Investors Ask “Where’s The Beef?” As Short Sellers Press Bets

3 Min. Read Time

Key News

Asian equities ended a poor month with a thud on very high volumes driven by today’s MSCI index rebalance.

China’s May PMIs missed expectations as Manufacturing was 48.8 versus expectations of 49.5 and April’s 49.2 and Non-manufacturing was 54.5 versus expectations of 55.2 and April’s 56.4. PMIs are a diffusion index with readings above 50 indicating growth/below 50 indicating decline on a month-over-month basis. Manufacturing’s poor read is not a good sign for the global economy since much of China’s manufacturing is export driven. Non-manufacturing’s pace of growth has slowed but is still growing. It is interesting that in both PMIs, business expectations are high with Manufacturing’s 54.1 and Non-manufacturing’s 60.4. The release confirmed investors’ concern that China’s economic rebound is incremental against the backdrop of policymakers’ lack of definitive stimulus. “Where’s the beef?” was a key line from a 1980s Wendy's commercial. Sure, policymakers talk a good game though haven’t delivered on stimulus.

CNY was weak versus the US dollar as some speculate that a US debt resolution could lead to a June Fed interest rate hike as the Asia dollar index fell. Yes, investors are being impatient considering COVID was running rampant across China in Q4. Despite China being a net inflow during today’s MSCI index rebalance, liquidity events allow investors to move capital. Month-end “window dressing” from managers is common as we see a lightening of exposure/getting names off the month-end statement/fact sheets. In the short run, investors are likely very overweight US stocks which now account for nearly two thirds of the MSCI All Country World Index. Within Asia, I would assume money has come out of China to fund interest in Japan and India.

