Weibo Earnings Negate Investor Pessimism

2 Min. Read Time

Key News

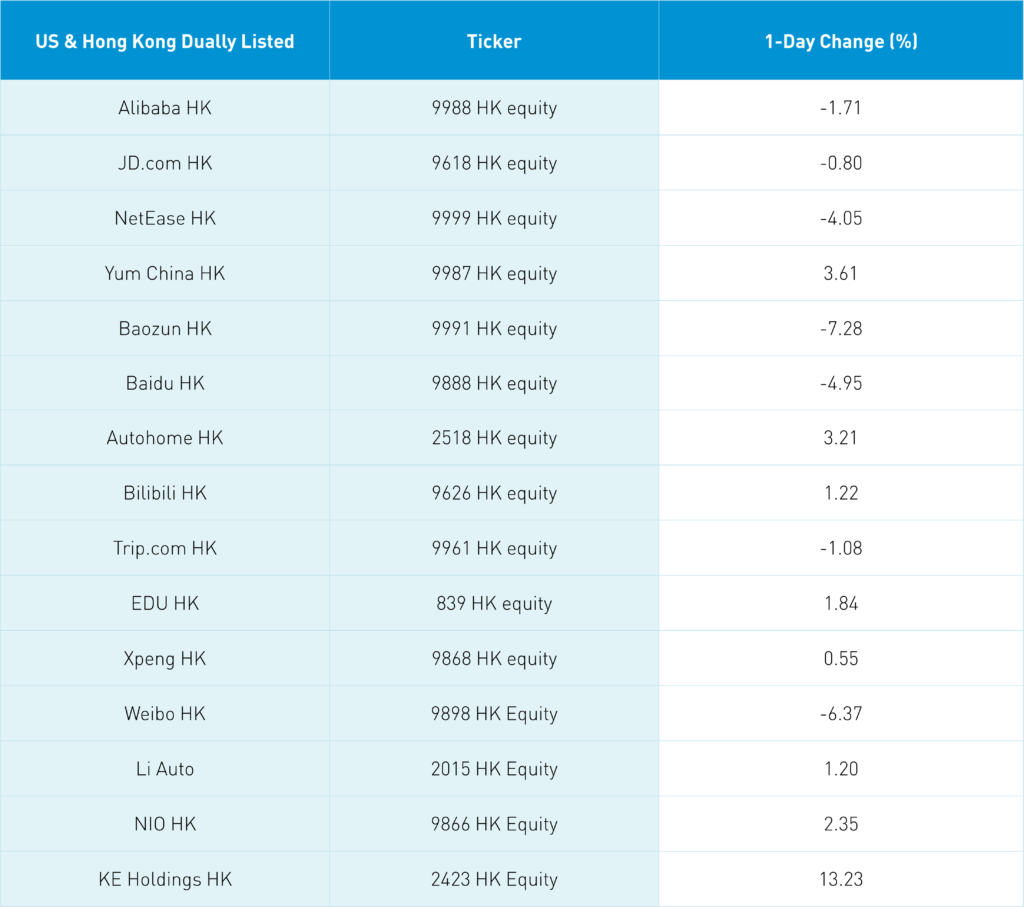

Asian equities were mixed overnight following the lackluster performance on Wall Street yesterday. Internet stocks were clipped after strong performance yesterday.

China’s lockdowns eased overnight as low-risk areas in Shanghai came back online, offering some relief for global supply chains. According to reports, a network of tens of thousands of lab testing booths are being set up across the country’s largest and most economically vital cities, with the goal of having residents always just a 15-minute walk away from a swabbing point. On the vaccine front, no news yet on the distribution of a China-made mRNA vaccine, though hopefully vaccines will be distributed as effectively as tests.

Weibo Earnings Overview

Chinese social media company Weibo beat analyst estimates slightly thanks to relatively resilient advertising revenue that increased +10% year-over-year (YoY) in the first quarter. The company released earnings following the close in Hong Kong, where the stock traded down in yesterday’s session as investors expected lockdowns to have a heavier impact on the company’s results.

- Revenue increased +6% YoY to RMB 484 million

- Net Income was RMB 110 million

- Net Income Margin was 22.8%

- Earnings per Share (EPS) was RMB 0.56 versus an estimated 0.47

KE Holdings (“Beike”) Earnings Overview

Online real estate platform KE Holdings reported earnings yesterday. The company’s results reflect the difficulties in China’s real estate market as it undergoes a regulatory re-vamp. Though, as we have started before, we believe we are seeing a turning of the tide in real estate. However, that would not be reflected in the company’s first quarter results. Nonetheless, the company’s losses were not as wide as expected and it produced a positive adjusted EPS. Clearly, the company is still in growth-mode.

