China Stocks Left “Home Alone” Despite Pension Reform Catalyst, Week In Review

7 Min. Read Time

Week in Review

- Asian equities were mixed for the week as Pakistan and Korea outperformed while the Philippines and Thailand underperformed.

- The Politburo’s statement following its meeting on Monday referred to China’s current monetary policy as “loose”, diverging from the usual term “stable” for the first time since 2011.

- US President-Elect Trump invited China’s Xi Jinping to his inauguration in January, a symbolic moment indicating, in our opinion, Trump’s desire to reach a sweeping deal with China in his second and final term as president.

- The China Passenger Car Association released data this week showing that new energy vehicle (NEV) sales were up +50% year-over-year (YoY) as of November.

Key News

Asian equities ended a mixed week as Mainland China and Hong Kong underperformed, as the former posted a small 1% loss, and the latter posted a small gain for the week.

The lack of Cenral Economic Work Conference (CEWC) stimulus details was cited as a factor. However, investors should note that:

- The CEWC doesn’t provide detailed numbers but provides broad guidance.

- Mainland state media will continue to provide incremental details.

- There was significant coverage of the CEWC readout in a very positive light across Mainland media outlets.

Seasonality is a culprit, as committing more risk going into year-end is a non-starter. The volume of trading desk color has also slumped as investors and desks head out on vacation. Trump’s tariff threats and US equity performance continue to sideline US investors, though a few folks are starting to notice Mainland China and Hong Kong stock performance.

There was a subtle but slight shift in the tone of the narrative around Trump as the President Elect invited Xi to his inauguration. Trump is focused on the US economy and the US stock market, which runs contrary to a “Trade War Version 2.0”. Negotiate tough? 100%. But we are sticking with our Art of Deal versus the Grapes of Wrath thesis (John Steinbeck’s book on Great Depression, which Smoot-Hawley tariffs did not cause, but certainly contributed to).

It is highly likely that the People’s Bank of China (PBOC) will cut rates next week when the US Fed cuts. That being said, today was a very poor outing as breadth (advancers vs. decliners) was awful in both markets. As I posted on Twitter (@ahern_brendan), Hong Kong and Mainland China futures were very weak in US trading hours yesterday. China’s10-year government bond yield hit a new 52-week low and an all-time low of 1.78% overnight. Mainland indices did rebalance today, which may have been a factor, though hard to ascertain.

The ETFs favored by the “National Team”, which are financial institutions with links to sovereign wealth, had high volumes, which tried to stem the market’s loss. Mainland investors bought a healthy net $1.84 billion worth of Hong Kong-listed stocks and ETFs, including Alibaba and the Hong Kong Tracker ETF, which saw large net buying. For the week, Mainland investors bought $2.72 billion worth of Hong Kong-listed stocks and ETFs, bringing the year-to-date total to $96.37 billion versus 2023’s total of only $40 billion. It is also important to note that 4.54% of Alibaba is now held by Mainland investors via Southbound Stock Connect.

Growth stocks favored by investors underperformed, as Geely Auto fell -5.09% and Baidu fell -0.86% on news their investment in an auto partner is faltering. Tencent fell -1.4% despite founder Ma “Pony” Huateng’s editorial in the People’s Daily titled “Promoting the Healthy and Sustainable Development of the Digital Economy”.

The PBOC and nine other government agencies released a notice on supporting the “silver economy,” i.e., the elderly population. They placed an emphasis on retirement, pensions, and financial reforms. This follows yesterday’s Ministry of Finance notice titled “On the Implementation of Individual Income Tax Policy For Individual Pensions Nationwide”, which expands the 36-city pilot program nationwide. Similar to IRAs here in the US, individuals can make a tax-deductible contribution and invest RMB 12,000 ($1,649) annually. Thus far, only 20 million of the 60 million people who signed up for the scheme have invested. Long term, it is an obvious catalyst.

