PCAOB’s Finish Line, Dynamic Zero Reiterated, Alibaba & NetEase Report

4 Min. Read Time

Alibaba & NetEase Q3 Earnings Overview

Alibaba (BABA US, 9998 HK) reported before the US market open this morning. Zero COVID policy continued to weigh on domestic consumption, and thus Alibaba, as one tends to hoard cash and not spend it if worried about facing a quarantine. We knew this was coming as Singles Day's goods sold amount wasn't disclosed though it's said to be in line with last year's number. The key will be the consumption outlook under dynamic zero COVID which will not happen overnight but will play out incrementally. Alibaba's investments in publicly traded companies created a loss in GAAP accounting though it didn't create a cash loss which is why analysts use "adjusted"/non-GAAP for tech companies. Also, stock options don't use cash but are viewed as if they did under GAAP. Cash flow and free cash flow were strong, with a significant increase in the company's stock buyback. The key is the outlook under dynamic zero COVID.

- Revenue increased 3% year over year (YoY) to RMB 207.176B ($29.124B) versus the estimate of RMB 208B, which is a miss of -0.8%.

- Income from operations increased 68% to RMB 207B ($3.534B)

- Net income loss of $3.158B versus an Adjusted Net Income of $4.754B

- EPS loss -$0.14 versus an Adjusted EPS of $1.82

- Cash increased to $68B

- Free cash flow increased 61% to $5.020B

- Stock buyback increased by another $15B, having purchased $18B under the original $25B buyback

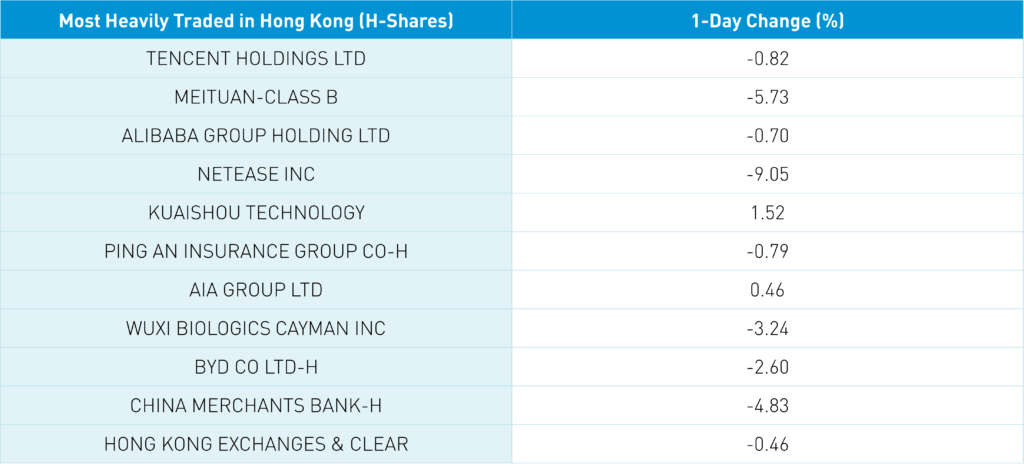

NetEase (NTES US, 9999 HK) fell -9.05% today after announcing that its long-running partnership distributing games from Blizzard in China had ended. Investors shot first, sending the stock plunging despite the company stating that the partnership accounted for low single-digit revenues. The two sides appeared to have differences of opinion on game distribution exclusivity in Asia and low profits for NetEase. NetEase reported after the Hong Kong close and crushing estimates with revenue rising +10.1% to RMB 24.426B ($3.433B) versus estimates of RMB 22.19B, EPS RMB 2.03 versus estimates of RMB 0.95 along with paying out a dividend and announcing a new $5B buyback program having already bought 27mm ADRs/$2.5B through September.

