Bilibili Gets Connected as Bank Contagion Goes Global, Week in Review

4 Min. Read Time

Week in Review

- China’s “Two Sessions” meetings of the 14th National People’s Congress are set to conclude this weekend after an unsurprising week in which a GDP target of “around 5%” was set and key financial regulators were consolidated.

- Trip.com reported a +7% increase in revenue year-over-year to RMB 5 billion compared to an estimate of RMB 4.9 billion, fueled by China’s reopening.

- JD.com reported a +7% increase in revenue year-over-year to RMB 42 billion, which was just shy of analyst expectations though the company’s net income alleviated margin concerns on consumer subsidies.

- The Ministry of Commerce stated Wednesday that it was willing to receive US Secretary of Commerce Gina Raimondo, who expressed an interest in visiting China.

Key News

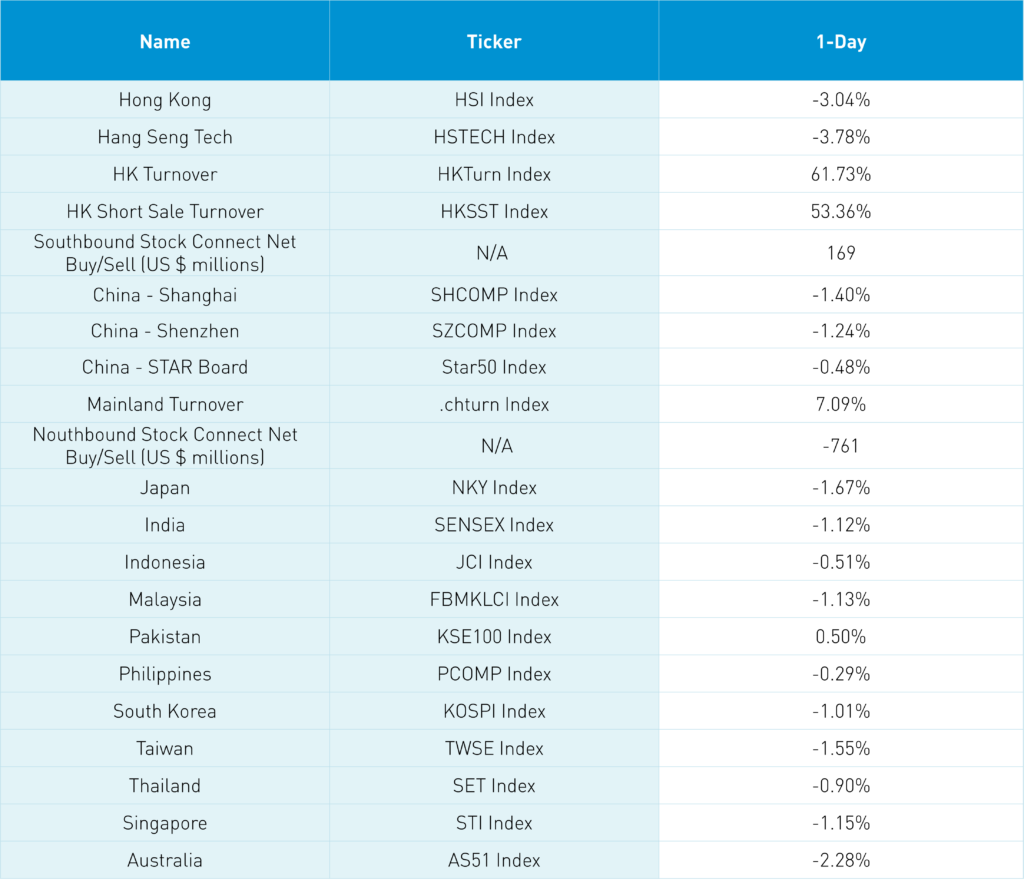

Asian equities ended the week with a thud as nearly all markets were off -1% as Australia fell more than 2%, Japan fell nearly -2%, and Hong Kong fell -3% on high volumes that increased +61% from yesterday, which is 134% of the 1-year average. Bank contagion fears against the backdrop of potentially more Fed interest rate hikes hit risk assets globally.