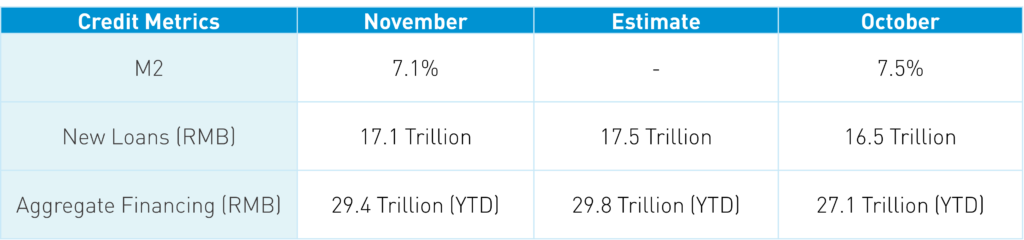

New loans missed expectations, though they were still up month-over-month. This supports the thesis that demand, not supply, is needed. There will be a big data release on Monday, including home prices, industrial production, retail sales, fixed asset investment, and property investment. Today’s market reaction should be noted by policymakers, especially considering “El Jefe” is saying the stock market should go higher.

The Hang Seng and Hang Seng Tech indexes fell -2.09% and -2.63%, respectively, on volume that increased +0.46% from yesterday, which is 121% of the 1-year average. 62 stocks advanced, while 444 stocks declined. Main Board short turnover increased 10% from yesterday, which is 125% of the 1-year average, as 16% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and large caps “outperformed” (i.e. fell less than) the growth factor and small caps. All sectors were negative, led lower by Real Estate, which fell -4.41%, Materials, which fell -4.21%, and Consumer Staples, which fell -3.48%. The top-performing subsectors were industry conglomerates and transportation. Meanwhile, the worst-performing subsectors were nonferrous metals, household and personal products, and food & beverage. Southbound Stock Connect volumes were 1.5x pre-stimulus levels as Mainland investors bought a net +$1.84 million worth of Hong Kong-listed stocks and ETFs, including the Hong Kong Tracker ETF and Alibaba, which were large net buys, and Tencent and XTALPI, which were moderate net buys. Meituan was a moderate/small net sell along with Semiconductor Manufacturing (SMIC) and Xiaomi.

Shanghai, Shenzhen, and the STAR Board fell -2.01%, -2.01%, and -2.09%, respectively, on volume that increased +10.9% from yesterday, which is 204% of the 1-year average. 786 stocks advanced, while 4,289 stocks declined. The value factor and small caps fell less than the growth factor and large caps. All sectors were negative, led lower by Real Estate, which fell -3.14%, Consumer Staples, which fell -2.93%, and Materials, which fell -2.81%. The top-performing subsectors were office supplies, cultural media, and leisure products. Meanwhile, education, insurance, and precious metals were among the worst-performing subsectors. Northbound Stock Connect volumes were nearly 3X the average. CNY and the Asia Dollar Index fell versus the US dollar. Treasury bonds rallied. Copper and steel fell.

