Premier Li’s Post-Close Consumption Push

2 Min. Read Time

Key News

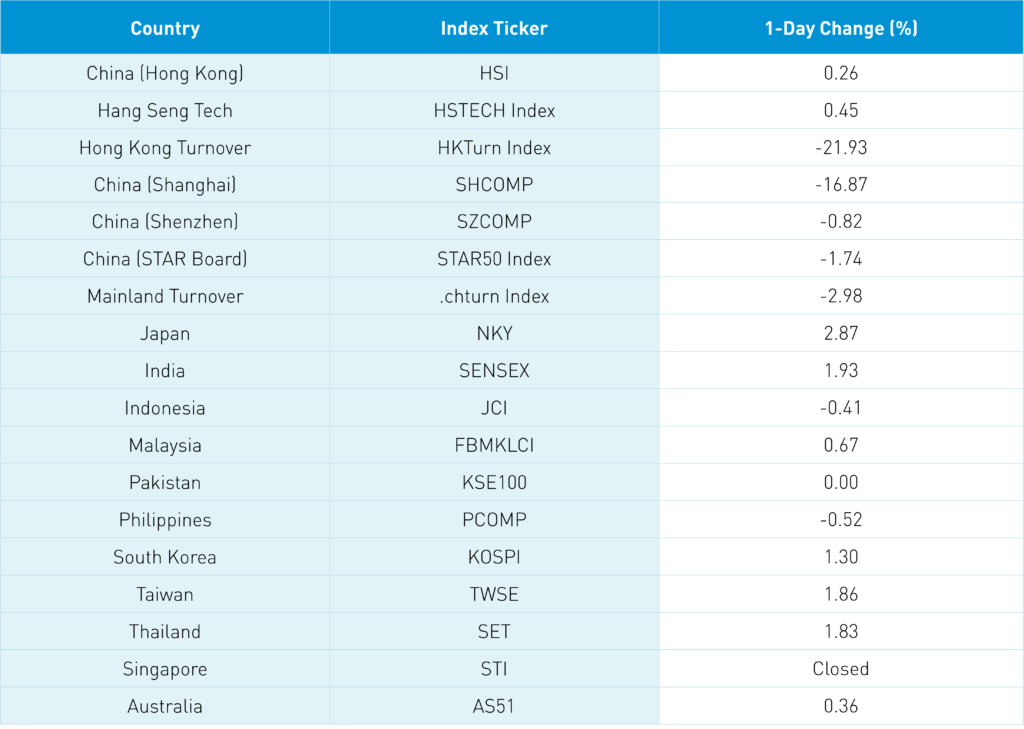

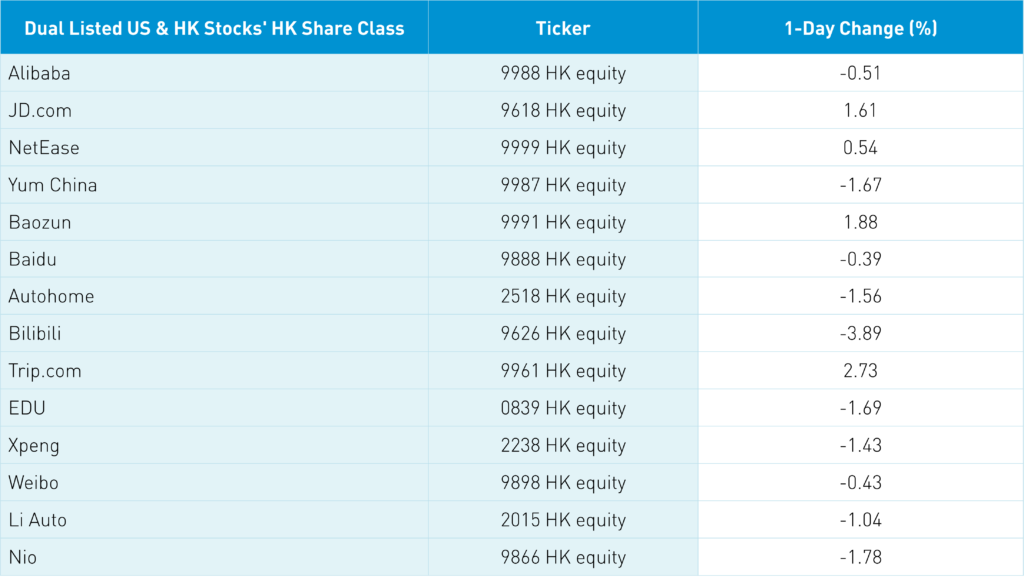

Asian equities were mixed overnight as Japan was up, Taiwan was ahead of Taiwan Semis earnings tomorrow, South Korea rebounded, and Mainland China was off. Hong Kong internet stocks were largely higher overnight shrugging off yesterday’s US downdraft in ADRs. US ADRs were off yesterday though no one should be surprised by the SEC adding more names to their non-compliant HFCAA list as they did yesterday. All 273 ADRs will be there in due time though hopefully a solution can be found.

Fairly quiet on the news front as Shanghai grapples with its covid lockdown with 1,189 new cases reported today, which depressed sentiment in Mainland China. Mainland investors are getting a bit antsy about a definitive policy response which we know is coming. After the close, the State Council released a statement including Premier Li that “policy measures to promote consumption” should be deployed. Automobiles and household appliances should be “encouraged” while “supporting new energy vehicle consumption”. Banks should be “encouraged” to lend to small-medium enterprises (private companies). The release mentions “RRR reduction” which would mean the PBOC cutting the number of deposits they hold on the books which is freed up for lending.

There is clearly an effort taking place to keep logistics and food supply going despite the obvious challenges associated with a lockdown. One reason for the lockdown is the low vaccination rate among the elderly, who are most vulnerable. According to an overnight statement from China CDC’s Wang Huaqing “The Omicron variant is still very harmful to the elderly, especially the elderly who have not been vaccinated and have chronic underlying diseases.”

Tencent’s daily buyback was joined after the Hong Kong close by AIA and HSBC announcing buybacks as well. A Mainland media source noted strong inflows into Mainland China ETFs that invest in Chinese equities. China’s March trade data saw strong export growth +12.9% year over year though imports were off -1.7%, which is well below expectations of 6.3%. Not sure if you can argue freight/logistics isn’t working with exports so strong. You can argue that households remain conservative based on tepid imports due to the threat of lockdowns.

