Meituan Shares Fall On NDRC Guidance, Week In Review

2 Min. Read Time

Week in Review

- Asian equities began the week lower as investors globally were risk-off on concerns about the Russia/Ukraine conflict. However, most major Asian indexes gained some ground back later in the week.

- The People’s Bank of China (PBOC), China’s central bank, injected RMB 100 billion into the financial system on Tuesday through the medium-term lending facility (MLF) while keeping the benchmark lending rate unchanged. This led China-based investors to buy Mainland equities and signals the central bank’s commitment to easing.

- China reported January inflation data on Wednesday. While commodity prices remained high, food prices declined to ease consumer inflation.

- China reported that foreign direct investment (FDI) increased +11.6% year-over-year in January versus +14.9% in December.

Friday’s Key News

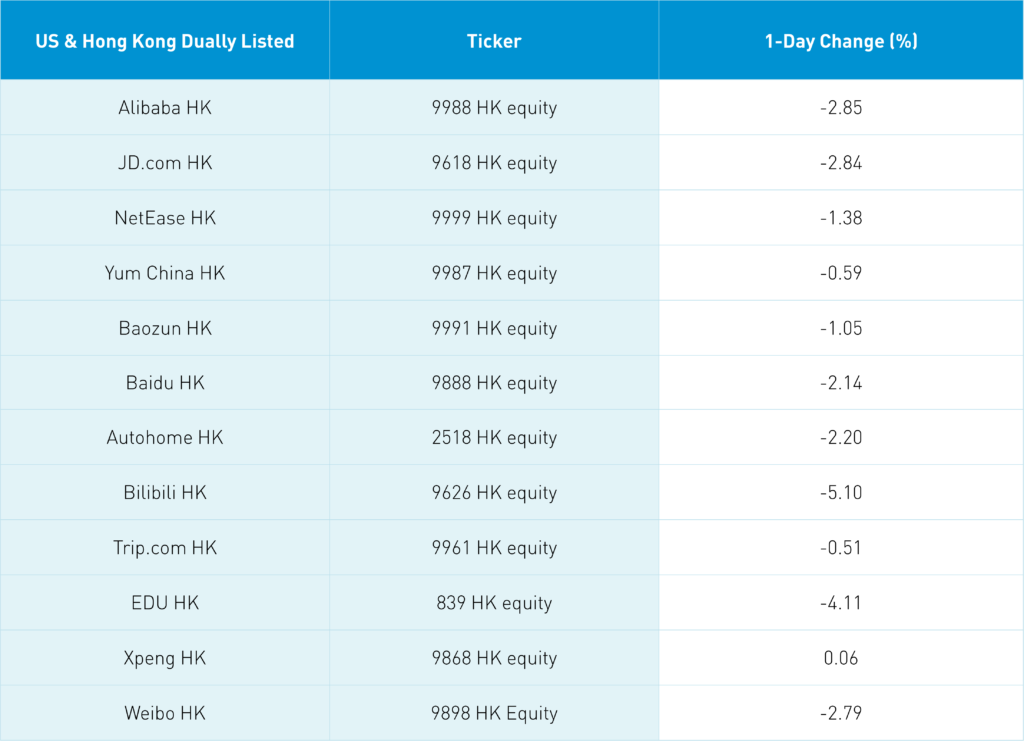

Asian equities were mixed though mostly higher overnight as Hong Kong underperformed due to a downdraft in Hong Kong-listed internet stocks driven by unexpected guidance from the National Development and Reform Commission (NDRC) that food delivery businesses lower service fees.

Meituan cratered over -14% overnight on the NDRC announcement. Meituan has been bogged down by new regulations for the past year, which have already weighed on the company’s margins. Initially, regulations focused on making the company classify couriers as full-time employees, rather than independent contractors. We knew that this would hurt the company’s margins. The new rule from the NDRC could have a similar effect by limiting how much the company can charge restaurants. This is likely a regulatory flare up geared toward reinforcing “common prosperity” ahead of the Two Sessions meetings in the first week of March. Nonetheless, we still believe that the worst is behind us when it comes to internet regulation and that the delivery fee announcement is an outlier. Remember that China Internet is still outperforming the S&P 500 by over 6% year-to-date.

Alibaba, JD.com, Meituan, and Ctrip released consumer related reports for Chinese New Year, in which winter activities, the digital economy, and local tourism were cited as bright spots for the E-Commerce platforms during the holiday season.

The China Securities Regulatory Commission revealed yesterday that four STAR Board-focused ETFs are under application review. Since September of 2020 19 STAR Board/ChiNext-dedicated ETFs have been launched in China, raising a total of RMB 70 billion. This is overwhelmingly positive for the technology innovation-focused board.

While the covid situation in Hong Kong remains dire, we are optimistic about the approval of Pfizer’s covid treatment for use in China. Also, Sinovac has released an mRNA vaccine, which bodes well for China’s potential reopening later this year.

