China Gov’t Goes “All-Out” while Q1 Earnings Power Rebound

2 Min. Read Time

Key News

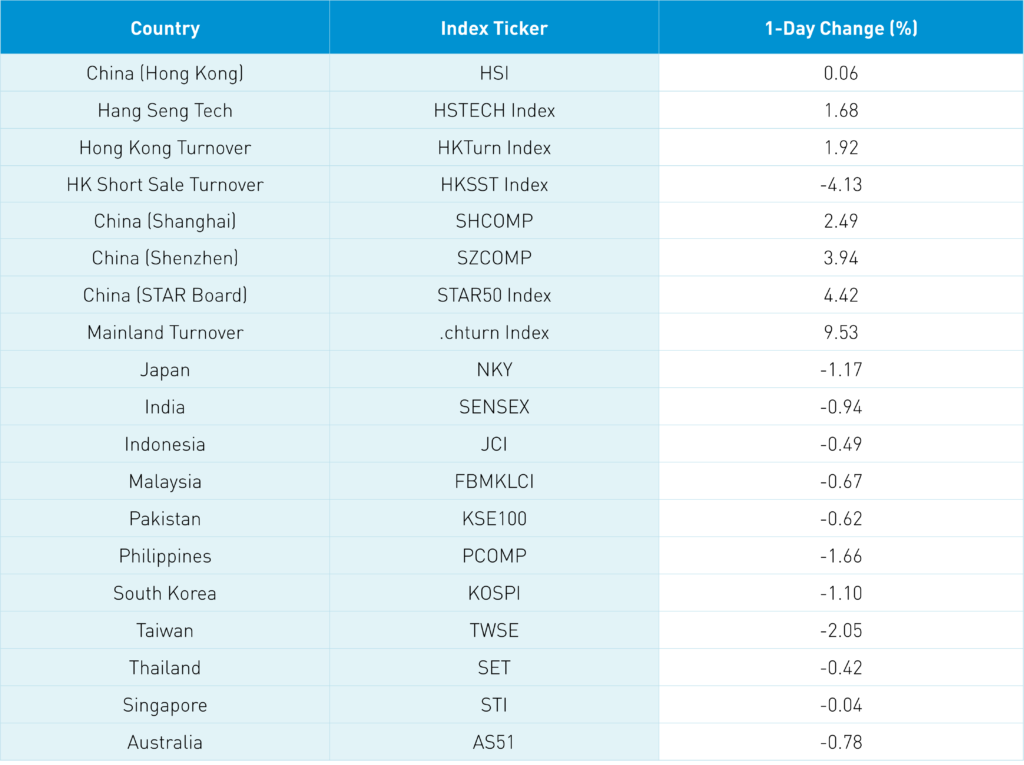

Asian equities were off following the US equity market’s downdraft as China, and Hong Kong were the only markets up. The Shanghai Composite gained +2.49%, Shenzhen +3.49%, STAR Board +4.42%, Hang Seng +0.06%, and Hang Seng Tech +1.68%. Tech-heavy Taiwan was off -2.05% as a Covid outbreak failed to receive western media attention.

President Xi headed the top economic policy team meeting, which resulted in a press release promising “all-out efforts” to support key areas of the economy.The release following the meeting called for “all-out efforts to strengthen infrastructure construction,” focusing on “sci-tech facilities, water conservancy projects, transport hubs, information infrastructure, and national strategic reserves.” The news sent material stocks in China and Hong Kong up +6.01% and +5.73%, and industrials stocks in China and Hong Kong +4.52% and +2.34%. The release also stated, “a smart grid must be developed, a series of new green, low-carbon energy bases built,” which lifted the cleantech ecosystem. Several important and widely held stocks released strong first quarter results as earnings season kicks off in China.

