, lifted initially by the morning release of Caixin’s May Services PMI, which came in at 57.1 versus expectations of 55.2 and April 56.4. Do not hold your breath for media headlines on China economic data outperforming, like the strong Caixin Manufacturing PMI release last week, which was not well telegraphed. Remember the Caixin surveys smaller companies and the gauge has increased for the 5th month in a row.

Mainland investors invested a very healthy $1.4 billion into Hong Kong stocks and ETFs via Southbound Stock Connect, the largest net buy day in two years. Most of the money went into three Hong Kong-listed ETFs, which had very high short turnover as 23% of Hong Kong’s Main Board turnover was short turnover. Individual stocks had low short turnover as 25% of Kuaishou’s turnover was short turnover. The jump in ETFs’ short turnover could be due to structured product issuance and/or shorts making a market as opposed to individual stock bets against the Hong Kong market.

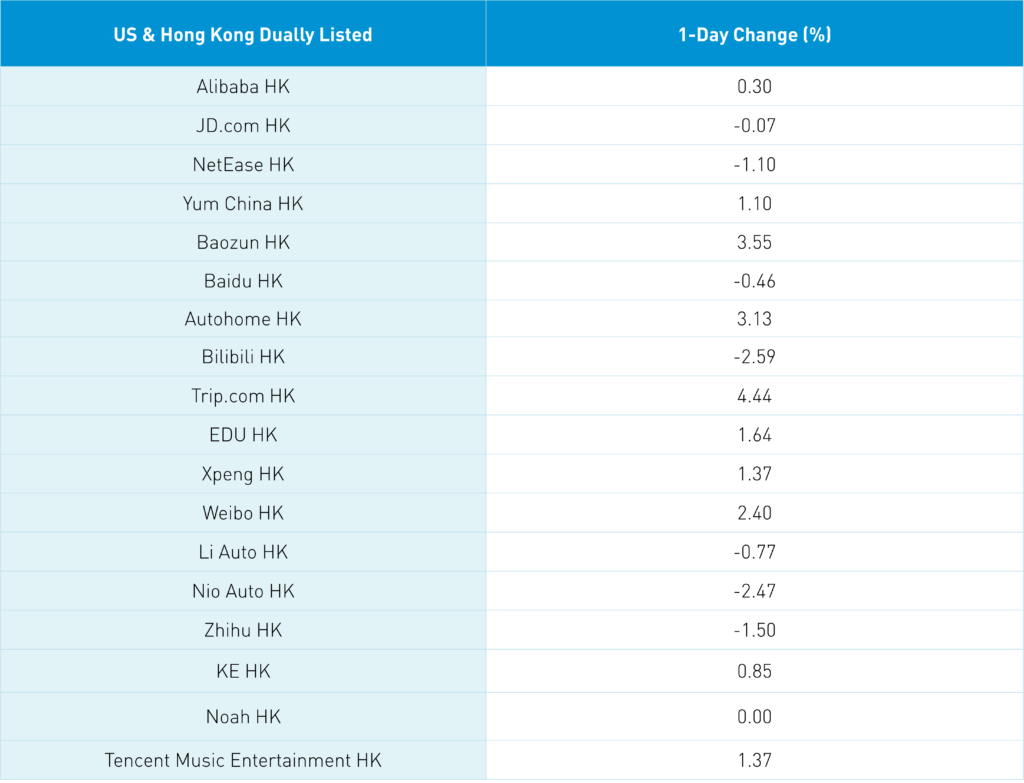

Internet stocks had a good day though didn’t jump as much as US-listed China stocks on Friday, as Hong Kong’s most heavily traded stocks were Tencent, which gained +1.2%, Alibaba, which gained +0.3%, and Meituan, which as flat.

There were no updates from JD.com’s 618 sales festival, news from which helped drive their stock and the E-Commerce market’s rebound on Thursday.

