Yum China Earnings Highlight Consumer Rebound

3 Min. Read Time

Key News

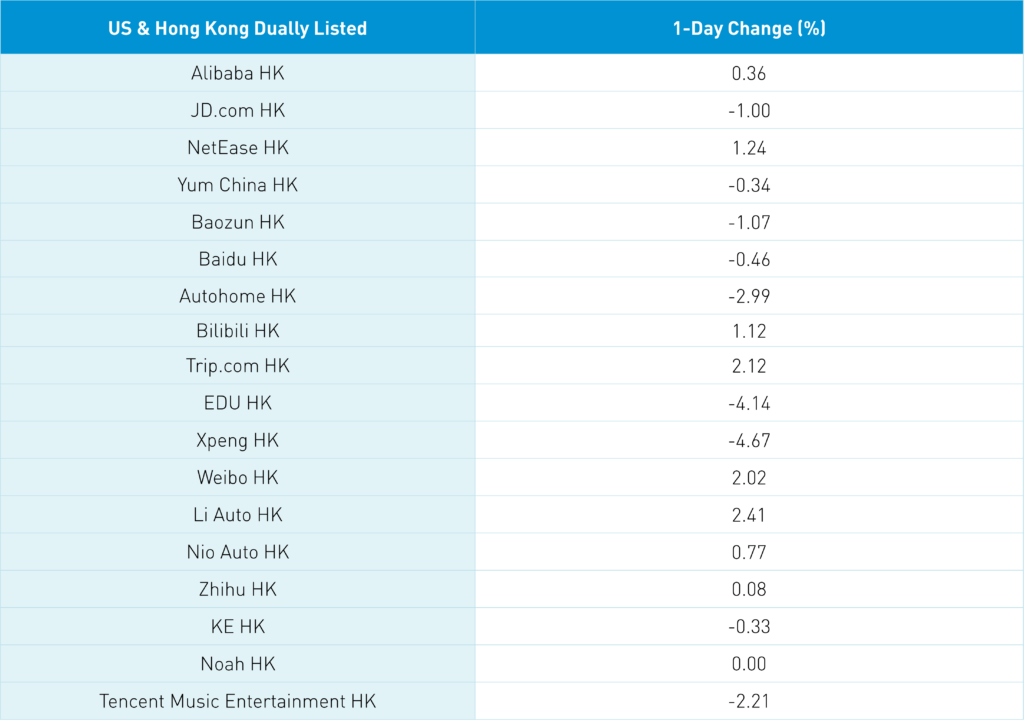

Asian equities were mixed but mostly higher overnight except for Hong Kong, which underperformed following recent strength.

Yum China Earnings Overview

US-listed Yum China, which operates American fast-food chains such as Taco Bell, Pizza Hut, and KFC in China, reported Q2 earnings after the US close yesterday. The results were outstanding, though revenue was a touch light compared to lofty analyst expectations. The year-over-year (YoY) comparison was an easy one due to Shanghai’s lockdown in Q2 2022, though the results versus Q2 2019 look strong as well. Revenue is +25% higher than in Q2 2022. Meanwhile, the conglomerate’s number of stores has grown to 13,602 from 2019’s 11,023.

One can become accustomed to crazy numbers when analyzing China, but, would you believe that Yum China has more loyalty program members than the entire population of the United States? At 445 million members, the loyalty program beats the US’ population of 332 million handily.

Andy Yeung, Yum China’s CFO, commented on the state of consumer during the earnings call, stating “obviously, since we have experienced three years of COVID it was likely going to take some time to regain some of the confidence. And so, that’s what we’re seeing right now.” Then, CEO Joey Wat astutely pointed out that, yes, “…China’s GDP has slowed down to growing probably (only) twice as fast as other developed countries. But that’s not too bad, isn’t it?” I would agree!

Click here for a virtual tour of a KFC in China!

Q2 2023, Year-over-year

- Revenue increased +25% to $2.65B from $2.13B versus an expected $2.734B

- Adjusted Net Income increased +137% to $199 million from $84 million, versus an expected $176.83 million

- Adjusted EPS increased +135% to $0.47 from $0.20 versus an expected $0.46

Last night’s fade from intra-day highs was partially due to reports that the Biden Administration would announce further details on outbound US investment restrictions as soon as mid-August. Our Washington, DC based policy research partners have stated with a high degree of confidence that these restrictions will be focused on active private equity investments, and not public equity. Public equity investments already fall under the regulatory guidance of the Committee on Foreign Investment in the United States (CFIUS).

