Tencent Music Entertainment & HUYA Beat, MSCI Index Review

6 Min. Read Time

Key News

Asian equities had a strong day except for India, as the US dollar weakened overnight, while Japan returned from yesterday’s holiday in good spirits and outperformed.

It was a very quiet summer night for news, which was paired with light volumes as markets wait for US inflation data along with China’s July economic data. After the close of July M2, new loans and aggregate financing improved month over month, though all slightly missed economist expectations. Hong Kong has made a small move off support levels as the Q2 earning season enters prime time, with Tencent and Meituan reporting tomorrow morning.

Online real estate company KE Holdings (BEKE US, 2423 HK) gained +7.67% in Hong Kong after strong results and outperformed its US ADR, which gained +5.49 % yesterday. This morning, Tencent Music Entertainment (TME US, 1698HK) gained +4.7% in Hong Kong as the company released financial results after the Hong Kong close and beat the big three (revenue, adjusted net income, and adjusted EPS), though year-over-year revenue declines appear to be weighing on the stock pre-market. Also reporting this morning, online game streamer HUYA (HUYA US) beat the big three with a shareholder-friendly $1.08 special dividend and an increase in their stock buyback.

Energy stocks were higher on Middle East tensions, while technology stocks also had a good day in both markets as continued chatter on iPhone 16 production is ramping up, leading Apple suppliers higher.

Hong Kong’s most heavily traded stocks by value were Tencent, up +0.96%, Meituan, down -0.58%, Alibaba, up +0.25%, China Construction Bank, down -0.36%, and Xiaomi, up +2.67%. Top internet stocks were also largely higher as NetEase fell -1.21%, JD.com gained +0.7%, Trip.com gained +0.3%, Kuaishou fell -0.11%, and Bilibili gained +1.99%. Mainland investors bought $246 million of Hong Kong stocks and ETFs, as Tencent and China Mobile were moderate net buys. The Mainland market managed small gains on volume that declined from the 1-year average as yesterday was the lightest day since May 25, 2020, as the trading value fell below RMB 500 billion for only the fourth time. Make that the fifth time, as today’s volume was even lighter than yesterday. Clean technology stocks had a strong day as a beneficiary of policy support. Another big news story was MSCI’s index review, which is discussed below. For freight delivery, ZTO will shift its MSCI market from the US to Hong Kong. Mainland media noted that US and Chinese financial regulators and diplomats are meeting in Shanghai, though there is little coverage in the West.

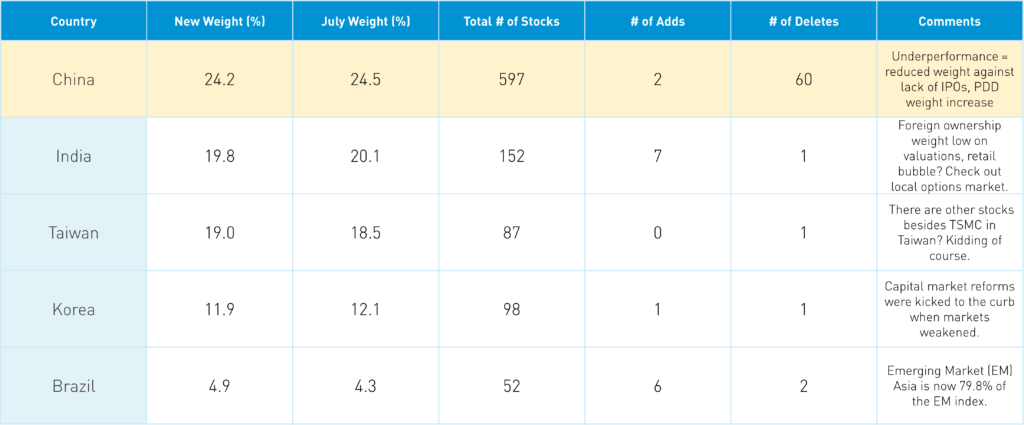

MSCI released its pro forma for the end-of-month index rebalance. The new emerging market country weights/total number of stocks/stock additions/stock deletions are shown below:

The Hang Seng and Hang Seng Tech gained +0.38% and flat/0.0%, respectively, on volume up +0.73% from yesterday, which is 69% of the 1-year average. 217 stocks advanced, while 230 declined. Main Board short turnover fell by -11.16% from yesterday, which is 72% of the 1-year average, as 18% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). Large capitalization and value stocks outperformed small capitalization and growth stocks. The top sectors were technology, up +1.5%, utilities, up +1%, and industrials, up +0.87%, while consumer staples fell by -0.63%, real estate fell by -0.16%, and consumer discretionary fell by -0.02%. The top sub-sectors were media, telecommunication services, and technical hardware, while automobile, food, and business professional services were the worst. Southbound Stock Connect volumes were light as Mainland investors bought $246 million of Hong Kong stocks and ETFs, as Tencent and China Mobile were moderate net buys while the Hong Kong Tracker ETF was a moderate/large net sell.

Shanghai, Shenzhen, and STAR Board gained +0.34%,+0.5%, and +0.48%, respectively, on volume down -3.69% from yesterday, which is 59% of the 1-year average. 2,799 stocks advanced, while 2,013 declined. Large capitalization and value stocks outperformed small capitalization and growth stocks. The top sectors were industrials, up +1.06%, technology, up +0.87%, and financials, up +0.83%, while consumer staples fell -0.72%, healthcare, fell -0.61%, and consumer discretionary fell -0.07%. The top sub-sectors were power generation equipment, energy equipment, and electric power grid, while liquor, pharmaceutical, and biotechnology were the worst. Northbound Stock Connect volumes were light as foreign investors were small net sellers, as Wuliangye, Wanhua, and Eoptolink were small net sells. Treasury bonds rallied. CNY and the Asia dollar index gained on the US dollar. Copper gained while steel fell.

