Real Estate Meeting Unsuccessful, Industrial Profits Rebound

2 Min. Read Time

Key News

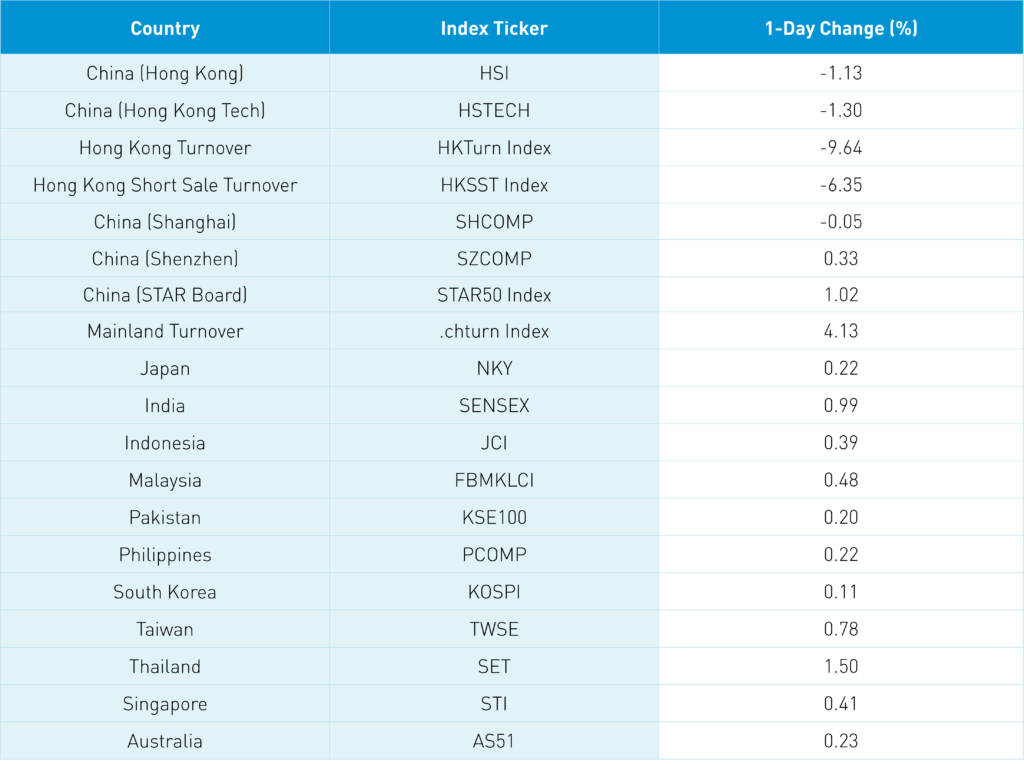

Asian equities were mixed overnight as China underperformed while Southeast and Northern Asia markets were slightly higher. A better-than-expected China economic data release and signs that we might not be out of the woods yet on the real estate front provided mixed signals for markets. Yesterday’s winners were today’s losers as real estate and internet were both weak on the day.

China’s National Bureau of Statistics (NBS) reported that industrial profits rose +0.8% in June from a year earlier. That is a significant improvement from May, when industrial profits declined by over 6% from a year earlier. The easing of lockdowns has led directly to an improvement in China’s industrial output.

Overnight, a meeting organized by the China Real Estate Association between distressed developers and financial institutions, held in Hangzhou, reportedly made little progress. Currently, the government is working out a bailout fund worth $300 billion, but they may have to increase the size of that fund to get unfinished projects completed and end the mortgage boycott. Remarkably, Hong Kong-listed developer Country Garden Holdings gave back all of yesterday’s gains. However, Mainland-listed developers fared better. Investors are uncertain where to go when it comes to China real estate, though we are seeing more indications of a bottom in the market.

Hong Kong-listed internet names were lower this morning, mirroring yesterday's sell-off in their US-listed counterparts. Alibaba erased most of yesterday's gains in Hong Kong following reports of its plans for a primary listing in Hong Kong. Meanwhile, an editorial in the Economic Daily, a state media outlet, published this morning said that China must further strengthen supervision of sales activities done via livestreaming and crack down on counterfeits, dimming sentiment on the day.

