Jinko Solar Gets Jiggy With A STAR Board IPO

2 Min. Read Time

Key News

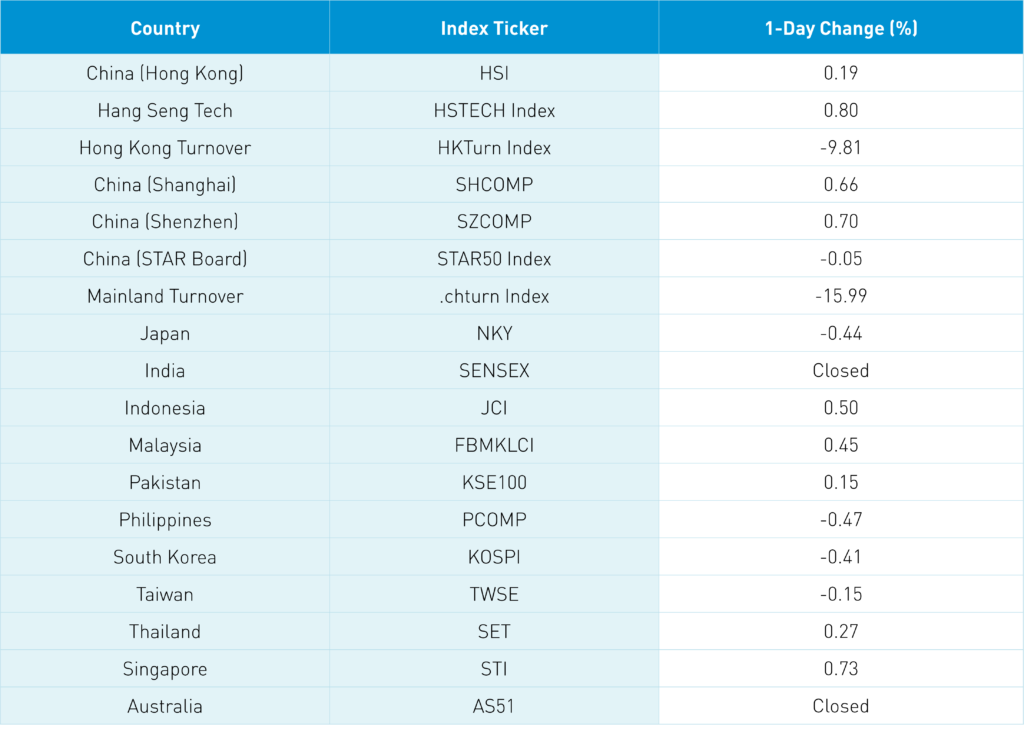

Asian equities had a positive day except for Japan and South Korea while Australia and India had the day off. Going into today’s trading session, the lead pre-market article in the Securities Journal, a prominent Mainland media outlet, was about Tuesday’s dramatic decline in Mainland stocks and how that move was disconnected from China’s economic fundamentals. In a nutshell, investors were told that yesterday was an aberration. The PBOC helped the cause by pumping liquidity into the financial system overnight as Chinese New Year travelers draw cash down for their vacations.

There was significant financial media coverage overnight on China’s top portfolio managers and their stock positions as year-end client letters and positions are revealed. A “star” China portfolio manager made Tencent his largest holding which would have been purchased through Southbound Stock Connect. Liquor stocks were trimmed, though not eliminated (the stocks had a decent day in China and especially Hong Kong as an FYI), while technology, clean technology, and consumption names appear to be fund favorites.

Baidu’s electric vehicle joint venture with Geely, called Jiddu, raised $40 million in advance of the 2023 launch of its robocar.

