Premier Li & PBOC Draw the Line in the Sand

3 Min. Read Time

Key News

Asian equities were mixed overnight as China and Hong Kong outperformed following last week’s drawdown, which follows the strong first two weeks of the month. Two weeks forward and one week back for Chinese stocks.

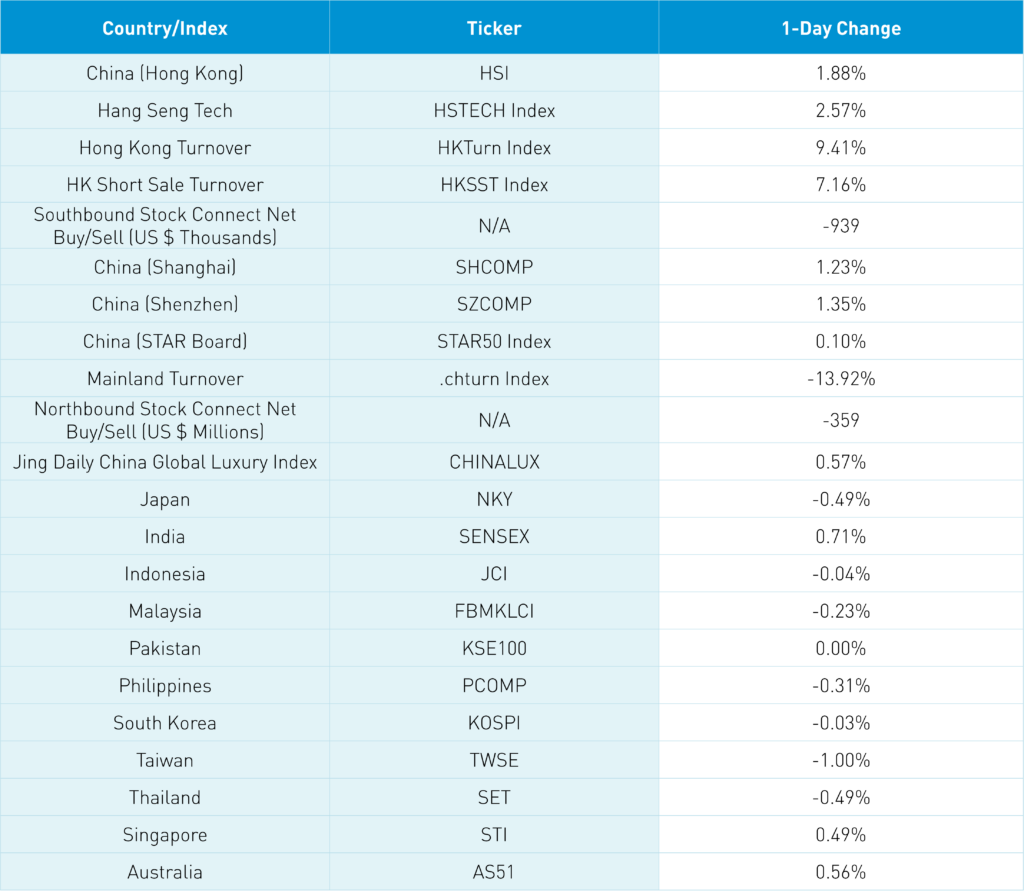

The Hang Seng Tech gained +2.57%, Shanghai +1.23%, and Shenzhen +1.35%, with Hong Kong and Mainland China exhibiting very strong advancers versus decliners. Premier Li Qiang’s speech at the World Economic Forum hosted in Tianjin, referred to as the Summer Davos, was a key catalyst. However, the event has received shockingly little coverage by Western media despite 1,500 attendees from 90 countries. Premier Li reiterated a 2023 GDP target of around 5%, but comments on Q2’s strength versus Q1 lifted market sentiment. He mentioned the problems with global decoupling without naming names, i.e., the US. The speech raises hopes that stimulus is coming, which this week’s PMIs might support as bad economic news could be good news for stimulus.

As we noted yesterday, many Chinese equity indices are sitting at/near key support levels. A Mainland media spokesperson publicly mentioned buying Chinese stocks for the first time yesterday in an interesting move. As noted in yesterday’s note, several prominent economists publicly discussed the need for more stimulus. This doesn’t occur often, as it is feasible that policymakers are getting the message. The PBOC got the message as the optics of CNY’s apprecation versus the US dollar garnered attention overnight as CNY gained +0.3%, closing at 7.21 from yesterday’s 7.23. Too much too soon! Yes, interest rate differentials drive currency movements though it shows skepticism of China’s economy. Potentially helping is talk US Treasury Secretary Yellen will visit China post-Blinken’s trip.

Talk of Biden’s dictator comments “undermining” Blinken’s trip is overblown as he was speaking at a fundraiser of rich supporters trying to remove them from their money. The words were meant for that audience and not any official policy. Green shoots on US-China relations. A very positive sign was the performance of Kuaishou +3.31% and Bilibili HK +3.39% despite news that regulators will examine internet addiction in China. Ultimately maybe there is no one left to sell, as this news would have crushed the names in the past.

