Solar Stocks Shine as New Video Game Approval Lifts Hong Kong Internet Stocks

2 Min. Read Time

Key News

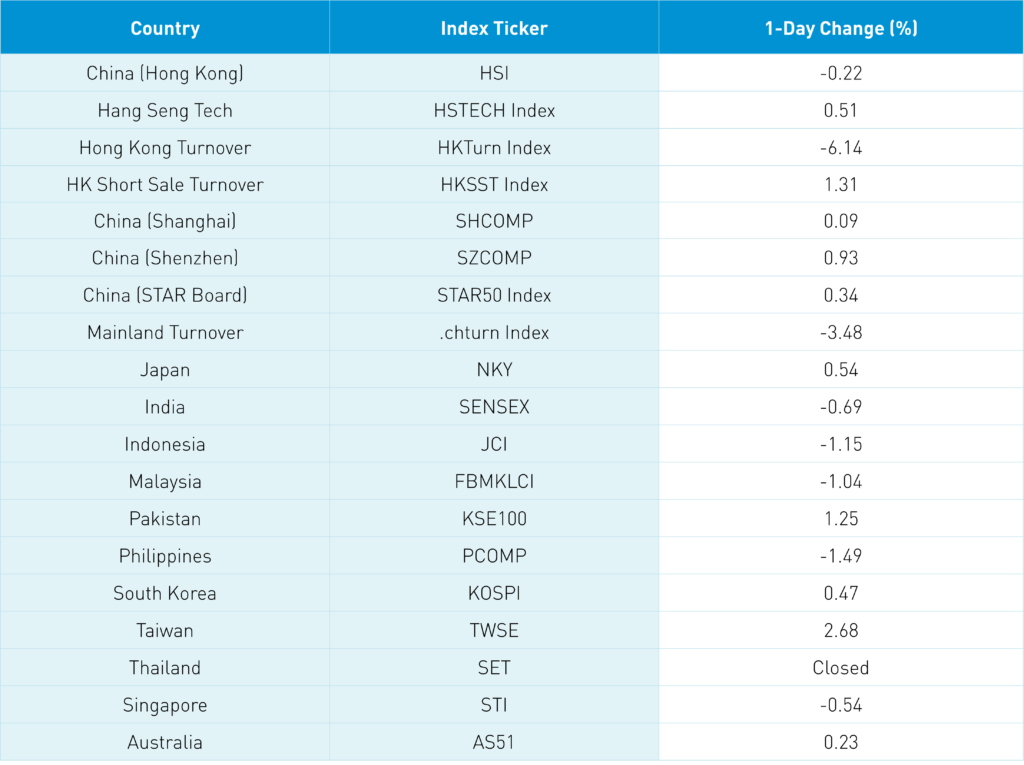

Asian equities were mixed as Taiwan had a strong day, the Philippines underperformed, and Thailand had a market holiday for Asarnha Bucha Day, which according to Google, is a Theravada Buddhist festival. June trade was released near the close of trading, with exports beating expectations while imports were a touch light. All in all, a solid release is an excellent sign for the global economy.

Hong Kong internet stocks were broadly higher following the approval of 67 new video games lifting related stocks like NetEase HK +1.83% and Bilibili HK +3.52%. Neither Tencent -0.71% nor NetEase had new games approved. Tencent, which has the sentiment overhang of Prosus trimming its stake in the company, bought another 890k shares overnight, extending its buyback streak to the eleventh day. Trip.com HK jumped +3.46% following talk of Hong Kong easing its visitor rules. Miner and processor Tianqi Lithium's Hong Kong IPO, the company's Mainland share class ticker 002466 CH, raised $1.7B though the stock was flat. US ADR listed wealth manager Noah listed in Hong Kong under ticker 6686 HK. Real estate was the worst sector in Hong Kong -3.5% though one of the top performers in China at +0.61%. Chatter that unfinished apartment buildings lead to owners not paying their mortgages also weighed on banks in Hong Kong -1.67% and the Mainland -1.46%.