Key News

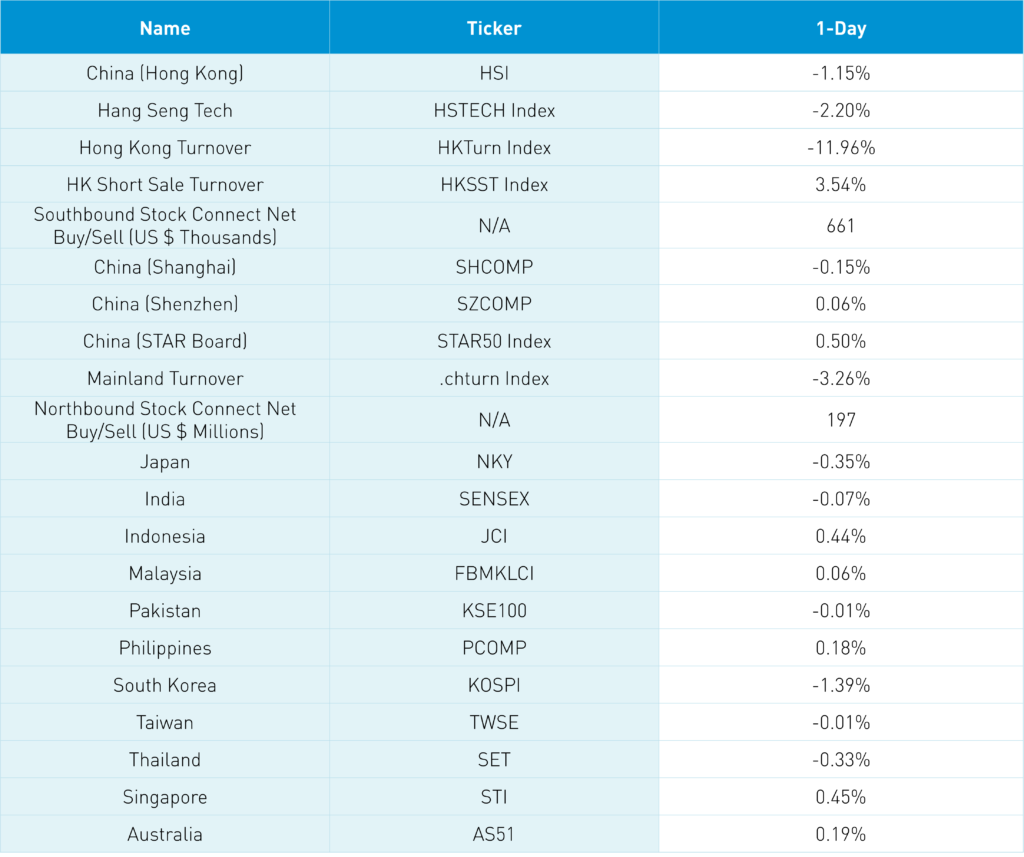

Asian equities were broadly lower following hawkish comments from US Fed officials as the Asia dollar index fell -0.43% on the US dollar's strength. Hong Kong and China mitigated morning losses following a late afternoon health press conference that reiterated dynamic COVID zero and increasing vaccinations.

Yesterday PCAOB Chair Williams' speech at the 14th International Institute on Audit Regulation commented on the Hong Kong visit, return home, and ongoing inspection of Alibaba, YUM China, and JD.com's auditors (PWC, KPMG, and Deloitte, respectively). She stated, "In December, the PCAOB will make determinations whether the PRC authorities have allowed us to inspect and investigate completely or whether they have continued to obstruct." So a finish line is given! After yesterday's China close, the PBOC provided their "China's Monetary Policy Implementation Report for the Third Quarter of 2022," which included comments on watching out for inflation that hit bond prices. Otherwise, the PBOC's comments aligned with supporting the real economy, maintaining proper liquidity, ensuring loans get to companies, and "firmly hold the bottom line of no systematic financial risks." Sounds good to me!

COVID cases continue to rise, with 2,328 new cases and another 20,804 asymptomatic cases.