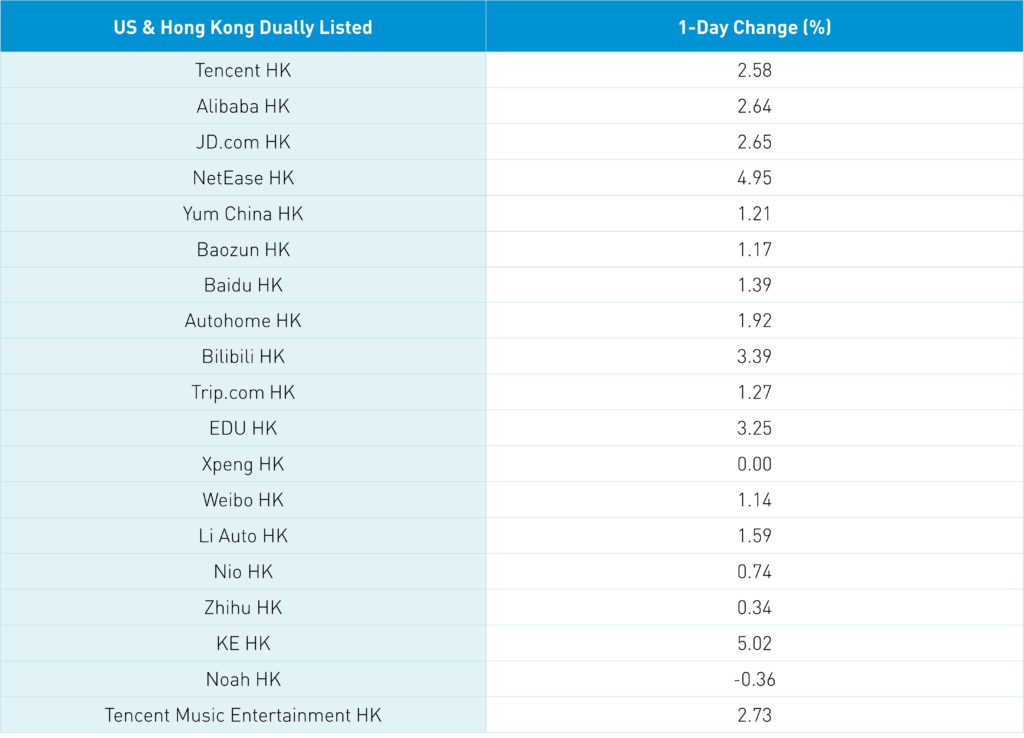

Remember, Q2 earnings will be released in August, which should be an easy comparison due to Q2 2022’s Shanghai lockdown and the big policymaker meeting at the end of July. Markets are forward-looking. Real estate was the top performer in Hong Kong +5.75% and China +4.31% as the Ministry of Housing and Urban-Rurual Development met with the Bank of China on “promoting high-quality development of housing and urban-rural development.” Hong Kong’s most heavily traded were Tencent +2.58%, Alibaba HK +2.64%, and Meituan +1.77% despite fairly significant selling in Hong Kong from Mainland investors via Southbound Stock Connect. The selling appeared to be concentrated in high dividend-paying SOEs and ETFs, as Tencent, Meituan, and Kuiashou were all net buys today. We want stronger volumes, but we’ll take the up day. Similarly, that Mainland China was up on very strong advancers to decliners though volume light.