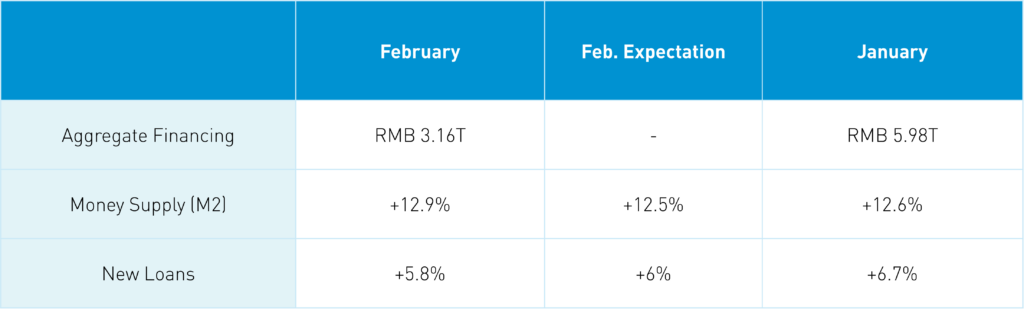

Strong February Chinese economic data released after the close was a non-factor.

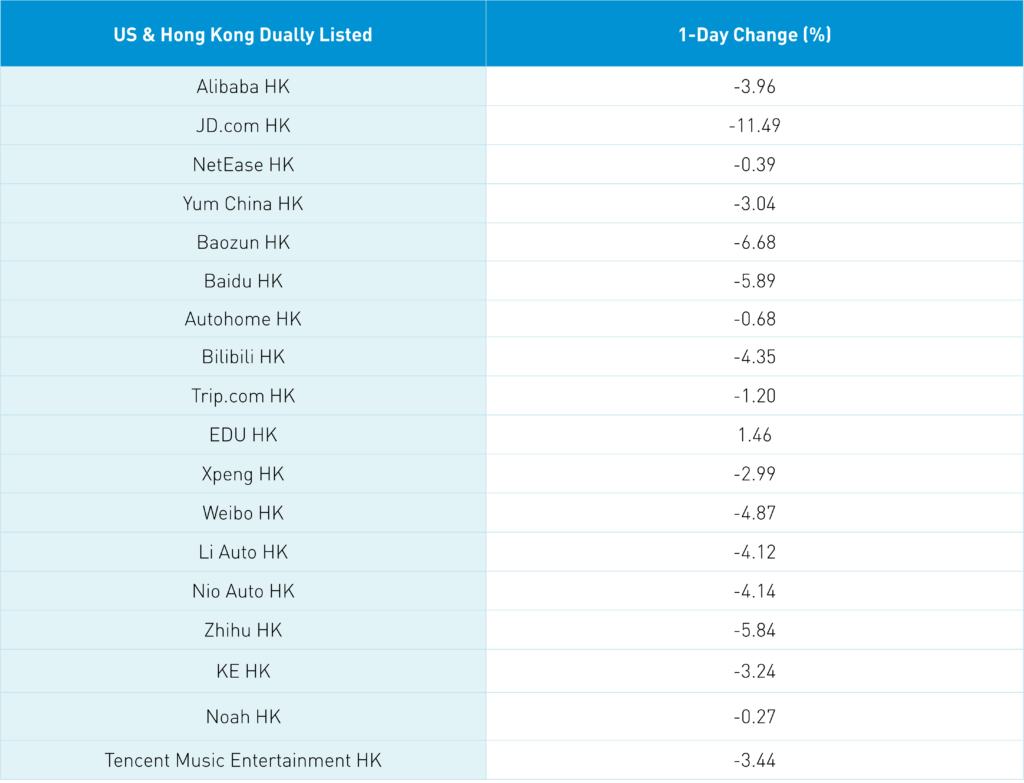

JD.com provided little clarity on their 2023 forecast during the earnings call. After the earnings call, companies tend to call analysts as a follow up to provide more information. On its follow up calls, JD.com told analysts that the consumer rebound would happen incrementally over the course of the year. I am not sure who was surprised by this, but the stock’s reaction indicates that some were surprised.

Insurance giant AIA (1299 HK) fell -4.62% after missing estimates on net income and earnings per share (EPS).

The “Dual Sessions” has underwhelmed investors thus far with few tangible economic stimulus policies and a conservative 2023 GDP target of 5%. The meetings ended with the new Premier’s press conference, which should provide tangible economic information.