COVID was unfortunately still a drag on markets as authorities locked down almost 1 million residents of Jiangxia, a district on the outskirts of Wuhan. However, and as we have noted previously, new disease management guidelines released by the central government last month may limit the economic impact of lockdowns. A full review of the new guidelines is available in our latest China Internet Earnings Report.

The Senate on Tuesday advanced the $280 billion America COMPETES bill, which is meant to boost the semiconductor industry in the United States and to accelerate high-tech research, an area where the US has fallen behind. The Senate needed 60 votes to advance the bill, and the final Senate vote will be held later this week, after which the House will take up the bill. An earlier version of the bill included a provision to shorten the compliance window for the Holding Foreign Companies Accountable Act (HFCAA), but that provision has been removed following SEC Chair Gensler’s recommendation. Also missing from the new version of the bill are China investment restrictions. These revisions should be positive for US-listed Chinese companies.

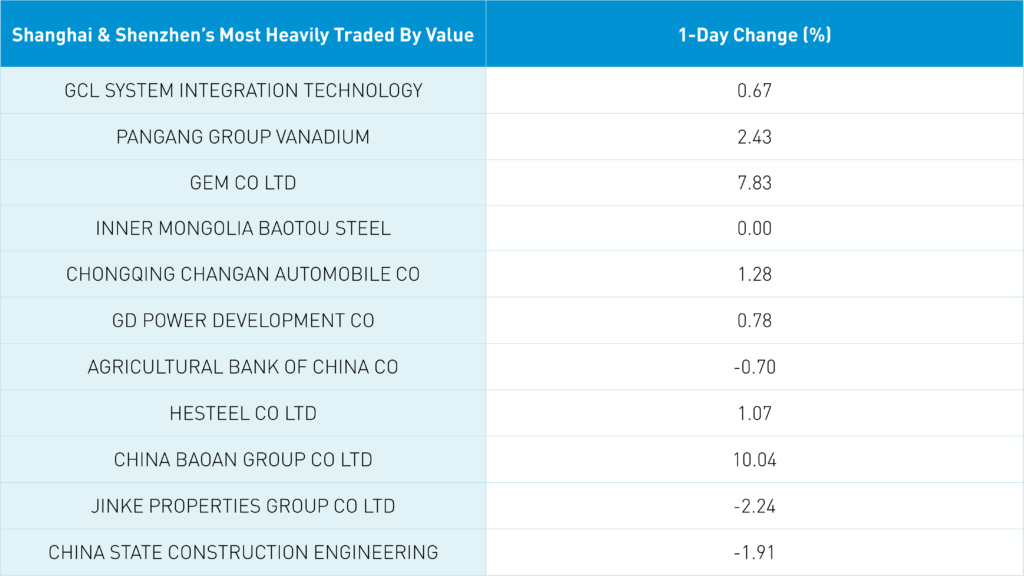

The Hang Seng and Hang Seng Tech Indexes fell by -1.13% and -1.30%, respectively, overnight on volume that was -10% lower than yesterday, which is approximately 70% of the 1-year average. Hong Kong short sale turnover decreased -6% overnight. Mainland investors bought a net $35 million worth of Hong Kong stocks overnight via Southbound Stock Connect. Both growth and value factors were lower overnight in Hong Kong.

Shanghai, Shenzhen, and the STAR Board closed -0.05%, +0.33%, and +1.02%, respectively, on volume that was +4% higher than yesterday. Foreign investors sold a net $552 million worth of Mainland stocks via Northbound Stock Connect. There was a slight growth tilt on the Mainland as the STAR Board outperformed the main board in Shanghai.

CNY was slightly stronger versus the US dollar, government bond yields were flat, and copper fell slightly.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.75 versus 6.76 yesterday

- CNY/EUR 6.85 versus 6.85 yesterday

- Yield on 1-Day Government Bond 1.04% versus 1.13% yesterday

- Yield on 10-Year Government Bond 2.77% versus 2.77% yesterday

- Yield on 10-Year China Development Bank Bond 2.95% versus 3.03% yesterday

- Copper Price -0.45%