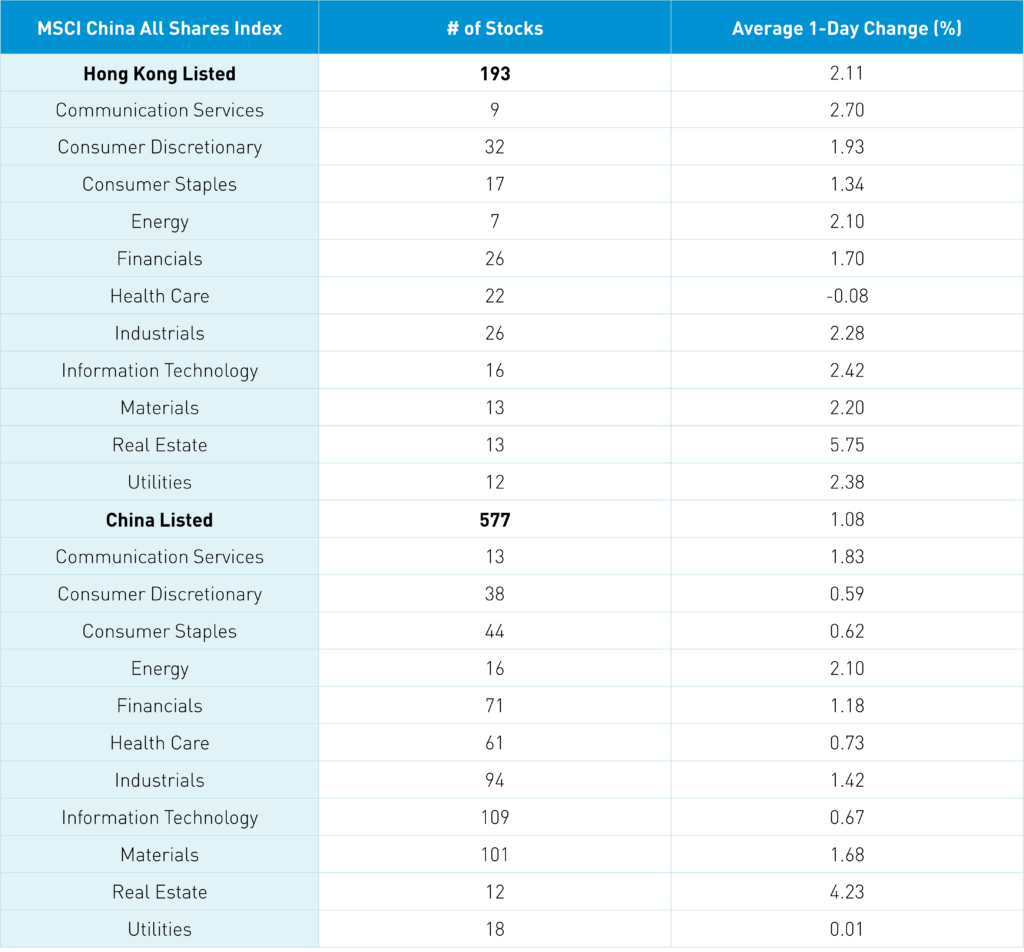

The Hang Seng and Hang Seng Tech gained +1.88% and +2.57% on volume +9.41% from yesterday, which is 79% of the 1-year average. 430 stocks advanced, while 74 declined. Main Board short turnover increased +7.11% from yesterday, 71% of the 1-year average, as 15% of turnover was short turnover. The growth factor outperformed the value factor as small caps outperformed large caps. The top sectors were real estate +5.75%, communication +2.7% ad tech +2.42%, while healthcare was the only negative sector -0.08%. The top sub-sectors were real estate, technical hardware, and insurance, while household products was the only negative sub-sector. Southbound Stock Connect volumes were light as Mainland investors sold a healthy -$827mm of Hong Kong stocks, with Tencent, Meituan, and Kuiashou all small net buys.

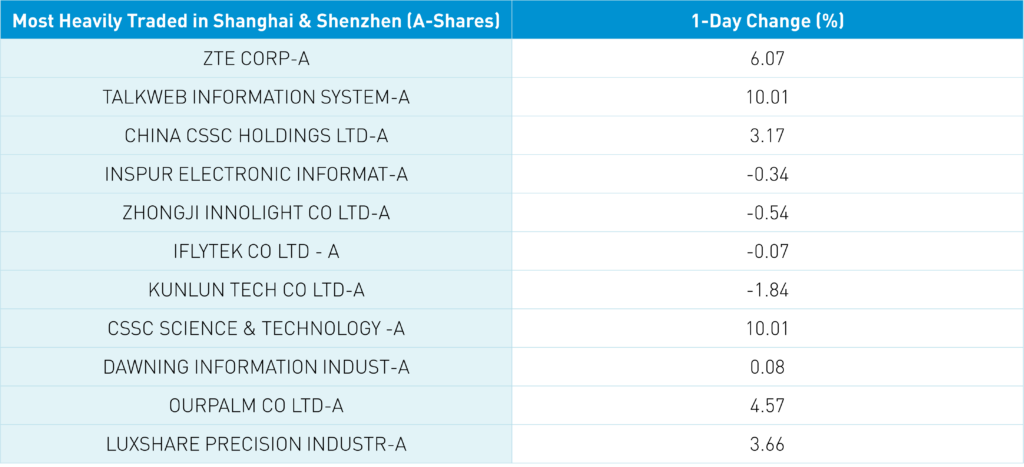

Shanghai, Shenzhen, and STAR Board gained +1.23%, +1.35%, and +0.1% on volume -13.92% from yesterday, 92% of the 1-year average. 4,070 stocks advanced, while 700 stocks declined. The value factor outperformed the growth factor as small caps outpaced large caps. All sectors were positive, with real estate +4.24%, energy +2.11%, and energy +1.85%. Northbound Stock Connect volumes were moderate as foreign investors sold -$359mm of Mainland stocks with Kweichow Moutai, shipbuilder China CSSC Holdings and China Tourism Group Duty Free all moderate/large net sells. CNY appreciated +0.3% to 7.21 from 7.23 versus the US dollar as the Asia dollar index gained +0.25%. Treasury bonds were flat while copper was off and steel gained.

Last Night's Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.22 versus 7.24 yesterday

- CNY per EUR 7.90 versus 7.89 yesterday

- Yield on 10-Year Government Bond 2.67% versus 2.67% yesterday

- Yield on 10-Year China Development Bank Bond 2.82% versus 2.81% yesterday

- Copper Price -0.12% overnight

- Steel Price +1.40% overnight