Fed Fears Weigh on Foreign Sentiment Though Not Chinese Sentiment

2 Min. Read Time

| Upcoming Webinars: |

| Join us today, April 6th for our webinar at 11:00 am EDT Carbon Reset: Where Allowance Markets Go From Here Click here to register. Join us tomorrow, April 7th for our webinar at 10:00 am EDT Q1 2022 China Market Update: The Sum of All Fears & Liu He Lifts the Market Click here to register. |

Key News

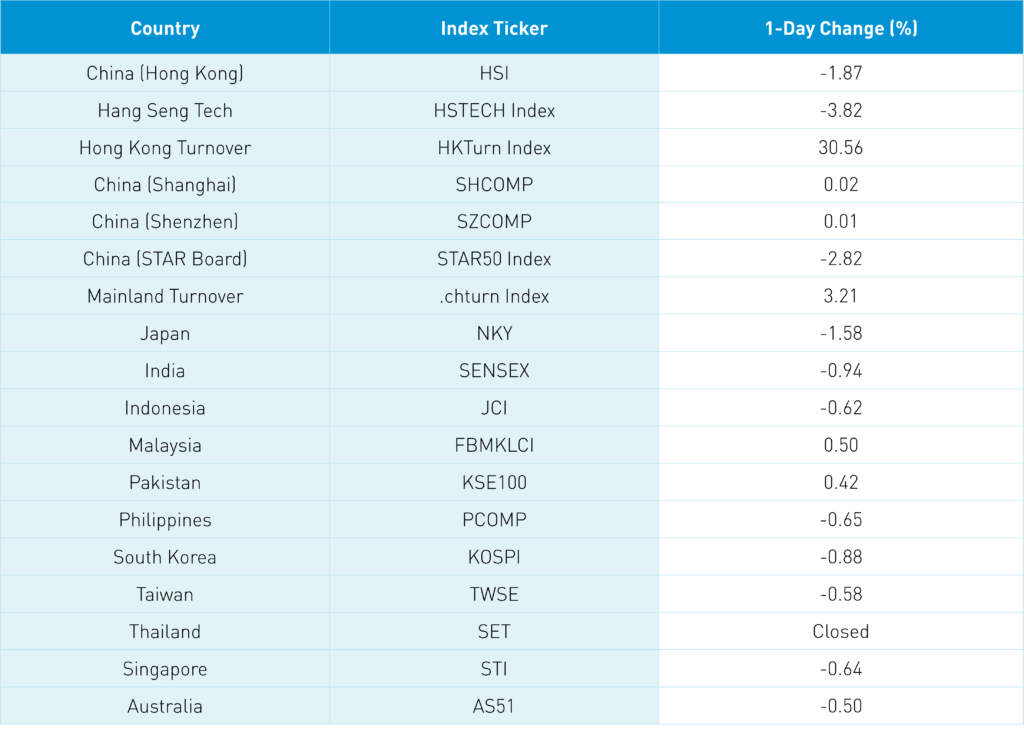

Thailand chose the right day to be on a market holiday as Asian equities took a one-two punch from Fed Gov Brainerd’s statement that US interest rates will rise in conjunction with the Fed balance sheet contracting. This is in advance of today’s Fed minutes release. Japan and Hong Kong underperformed while China managed a small gain as Shanghai’s lockdown weighed on foreign sentiment, reflected in Hong Kong's weakness more so than in China.

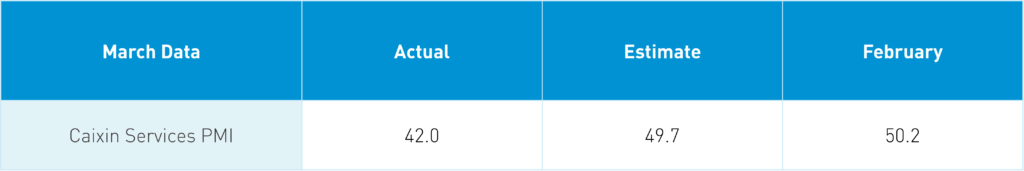

The March Caixin Services PMI missed expectations of 49.7 versus the release of 42 and Feb’s 50.2.