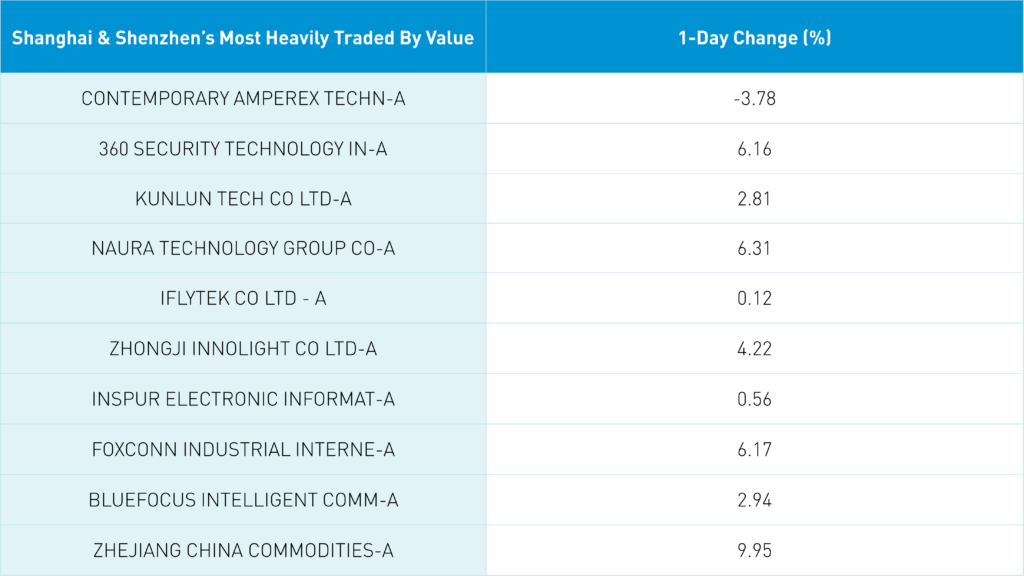

Mainland China’s CATL was off -3.78% on rumors that Tesla would not use their batteries for US-made electric vehicles, though the company denied the rumor. Mainland EV names saw profit taking after Friday’s news of further tax exemptions, and strong May sales, reported last week.

Real estate was off in both Hong Kong and Mainland China as Bloomberg’s report of further support did not materialize over the weekend, though something is likely coming.

The Financial Times reported that the CIA’s Bill Burns made a secret trip to China last month. Meanwhile, US and Chinese defense heads shook hands, though did not have a private conversation at the Shangri-La Dialogue in Singapore. CNY and the Asia Dollar Index were off versus the dollar.

