The Year of The Ox Was A Rough Bull Ride, CSRC Suggests Solution To HFCAA, Week In Review

3 Min. Read Time

Week In Review

- We have two videos this week. In one, Dr. Xiaolin Chen discusses China’s path to carbon neutrality by 2060. In another, Xiabing Su goes on the ground in China to investigate the end of platform exclusivity.

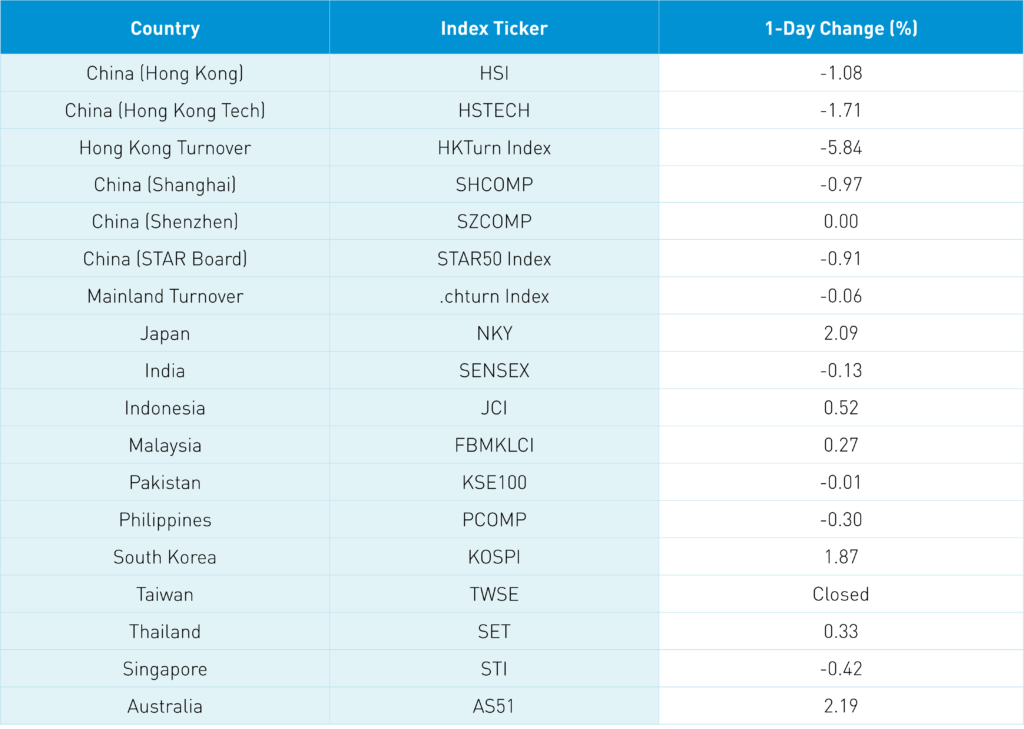

- Asian equities were broadly lower this week as the continent’s markets were not spared the global tech/growth dump.

- Fosun Pharma fell by over 7% on Monday after surging on Friday last week after announcing its agreement with Merck to produce its covid-19 pill for distribution in the Chinese market.

- JD.com may spin off its fintech unit, JD Technology (formerly known as JD Digits) through a Hong Kong listing.

- Jinko Solar (JKS US) re-listed on the STAR Board on Wednesday. Shares were offered at RMB 5 but rose throughout the day to reach over RMB 10.

- Kweichow Moutai announced the construction of a new factory. Investors cheered the announcement, and the consumer staples stock was one of the few bright spots in China’s equity market on Thursday as investors reacted negatively to the US Fed Chair’s announcement of a rate hike in March.

- Our friends at Jing Daily recently featured KraneShares analyst Megan Gummer's article, a thorough analysis of the Metaverse and the exciting potential opportunities for luxury brands.

Friday’s Key News

Asian equities were mixed overnight as Japan and South Korea rebounded while most markets were off on light volume in advance of Chinese New Year. Mainland markets will be closed all next week while Tuesday is the most important holiday regionally. Hong Kong has a half-day on Monday and will be closed Tuesday through Friday. Thin markets tend to be volatile. As such, we should take market movements with a grain of salt.

After the close in Asia, Reuters reported that the Vice Chairman of the China Securities Regulatory Commission (CSRC), China’s SEC, Fang Xinghai met with global financial institutions yesterday in China. The potential delisting of US-listed ADRs was a topic of discussion as the regulator suggested a “positive surprise by June or earlier”. That would be a positive!

