Internet & Reopening Plays Roll On

3 Min. Read Time

Key News

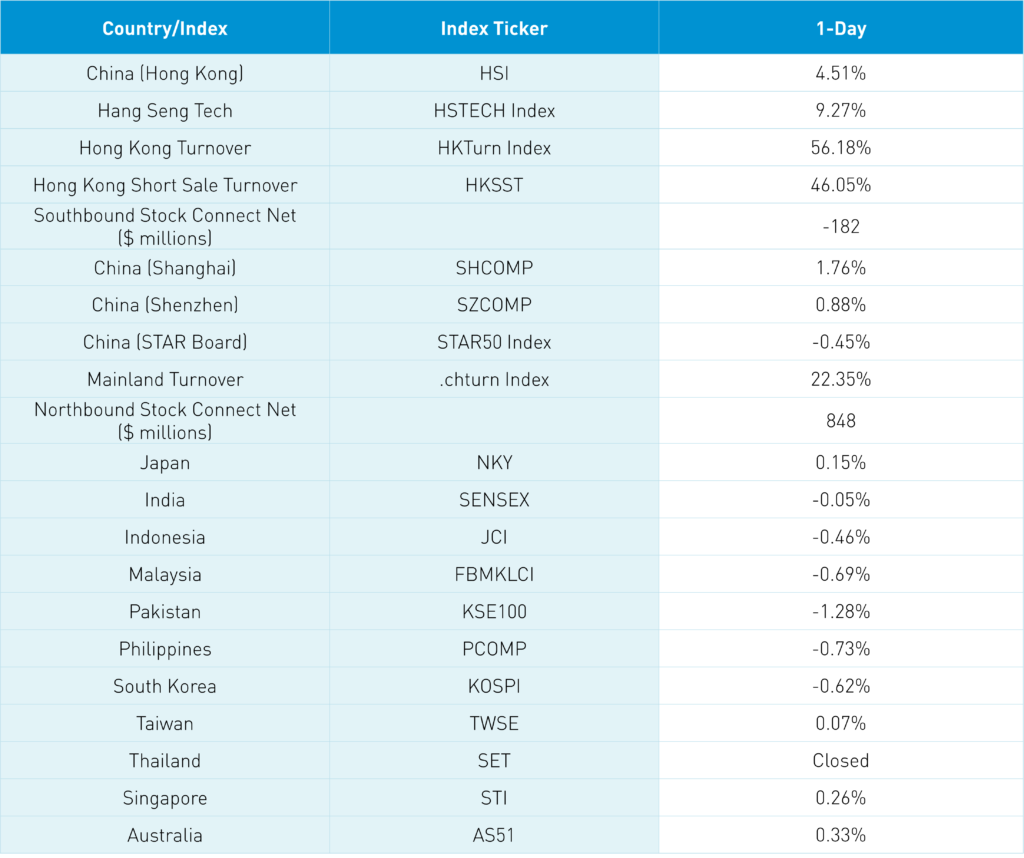

Asian equities were mostly higher as Hong Kong and Mainland China outperformed while Thailand was on holiday for the late King Bhumibol Adulyadej’s Birthday. The continued rollback of COVID rules across multiple cities, especially Shanghai, led to another strong day in Hong Kong, China, and especially Hong Kong-listed internet stocks.

Mainland media highlighted an expert from the Beijing Institute of Respiratory Diseases, who stated that “the pathogenic and toxicity of the Omicron mutuals… were significantly weakened compared with the original strain and Delta.” With the less lethal omicron variant versus the original covid and delta, it makes sense to dial back restrictions in addition to the frustration of the population over nearly three years of strict policies. This is despite the 4,247 new covid cases along with 25,477 asymptomatic cases reported today.

