Mainland Investors Buy The Dip In Hong Kong

6 Min. Read Time

Key News

Asian equities were largely lower despite a weaker US dollar overnight, as Japan outperformed and India underperformed.

Hong Kong-listed growth stocks were hit with profit-taking, triggered by President Trump’s last Friday night release stating “The Committee on Foreign Investment in the United States (CFIUS) will be used to restrict Chinese investments in strategic U.S. sectors like technology, critical infrastructure, healthcare, agriculture, energy, raw materials, and others.” China’s corporate investment in the US has gone basically to zero, so restricting zero means zero, as the tough language has little bite.

Ironically, the China-based health care companies that have built US facilities and hired US employees were off the most. Wuxi Biologics was down -9.04% and Wuxi AppTec was down -10.14%, as healthcare underperformed in both Hong Kong and Mainland China. Health care stocks had been picking up on government policy support for biotech and new drug innovation.

The White House release also alluded to looking at US-listed China stocks’ variable interest entity (VIE) structures, despite the companies adhering to PCAOB audit reviews. The release was harsh in repeatedly calling China a “foreign adversary”, which should make US companies with high China revenues nervous, though maybe this is the “Art of the Deal”.

Hong Kong-listed internet stocks were off on profit -taking. This is despite the fact that Alibaba, which fell -2.02%, committed to invest $53 billion over the next three years “to advance its cloud computing and AI infrastructure”. The company stated that “cloud computing remains Alibaba’s clearest revenue driver in AI, with demand for AI hosting services surging”. Alibaba’s Cloud unit grew revenue by +11% year-over-year (YoY) in the fourth quarter.

Real estate had a strong day as Shenzhen Metro, i.e. the Shenzhen local government, further supported distressed developer Vanke with another loan and reports of land sale prices increasing. Could the Vanke takeover playbook be repeated with other developers? We shall see.

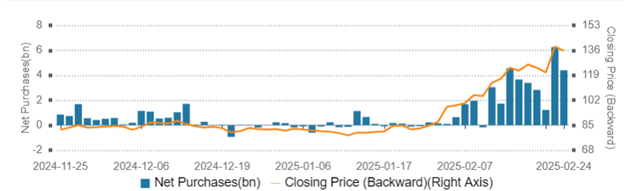

Mainland investors bought the dip in Hong Kong today, with $1.77 billion of net buying, led by strong buying in both Alibaba and Xiaomi. Year-to-Date (YTD), Mainland investors have bought a net $28.74 billion worth of Hong Kong-listed stocks via Southbound Stock Connect. Like in Hong Kong, Mainland China bounced around the room, though on very high turnover, exceeding RMB 2 trillion. As in Hong Kong, breadth (advancers vs. decliners) was mixed, as electric vehicle (EV) plays CATL and BYD fell -1.47% and -1.75%, respectively. It was a quiet night as Trip.com reported after the US close, today.

Alibaba - Net Buying Via Southbound Stock Connect

My Milan-based colleague Paolo forwarded a reader’s recommendation of Nicolai Tangen’s podcast titled In Good Company. As the world’s largest institutional investor, the Norges Bank CEO interviews a wide range of investors, CEOs, and other interesting people. Please don’t hesitate to reach out anytime with recommendations!

The Hang Seng and Hang Seng Tech indexes fell 0.58% and -1.19%, respectively, on volume that declined -9.54% from Friday, which is 240% of the 1-year average. 259 stocks advanced, while 230 stocks declined. Main Board short turnover decreased -9.42% from Friday, which is 200% of the 1-year average, as 14% of turnover was short turnover (Hong Kong short turnover includes ETF short volume, which is driven by market makers’ ETF hedging). The value factor and small caps “outperformed”, i.e. fell less than, the growth factor and large caps. The top-performing sectors were Real Estate, which gained +3.45%, Consumer Staples, which gained +1.34%, and Energy, which gained +0.47%. Meanwhile, the worst-performing sectors were Communication Services, which fell -3.46%, Health Care, which fell -2.66%, and Information Technology, which fell -1.03%. The top-performing subsectors were real estate management, national defense, and food. Meanwhile, software, pharmaceuticals, and consumer staples distribution were among the worst-performing. Southbound Stock Connect volumes were very high as Mainland investors bought a net $1.77 billion worth of Hong Kong-listed stocks and ETFs, including Alibaba and Xiaomi, which were large net buys, Tencent, which was a moderate net buy, Semiconductor Manufacturing International (SMIC), Meituan, Hua Hong Semiconductor, and China Unicom. CNOOC was a small net sell.

Shanghai, Shenzhen, and the STAR Board diverged to close -0.18%, +0.13%, and +0.48%, respectively, on volume that decreased -5.1% from Friday, which is 183% of the 1-year average. 2,645 stocks advanced, while 2,351 stocks declined. The value factor and small caps gained more than the growth factor and large caps. The top-performing sectors were Real Estate, which gained +2.1%, Materials, which gained +0.35%, and Consumer Staples, which gained +0.32%. Meanwhile, the worst-performing sectors were Health Care, which fell -0.99%, Utilities, which fell -0.43%, and Financials, which fell -0.37%. The top-performing subsectors were chemical fiber, construction, and fertilizers and pesticides. Meanwhile, education, biotech, and telecom were among the worst-performing subsectors. Northbound Stock Connect volumes were well above average. CNY and the Asia Dollar Index posted small gains versus the US dollar. Treasury bonds fell. Copper rose while steel fell.