CEO Stanley Yongdong Peng said: "In the first quarter, facing significant uncertainties arising from the outbreaks of COVID-19 variants in some cities and a soft macroeconomic outlook, we continued to strive forward with a determined focus on serving our customers, caring for our service providers and an optimistic mindset to further grow our presence in the broader housing related services."

- Revenue decreased -40% to RMB 12.5 billion

- Net Income was RMB -439 million

- Net Income Margin was -3.5%

- Earnings per Share (EPS) was RMB 0.02 versus an estimated -0.36

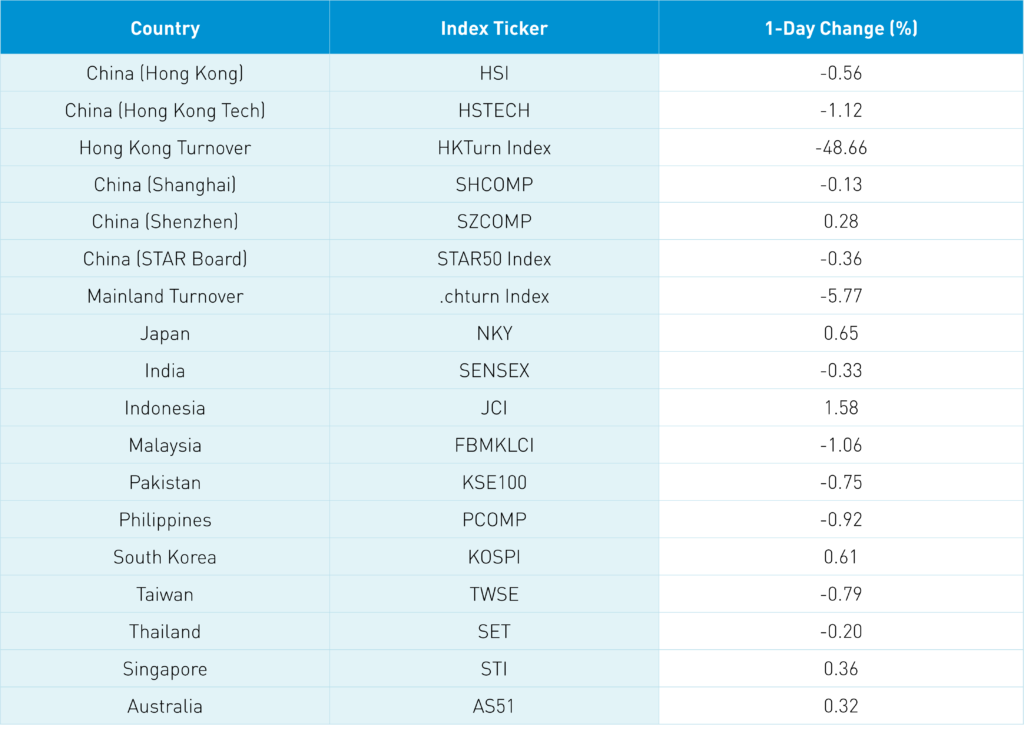

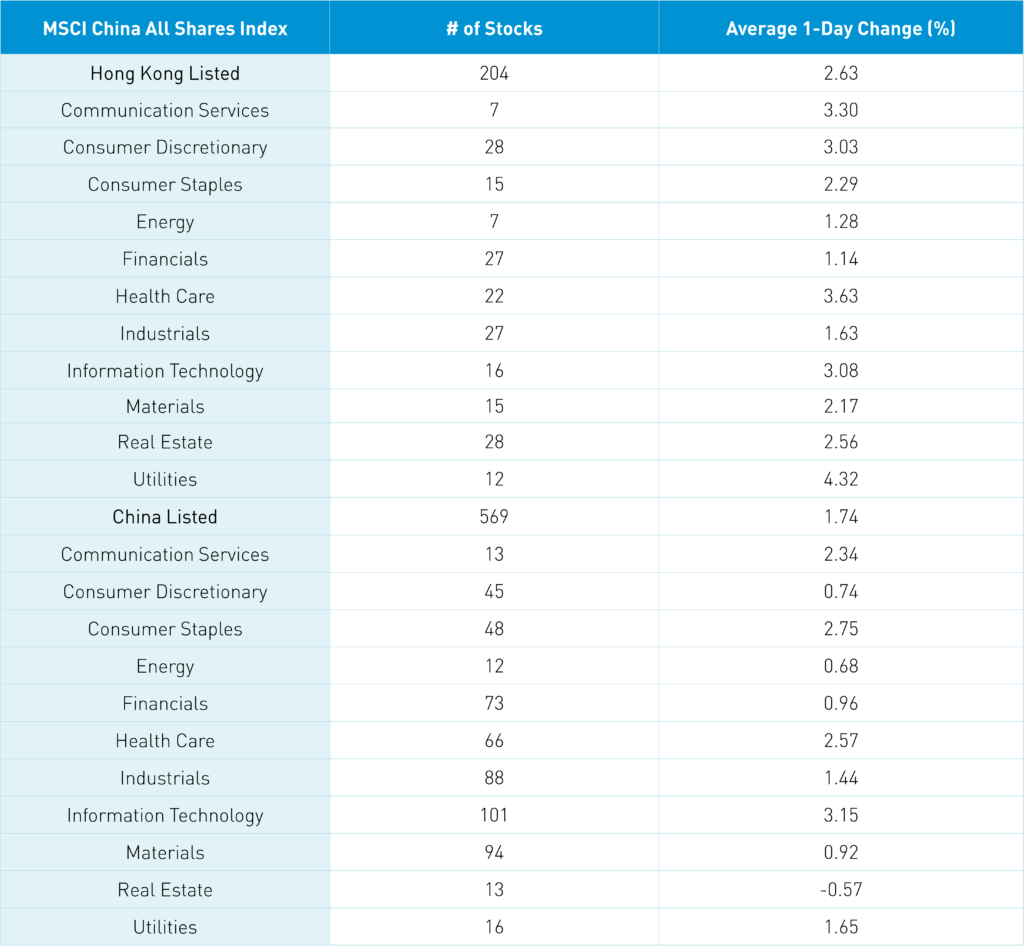