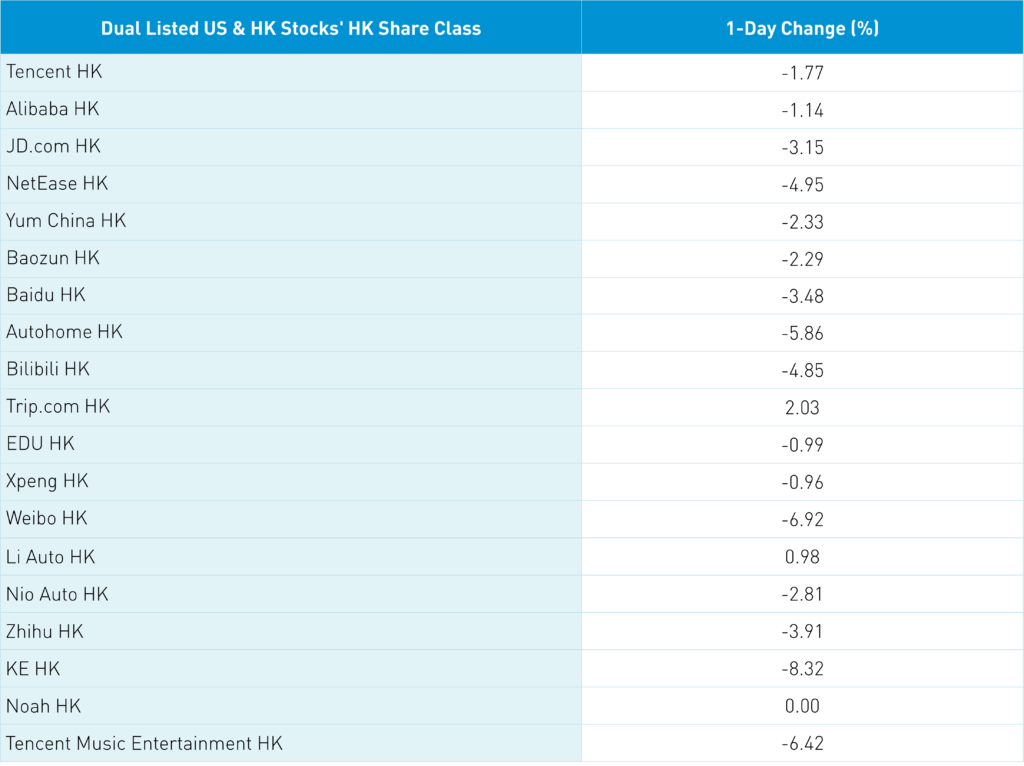

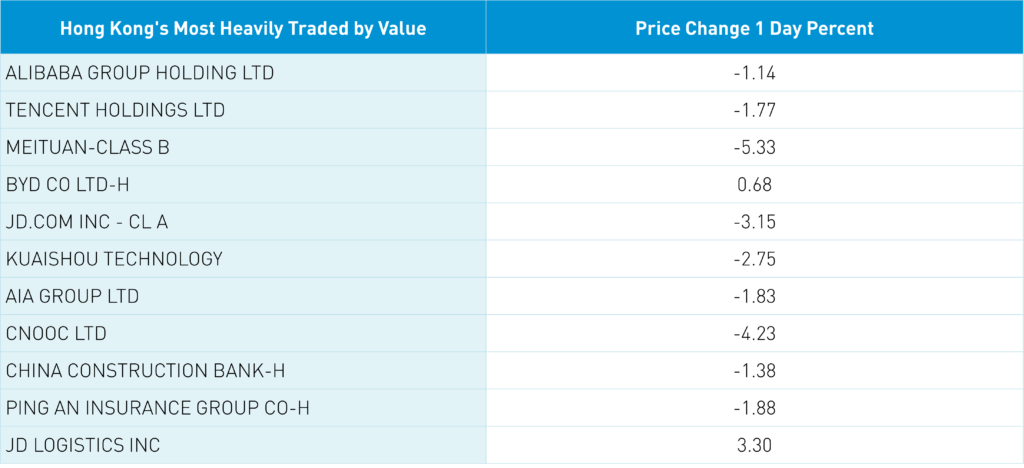

Several brokers called today a capitulation day as investors puked up shares at any price. Selling was concentrated in offshore China, i.e. foreign investors’ definition of China, more so than onshore China, which is predominantly held by investors in China. Short volume jumped to 20% of total volume, which is a high level in light of the large jump in MSCI-driven high volumes in Hong Kong. We saw individual stocks reach very high high short turnover levels as a percentage of total turnover such as Alibaba, which saw 32% short volume, Kuaishou, which saw 38% short volume, JD.com, which saw 21% short volume, and Trip.com, which saw 44% short volume. I would recommend (again) that these companies pay a dividend to hurt these short sellers. It is interesting that shorts would press their bets at these levels, though the geopolitical backdrop has kept investors sidelined. Yes, we likely had long-term institutional investors, i.e. China’s “National Team”, which is comprised of insurance companies and sovereign wealth funds/pension plans, buying today’s dip as part of their strategic outlook.

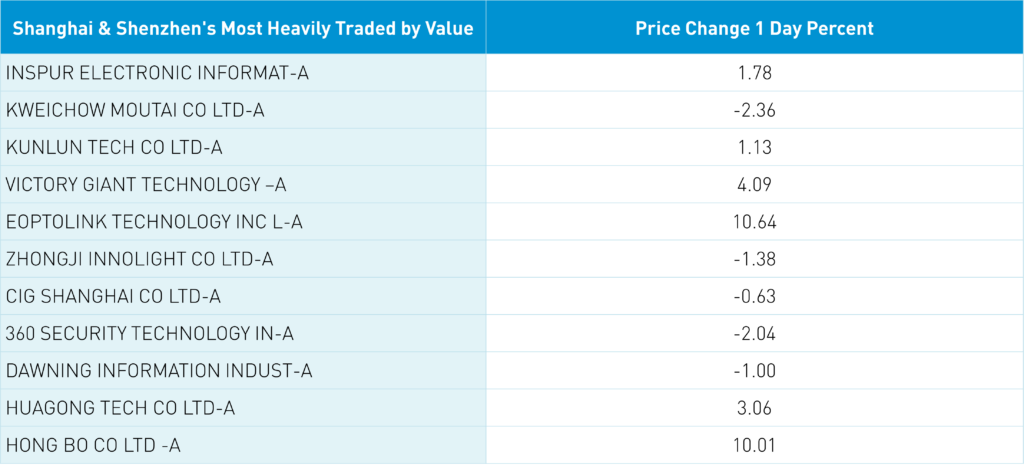

Mainland tech shares gained on the recent all-things AI enthusiasm led by subsectors such as semiconductors and computer hardware. It is interesting that both Elon Musk and Jamie Dimon are not backing away from the opportunity in China, as evidenced by their current and upcoming trips. Hopefully, today was the low as things are more likely to get better going forward, in my opinion.