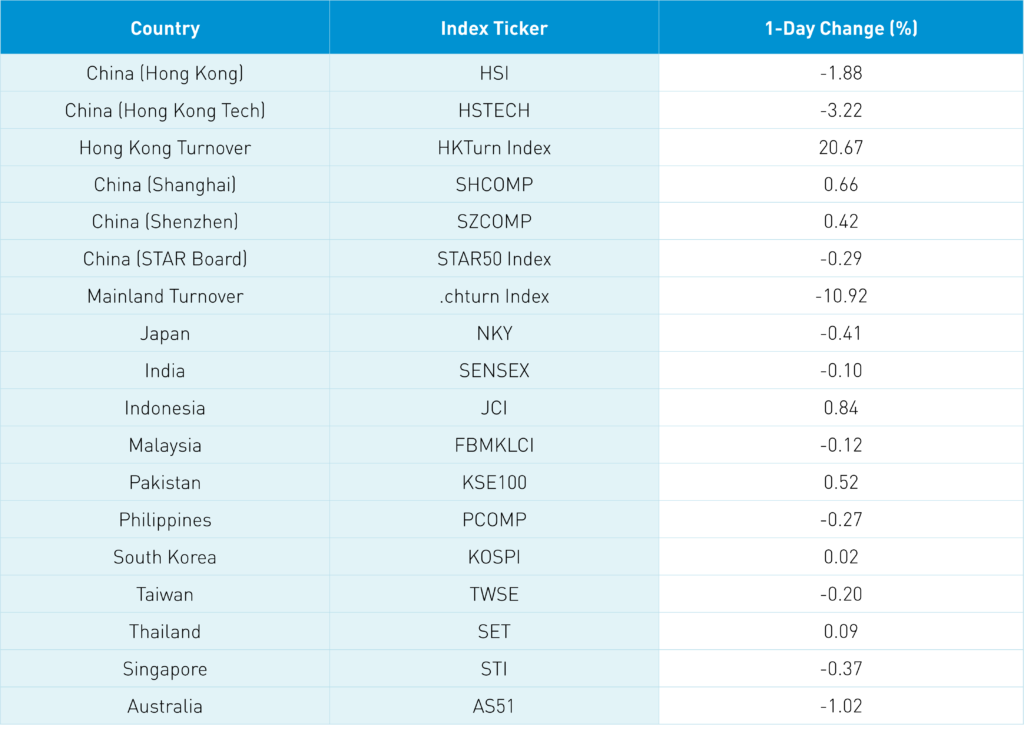

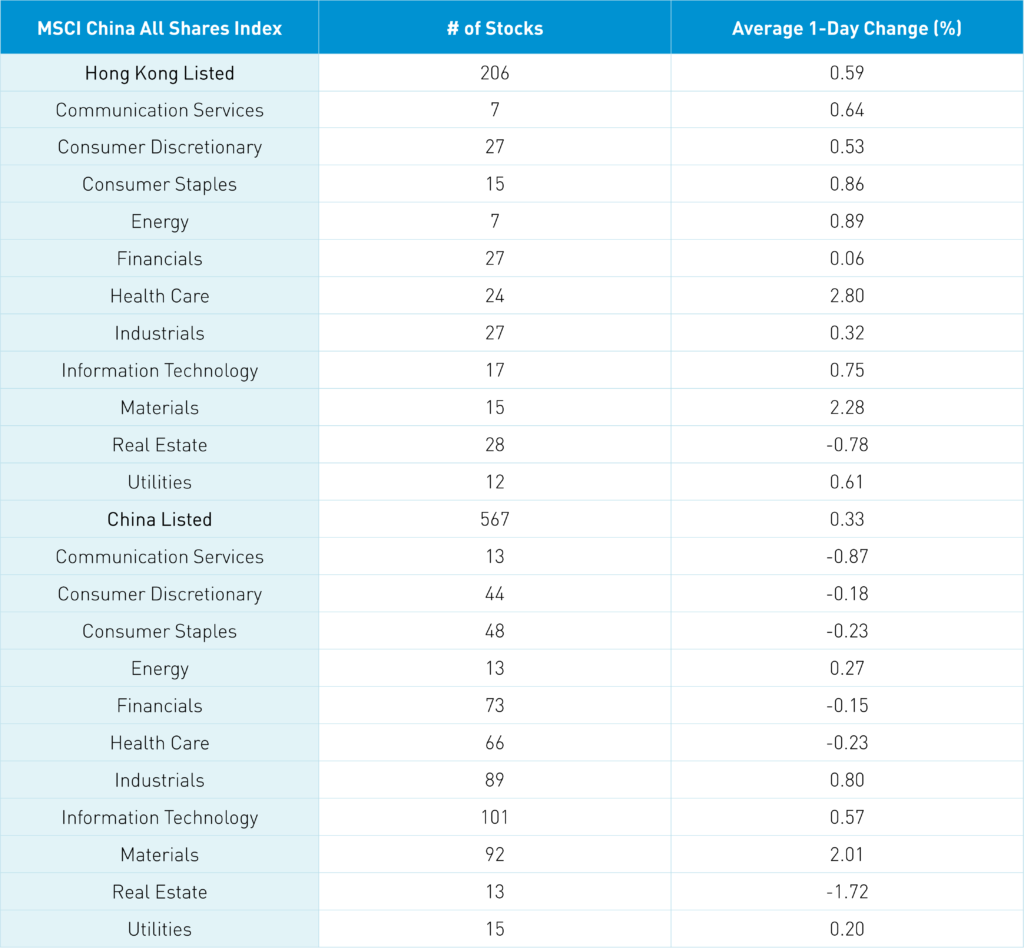

The Hang Seng Index fell -1.88% overnight, pulled lower by Hong Kong-listed China internet stocks as the Hang Seng TECH Index fell -3.22%. Volumes were up +20.67%, edging closer to the 1-year average. The materials sector was a bright spot in both Hong Kong and Mainland China.

Shanghai, Shenzhen, and the STAR Board closed +0.66%, +0.42%, and -0.29%, respectively, overnight on volumes that were -10.92% lower than yesterday, well below the 1-year average.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.33 versus 6.34 yesterday

- CNY/EUR 7.18 versus 7.20 yesterday

- Yield on 1-Day Government Bond 1.60% versus 1.50% yesterday

- Yield on 10-Year Government Bond 2.80% versus 2.78% yesterday

- Yield on 10-Year China Development Bank Bond 3.01% versus 3.03% yesterday

- Copper Price +0.15% overnight