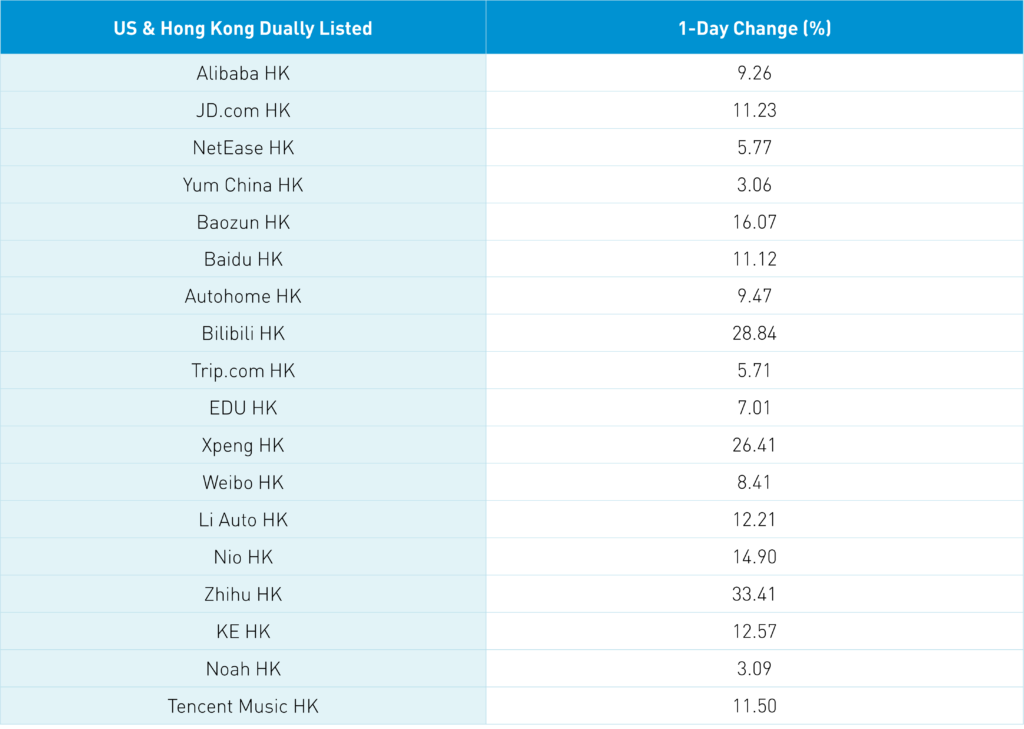

Over the weekend, China internet stocks were called the “best China reopening play” due to the companies’ exposure to E-Commerce and online travel booking along with “distressed” valuations, highlighted by an analyst who covers the space. As my colleague, Jonathan Shelon, eloquently stated, “Chinese internet stocks are the transmission engines for domestic consumption as it occurs online.” At our investor conference last week, Alibaba’s Head of Investor Relations Robert Lin spoke about the company’s critical role in retail sales.

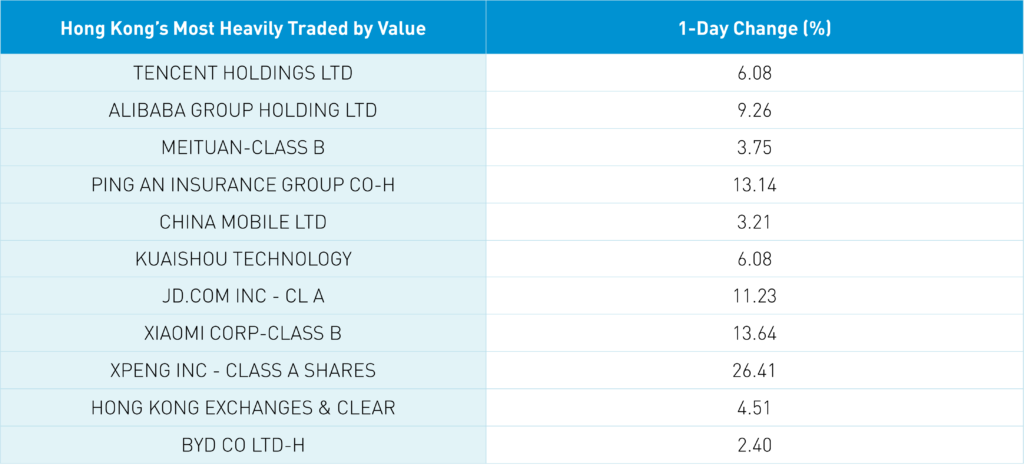

Shorts covering their positions led to several very outsized performers today, including Bilibili, which gained +28% and Xpeng, which gained +26%. Hong Kong’s most heavily traded stocks by value were Tencent, which gained +6.08%, Alibaba HK, which gained +9.26%, and Meituan, which gained +3.75%.