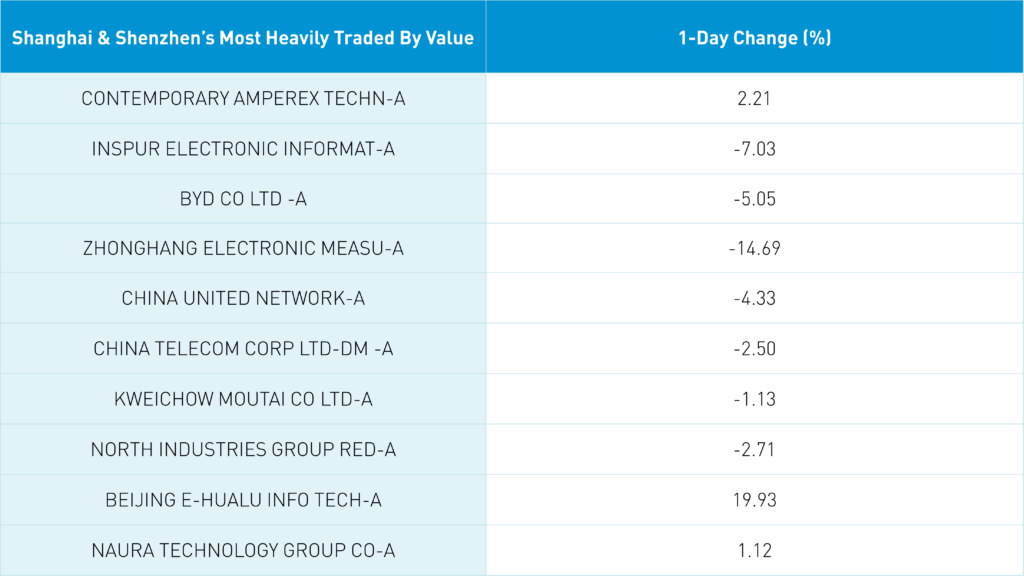

Positive data today included Prada’s 2022 financial results, which included the statement that “China has restarted to be an engine of growth”. Global EV battery maker CATL gained +2.21% after beating analyst expectations with net income RMB 30.72 billion versus expectations of RMB 28.8 billion.

Bilibili, which fell -4.35% overnight, was added to Southbound Stock Connect, allowing Mainland investors to buy the stock for the first time. These positives were non-factors as Hong Kong’s 100 most heavily traded stocks included just 8 advancing stocks as Tencent fell -2.53%, Meituan fell -1.55%, JD.com fell -11.49%, and Alibaba fell -3.96%. Autos were off in both Hong Kong and Mainland China as local media noted an auto price war.

China was off though not nearly as much as Hong Kong as the Hang Seng Index closed at 19,319. Foreign investors sold -$761 million worth of Mainland stocks as Mainland investors bought a net $169 million worth of Hong Kong stocks. Where do we go from here?

Coincidentally, I am reading Bob Pisani’s book Shut Up and Keep Talking, which I recommend highly. The chapter I read last night included the stress Bob experienced following internet bubble, 9/11, and Enron/WorldCom, which led him to discover meditation as a stress reliever. I will be exploring meditation this weekend as my mental state is a positive behavioral finance signal.

It is interesting to note that both the Asia dollar index and China’s Renminbi appreciated slightly versus the US dollar. Today felt like capitulation based on the volume spike though predicting the future is difficult. The market’s movement should provide a strong incentive for the new Premier’s press conference next weekend to come out swinging. At some point, investors will recognize that China’s economy has positive prospects on a relative and absolute basis.

One factor that the Chinese government needs to address is the difficulty in getting to China. The lack of communication between Beijing and Washington, DC has been a constant theme here. The political rhetoric is only exacerbated by the difficulty businesspeople experience in traveling to China. For China to fully reopen, it must address this issue, in my opinion.