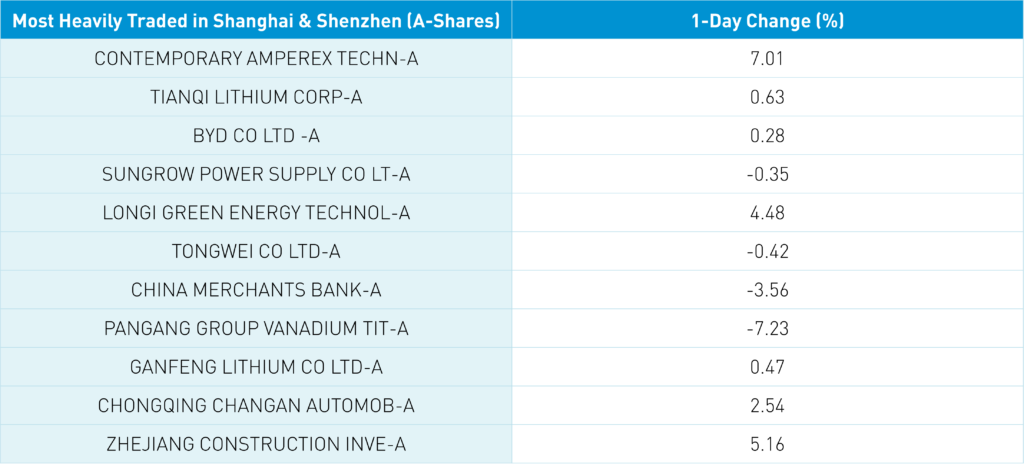

The US $ bonds of real estate companies are in free fall as investors have thoroughly exited the space. The clean tech ecosystem, emphasizing solar, had a strong day in the Mainland following talk of government support of solar installation to help China reach the 2025 peak carbon goal. Worth noting Hong Kong missed the memo. Foreign investors sold a healthy $1B of Mainland stocks via Northbound Stock Connect, with China Merchants Bank and ICBC seeing strong selling.

A Mainland media source noted Shanghai University of Finance and Economics's quarterly Shanghai consumer confidence index was at 108, which +100 signifying optimism and below 100 signaling pessimism. The release was off from Q1 due to concerns about Shanghai re-entering a lockdown. Yes, there continue to be new covid cases in China and Hong Kong. However, we see targeted quarantines at the district, neighborhood, or apartment building level instead of city-wide lockdowns. Hong Kong is averaging nearly 3k new cases but is the city shut down? No.