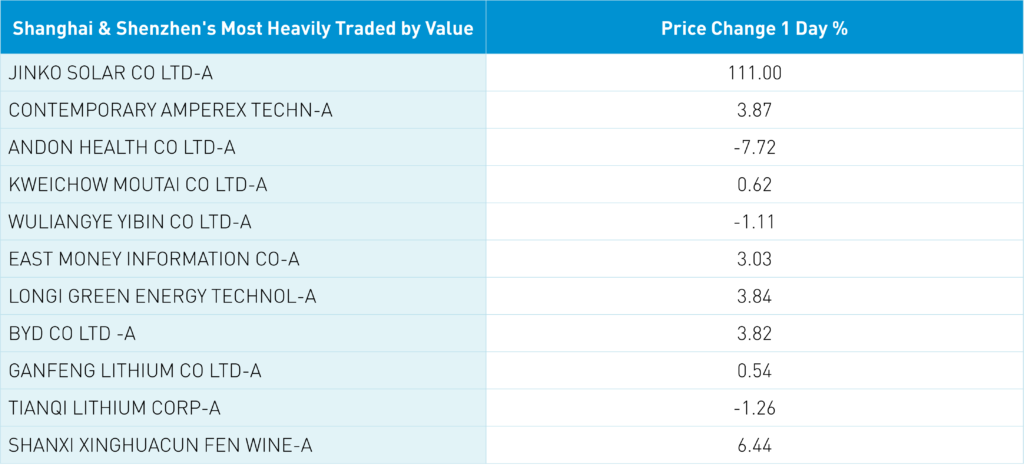

US-listed Jinko Solar (JKS US) re-listed overnight on the STAR Board after raising $1.5 billion from investors. Shares were offered at CNY 5 though closed the day at CNY 10.55 for a healthy +111% gain. Unfortunately, the STAR Board and US ADR are not fungible (you can’t swap one for the other) though it should help JKS today.

