Alibaba’s $1 Billion Southbound Debut!

3 Min. Read Time

Alibaba’s 1st Day of Southbound Stock Connect Trading Leads to +$1B of Inflows

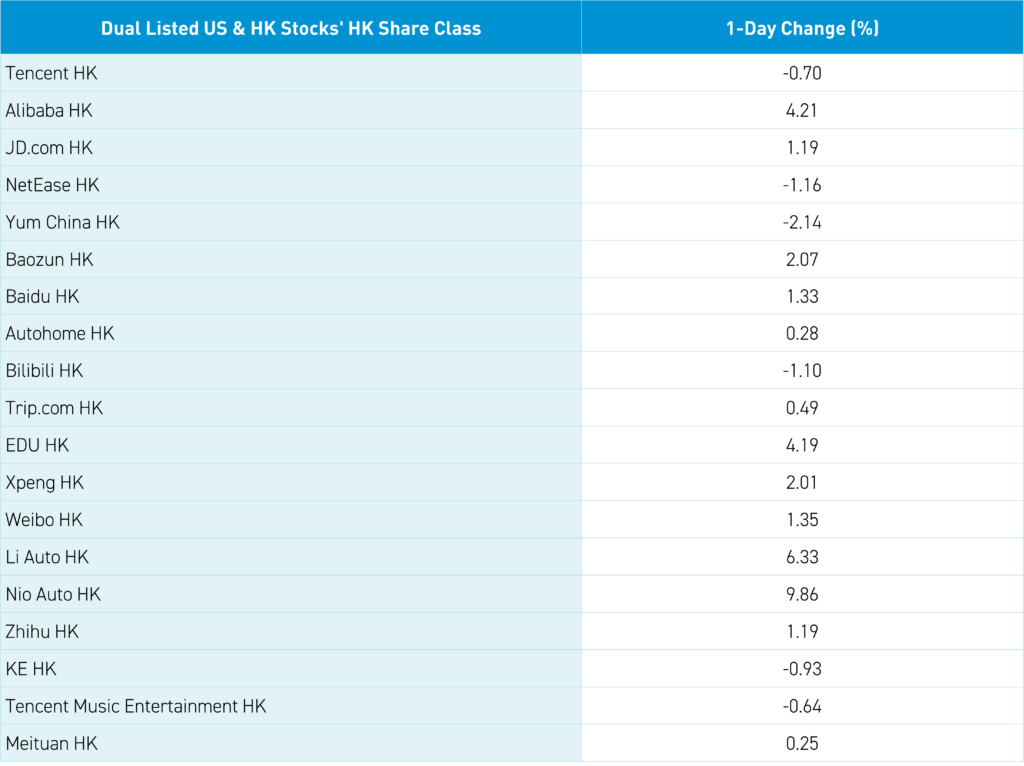

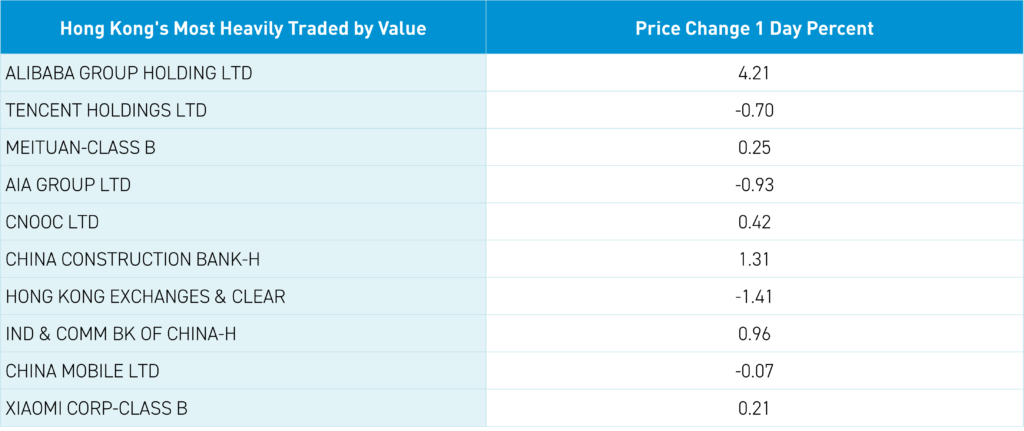

Alibaba’s Hong Kong share class (9988 HK) gained +4.21% as Mainland investors bought a very healthy HKD 8.471 billion/US $1.086 billion. Alibaba's Hong Kong shares traded on very high volume as the value traded was 4X higher than the second highest volume stock, with 206 million shares traded today versus the 1-year average of 47 million shares as the value of volume traded was worth $2.161 billion versus the 1-year average of 461 million. It was a very strong start, which I believe, using Tencent’s 10% ownership via Southbound