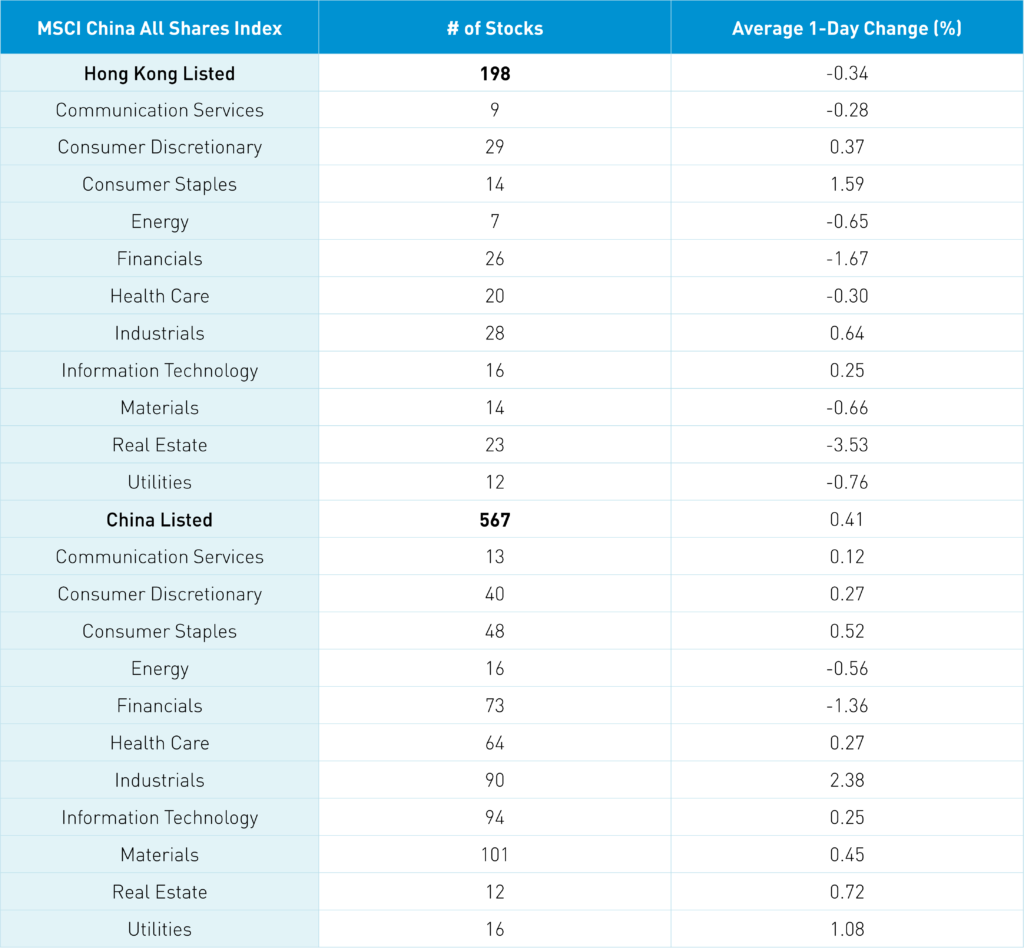

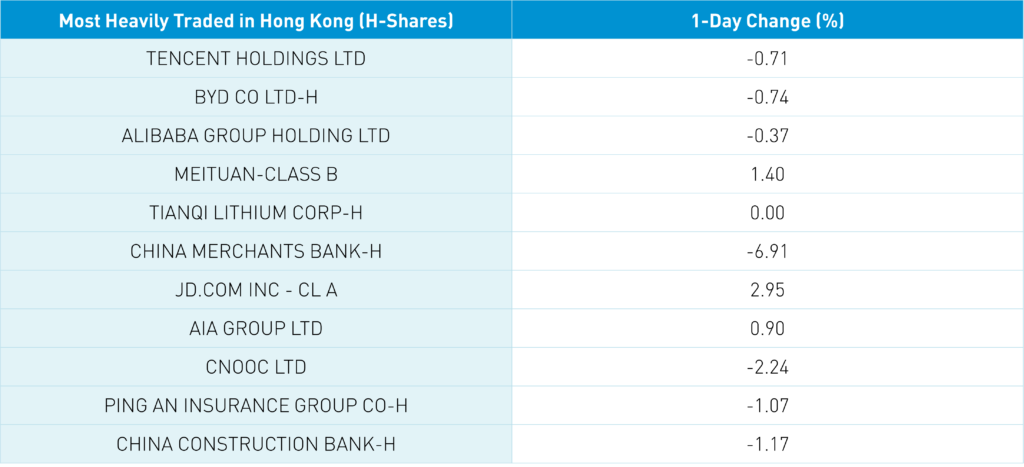

The Hang Seng and Hang Seng Tech diverged by -0.22% and +0.51% on volume -6.14% from yesterday, which is 77% of the 1-year average. 195 stocks advanced while 276 declined. Hong Kong short sale turnover increased +1.31%, 91% of the 1-year average, as 19% of Hong Kong volume was short. Growth factors were mixed as value underperformed and large caps outpaced small caps. Top sectors were staples +1.59%, industrials +0.64% and discretionary +0.37% while real estate -3.53%, financials -1.67% and utilities -0.76%. Top sub-sectors were power equipment stocks, Tik Tok-related companies, liquor, wind power, rare earth, and nuclear power companies. The bottom sub-sectors were property managers, banks, and real estate companies. Southbound Stock Connect volumes were light as Mainland investors were net buyers of Hong Kong stocks, with Tencent and Meituan small net buys.

Shanghai, Shenzhen, and STAR Board gained +0.09%, +0.93%, and +0.34% on volume -3.48% from yesterday, which is 79% of the 1-year average. 3,225 stocks advanced while 1,190 stocks declined. Growth factors outpaced value factors as small caps outperformed large caps. Top sectors were industrials +2.36%, utilities +1.06%, and real estate +0.7% while energy and financials were off -0.58% and -1.38%. The top sub-sectors were power companies, EV, and solar while semis and banks were among the worst. Northbound Stock Connect volumes were moderate as foreign investors sold a healthy -$1.022B. Treasury bonds rallied, CNY was off slightly versus the US $, and copper was hit -3.12%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.73 versus 6.72 yesterday

- CNY/EUR 6.76 versus 6.76 yesterday

- Yield on 10-Year Government Bond 2.81% versus 2.81% yesterday

- Yield on 10-Year China Development Bank Bond 3.06% versus 3.06% yesterday

- Copper Price -3.12% overnight