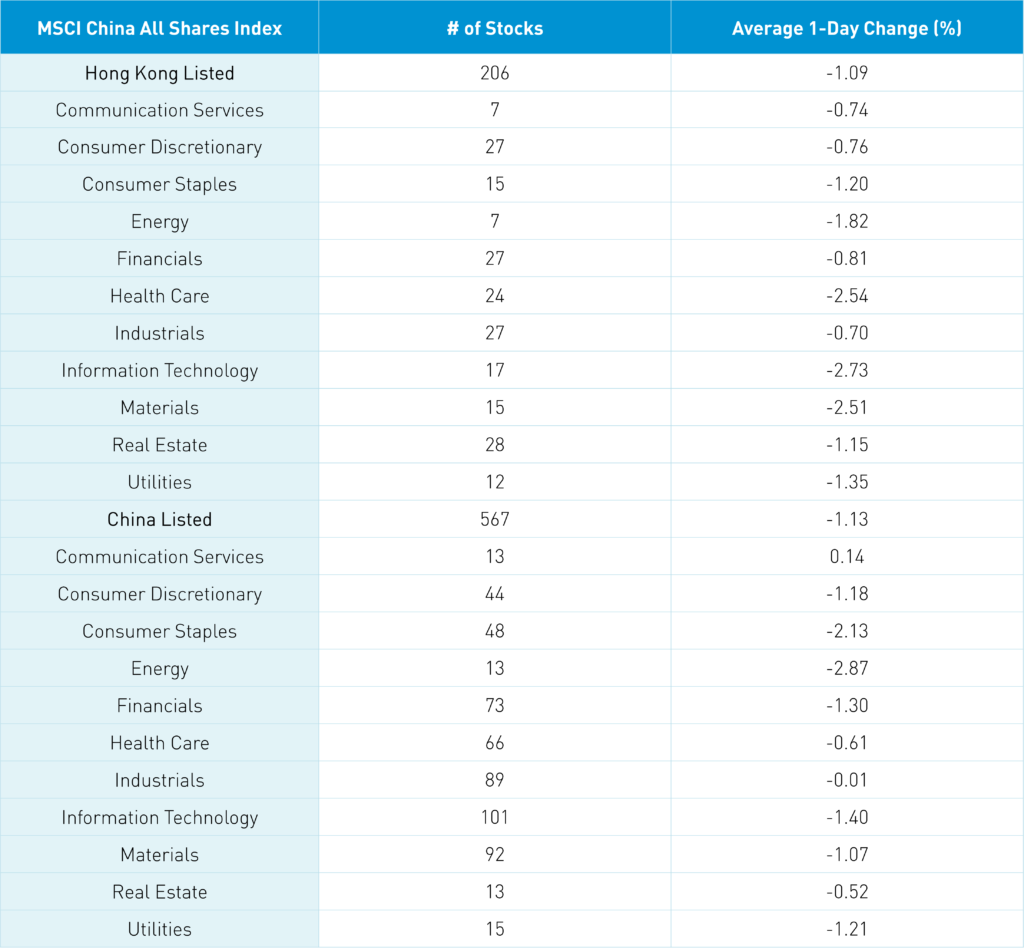

The Hang Seng was off -1.08% as volume was off -5.87%, which is only 79% of the 1-year average while decliners beat advancers by 3 to 1. Hong Kong’s most heavily traded stocks by value were Tencent, which fell -0.65%, Alibaba HK, which gained +1.38%, and Meituan, which fell -0.67%. Southbound Stock Connect was closed today so Hong Kong stocks did not benefit from the usual buying from Mainland Chinese investors. Tesla’s production woes weighed on the electric vehicle ecosystem in Hong Kong and China. I was a little surprised that Apple’s strong results did not give a lift to tech plays, but so be it.

Mainland markets were quiet as Shanghai fell -0.97%, Shenzhen was flat, and the STAR Board fell -0.91% as volume was down -0.06% from yesterday, which is only 78% of the 1-year average. Advancers beat decliners by nearly 3 to 1. Chinese asset managers buying their own mutual funds garnered media attention, but everyone too ready for vacation to care. People take vacation very serious in China as they literally turn off their work phones for the full week. Foreign investors sold -$1.96 billion worth of Mainland stocks today as they put that money to work elsewhere during the weeklong holiday. This is not a directional bet, but, rather, earning a return for the holiday. For the week, foreign investors pulled -$4.1 billion from the Mainland market, which weighed on the market due to the otherwise light volumes. We will likely see most or maybe all of this money come back the week after next. Some of that money may have made its way into Chinese Treasury bonds, which rallied overnight.

The Mainland’s most heavily traded stocks by value were CATL, which gained +3.06% as preliminary fiscal year results show net income will rise between +151% to +196%. Foreign favorites, other than CATL, were hit hard on the foreign selling as Kweichow Moutai fell -3.97%, BYD fell -6%, and Longi Green Energy fell -5.8%. CNY rallied versus the US dollar while copper pulled an inverse James Bond, falling -0.07%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.36 versus 6.37 yesterday

- CNY/EUR 7.09 versus 7.10 yesterday

- Yield on 1-Day Government Bond 1.64% versus 1.66% yesterday

- Yield on 10-Year Government Bond 2.70% versus 2.73% yesterday

- Yield on 10-Year China Development Bank Bond 2.97% versus 2.99% yesterday

- Copper Price -0.07% overnight