Moonshot Weighs on Wuxi While Nio Fans Rejoice in ET5 Launch

2 Min. Read Time

Key News

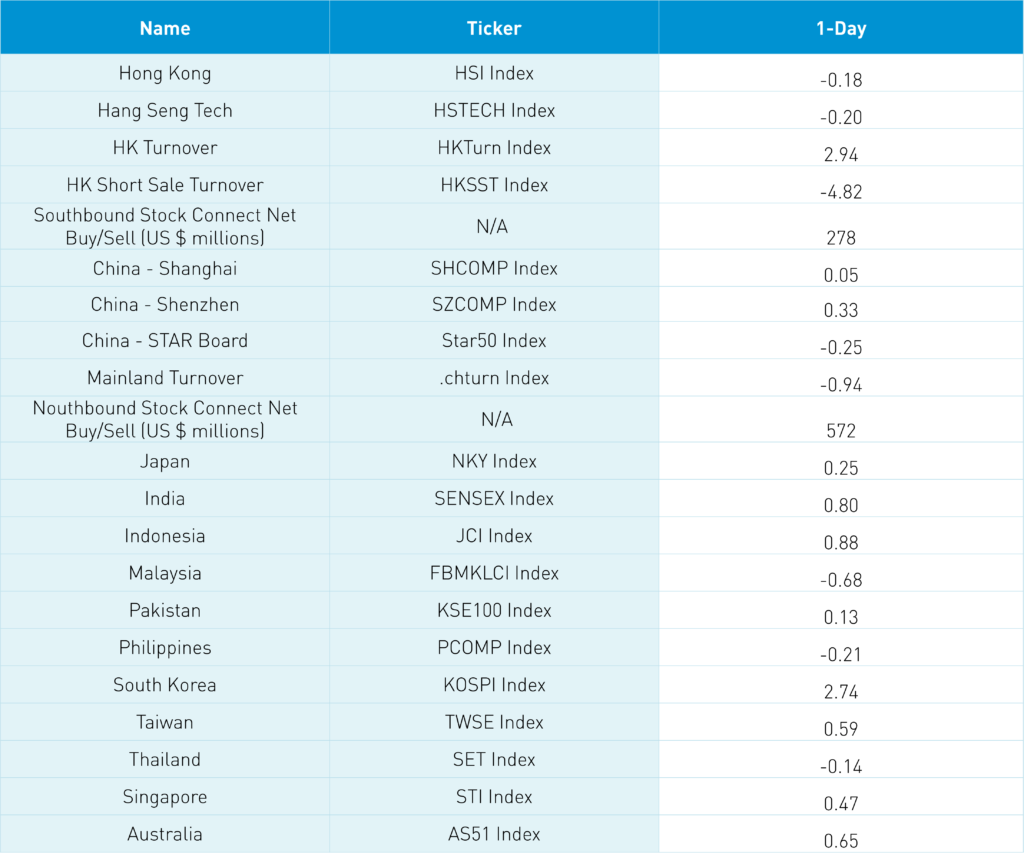

Asian equities were largely higher while Hong Kong was off as the Asia Dollar Index increased overnight.