Hong Kong internet names were down on the risk-off sentiment following Tencent's Q3 results, falling -0.82%. Tencent's announced spin-off of its Meituan position to shareholders weighed on Meituan, which fell -5.73% overnight, but also other companies in which Tencent has a stake as they could be spun off next. Tencent had strong net buying from Mainland investors via Southbound Stock Connect today though Meituan was a strong net sell. It is worth noting that Mainland investors have been net buyers of distressed real estate property developer Country Garden's Hong Kong stock over the last few days for the time ever! Real estate is receiving much attention though headwinds remain. Hong Kong Main Board short volume picked up slightly but has been relatively quiet.

There have been increased signs of China's internet regulation walking back as a Chinese government media source recently blamed high youth unemployment on the crackdown.

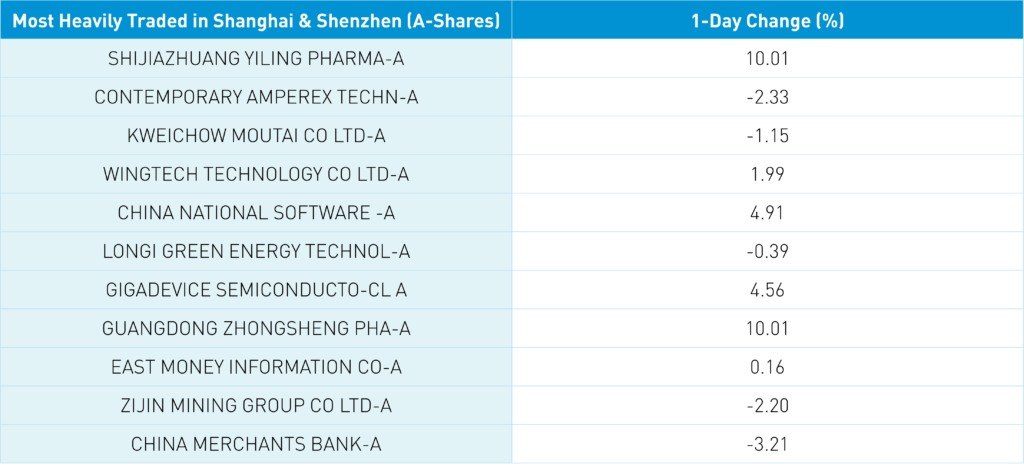

Yiling Pharmaceutical (002603 CH) gained +10.01% today following strong moves all week as China's most heavily traded stock today after filing for a cure for the common cold using traditional Chinese medicine. We are one of the largest foreign holders, as an FYI.