The Politburo meets tomorrow, which might give us clues on economic policies coming out of the upcoming Central Economic Work Conference (CEWC) in ten days.

A bank’s global strategist upgraded China to overweight for the first time after having kept it at equal weight for two years. Investors that are underweight China may have to chase the names as a result.

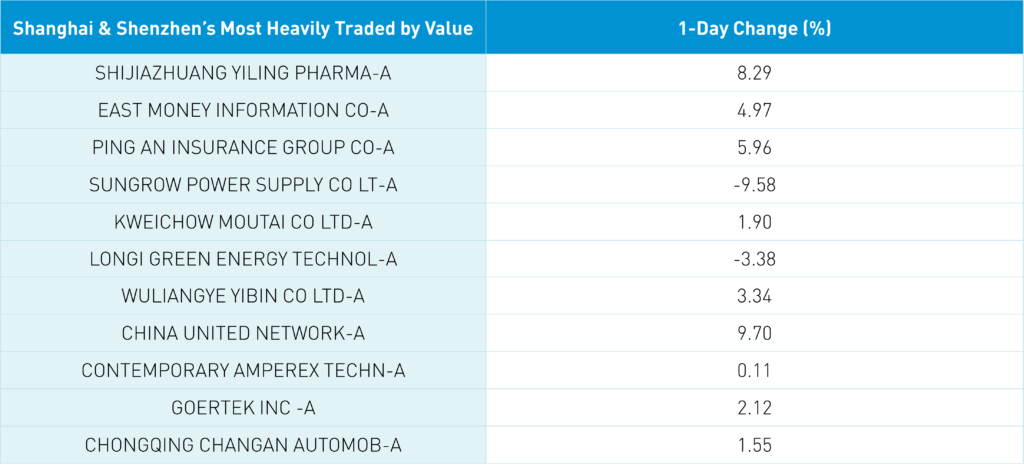

Mainland China had a good day except for semiconductor stocks. The Mainland’s most heavily traded stocks by value were Shijiazhuang Yiling Pharmaceutical, which gained +8.29%, broker East Money, which gained +4.97%, and Ping An Insurance, which gained +5.96%, and Sungrow Power, which fell -9.58% on weak European demand. Financials had a good day on the Mainland, gaining +4.95% as financial regulators’ policies allow the banks to support distressed property developers. Foreign investors bought $848 million worth of Mainland stocks today. CNY had a strong day, gaining +1.48% versus the US dollar to close at 6.96 CNY per USD, while the Asia dollar index gained +0.47%.