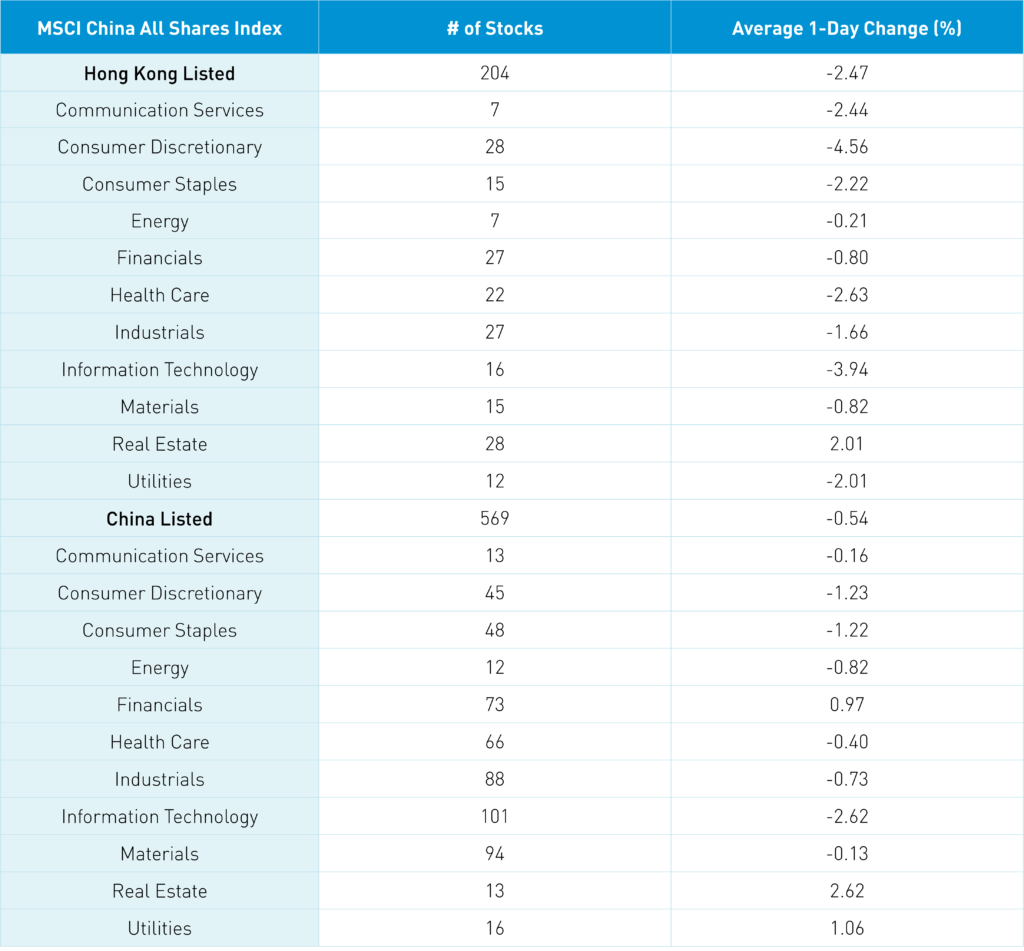

Real estate was the best performing sector in China +2.62% and Hong Kong +2% on continued optimism that increased policy support is coming. Troubled developer Kaisa announced a deal with a Chinese asset manager and industrial zone owner to jump-start several stalled projects.

