PCAOB Officials Arrive in Beijing, Week In Review

2 Min. Read Time

Week in Review

- The arrest of a man named Ma in Hangzhou sent Alibaba lower on Tuesday, though the man arrested was not Jack Ma. This is an unfortunate example of investors’ willingness to “shoot first and ask questions later.”

- Bilibili announced that it would be migrating its Hong Kong listing from a secondary listing to a dual primary listing while KE Holdings filed for a Hong Kong listing.

- An editorial published by the Economic Daily, a Mainland media source, noted new draft policies set to support innovation and sustainable development among internet platforms and the end of the previous regulatory cycle, which focused on addressing issues in the industry. The article followed government meetings with industry leaders over the long weekend.

Friday’s Key News

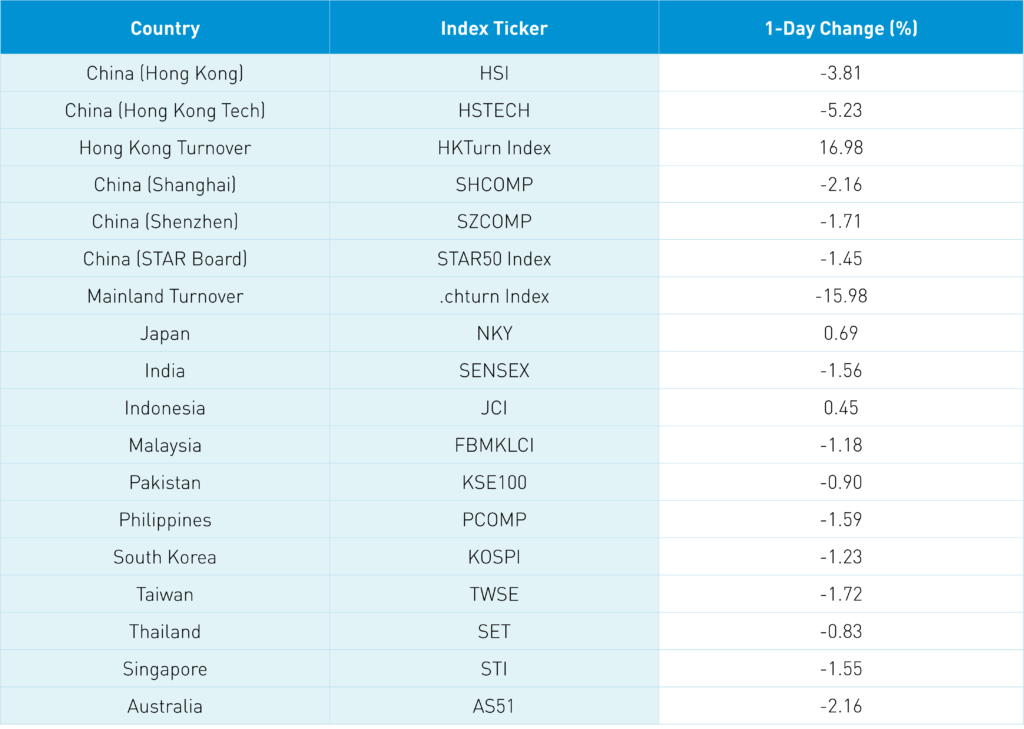

Asian equities followed US equities lower except for Japan overnight as the delayed reaction to the US Fed’s 0.50% interest rate hike on Wednesday bled into Asian markets. Internet stocks were particularly hard hit, though there were few places to hide in last night’s price action outside of a handful of value sectors.

Reuters reported that officials from the US Public Company Accounting Oversight Board (PCAOB) have arrived in Beijing to attempt to settle the issue of audit reviews for US-listed Chinese companies and avoid delisting. While this is not the first time that officials from the US regulatory body have visited China, this is the first time they have travelled since the CSRC stated its readiness to make key concessions to allow audit reviews by foreign regulators and asked US-listed firms to prepare for more audit disclosures. Good news!