Last Night's Performance

| Country/Index | Ticker | 1-Day Change |

|---|---|---|

| China (Hong Kong) | HSI Index | -0.6% |

| Hang Seng Tech | HSTECH Index | -1.2% |

| Hong Kong Turnover | HKTurn Index | -9.5% |

| HK Short Sale Turnover | HKSST Index | -9.4% |

| Short Turnover as a % of HK Turnovr | N/A | 13.9% |

| Southbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | 0 |

| China (Shanghai) | SHCOMP Index | -0.2% |

| China (Shenzhen) | SZCOMP Index | 0.1% |

| China (STAR Board) | Star50 Index | 0.5% |

| Mainland Turnover | .chturn Index | -5.1% |

| Nouthbound Stock Connect Net Buy/Sell (US $ Millions) | N/A | Not Available |

| Jing Daily China Global Luxury Index | CHINALUX Index | -0.2% |

| Japan | NKY Index | 0.3% |

| India | SENSEX Index | -1.1% |

| Indonesia | JCI Index | -0.8% |

| Malaysia | FBMKLCI Index | -0.4% |

| Pakistan | KSE100 Index | 1.4% |

| Philippines | PCOMP Index | 0% |

| South Korea | KOSPI Index | -0.4% |

| Taiwan | TWSE Index | -0.7% |

| Thailand | SET Index | -0.8% |

| Singapore | STI Index | -0.1% |

| Australia | AS51 Index | 0.1% |

| Vietnam | VNINDEX Index | 0.6% |

| MSCI China All Shares Index | # of Stocks | Average 1-Day Change (%) |

|---|---|---|

| Hong Kong Listed | 152 | -1.12 |

| Communication Services | 9 | -3.46 |

| Consumer Discretionary | 30 | -0.46 |

| Consumer Staples | 13 | 1.34 |

| Energy | 7 | 0.47 |

| Financials | 23 | 0.39 |

| Health Care | 13 | -2.66 |

| Industrials | 19 | -0.82 |

| Information Technology | 10 | -1.03 |

| Materials | 10 | -0.77 |

| Real Estate | 6 | 3.45 |

| Utilities | 12 | -0.08 |

| Mainland China Listed | 432 | -0.07 |

| Communication Services | 9 | -0.32 |

| Consumer Discretionary | 31 | -0.37 |

| Consumer Staples | 27 | 0.31 |

| Energy | 16 | -0.21 |

| Financials | 63 | -0.38 |

| Health Care | 40 | -1 |

| Industrials | 69 | 0.15 |

| Information Technology | 85 | 0.11 |

| Materials | 68 | 0.35 |

| Real Estate | 7 | 2.09 |

| Utilities | 17 | -0.43 |

| US & Hong Kong Dually Listed | Ticker | 1-Day Change (%) |

|---|---|---|

| Tencent HK | 700 HK Equity | -3.8 |

| Alibaba HK | 9988 HK Equity | -2 |

| JD.com HK | 9618 HK Equity | -0.3 |

| NetEase HK | 9999 HK Equity | -1.6 |

| Yum China HK | 9987 HK Equity | -1 |

| Baozun HK | 9991 HK Equity | 0.4 |

| Baidu HK | 9888 HK Equity | 0 |

| Autohome HK | 2518 HK Equity | 0.7 |

| Bilibili HK | 9626 HK Equity | -1.4 |

| Trip.com HK | 9961 HK Equity | 2.3 |

| EDU HK | 9901 HK Equity | -4.7 |

| Xpeng HK | 9868 HK Equity | 0.5 |

| Weibo HK | 9898 HK Equity | 1.2 |

| Li Auto HK | 2015 HK Equity | -2.9 |

| Nio Auto HK | 9866 HK Equity | -0.7 |

| Zhihu HK | 2390 HK Equity | -9.2 |

| KE HK | 2423 HK Equity | 2.7 |

| Tencent Music Entertainment HK | 1698 HK Equity | 9.5 |

| Meituan HK | 3690 HK Equity | 2.2 |

| Hong Kong's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| TENCENT HOLDINGS LTD | -3.8 |

| ALIBABA GROUP HOLDING LTD | -2 |

| XIAOMI CORP-CLASS B | -0.2 |

| SEMICONDUCTOR MANUFACTURING | 1.5 |

| MEITUAN-CLASS B | 2.2 |

| KUAISHOU TECHNOLOGY | -5.6 |

| PING AN INSURANCE GROUP CO-H | 1.7 |

| BYD CO LTD-H | -0.9 |

| HONG KONG EXCHANGES & CLEAR | -1.5 |

| WUXI BIOLOGICS CAYMAN INC | -9 |

| Shanghai and Shenzhen's Most Heavily Traded by Value | 1-Day Change (%) |

|---|---|

| TALKWEB INFORMATION SYSTEM-A | -0.6 |

| ZTE CORP-A | 0.9 |

| EAST MONEY INFORMATION CO-A | -0.9 |

| CHINA UNITED NETWORK-A | -1.3 |

| DHC SOFTWARE CO LTD -A | 3.4 |

| CAMBRICON TECHNOLOGIES-A | 5.1 |

| IEIT SYSTEMS CO LTD-A | -0.9 |

| SICHUAN CHANGHONG ELECTRIC-A | 4.6 |

| WILL SEMICONDUCTOR CO LTD-A | -5.1 |

| UNISPLENDOUR CORP LTD-A | 1.8 |

Last Night's Exchange Rates, Prices, & Yields

- CNY per USD 7.25 versus 7.26

- CNY per EUR 7.59 versus 7.60

- Yield on 10-Year Government Bond 1.76% versus 1.72% Friday

- Yield on 10-Year China Development Bank Bond 1.77% versus 1.73% Friday

- Copper Price -0.12%

- Steel Price -0.83%