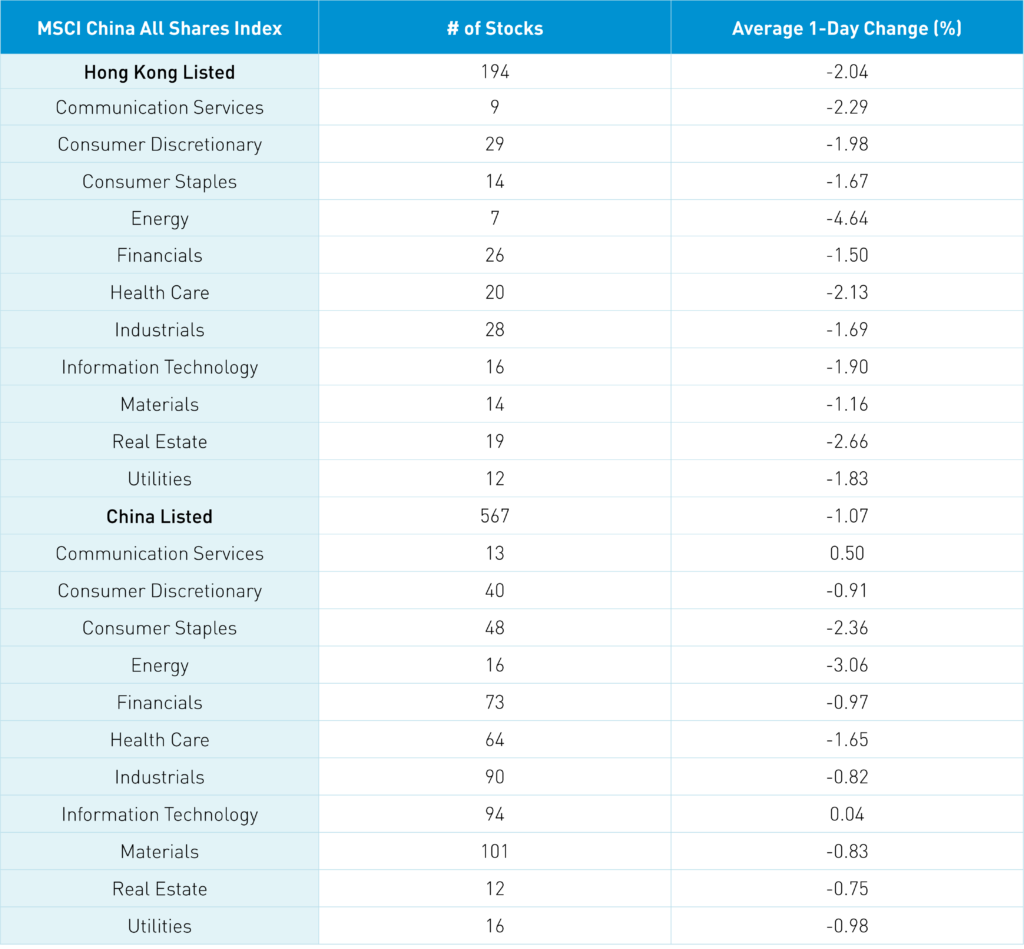

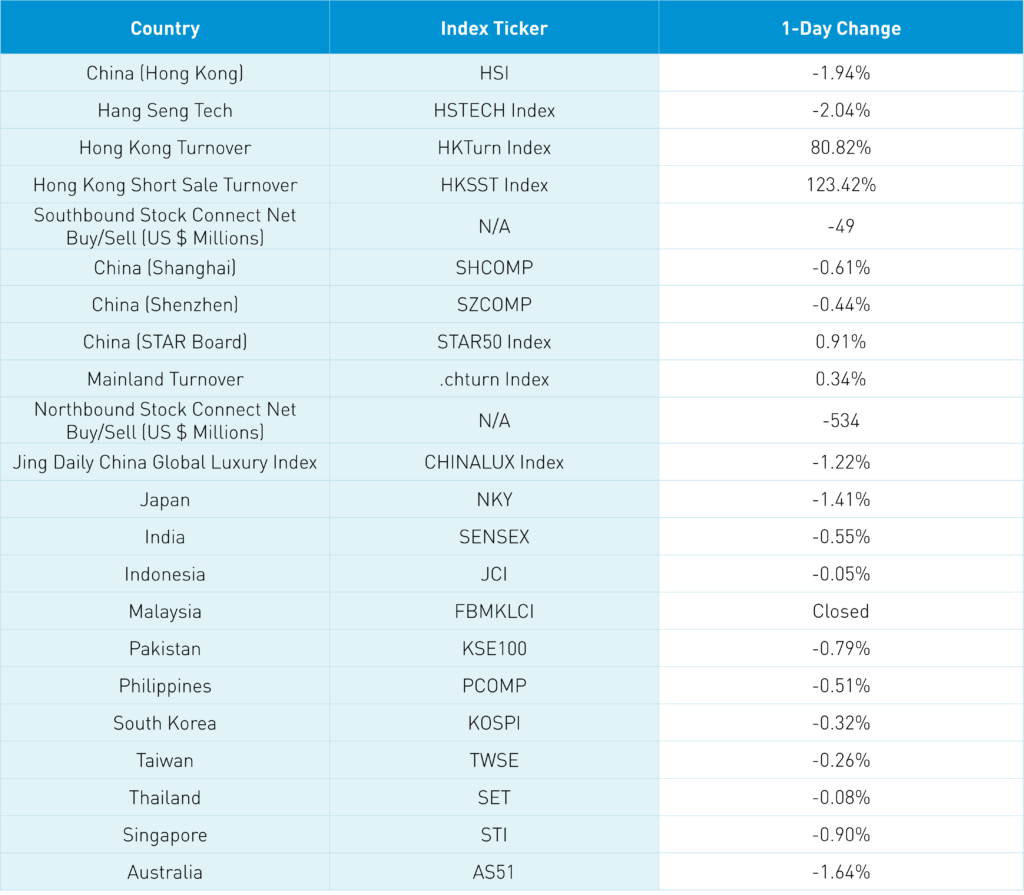

The Hang Seng and Hang Seng Tech indexes fell -1.94% and -2.04%, respectively, on volume that increased +80.82% from yesterday, which is 144% of the 1-year average. 82 stocks advanced while 420 declined. Main Board short turnover increased +123%, which is 174% of the 1-year average as 20% of turnover was short turnover. Growth factors “outperformed,” i.e. fell less, than value factors as small caps “outperformed” large caps by a small margin. All sectors were negative as energy fell -4.63%, real estate fell -2.65%, and communication services fell -2.28%. All subsectors were negative as energy, household products, and real estate were among the worst-performing. Southbound Stock Connect volumes were light as Mainland investors sold a net -$49 million worth of Hong Kong stocks as Meituan was a moderate net buy, Tencent was a moderate net sell, and Li Auto and Kuiashou were both small net sells.

Shanghai, Shenzhen, and the STAR Board diverged to close -0.61%, -0.44%, and +0.91%, respectively, on volume that increased +0.34% from yesterday, which is 101% of the 1-year average. 1,727 stocks advanced while 2,946 stocks declined. Growth and value factors were lower while small caps fell less than large caps. Communication services and technology gained +0.51% and +0.05%, respectively, while energy fell -3.05%, consumer staples fell -2.35%, and healthcare fell -1.64%. The top-performing subsectors were computer hardware, software, and land transportation while the coal, liquor, and water industries were the worst. Northbound Stock Connect volumes were high as foreign investors sold a net -$534 million worth of Mainland stocks with Kweichow Moutai was a large net sell, Beijing-Shanghai High-Speed Railway, which was added to Stock Connect only recently, was a small net buy, and China Tourism Duty Free was a moderate net sell. CNY fell -0.4% to 7.10 CNY per USD while the Asia Dollar Index fell -0.25% versus the US dollar. Treasury bonds rallied while copper and steel were off.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.10 versus 7.07 yesterday

- CNY per EUR 7.59 versus 7.59 yesterday

- Asia Dollar Index -0.25% overnight

- Yield on 10-Year China Development Bank Bond 2.68% versus 2.70% yesterday

- Yield on 10-Year China Development Bank Bond 2.85% versus 2.88% yesterday

- Copper Price -0.18% overnight

- Steel Price -1.00% overnight