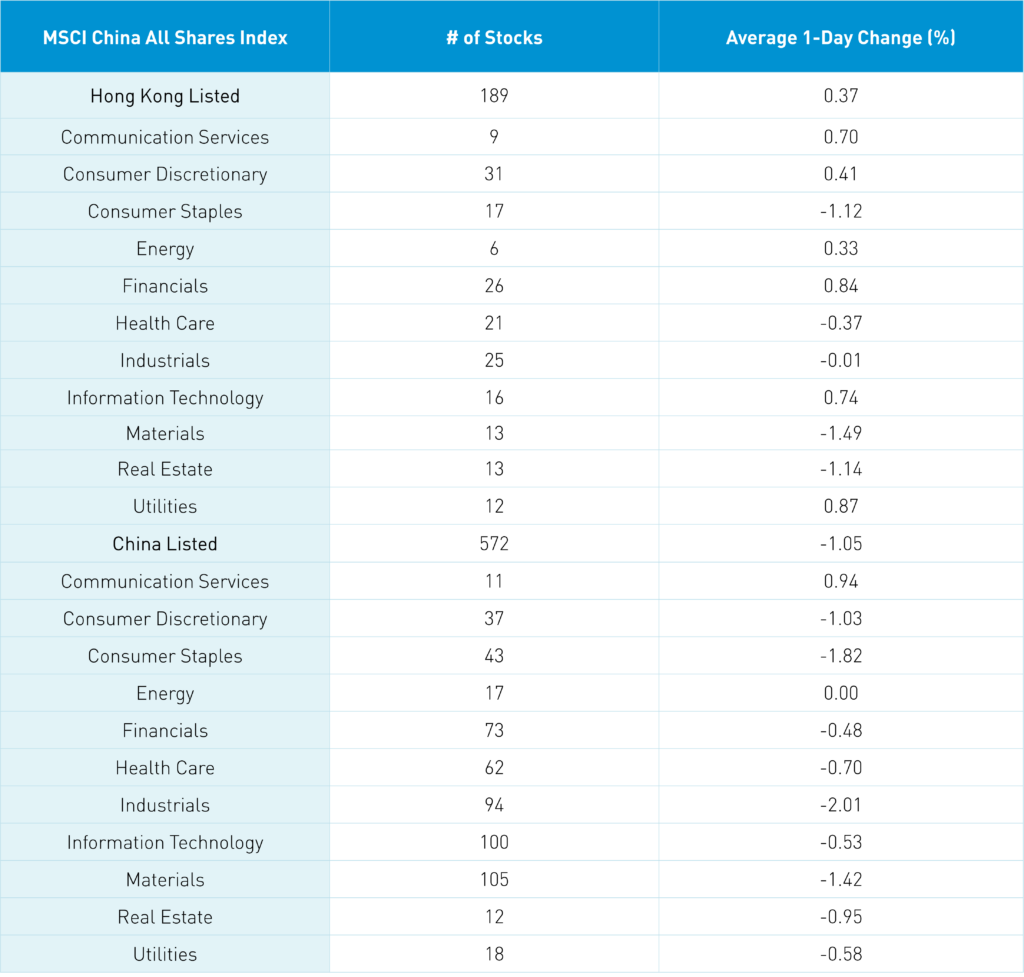

The Hang Seng and Hang Seng Tech indexes gained +0.84% and +0.43%, respectively, on volume that decreased -33.01% from Friday, which is 84% of the 1-year average. 236 stocks advanced, while 249 stocks declined. Main Board short turnover declined -0.69% from Friday, which is 118% of the 1-year average as 23% of turnover was short turnover. Value factors outperformed growth factors as large caps outpaced small caps. The top-performing sectors were utilities, which gained +0.87%, financials, which gained +0.84%, and technology, which gained +0.74%. Meanwhile, materials fell -1.48%, real estate fell -1.14%, consumer staples fell -1.12%. The top-performing subsectors were semiconductors, telecom, and insurance. Meanwhile, food, household products, and materials were among the worst-performing. Southbound Stock Connect volumes were moderate as Mainland investors net bought Hong Kong stocks while Tencent was a small net sell and Meituan and Kuaishou were small net buys.

Shanghai, Shenzhen, and the STAR Board diverged to close +0.07%, -0.09%, and -0.15%, respectively, on volume that decreased -7.12% from Friday, which is 94% of the 1-year average. 2,463 stocks advanced while 2,152 stocks declined. Value factors outperformed growth factors as large caps outpaced small caps. Communication services and energy gained +0.96% and +0.03%, respectively, while industrials fell -1.99%, consumer staples fell -1.79%, and materials fell -1.4%. The top-performing subsectors were cultural media, internet, and leisure products. Meanwhile, precious metals, power generation equipment, and household products were among the worst. Northbound Stock Connect volumes were moderate as foreign investors sold a net -$170 million worth of Mainland stocks as Foxconn was a small net sell and Kweichow Moutai and Kingsoft Office Software were small net buys.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.10 yesterday

- CNY per EUR 7.60 versus 7.59 yesterday

- Yield on 1-Day Government Bond 1.45% versus 1.50% yesterday

- Yield on 10-Year Government Bond 2.69% versus 2.70% yesterday

- Yield on 10-Year China Development Bank Bond 2.84% versus 2.85% yesterday

- Copper Price +0.17%

- Steel Price +2.11%