The Hang Seng and Hang Seng Tech Indexes closed -0.56% and -1.12%, respectively, on volume that decreased -49% from yesterday. Health care was one of the best performing sectors in Hong Kong while financials were laggards.

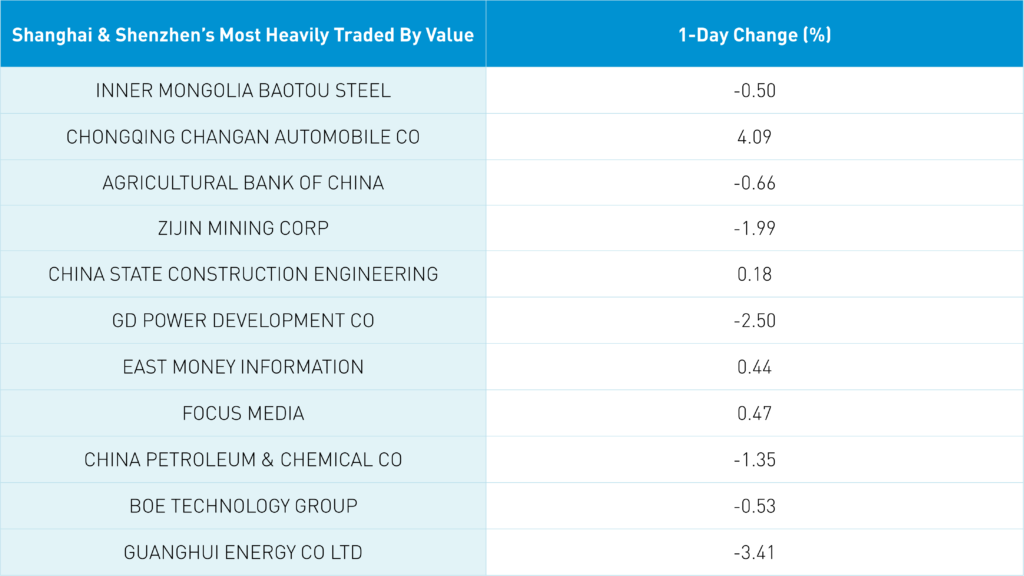

Shanghai, Shenzhen, and the STAR Board closed -0.13%, 0.28%, and -0.36%, respectively, on volume that decreased -6% from yesterday. Technology was one of the best performing sectors on the Mainland while real estate names were laggards.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.67 versus 6.67 yesterday

- CNY/EUR 7.15 versus 7.16 yesterday

- Yield on 1-Day Government Bond 1.20% versus 1.23% yesterday

- Yield on 10-Year Government Bond 2.76% versus 2.74% yesterday

- Yield on 10-Year China Development Bank Bond 2.99% versus 2.98% yesterday

- Copper Price +0.35% overnight