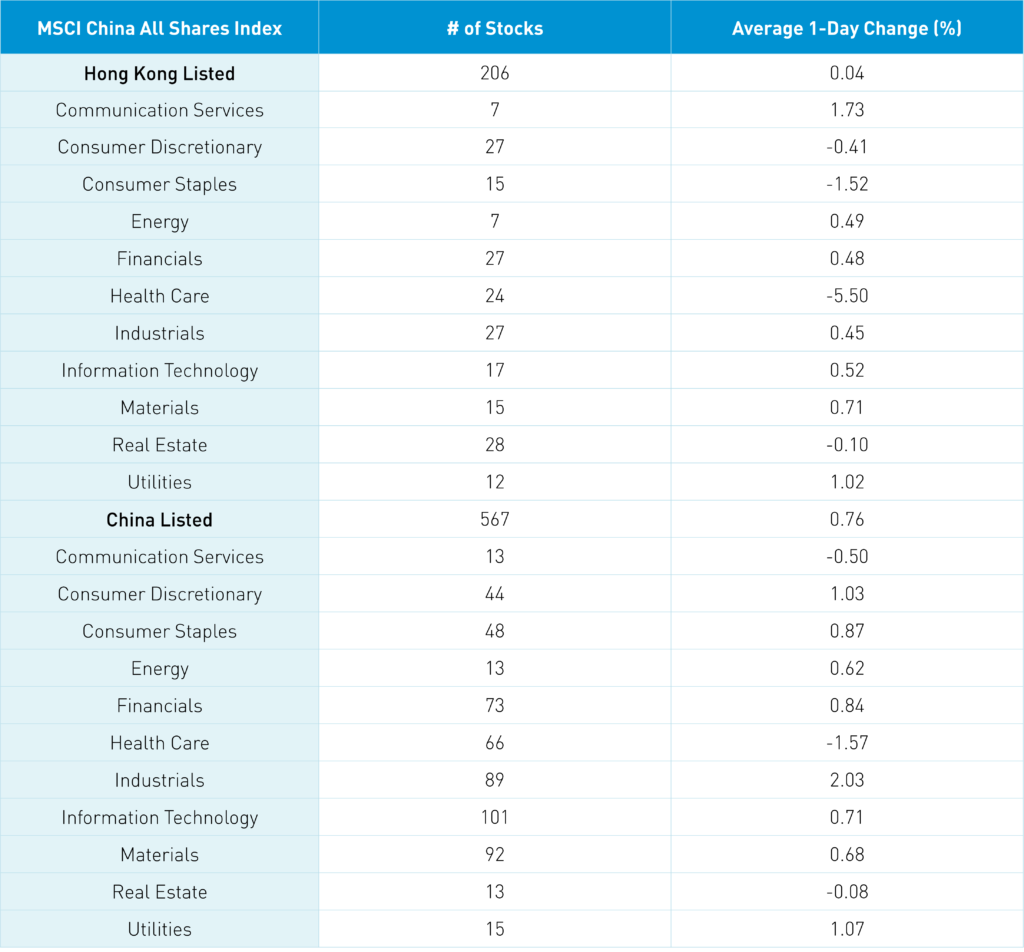

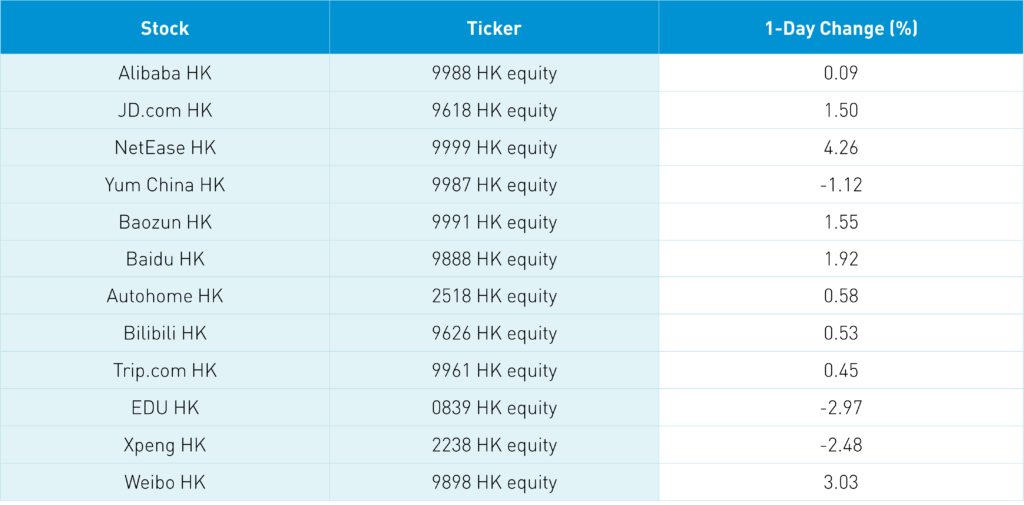

The Hang Seng gained +0.19% on volume that was down -9.81% from yesterday, which is only 82% of the 1-year average as decliners outpaced advancers by 220 to 242. Hong Kong’s most heavily traded stocks were Tencent, which gained +1.46%, Ausnutria Dairy, which gained +0.72%, Meituan, which fell -0.35%, Alibaba HK, which gained +0.09%, and Kuaishou, which gained +4.04%. Tencent and Meituan were net buys from Mainland investors via Southbound Stock Connect with an emphasis on the latter. Healthcare had another poor day in Hong Kong, falling -5.4% and Mainland China, where the sector was down -1.55% overall on reports that Shanghai was expanding its drug procurement list.

The Mainland market rebounded overnight as Shanghai gained +0.66%, Shenzhen gained +0.7%, and the STAR Board fell -0.05% (likely driven by investors selling shares to get involved in the Jinko IPO). Volumes fell -15.99%, which is only 75% of the 1-year average as investors pack their bags for the holiday while breadth was 2 to 1 advancers to decliners. The clean technology system finally had a strong day as the electric vehicle (EV) ecosystem, solar, and wind gained. Foreign investors bought $180 million worth of Mainland stocks today via Northbound Stock Connect. Treasury bonds eased a touch, CNY gained a little versus the US dollar, and copper gained +0.4%.

The State Administration of Taxation reported that tax revenue declined in 2021 by 0.1%, which is a form of stimulus.

Ministry of Finance reported that SOEs made RMB 4.516 trillion in 2021, which is up +30.1% from 2020. Meanwhile, SOEs' asset to liability ratio increased +0.3% to 63.7%.

Several regulatory bodies put out statements on corruption crackdowns. Tencent recently announced it had fired seventy employees for various reasons.

I’ve been surprised that more US-listed Chinese ADRs haven’t relisted in Hong Kong after Hong Kong Exchanges & Clearing (HKEX) eased its relisting requirements. I was told on a call last night that companies can confidentially file. I got the sense that many US-listed Chinese ADR companies have done so or are doing it now.

The US finally got around to appointing a new ambassador to China as Nicholas Burns was sworn in yesterday. I have no idea how diplomatic processes work, but a year with no ambassador? That might help explain the poor state of US-China diplomatic relations.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.32 versus 6.33 yesterday

- CNY/EUR 7.13 versus 7.15 yesterday

- Yield on 10-Year Government Bond 2.71% versus 2.70% yesterday

- Yield on 10-Year China Development Bank Bond 2.96% versus 2.98% yesterday

- Copper Price +0.40% overnight