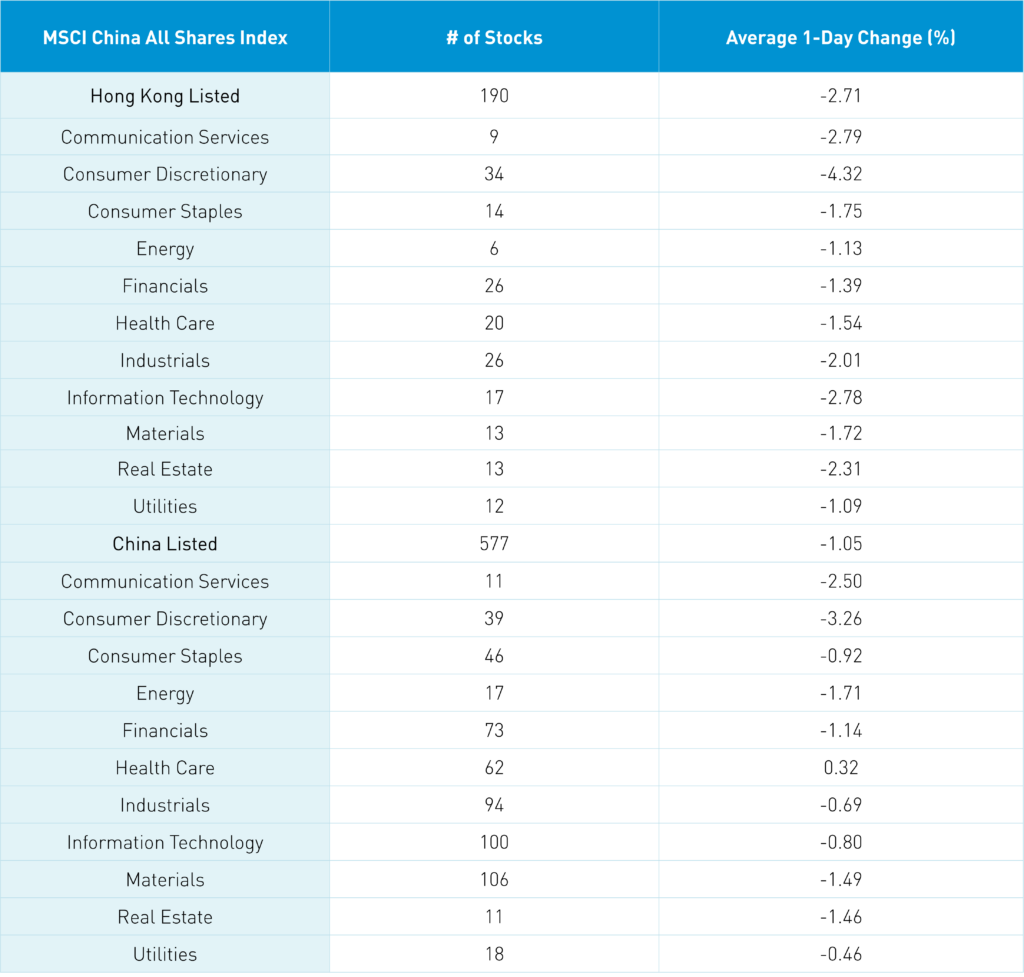

The Hang Seng and Hang Seng Tech indexes fell -3.04% and -3.78%, respectively, on volume that increased +61.73% from yesterday, which is 134% of the 1-year average. 43 stocks advanced while 456 declined. Main Board short sale turnover increased +53.36% from yesterday, which is 126% of the 1-year average, as 16% of turnover was short turnover. Value factors “outperformed” growth factors, while small caps outpaced large caps. All sectors were down as consumer discretionary fell -4.32%, communication fell -2.79%, and technology fell -2.79%. All subsectors were negative as autos, retail, and telecom were the worst performers. Southbound Stock Connect volumes were moderate as Mainland investors bought $169 million worth of Hong Kong stocks as Tencent, Meituan, and Kuiashou were all net buys.

Shanghai, Shenzhen, and the STAR Board were down -1.4%, -1.24%, and -0.48%, respectively, on volume that increased +7.09% from yesterday, which is 90% of the 1-year average. 566 stocks advanced, while 4,099 stocks declined. Growth factors “outperformed” value factors while small caps outpaced large caps. Healthcare was the only positive sector +0.33% while discretionary -3.26%, communication -2.5% and energy -1.71%. Top and only positive sub-sectors were healthcare, precious metals and office supplies while auto, auto parts and telecom. Northbound Stock Connect volumes were moderate/high as foreign investors sold -$761mm of mainland stocks. CNY gained +0.18% versus the US dollar closing at 6.95, Treasury bonds rallied while Shanghai copper fell -0.23% and steel gained +1.69%.