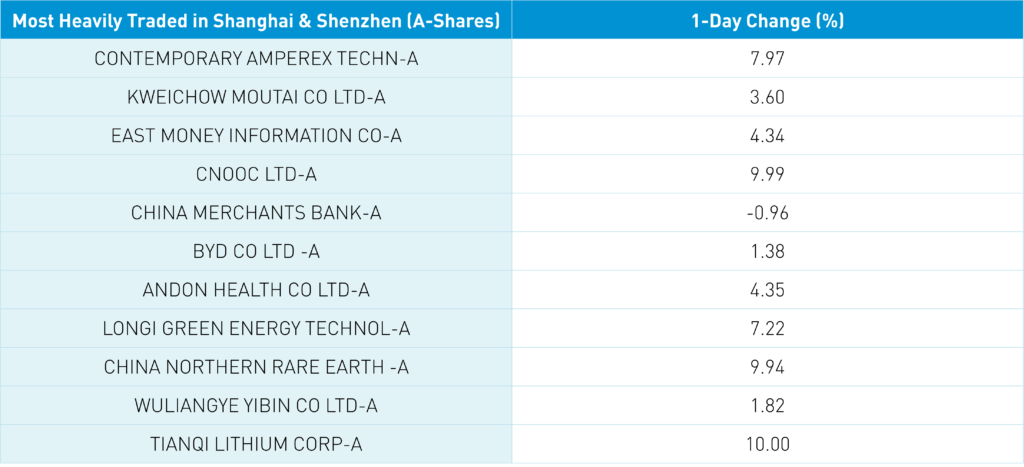

Ganfeng Lithium (0024600 CH) gained +10% after quarterly profit jumped +955% as net income was RMB 3.53B versus last year’s RMB 471mm. Huayou Cobalt (603799 CH) +9.99% after net income was increased RMB 1.21B from Q1 2021’s RMB 654.2mm. Kweichow Moutai (600519 CH) +3.6% after revenue +18% year over year and net income +24% YoY. After the close, BYD (1211 HK and 002594 CH) reported net income increased RMB 808mm from RMB 237mm YoY. Not all results were this steller as Fosun Pharma (600196 CH) saw net income decline to RMB 462mm from Q1 2021’s RMB 847mm. Yes, we know Q2 will be off though the Mainland China equity market is in a bear market on these fears. Beijing reported more than 19mm people have been tested, with 46 new cases reported overnight. The majority were in the Chaoyang District, where we would stay at the JW Marriott coincidentally. Shanghai reported 1,606 cases though the rate of new infections is slowing. Bloomberg Business had a piece on why there are no mRNA vaccines in China which we have spilled some ink on recently. Chatter on the development of an mRNA vaccine has picked up. There should be an exceedingly strong incentive to get such a vaccine up and running.