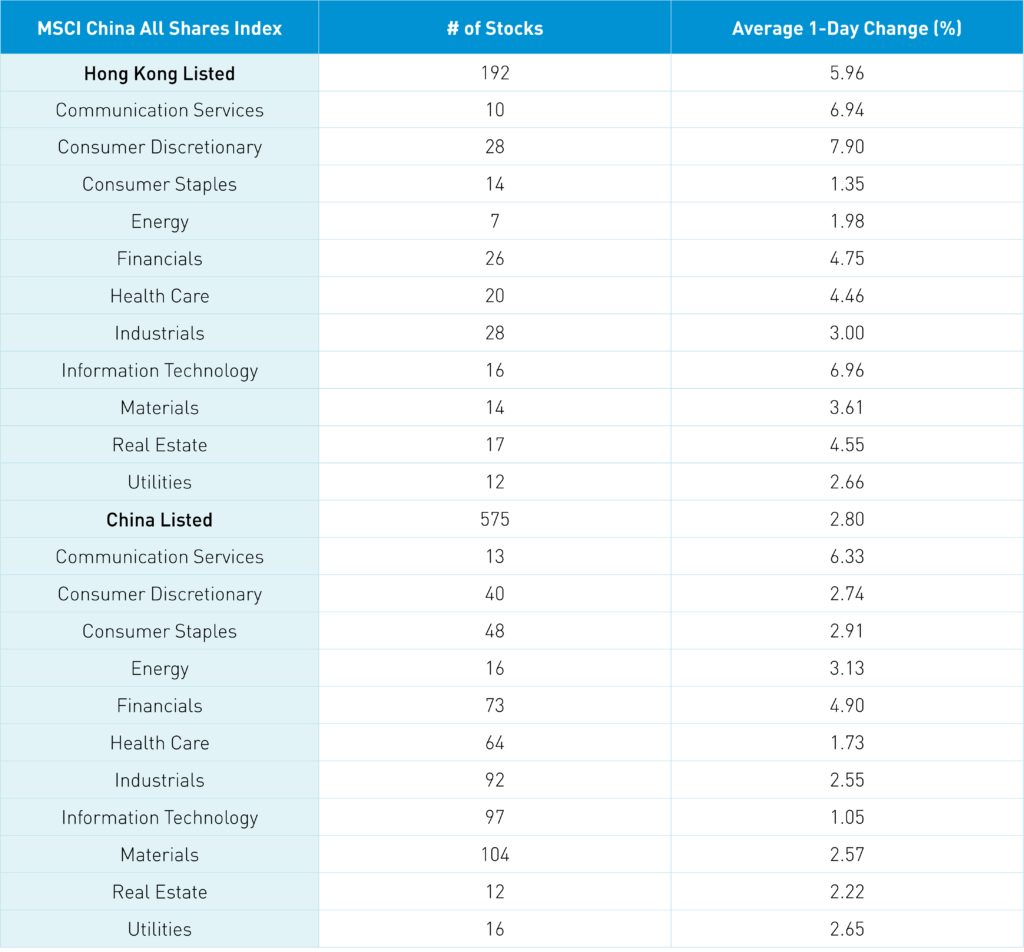

The Hang Seng and Hang Seng Tech indexes gained +4.51% and +9.27%, respectively, on volume that increased +56.18% from Friday, which is 181% of the 1-year average. 470 stocks advanced, while 41 stocks declined. Main Board short sale turnover increased +46.31% from Friday, which is 148% of the 1-year average, as 14% of turnover was short turnover. Growth and value factors were mixed as small caps outpaced large caps. All sectors were positive as consumer discretionary gained +7.9%, technology gained +6.96%, and communication services gained +6.93%. The top performing subsectors in Hong Kong were healthcare equipment, retail, and hardware equipment, while semiconductors were off. Southbound Stock Connect volumes were high as mainland investors sold a net -$182 million worth of Hong Kong stocks. Tencent was a large net sell in the trading program, while Meituan was a slight net buy, Kuaishou was a moderate buy, and Xpeng was a moderate net sell.

Shanghai, Shenzhen, and the STAR Board diverged to close +1.76%, +0.88%, and -0.45%, respectively, on volume that decreased -22.35% from yesterday, which is 111% of the 1-year average. 3,286 stocks advanced, while 1,366 stocks declined. Value factors outpaced growth factors, as large caps outperformed small caps. All sectors were positive as communication services gained +6.34%, financials gained +4.9%, and energy gained +3.13%. The top-performing subsectors on the Mainland were telecom, diversified financials, and construction. Meanwhile, power generation equipment, motorcycles, and chemicals were among the worst. Northbound Stock Connect volumes were moderate/high as foreign investors bought a net $848 million worth of Mainland stocks. CNY gained over +1% from Friday versus the US dollar to close at 6.96 from Friday’s 7.05, Treasury bonds sold off slightly, and copper gained +0.59%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.96 versus 7.05 Friday

- CNY per EUR 7.34 versus 7.37 Friday

- Yield on 1-Day Government Bond 1.10% versus 1.20% Friday

- Yield on 10-Year Government Bond 2.89% versus 2.87% Friday

- Yield on 10-Year China Development Bank Bond 3.02% versus 3.00% Friday

- Copper Price +0.59% overnight