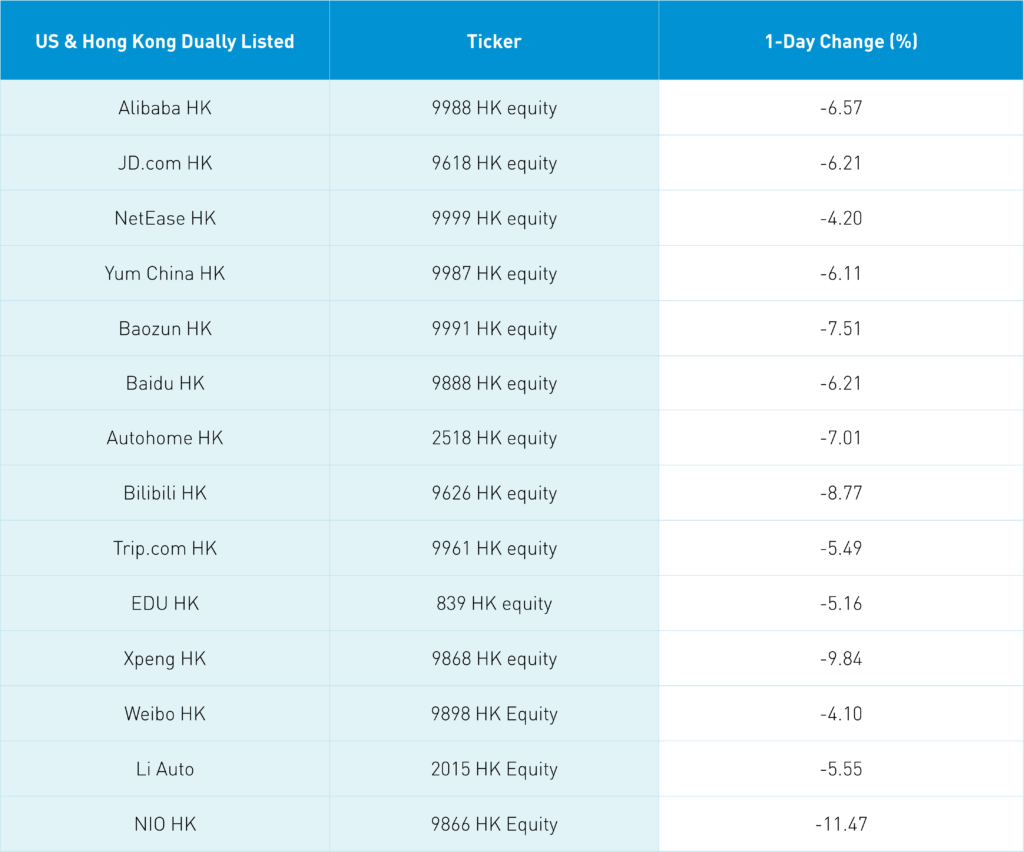

Shares in China-based internet companies are directly mirroring their US peers, which sold off heavily yesterday. The lack of a specific catalyst overnight and regulatory uncertainty related to delisting and the precise policies that China’s officials will undertake to support their development meant that these stocks traded in line with their US peers’ disappointing performance. However, for both the US and China internet space, Bank of America’s key bull/bear indicator is now close to “extreme bear,” which usually precedes a turnaround. However, timing is uncertain.

The electric vehicle ecosystem was off heavily overnight as Nio and XPeng were added to the SEC’s list of companies that could potentially face delisting.

Real estate names were off in China and Hong Kong. In particular, Country Garden Holdings fell by nearly -10% in Hong Kong.

Evergrande announced it reached an agreement with yuan bondholders to extend a payment by six months. The holders of onshore bonds totaling $3 billion made the decision to provide the embattled property developer with some relief with 99% voting in favor. Although the company is still not out of the woods yet, tides appear to be turning in China’s real estate sector and creditors appear to be willing to cut the company some slack. The Labor Day weekend, which was last weekend in China, is typically a boom time for property sales, though not so much this year. Nonetheless, Evergrande is offering 2,000 homes for sale as of April 30th.