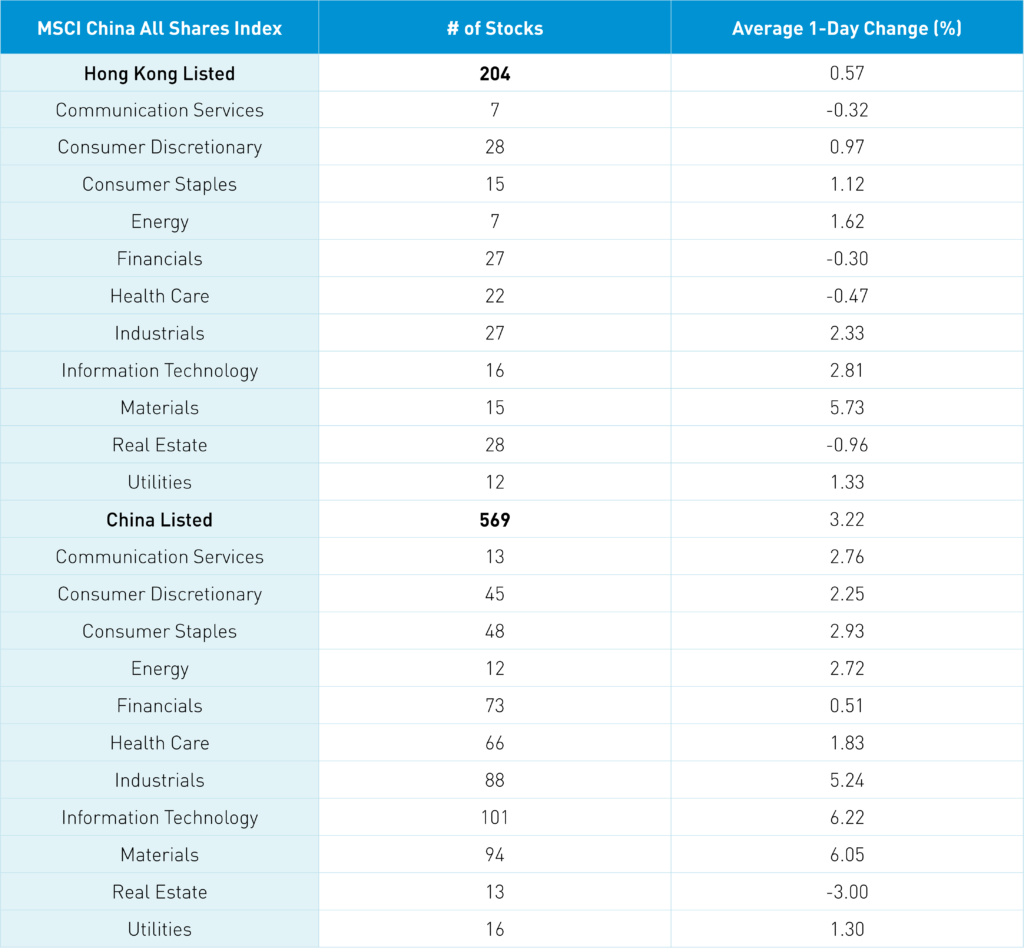

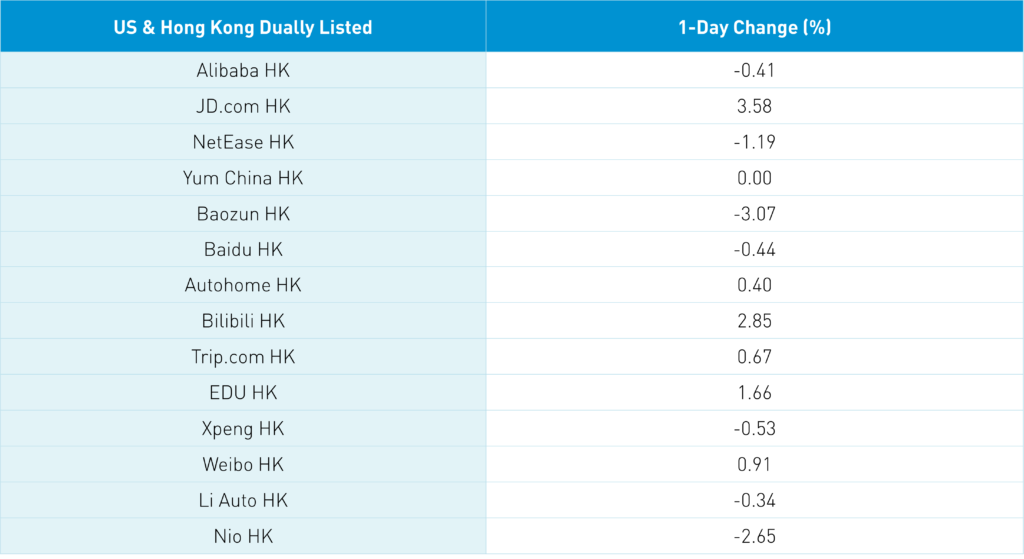

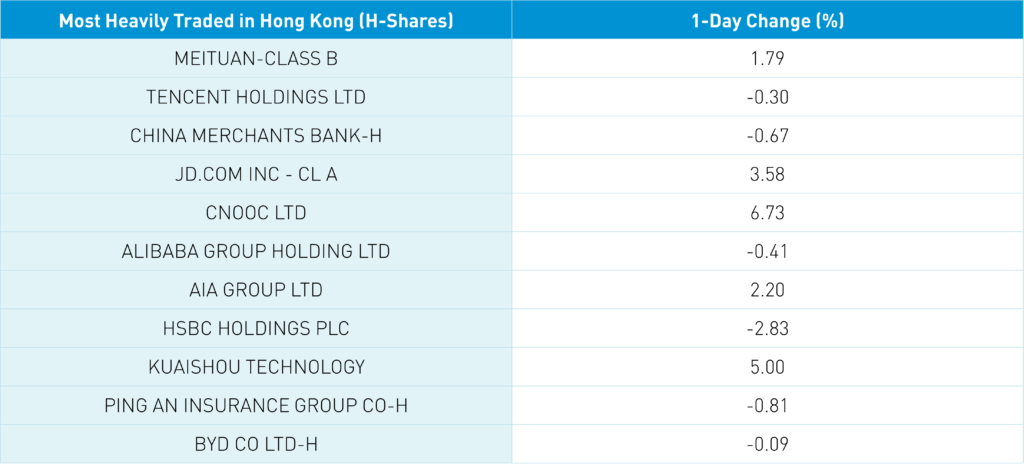

The Hang Seng Index and Hang Seng Tech Index gained +0.06% and +1.68% on volume +1.92%, which is 86% of the 1-year average. There were 307 advancers and 163 decliners. Hong Kong short sale volume declined by -4.13%, which is 95% of the 1-year average. Interesting day as a combination of consumption plays, tech such as semis and software outperformed. Factors were such as value and dividend did well versus growth though quality perked up. Sectors performers were materials +5.72%, tech +2.81%, industrials +2.33% and energy +1.62% while real estate -0.96%, healthcare -0.48% and communication -0.32%. Mainland investors were net buyers of Hong Kong stocks today, with Meituan seeing a strong net buy and Tencent

Shanghai, Shenzhen, and STAR Board gained +2.49%, +3.94%, and +4.42% on volume +9.53%, which is 85% of the -year average. There were 3,547 advancing stocks and 869 declining stocks. Growth factors significantly outperformed value factors today: tech +6.18%, materials +6.01%, industrials +5.21%, and real estate -3.03%. Clean technology had a very strong day led by clean technology stocks such as EV battery stock maker CATL +7.97%, lithium stock Tianqi Lithium +10%, and Ganfeng Lithium +10% after quarterly profit jumped +955% as net income was RMB 3.53B versus last year’s RMB 471mm and solar stocks such as Longi Green Energy +10%. Today, foreign investors bought $665mm of Mainland stocks via Northbound Stock Connect. Treasury bonds sold off, CNY eased -0.1% versus the US $, and copper +0.19%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.55 versus 6.54 yesterday

- CNY/EUR 6.95 versus 6.99 yesterday

- Yield on 10-Year Government Bond 2.84% versus 2.83% yesterday

- Yield on 10-Year China Development Bank Bond 3.07% versus 3.05% yesterday

- Copper Price +0.19%