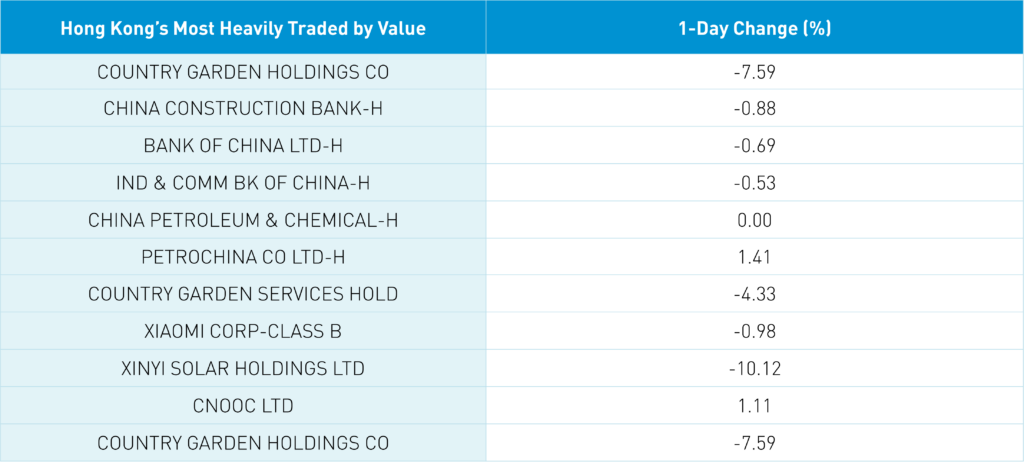

Real estate developer Country Garden fell -7.6% after canceling a planned share sale. The cancelled share sale comes following significant pressure on the developer’s bonds. This also weighed on developers broadly, which have traded around the room lately on expectations of more support combined with continuing financial difficulties.

Short video platform Kuaishou posted a profit alert for the first half that was higher than analysts’ expectations. Shares surged initially, though the rally faded along with the broader Hong Kong market.

China’s top officials continue to endorse (1) shoring up investor confidence in China’s capital markets and (2) active support for the platform economy, i.e. internet companies. To this end, Bloomberg reported yesterday that the PBOC is seeking to set up a STAR Market equivalent for fixed income. The new market will focus on high yield bond offerings by small and medium-sized technology companies.

The Hang Seng and Hang Seng Tech indexes closed lower by -0.34% and -0.26%, respectively, overnight on volume that decreased -26% from yesterday. However, short sale turnover was relatively flat day-over-day. Mainland investors bought a net $1.2 billion worth of Hong Kong stocks overnight via Southbound Stock Connect, buying the dip on slight weakness. The top-performing sectors were energy, telecom, and materials. Meanwhile, industrials, consumer staples, and real estate were among the worst.

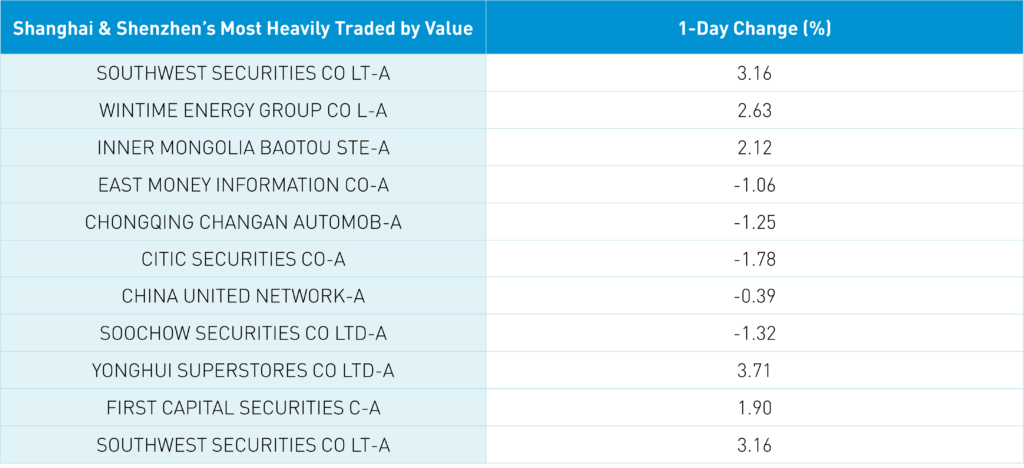

Shanghai, Shenzhen, and the STAR Board were mixed to close flat, -0.37%, and +0.07%, respectively, overnight on volume that decreased -14% from yesterday. Foreign investors bought a net $231 million worth of Mainland stocks via Northbound Stock Connect. The top-performing sectors were utilities, energy, and telecom. Meanwhile, consumer discretionary, financials, and industrials were among the worst. Treasury bonds were flat overnight while copper and steel gained.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.17 versus 7.14 yesterday

- CNY per EUR 7.85 versus 7.86 yesterday

- Yield on 1-Day Government Bond 1.40% versus 1.40% yesterday

- Yield on 10-Year Government Bond 2.66% versus 2.66% yesterday

- Yield on 10-Year China Development Bank Bond 2.76% versus 2.77% yesterday

- Copper Price +1.64% overnight

- Steel Price +0.34% overnight