Stock Connect, would mean $20 billion of inflow, though that could take a year. Alibaba’s shareholders approved the transition to a dual primary listing, adding the HKEX and the NYSE as primaries. This also means that based on Hong Kong rules, the company discloses buybacks after the close of business. Today, the company announced it bought the equivalent of 5,921,600 HK shares on the NYSE yesterday, meaning they bought 740,200 US-listed ADRs yesterday. Alibaba’s US ADR traded 10,434,425 shares yesterday, which means that 7.09% of yesterday’s volume in Alibaba’s ADR was due to its buyback.

Key News

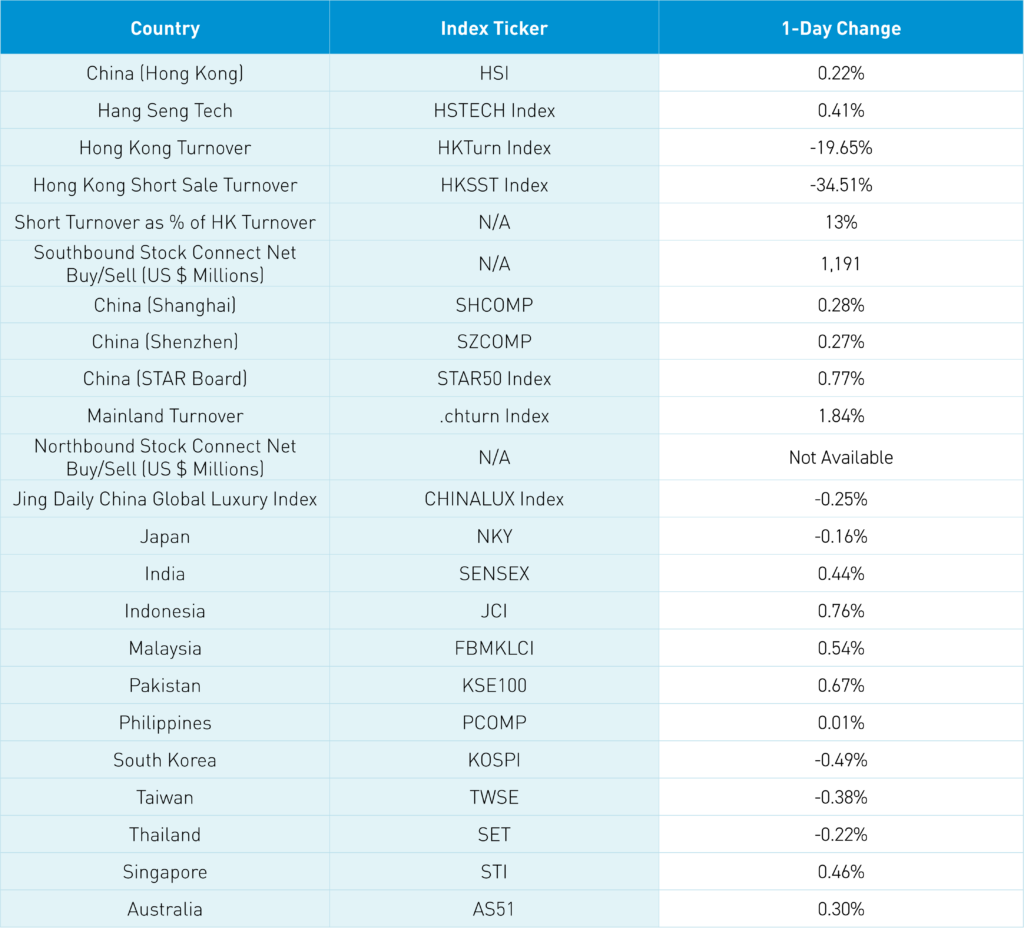

Asian equities were largely higher except for Japan, South Korea, and Taiwan, which underperformed.