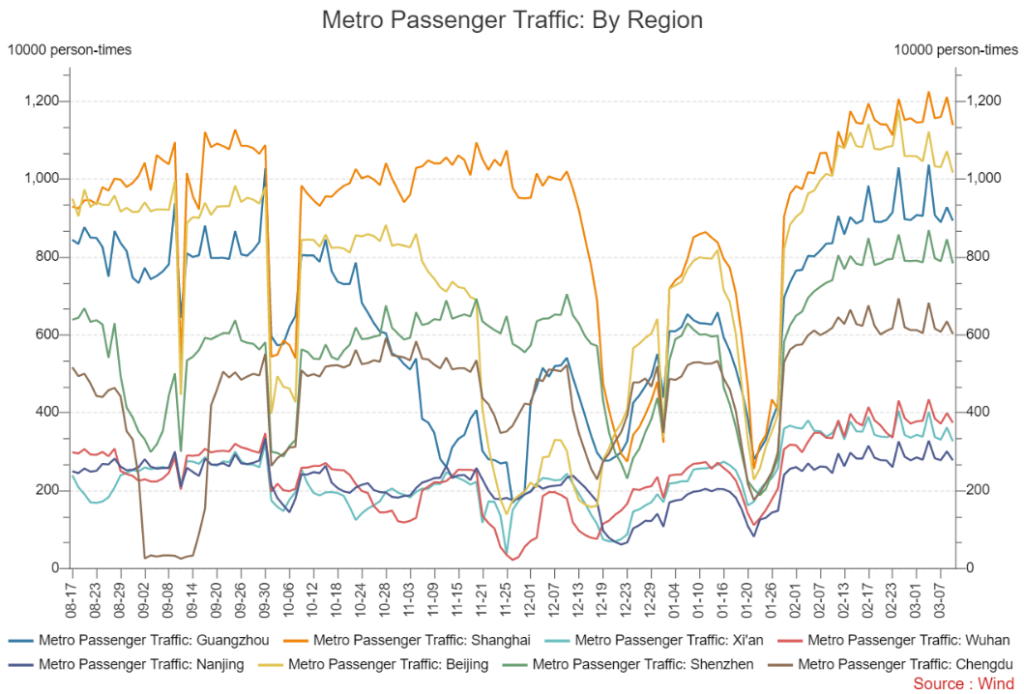

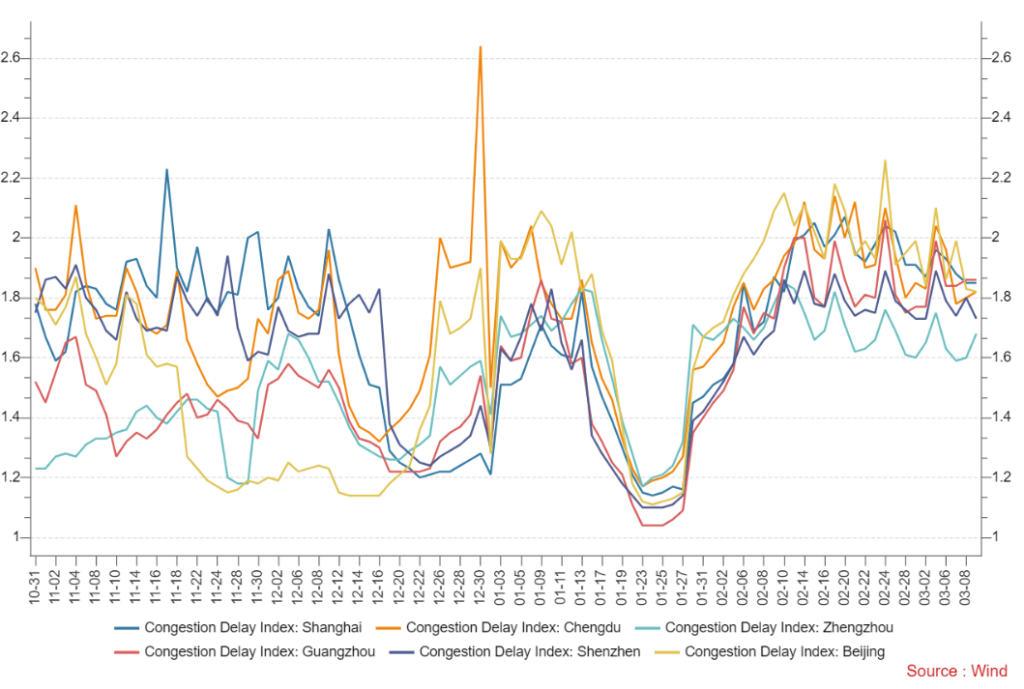

Major Chinese City Mobility Tracker

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 6.90 versus 6.97 yesterday

- CNY per EUR 7.39 versus 7.38 yesterday

- Yield on 1-Day Government Bond 1.55% versus 1.50% yesterday

- Yield on 10-Year Government Bond 2.86% versus 2.88% yesterday

- Yield on 10-Year China Development Bank Bond 3.06% versus 3.06% yesterday

- Copper Price -0.23%

- Steel Price +1.69%