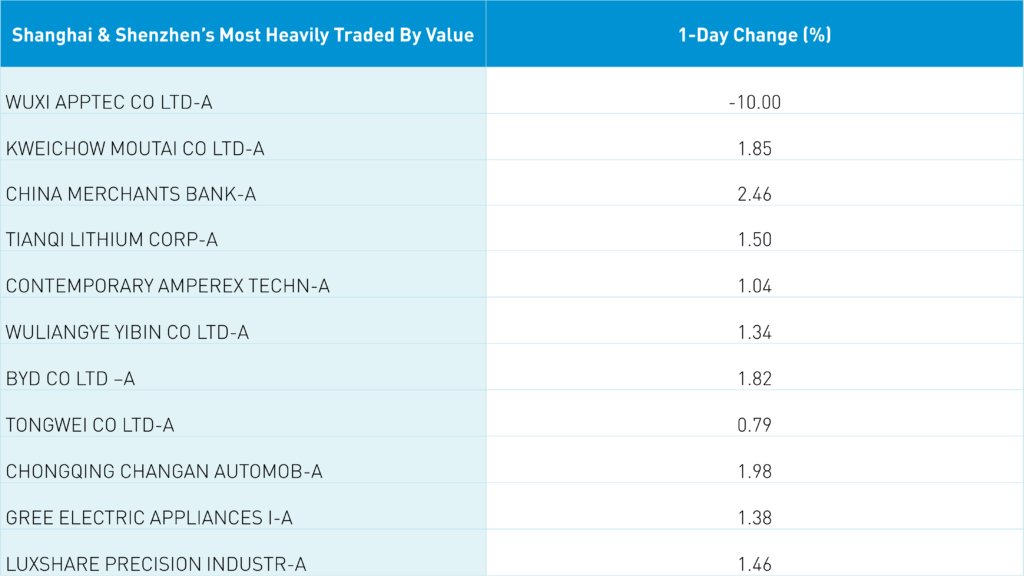

Hong Kong and Chinese biotech stocks were hit hard after President Biden’s Cancer Research "Moonshot" initiative was launched, presenting the potential for onshoring contract research that is currently done by Chinese firms. The initiative aims to find a cure for cancer by growing the US biotech industry, which investors took as a negative for Chinese biotech and healthcare companies. Wuxi Biologics (2269 HK) was Hong Kong’s most heavily traded stock by value today, falling -19.94% while WuXiAppTec (2359 HK) fell -16.82% as investors shot first before asking questions. Big companies like Wuxi already have significant operations in the United States so the reaction feels overdone.

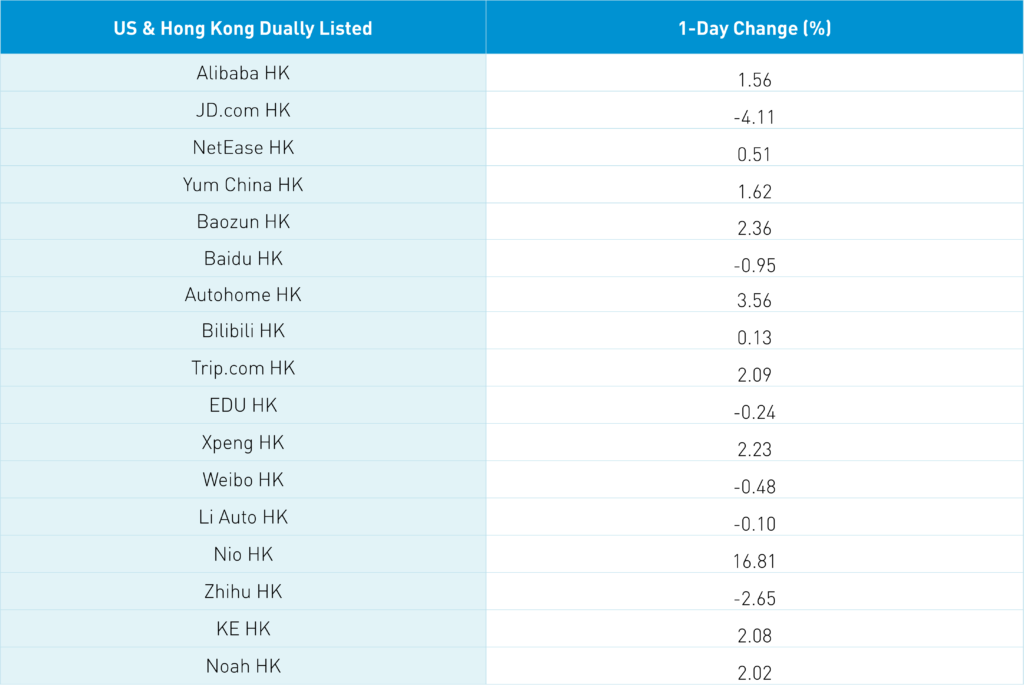

Nio (9866 HK) was up +16.81% after releasing its ET5 sedan to a Tesla-like fan frenzy.

Hong Kong internet names were mixed despite a strong session yesterday in the United States as JD.com HK (9618 HK) fell -4.11% on no news. However, Hong Kong short sale turnover has come down recently.

Rumors that Putin, Modi, and Xi may meet this week might have weighed on foreign sentiment. Post close, Bloomberg is reporting Chinese banks were asked to report their exposure to indebted conglomerate Fosun according to “sources”. Domestic investors returned from holiday in a better mood as Shanghai and Shenzhen gained though off their intra-day highs. Investors noted another economic support speech and mixed loan/credit data. Foreign investors bought $572 million of Mainland stocks today via Northbound Stock Connect. CNY was off a touch versus the US as Chinese Treasury prices eased.