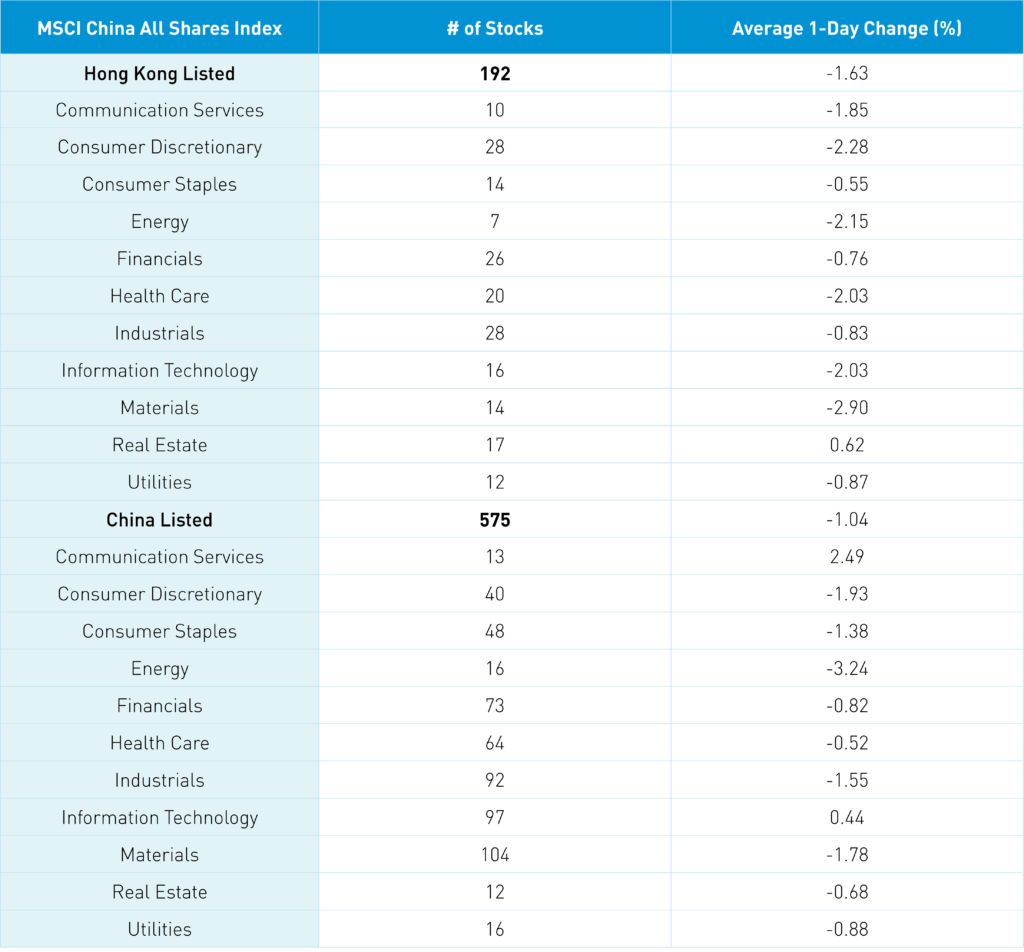

The Hang Seng and Hang Seng Tech Index fell -1.15% and -2.2% on volume -11.96% from yesterday, which is 123% of the 1-year average. 158 stocks advanced, while 318 stocks declined. Main Board short turnover increased by 3.53% from yesterday, which is 126% of the 1-year average, as 18% of turnover was short turnover. Value factors outpaced growth factors, while small caps outperformed large caps. The only positive sector was real estate +0.62%, while materials -2.9%, discretionary -2.28%, and energy -2.15%. The top sub-sectors were telecom services, insurance, and real estate, while media, auto, and materials were the worst. Southbound Stock Connect volumes were very high/1.5X the 1-year average as Mainland investors bought $661mm of Mainland stocks with

Shanghai, Shenzhen, and STAR Board were mixed -0.15%, +0.06%, and +0.5% on volume -3.26% from yesterday, which is 94% of the 1-year average. 2,635 stocks advanced, while 1,917 stocks fell. Both value and growth factors were off as small caps "outperformed" large caps. Communication and tech gained +2.32% and +0.28%, energy -3.39%, discretionary -2.09%, and materials -1.95%. The top sub-sectors were computer hardware, internet, and software, while coal, precious metals, and auto were among the worst. Northbound Stock Connect volumes were moderate/light as foreign investors bought $197mm of Mainland stocks. Treasury bonds eased, CNY fell -0.44% versus the US dollar to 7.12, and copper pulled a Sammy Hagger -0.55%.