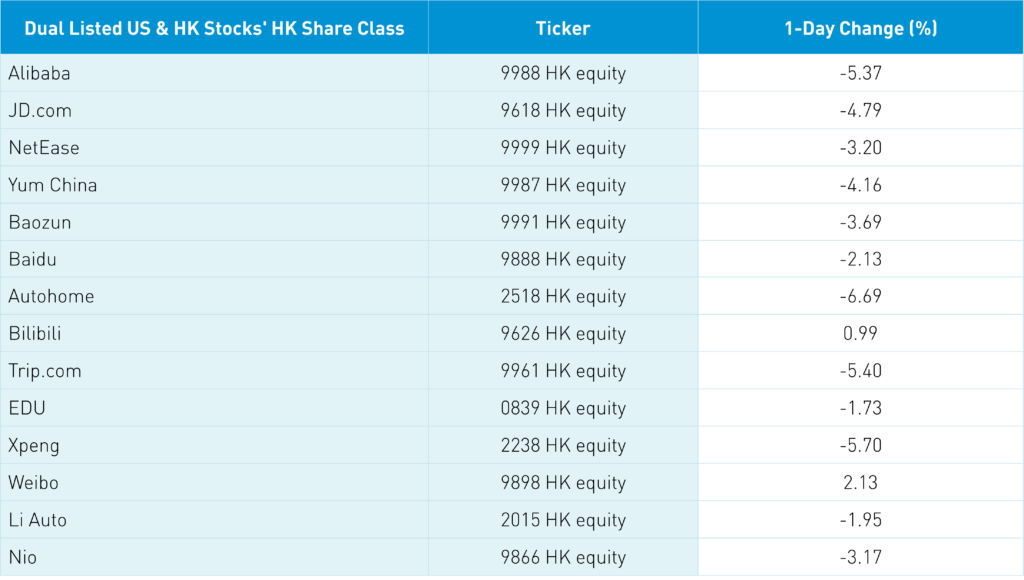

Hong Kong internet stocks were off/took a breather following US ADRs’ weakness on Tuesday. Skeptics will want to see a definitive HFCAA deal or a clear understanding of a path to compliance. US tech weakness didn’t help as the growth underperformed value. It would be interesting if US regulators opined on biotech company BeiGene’s (BGNE US, 6160 HK) decision to switch its auditor from E&Y China to E&Y USA. The latter is a PCAOB compliant auditor, which would allow BeiGene to be HFCAA compliant. The company’s move was after it submitted its 2021 annual report to the SEC which is why it ended up on the non-compliance list. I do not believe this move is feasible for most ADRs as the company derives more revenue outside of China than in China.

Hong Kong-listed Kintor Pharma closed +106% after announcing a positive covid drug trial though the drug has yet to be approved unlike Pfizer’s oral drug currently in use in China. The EV ecosystem was off in both Hong Kong and China as the market is worried higher input prices could lead car manufacturers to increase prices due to higher input prices for lithium and other materials.

The Hang Seng Index was off -1.87% on light volume up lightly from Monday’s lackluster volume. Bloomberg is having a data issue on Hong Kong’s turnover but from looking at volumes of individual stocks they appear light to me. Apologies for this. Decliners outpaced advancers almost 2 to 1. Hang Seng Tech was off -3.82% led lower by internet names and broad tech weakness. All sectors were negative less real estate. Mainland investors were small net buyers of Hong Kong stocks as Tencent was a small net sell and Meituan bought. Tencent bought 785k shares today as its buyback streak is now eight days in a row.

Shanghai, Shenzhen, and STAR Board diverged +0.02%, +0.01%, and -2.82%, respectively, on light volume just below the 1-year average. Advancers outpaced decliners 2 to 1 as value and dividend factors outperformed growth and momentum factors. Tech, discretionary and staples were weak down -2.48%, 1.23% and -1.22% while real estate, utilities and financials gained +2.63%, +1.07% and +0.98%. Foreign investors were net sellers of Mainland stocks though due to the Bloomberg data issue the exact number isn’t known to me.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.36 versus 6.34 yesterday

- CNY/EUR 6.94 versus 7.04 yesterday

- Yield on 10-Year Government Bond 2.76% versus 2.81% yesterday

- Yield on 10-Year China Development Bank Bond 3.01% versus 3.04% yesterday

- Copper Price +0.46% overnight