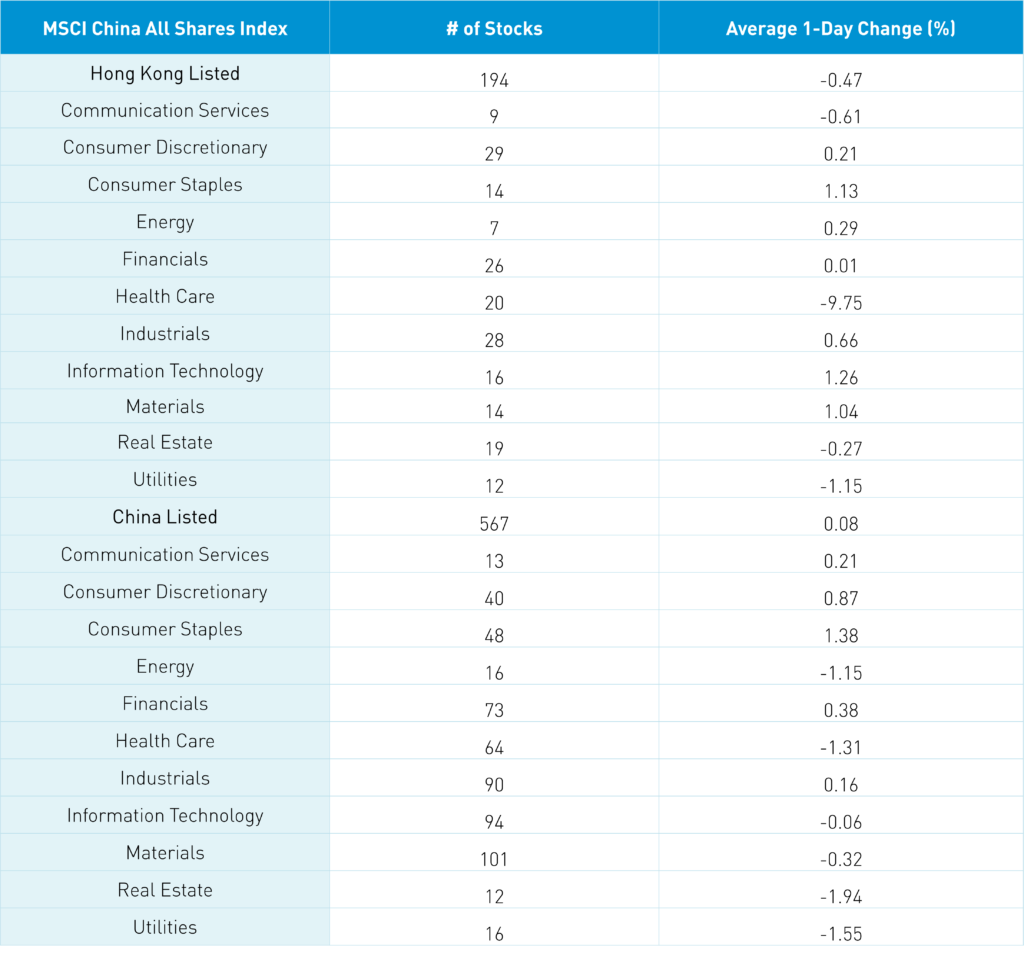

The Hang Seng and Hang Seng Tech were -0.18% and -0.2% on volume +2.95% from Friday which is 76% of the 1-year average. 271 stocks advanced while 211 stocks declined. Hong Kong short sale turnover declined -4.81% from Friday which is 71% of the 1-year average as short sale turnover was 16% of total turnover. Value and growth factors were mixed today as large caps outperformed small caps. Top sectors were tech +1.26%, staples +1.13%, and materials 1.04% while healthcare -9.75%, utilities -1.16%, and communication -0.61%. Top sub-sectors were Tik Tok ecosystem, auto parts, semis, and agriculture/food related while biotech, healthcare drugs, and software were down. Mainland investors bought $224 million of Hong Kong stocks via Southbound Connect with Wuxi Biologics a moderate buy, Meituan a moderate buy, Tencent a small buy, while Li Auto was a small sell and Kuiashou was a small/moderate sell.

Shanghai, Shenzhen, and STAR Board diverged +0.05%, +0.33%, and -0.25% respectively on volume -0.94% from Friday which is 76% of the 1-year average. 2,353 stocks advanced while 2,132 stocks declined. Top sectors were staples +1.38%, discretionary +0.87%, and financials +0.38% while real estate -1.94%, utilities -1.55%, and healthcare -1.31%. Top subsectors were office supplies and agriculture/food related while biotech, real estate, and electricity utilities were among the worst. Foreign investors bought $572 million of Mainland stocks via Northbound Stock Connect. Chinese Treasury bonds sold off, CNY eased versus the US $ to 6.93 and copper +1.41%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.93 versus 6.92 Friday

- CNY/EUR 7.04 versus 6.98 Friday

- Yield on 10-Year Government Bond 2.64% versus 2.63% Friday

- Yield on 10-Year China Development Bank Bond 2.81% versus 2.80% Friday

- Copper Price +1.41% overnight