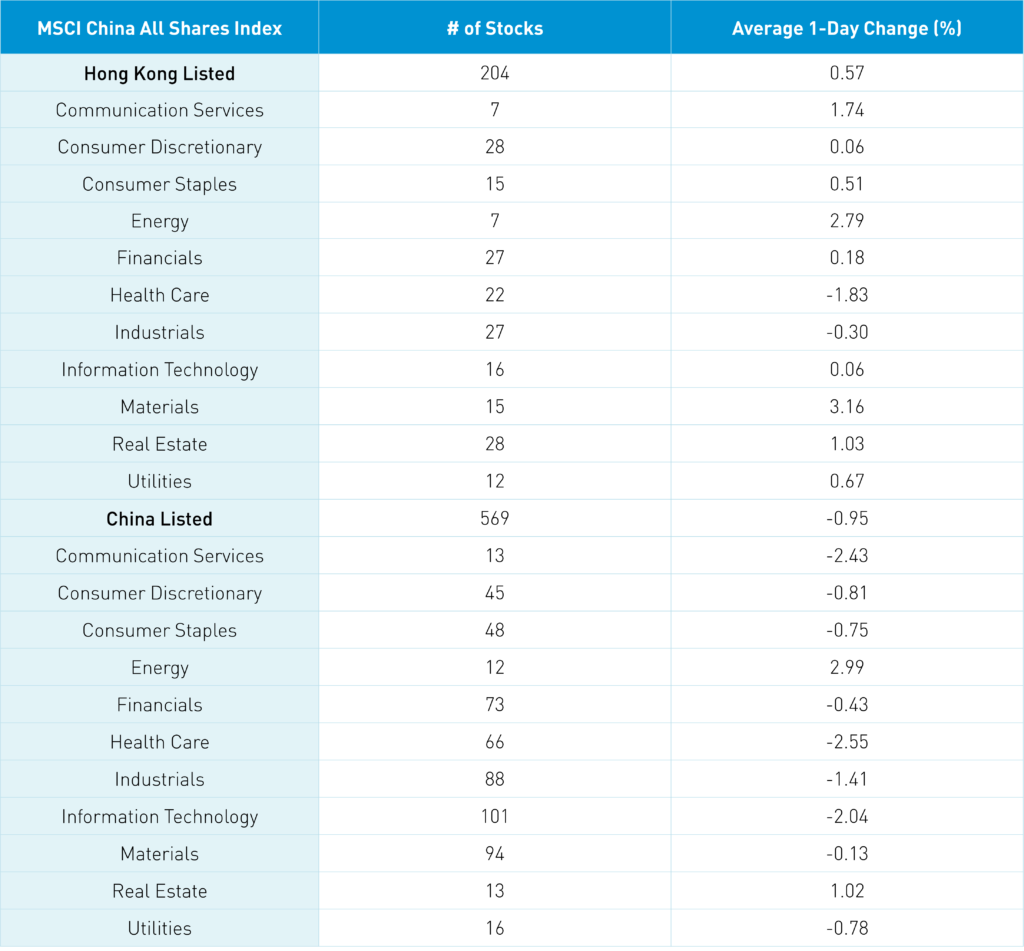

The Hang Seng Index overcame morning losses to close +0.26% while the Hang Seng Tech Index gained +0.45% as internet stocks were largely positive on volumes down -21.93% from yesterday, which is only 68% of the 1-year average. Decliners outpaced advancers 251 to 221 though large caps outpaced small caps which helped indices stay positive. Hong Kong short sale volume declined -16.87% from yesterday which is just below the 1-year average. The value factor was the best performer as materials +3.16%, energy +2.79% and real estate +1.03% though Tencent +1.97% pulled communication +1.74%. Tencent and Meituan were both net small buys from Mainland investors via Southbound Stock Connect. Tencent bought another 804k shares for the 13th trading day in a row.

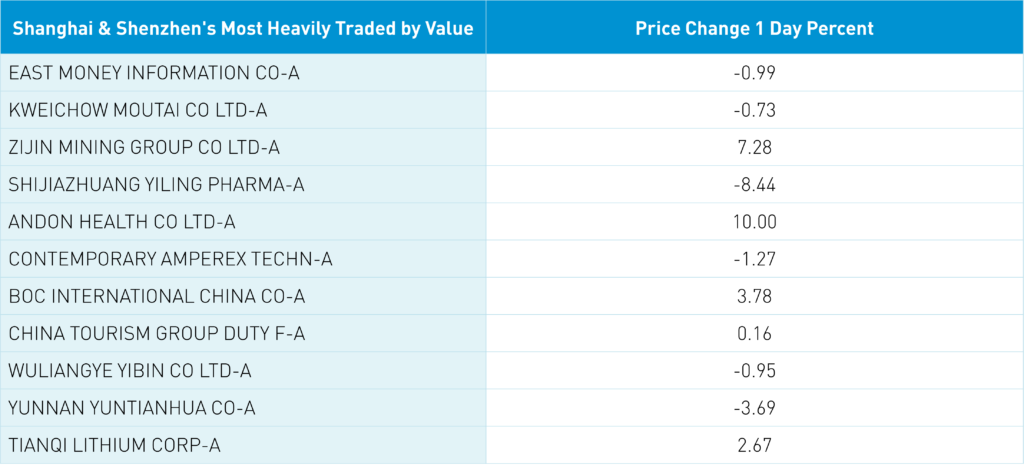

Shanghai, Shenzhen, and STAR Board were off -0.82%, -1.74%, and -2.98% on volume -4.69% from yesterday, which is only 82% of the 1-year average. Decliners outpaced advancers 3 to 1 as small caps underperformed large caps. The best performing factor was value followed by size (large caps > small caps) and dividends, which is evidenced by energy +3% and real estate +1.03% being the only positive sectors today while tech, communication, and healthcare were the bottom performers. Foreign investors sold -$78mm of Mainland stocks via Northbound Stock Connect. Chinese Treasury bonds rallied, CNY gained versus the US $ by a very small amount and copper gained a touch.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.37 versus 6.37 yesterday

- CNY/EUR 6.90 versus 6.93 yesterday

- Yield on 10-Year Government Bond 2.76% versus 2.77% yesterday

- Yield on 10-Year China Development Bank Bond 3.00% versus 3.01% yesterday

- Copper Price +0.94% overnight