Alibaba accounted for 58 points of the Hang Seng’s 37-point gain, indicating the Hong Kong market would have been weaker if not for Alibaba. Internet stocks were mixed, though Hong Kong electric vehicle (EV) stocks had a strong day based on yesterday’s August EV and hybrid sales numbers, with Li Auto up +6.33%, BYD up +0.51%, XPeng up +2.01%, and NIO up +9.86%.

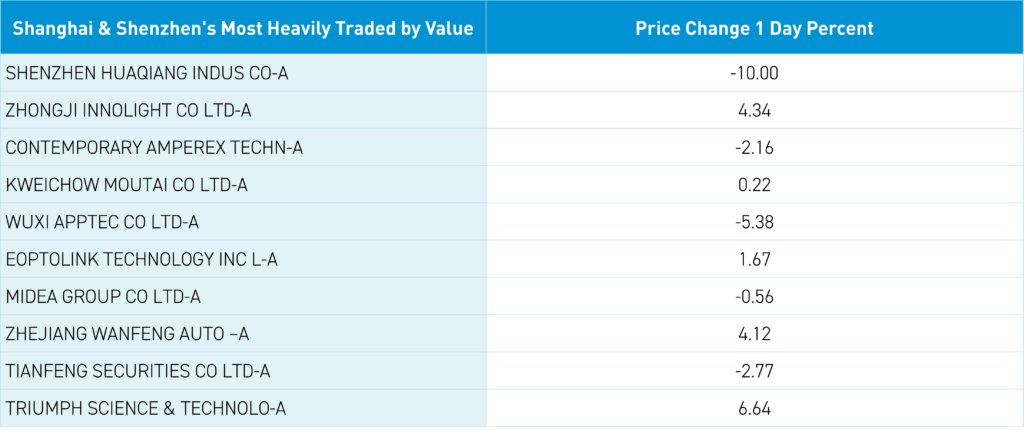

Healthcare stocks were weak in both Hong Kong and Mainland China, with Wuxi Biologics down -3.88% and Wuxi AppTec down -10.43% after the US House passed the Biosecure Act, which would ban the companies from US government contracts. The move also jeopardizes the thousands of Americans employed by the companies, though there are some questions about whether it will pass the Senate. Congress acting as judge, jury, and executioner is a frightening prospect, though the companies should mount a legal challenge, if it passes the Senate, which remains unlikely.

China’s August trade data must have been good due to the lack of Western media coverage as exports increased by +8.7% year-over-year versus an expected +6.6% and July’s 7.0%. Imports increased by +0.5% but missed expectations of +2.5% and were well off July’s +7.2%. The data tells us the global economy continues to perform, requiring Chinese exports while low commodity prices weigh on imports along with tepid domestic consumption.

Huawei’s launch of the three-folded Mat XT went on sale with the 256 GB for RMB 19,999 and the 512 GB for RMB 21,999, which is a real competitor for Apple’s new iPhone 16. The news lifted Huawei suppliers and the technology sector as Mainland China managed small gains. The National Team’s favored ETFs had average volumes.

US and Chinese military commanders met in a positive sign while President Xi met with Spain’s Prime Minister Pedro Sanchez and Norway’s Prime Minister Jonas Gahr Store.