Last Night's Performance

| Country/Index | Ticker | 1-Day Change |

|---|---|---|

| China (Hong Kong) | HSI Index | 0.4% |

| Hang Seng Tech | HSTECH Index | 0% |

| Hong Kong Turnover | HKTurn Index | 0.7% |

| HK Short Sale Turnover | HKSST Index | -11.2% |

| Short Turnover as a % of HK Turnovr | N/A | 17.8% |

| Southbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | 245.6 |

| China (Shanghai) | SHCOMP Index | 0.3% |

| China (Shenzhen) | SZCOMP Index | 0.5% |

| China (STAR Board) | Star50 Index | 0.5% |

| Mainland Turnover | .chturn Index | -3.7% |

| Nouthbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | Not Available |

| Jing Daily China Global Luxury Index | CHINALUX Index | 0.9% |

| Japan | NKY Index | 3.4% |

| India | SENSEX Index | -0.9% |

| Indonesia | JCI Index | 0.8% |

| Malaysia | FBMKLCI Index | 0.2% |

| Pakistan | KSE100 Index | -0.1% |

| Philippines | PCOMP Index | 0.6% |

| South Korea | KOSPI Index | 0.1% |

| Taiwan | TWSE Index | 0.1% |

| Thailand | SET Index | 0.1% |

| Singapore | STI Index | 0.7% |

| Australia | AS51 Index | 0.2% |

| MSCI China All Shares Index | # of Stocks | Average 1-Day Change (%) |

|---|---|---|

| Hong Kong Listed | 154 | 0.18 |

| Communication Services | 9 | 0.09 |

| Consumer Discretionary | 29 | 0 |

| Consumer Staples | 13 | -0.01 |

| Energy | 7 | 0.01 |

| Financials | 24 | 0.02 |

| Health Care | 14 | 0.01 |

| Industrials | 18 | 0.01 |

| Information Technology | 11 | 0.03 |

| Materials | 11 | 0 |

| Real Estate | 6 | 0 |

| Utilities | 12 | 0.01 |

| China Listed | 487 | 0.24 |

| Communication Services | 13 | 0 |

| Consumer Discretionary | 41 | 0 |

| Consumer Staples | 32 | -0.04 |

| Energy | 17 | 0.01 |

| Financials | 68 | 0.09 |

| Health Care | 45 | -0.02 |

| Industrials | 74 | 0.09 |

| Information Technology | 93 | 0.07 |

| Materials | 80 | 0.02 |

| Real Estate | 7 | 0 |

| Utilities | 17 | 0.01 |

| US & Hong Kong Dually Listed | Ticker | 1-Day Change (%) |

|---|---|---|

| Tencent HK | 700 HK Equity | 1 |

| Alibaba HK | 9988 HK Equity | 0.3 |

| JD.com HK | 9618 HK Equity | 0.7 |

| NetEase HK | 9999 HK Equity | -1.2 |

| Yum China HK | 9987 HK Equity | -2.3 |

| Baozun HK | 9991 HK Equity | 2.1 |

| Baidu HK | 9888 HK Equity | -0.1 |

| Autohome HK | 2518 HK Equity | -2.4 |

| Bilibili HK | 9626 HK Equity | 2 |

| Trip.com HK | 9961 HK Equity | 0.3 |

| EDU HK | 9901 HK Equity | 2.4 |

| Xpeng HK | 9868 HK Equity | -1.9 |

| Weibo HK | 9898 HK Equity | 4.3 |

| Li Auto HK | 2015 HK Equity | -2 |

| Nio Auto HK | 9866 HK Equity | 0.7 |

| Zhihu HK | 2390 HK Equity | -2.1 |

| KE HK | 2423 HK Equity | 7.7 |

| Tencent Music Entertainment HK | 1698 HK Equity | 4.7 |

| Meituan HK | 3690 HK Equity | -0.6 |

| Hong Kong's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| TENCENT HOLDINGS LTD | 1 |

| MEITUAN-CLASS B | -0.6 |

| ALIBABA GROUP HOLDING LTD | 0.3 |

| CHINA CONSTRUCTION BANK-H | -0.4 |

| XIAOMI CORP-CLASS B | 2.7 |

| CHINA MOBILE LTD | 1.5 |

| IND & COMM BK OF CHINA-H | 0.2 |

| AIA GROUP LTD | 1.4 |

| CNOOC LTD | 1.6 |

| BYD CO LTD-H | -0.3 |

| Shanghai and Shenzhen's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| DAZHONG TRANSPORTATION GRP-A | -4.4 |

| CONTEMPORARY AMPEREX TECHN-A | 2.8 |

| ZHONGJI INNOLIGHT CO LTD-A | 3.2 |

| XIAMEN KING LONG MOTOR GR -A | 10 |

| AEROSPACE HI-TECH HOLDINGS-A | -1.7 |

| KWEICHOW MOUTAI CO LTD-A | -0.9 |

| BAIC BLUEPARK NEW ENERGY -A | 1.4 |

| ZIJIN MINING GROUP CO LTD-A | 1.2 |

| FOXCONN INDUSTRIAL INTERNE-A | 0.7 |

| QIMING INFORMATION TECH -A | 5.7 |

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.16 versus 7.18 yesterday

- CNY per EUR 7.82 versus 7.85 yesterday

- Yield on 10-Year Government Bond 2.22% versus 2.25% yesterday

- Yield on 10-Year China Development Bank Bond 2.26% versus 2.31% yesterday

- Copper Price: +1.20%

- Steel Price: -1.08%