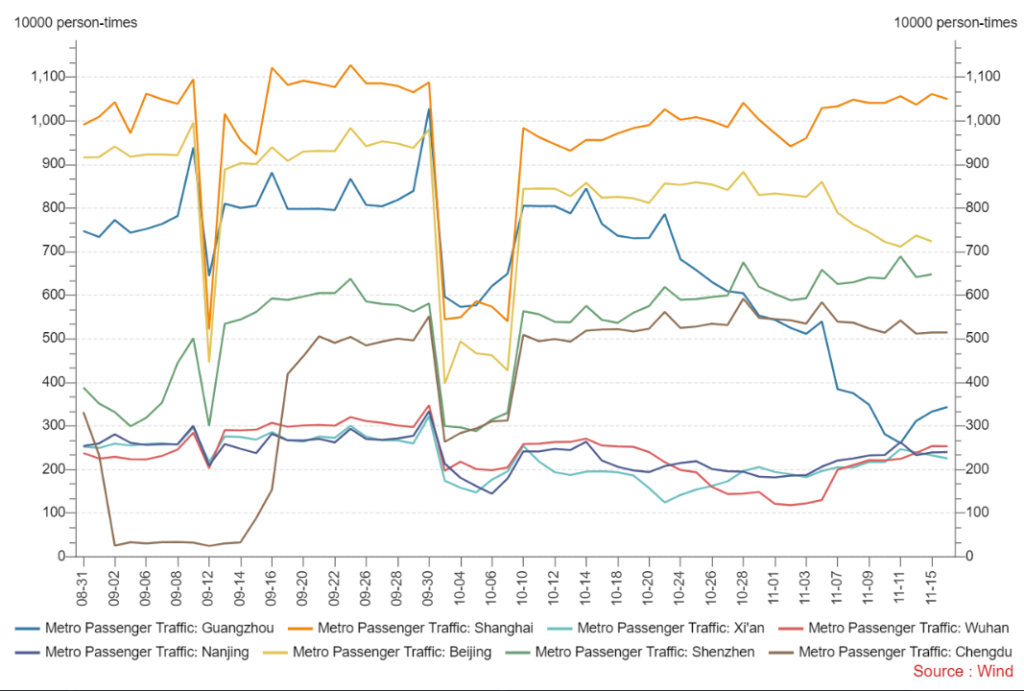

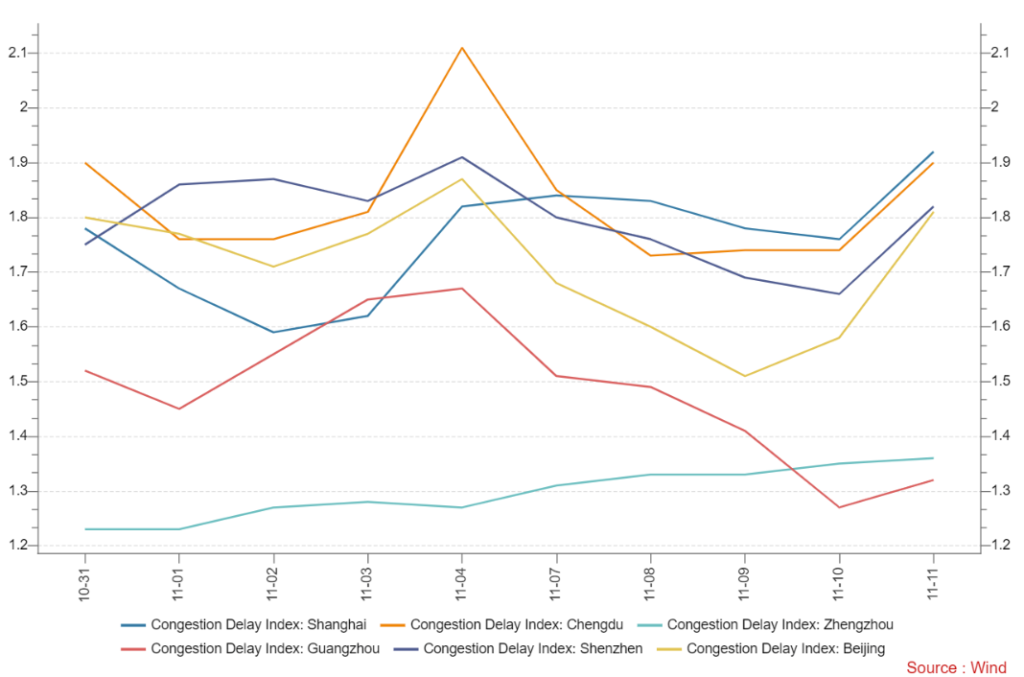

Major City Mobility Tracker

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.13 versus 7.09 yesterday

- CNY per EUR 7.40 versus 7.38 yesterday

- Yield on 10-Year Government Bond 2.83% versus 2.82% yesterday

- Yield on 10-Year China Development Bank Bond 2.94% versus 2.98% yesterday

- Copper Price -0.55% overnight