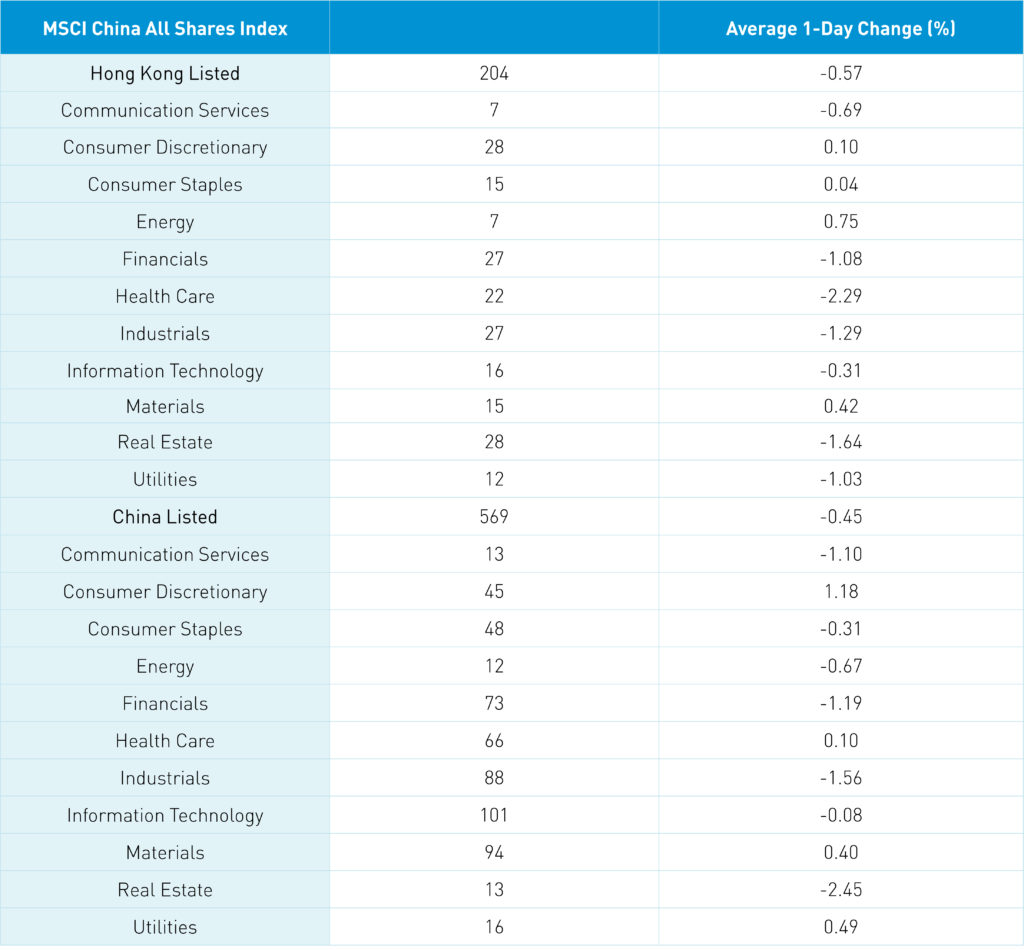

The Hang Index and Hang Seng TECH Index both closed sharply lower at -3.81% and -5.23%, respectively, overnight on volume that was +17% higher than yesterday. Nearly all sectors in Hong Kong were lower except for consumer staples, energy, and utilities. Value factors slightly outpaced growth factors.

Shanghai, Shenzhen, and the STAR Board closed -2.16%, -1.71%, and -1.45%, respectively, on volume that was -16% lower than yesterday. The yield on the 10-year China treasury was flat while CNY depreciated slightly versus the US dollar and copper prices fell.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.67 versus 6.66 yesterday

- CNY/EUR 7.04 versus 6.99 yesterday

- Yield on 1-Day Government Bond 1.44% versus 1.44% yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.83% yesterday

- Yield on 10-Year China Development Bank Bond 3.06% versus 3.05% yesterday

- Copper Price -1.37% overnight