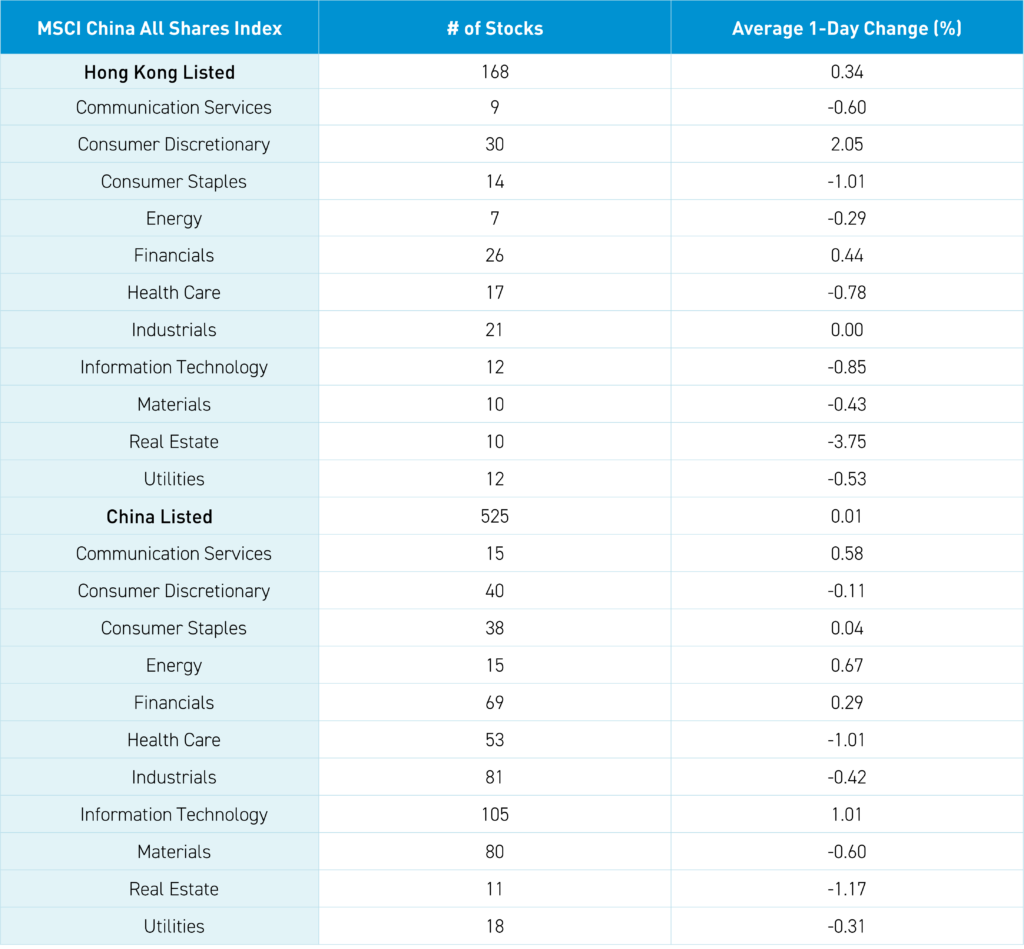

The Hang Seng and Hang Seng Tech indexes gained +0.22% and +0.41%, respectively, on volume that decreased -19.65% from yesterday, which is 104% of the 1-year average. 144 stocks advanced, while 330 stocks declined. Main Board short turnover declined by -31.61% from yesterday, which is 81.5% of the 1-year average, as 13% of turnover was short turnover (HK short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). Large capitalization and growth stocks outpaced small capitalization and value stocks. The top sectors were consumer discretionary, up +2.05%, financials, up +0.44%, and industrials flat at 0.0%, while real estate fell -3.75%, consumer staples fell -1.01%, and technology fell -0.85%. The top sub-sectors were retailing, automobiles, and banks, while food/staples, semiconductors, and pharmaceuticals were the worst. Southbound Stock Connect volumes were light as Mainland investors bought $1.191 billion with Alibaba a large net buy while Li Auto and Tencent were small net sells.

Shanghai, Shenzhen, and the STAR Board gained +0.28%, +0.27%, and +0.77%, respectively, on volume that increased +1.84% from yesterday, which is 67% of the 1-year average. 2,938 stocks advanced, while 1,915 stocks declined. Large capitalization and growth stocks outpaced small capitalization and value stocks. The top sectors were technology, up +1%, energy, up +0.66%, and communication services, up +0.57%, while real estate was down -1.18%, healthcare was down -1.02%, and materials was down -0.61%. The top sub-sectors were software, computer hardware, and motorcycles, while catering/tourism, education, and pharmaceuticals were the worst. Northbound Stock Connect volumes were light. Treasury bonds rallied. CNY fell versus the US dollar, while the Asia dollar index made a small gain. Copper and steel gained.

Last Night's Performance

Last Night's Exchange Rates, Prices, & Yields

- CNY per USD 7.11 versus 7.11 yesterday

- CNY per EUR 7.85 versus 7.87 yesterday

- Yield on 10-Year China Government Bond 2.11% versus 2.12% yesterday

- Yield on 10-Year China Development Bank Bond 2.22% versus 2.22% yesterday

- Copper Price +1.01%

- Steel Price +1.81%