Last Night's Performance

| Country/Index | Ticker | 1-Day Change |

|---|---|---|

| China (Hong Kong) | HSI Index | -2.1% |

| Hang Seng Tech | HSTECH Index | -2.6% |

| Hong Kong Turnover | HKTurn Index | 0.5% |

| HK Short Sale Turnover | HKSST Index | 10.9% |

| Short Turnover as a % of HK Turnovr | N/A | 15.9% |

| Southbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | 1512.4 |

| China (Shanghai) | SHCOMP Index | -2% |

| China (Shenzhen) | SZCOMP Index | -2% |

| China (STAR Board) | Star50 Index | -2.1% |

| Mainland Turnover | .chturn Index | 10.9% |

| Nouthbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | Not Available |

| Jing Daily China Global Luxury Index | CHINALUX Index | -0.7% |

| Japan | NKY Index | -1% |

| India | SENSEX Index | 1% |

| Indonesia | JCI Index | -0.9% |

| Malaysia | FBMKLCI Index | 0.4% |

| Pakistan | KSE100 Index | 0.2% |

| Philippines | PCOMP Index | -0.4% |

| South Korea | KOSPI Index | 0.5% |

| Taiwan | TWSE Index | -0.1% |

| Thailand | SET Index | -0.6% |

| Singapore | STI Index | 0% |

| Australia | AS51 Index | -0.4% |

| MSCI China All Shares Index | # of Stocks | Average 1-Day Change (%) |

|---|---|---|

| Hong Kong Listed | 152 | -2.23 |

| Communication Services | 9 | -1.55 |

| Consumer Discretionary | 30 | -3.16 |

| Consumer Staples | 13 | -3.48 |

| Energy | 7 | -1.62 |

| Financials | 23 | -2.19 |

| Health Care | 13 | -1.7 |

| Industrials | 19 | -0.22 |

| Information Technology | 10 | -0.77 |

| Materials | 10 | -4.21 |

| Real Estate | 6 | -4.41 |

| Utilities | 12 | -0.53 |

| Mainland China Listed | 432 | -2.45 |

| Communication Services | 9 | -1.71 |

| Consumer Discretionary | 31 | -2.45 |

| Consumer Staples | 27 | -2.93 |

| Energy | 16 | -2.15 |

| Financials | 63 | -2.78 |

| Health Care | 40 | -2.61 |

| Industrials | 69 | -2.4 |

| Information Technology | 85 | -2 |

| Materials | 68 | -2.82 |

| Real Estate | 7 | -3.14 |

| Utilities | 17 | -0.53 |

| US & Hong Kong Dually Listed | Ticker | 1-Day Change (%) |

|---|---|---|

| Tencent HK | 700 HK Equity | -1.4 |

| Alibaba HK | 9988 HK Equity | -2.6 |

| JD.com HK | 9618 HK Equity | -2.3 |

| NetEase HK | 9999 HK Equity | -2.9 |

| Yum China HK | 9987 HK Equity | -1.1 |

| Baozun HK | 9991 HK Equity | -0.7 |

| Baidu HK | 9888 HK Equity | -0.9 |

| Autohome HK | 2518 HK Equity | -0.2 |

| Bilibili HK | 9626 HK Equity | -4.6 |

| Trip.com HK | 9961 HK Equity | -2.9 |

| EDU HK | 9901 HK Equity | -4.9 |

| Xpeng HK | 9868 HK Equity | -5.9 |

| Weibo HK | 9898 HK Equity | -2.2 |

| Li Auto HK | 2015 HK Equity | -4.9 |

| Nio Auto HK | 9866 HK Equity | -4 |

| Zhihu HK | 2390 HK Equity | -2.8 |

| KE HK | 2423 HK Equity | -5.1 |

| Tencent Music Entertainment HK | 1698 HK Equity | -0.7 |

| Meituan HK | 3690 HK Equity | -3.7 |

| Hong Kong's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| TENCENT HOLDINGS LTD | -1.4 |

| MEITUAN-CLASS B | -3.7 |

| ALIBABA GROUP HOLDING LTD | -2.6 |

| XIAOMI CORP-CLASS B | -0.8 |

| CHINA CONSTRUCTION BANK-H | -1.1 |

| JD.COM INC-CLASS A | -2.3 |

| PING AN INSURANCE GROUP CO-H | -2.9 |

| AIA GROUP LTD | -2.2 |

| HONG KONG EXCHANGES & CLEAR | -2.4 |

| SEMICONDUCTOR MANUFACTURING | -4.4 |

| Shanghai and Shenzhen's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| EAST MONEY INFORMATION CO-A | -5.4 |

| SERES GROUP CO L-A | -4.7 |

| YONGHUI SUPERSTORES CO LTD-A | 3 |

| BLUEFOCUS INTELLIGENT COMM-A | 3.6 |

| CCOOP GROUP CO LTD-A | 0.7 |

| EOPTOLINK TECHNOLOGY INC L-A | -0.6 |

| JIANGSU HOPERUN SOFTWARE C-A | -2.7 |

| CONTEMPORARY AMPEREX TECHN-A | -2.4 |

| KWEICHOW MOUTAI CO LTD-A | -3 |

| GREATOO INTELLIGENT EQUIPM-A | -10 |

Last Night's Exchange Rates, Prices, & Yields

- CNY per USD 7.28 versus 7.27 yesterday

- CNY per EUR 7.63 versus 7.63 yesterday

- Yield on 10-Year Government Bond 1.78% versus 1.82% yesterday

- Yield on 10-Year China Development Bank Bond 1.85% versus 1.89% yesterday

- Copper Price -0.90%

- Steel Price -1.23%